by Blaine Rollins, CFA, 361 Capital

If you thought that the Winter Olympics were tough for Team U.S.A., just wait until you see the task at hand this week. We need to sell a quarter of a trillion dollars in Treasuries to many foreign buyers in a market with vertical interest rates and a falling U.S. dollar. So, grab your most comfortable pair of shoes and best looking outfit, because we could be in for a dancing marathon. All the paper will be sold, and money raised, because we need it. The question of course is what buyers are willing to pay and thus what interest rate will they receive. Is this still a good time to beat up the Chinese and Japanese steel companies over tariffs? Maybe not.

The equity markets ignored bonds for the week while it worked on its own recovery from the previous week’s 10% correction. While most prices did bounce, few were impressed as breadth and volumes only garnered a slow clap. We have tested the market’s low and now must see if we can test January highs. But this bounce will take more breadth and more buying volume if it is going to get a medal. In other words, keep some powder dry and don’t even think about shorting the VIX.

And you thought that video from the top of the large hill ski jump was scary…

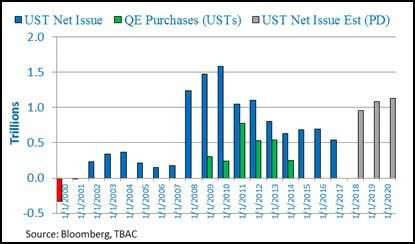

The theme for the upcoming week is the $258 Billion in Treasury issuance. There are $151 Billion in T-Bills set to be auctioned tomorrow, along with $28 Billion in 2Yr Treasuries. On Wednesday, there will be $15 Billion of 2Yr Floating Rate notes and $35 Billion of 5Yr Treasuries auctioned. Those will be followed by $29 Billion of 7Yr Treasuries on Thursday. As we have noted several times in recent weeks, this will be the dominant theme for 2018. According to the Treasury Department’s most recent refunding announcement at the end of last month, the Primary Dealer forecast for treasury net issuance in 2018 is $950 Billion. That is followed by a forecast for 1.083 Trillion in 2019 and $1.128 Trillion in 2020. Those estimates are likely to rise in the next refunding statement in early May. It was during 2008-2012 that net issuance repeatedly exceeded $1 Trillion annually. From 2009 through 2014, the Federal Reserve’s QE Treasury purchases equated to 40% of the Treasury Department’s net issuance. From 2011 to 2016, QE purchases equated to 60% of net issuance. Even in the most optimistic scenario surrounding this Bill and Note issuance, they still represent liquidity coming out of the financial system.

(Jones Trading)

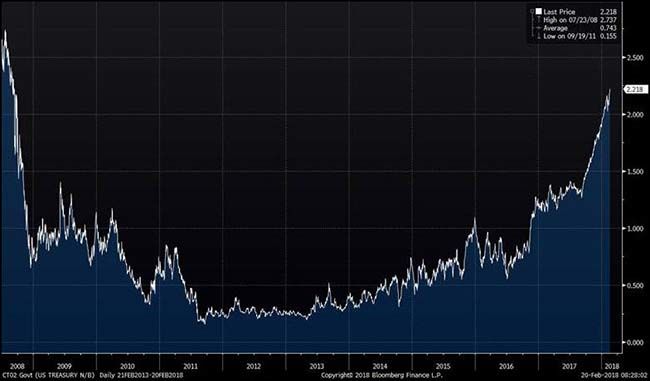

The 2-year yield from 2008 has become a half pipe…

The 2-year yield > 2.2% for the 1st time since 2008.

One bond manager’s thoughts on the rise in issuance…

From an interview with Bob Michele, JPMorgan Asset Management’s chief investment officer for fixed income, currencies and commodities who oversees $470 billion in assets.

Q: What about the prospect of increased Treasury issuance due to surging budget deficits at the same time as the Fed withdraws as a buyer of last resort?

A: I worry about that. I think there’s no doubt that what we’re seeing coming out of the budget, the US is losing its fiscal discipline and you’ll see increased supply coming out of the Treasury at a time when the Fed is reducing its holding. But I think that’s what gets us up to 3, 3.25% and we just see from our position the flow of money coming in from Asia and Europe into the US market.

So there are buyers of a backup [in yields] and as long as monetary policy is so accommodative and they’re running negative policy rates in those markets you’re going to see that money come in and support the US market.

The one thing that changes all of this is inflation. Because what we’re all talking about is a Fed looking to get something more normal in policy, we’re talking about supply/demand — and those are well telegraphed to the market and the markets I think can price those in realistically and absorb them.

Even the amount of supply coming from fiscal spending in the US I don’t think will panic the market. What panics the market is rising inflation expectations. So if you see a sharp rise in prices, whether it’s core CPI [consumer prices excluding food and energy], personal consumption expenditure and wages, people will immediately look to the central banks and the Fed in particular to accelerate their tightening.

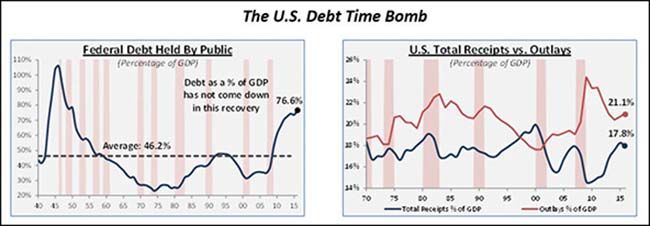

As you know, we spend more than we make and we are running up our credit card…

Don’t even think about what could happen if interest rates rise and our service cost goes up.

(Wolfe Research)

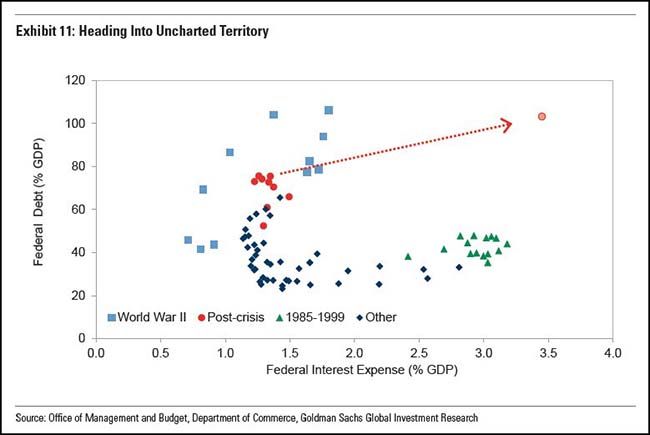

Goldman Sachs suggests that we might be checking into the Hotel California…

The US also appears to be headed into uncharted territory—at least for US fiscal policy—regarding the relationship between interest expense and the debt level. As shown in Exhibit 11, interest expense considerably exceeded the current level during the late 1980s and early 1990s, though the debt level was moderate. By contrast, the debt level was slightly higher during and just after World War II than it is today, while the level of interest expense was similar. However, we project that, if Congress continues to extend existing policies, including the recently enacted tax and spending legislation, federal debt will slightly exceed 100% of GDP and interest expense will rise to around 3.5% of GDP, putting the US in a worse fiscal position than the experience of the 1940s or 1990s.

(Goldman Sachs)

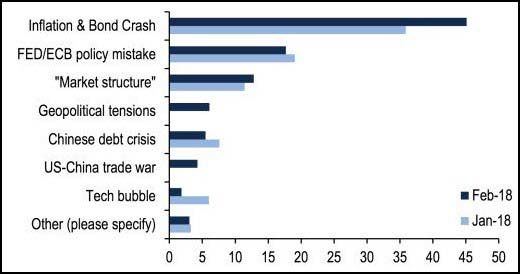

And so it is no coincidence that our fears have turned to Central Banks, Inflation and Bonds…

Top PM worries from the Feb 2018 Merrill Lynch Fund Manager Survey

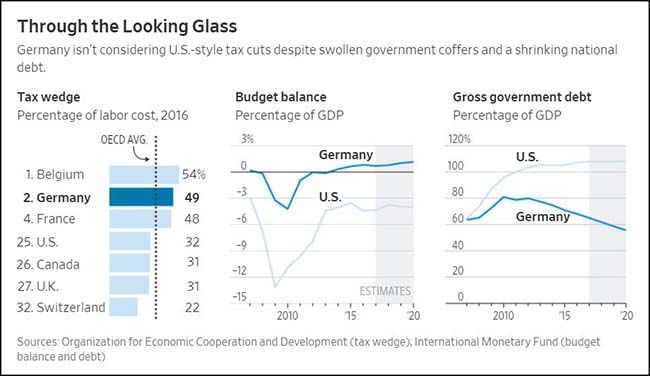

And in opposite world, there is Germany which has a budget surplus and little debt…

The German government never had so much money or so many ideas about how to spend it. The one thing that isn’t being discussed is giving it back to taxpayers.

Tax cuts—a fixture of the political debate in the U.S., where the government hasn’t balanced its books in decades—are barely on the agenda here, even though Germany’s next government is expected to post a consolidated budget surplus of roughly €50 billion ($62 billion) between now and 2021, according to finance ministry calculations.

(WSJ)

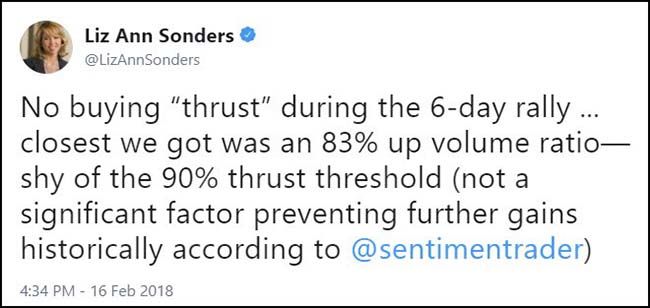

Looking at U.S. stocks last week, I see a narrow bounce…

@ArthurHill: $SPY cleared its 50-day SMA last week, but three other broad index ETFs fell short. $RSP, $MDY and $IJR did not clear their 50-day SMAs. Mid and small gaps are still lagging large caps.

And I also see weak volumes…

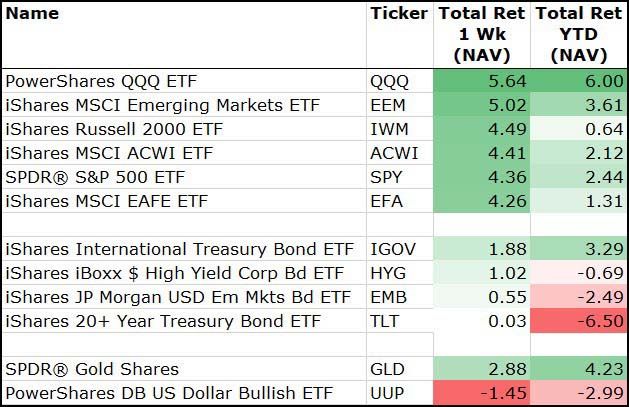

Lots of green on the week across the asset classes…

(2/16/2018)

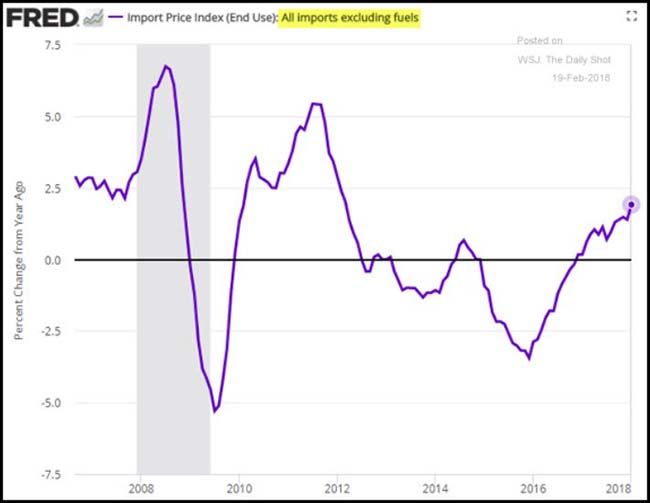

U.S. dollar weakness has led to rising import prices…

This is not going to make the inflation watchers or bond markets happy.

(WSJ/Daily Shot)

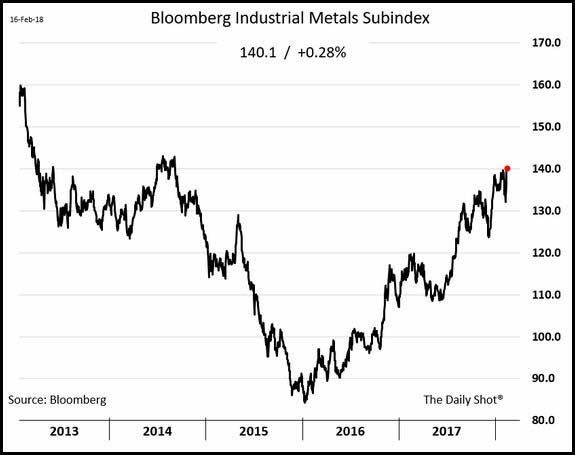

But a weak U.S. dollar will make commodity traders happy…

(WSJ/Daily Shot)

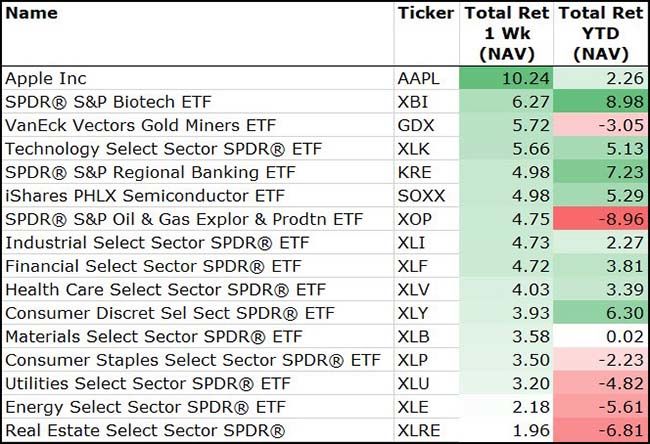

All U.S. sectors also ended green last week led by the market’s largest stock…

Important to note that defensive sectors have continued to lag for the week as they have for all of 2018.

(2/16/2018)

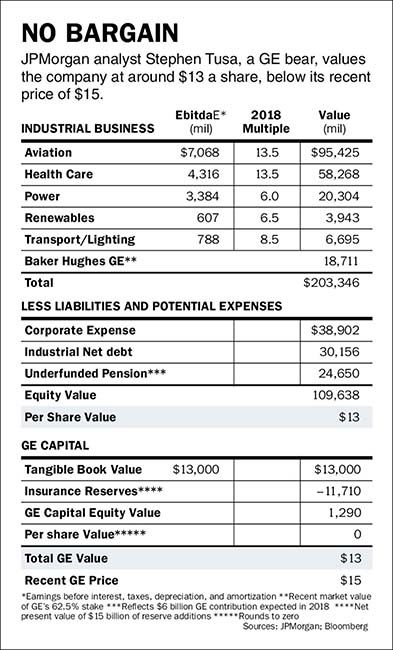

GE is getting closer…

Almost every investor hates GE. The stock has underperformed massively. The new CEO is throwing much overboard and fewer problematic financial services companies will make the organization easier to analyze. We can only hope that Dow Jones throws it out of its Industrial index. It could mark the bottom in the stock.

The next humiliation for GE as a U.S. corporate icon could come if it is dropped from the Dow Jones Industrial Average as a result of its depressed stock price. It is the last remaining original member of the 1896 Dow: Its peers included the U.S. Leather Company and Tennessee Coal, Iron & Railroad.

With the lowest share price among the Dow 30— Pfizer is next at $35—GE is largely irrelevant in an index that is weighted by the prices of the individual stocks, not market values. The committee overseeing the Dow might decide to add a company that can make more of a difference to the index.

If GE is dumped from the Dow industrials, bulls would seize on that as a sign of a bottom. Yet a close look at GE suggests the stock isn’t cheap based on earnings, a sum-of-the-parts analysis, leverage, complexity, and business challenges. GE’s best days may lie in the past.

(Barron’s)

Finally, thanks to Disney for giving us all a reason to escape reality over the weekend…

The movie from Walt Disney Co.’s superhero factory opened with estimated weekend sales of $192 million, ComScore Inc. said Sunday in an email, setting a record for a February opening and likely becoming the biggest movie ever starring a largely black cast. It’s the fifth-biggest open ever in the domestic market and second-biggest for Marvel. Analysts were forecasting as much as $185 million for Friday through Sunday…

“Black Panther” was also the biggest movie globally over the weekend, taking in $361 million, according to a statement from the studio. It opened in about 70 percent of the international territories that are slated to show the film, but won’t debut in China, the world’s second biggest market, until March 9.

Copyright © 361 Capital