by Blaine Rollins, CFA, 361 Capital

Just like a desert storm, the shift in market sentiment came quickly. And last week’s change not only hit risky instruments like equities, but it also sandblasted government bonds, credit and commodities (even gold!). This event is going to leave a mark on investors’ minds for some time. While many want to blame the short volatility traders, it was much more than that. This was the market further waking up to the outlook for higher interest rates from a hot economy, and a ballooning deficit combined with a changing Federal Reserve. The question is no longer when the 10-year Treasury yield will pass 3%, but when will it pass 4%.

The White House is betting that even more stimulus will solve everything, but I am uncertain how inflation ripping higher is going to create demand for the extra $500b in U.S. debt that we are going to need to sell in 2018. On Wednesday, we will get a look at the recent CPI report. The market wants a ‘core’ print of +0.2%. Anything more and Treasury Secretary Mnuchin will need to do a song and dance to sell bills, bonds and notes at the next auction. Earnings will take a back seat from here. With the highly correlated decline that we had last week, macro data points and politics will take the center stage for now. Volatility has returned and it will stay with us for a while. We will test the recent lows and test the highs. Investors are changing up their portfolios and getting ready for the new environment. Time to put on your goggles.

To receive this weekly briefing directly to your inbox, subscribe now.

Ray Dalio updates his Davos comments from two weeks ago. And they are very different…

About 10 days ago, that’s where I thought we were. However, recent spurts in stimulations, growth, and wage numbers signaled that the cycle is a bit ahead of where I thought it was. These reports understandably led to the reactions in bonds, which affected stocks as they did. Then on Friday, we heard the announced budget deal that will produce both more fiscal stimulation and more T-bond selling by the Treasury, which is more bearish for bonds. And soon ahead, we will hear about a big (and needed) infrastructure plan and the larger deficits and more Treasury bond selling that will be needed to fund them. In other words, there is a whole lot of hitting the gas into capacity constraints that will lead to nominal rate rises driven by the markets. The Fed’s reactions to them and the amount of real (inflation-adjusted) rate rises that will result will be very important, so we will be monitoring this closely.

What we do know is that we are in the part of the cycle in which the central banks’ getting monetary policy right is difficult and that this time around the balancing act will be especially difficult (given all the stimulation into capacity constraints and given the long durations of assets and a number of other factors) so that the risks of a recession in the next 18-24 months are rising. While most market players are focusing on the strong 2018, we are focusing more on 2019 and 2020 (which is the next presidential election year). Frankly, it seems to be inappropriate oversight to not be talking about the chances of a recession and what that recession might look like prior to the next election.

(LinkedIn)

And some thoughts from Goldman’s desk…

Brian Levine, co-head of global equities trading at Goldman Sachs, on Friday sent out an email to the investment bank’s bigger clients that also warned that the market probably still has not hit its bottom.

“Historically shocks of this magnitude find their troughs in panicky selling,” he said in the email, seen by the FT. “I’ve been amazed at how little ‘capitulation selling’ we’ve seen on the desk . . . The ‘buy on the dip’ mentality needs to be thoroughly punished before we find the bottom.”…

“longer term, I do believe this is a genuine regime change, one where you sell-the-rallies rather than buy-the-dips”.

Did you get your “I survived the crash of Feb 2018” shirt?

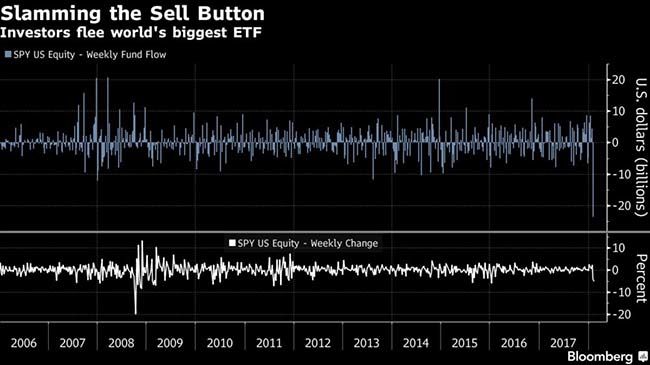

Did you know that the SPY ETF saw 8% of its assets leave last week?

The SPDR S&P 500 exchange-traded fund (ticker SPY) suffered a record $23.6 billion in outflows last week amid the worst momentum swing in history for the underlying U.S. equity benchmark. Outflows amounted to 8 percent of the fund’s total assets at the start of the week, a rate of withdrawals not seen since August 2010. A blowup in volatility-linked products sent markets haywire, eliciting waves of risk aversion from jittery investors.

And Goldman Sachs points out another observation on flows…

(@RobinWigg)

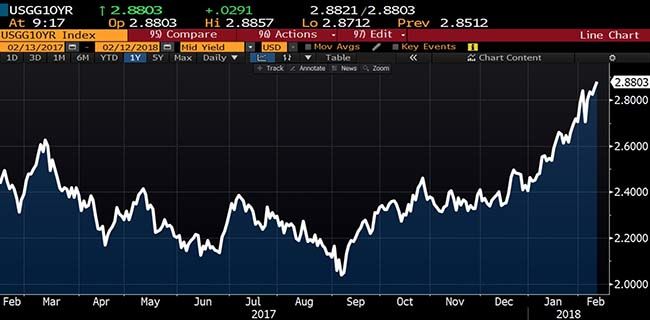

Meanwhile, interest rates continue to move higher leaving investors with nowhere to hide but cash…

@jsblokland: 10-year US Treasury #yield – 2.88%…

“If I had a choice between holding a US Treasury bond or a hot burning coal in my hand, I would choose the coal. At least that way I would only lose my hand.” (PTJ)

Paul Tudor Jones sent out a well-timed investor update on February 2nd…

In the letter, he highlighted how President Trump’s State of the Union address on Jan. 30 touting “the biggest tax reforms in American history” should frighten investors who’ve amassed more than $3 trillion in bonds into mutual funds and exchange-traded funds since 2008.

“This statement probably brought the loudest cheer of the night this week as all the Republicans jumped to their feet and offered a chorus of huzzahs. No doubt the tax cut has had a profound impact on the economy in the short-term and that will continue,” Jones wrote. “But I wonder if they would have remained cheering if President Trump had followed with, ‘By the way, Treasury auctions will increase this year from the current projection of $583 billion to almost $1 trillion. Relative to recent auction sizes, Treasury auctions will be higher by $500 billion next year and by $545 billion in 2020. And, secondly, the Congressional Budget Office’s long-term projection for our debt/GDP will eclipse that of Japan at its peak, possibly making us the most indebted country in the world by 2033.’”

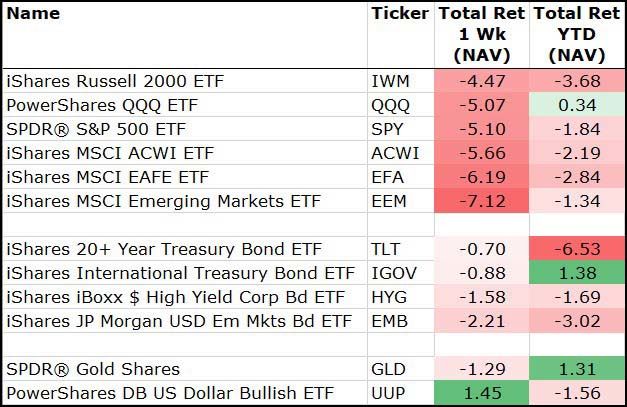

Last week everything lost money except for U.S. dollars…

And every Sector also lost money…

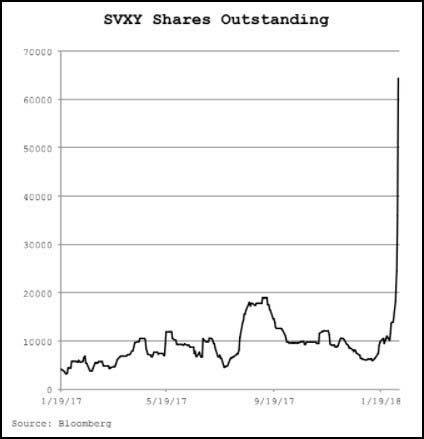

As Jared Dillian notes, investors were quickly returning to the Short Volatility trade…

Even as many investors just lost 90% in shorting several of the VIX instruments, others were rushing to fill the void and return to picking up the dimes being throw in front of the steamroller. This may not end well (again) for the dime pickers.

Hot economy = Rising interest rates…

The Economist nails it…

Transportation cost surge is causing a jump in new truck orders…

Trucking companies in January ordered the most new big rigs in nearly 12 years, as they hustled to take advantage of one of the hottest freight markets in recent memory.

A nationwide shortage of available trucks has sent shipping costs soaring, with retailers and manufacturers in some cases paying over 30% above typical rates to book last-minute transportation for cargo. Trucking companies, buoyed by strong demand and flush with cash following the recent tax overhaul, are accelerating plans to replace or expand their fleets.

The arrival of more trucks could stabilize the freight market, helping shippers. But relief could be months away. Many trucks ordered in January won’t be delivered until the second half of the year, and fleets are having trouble recruiting enough drivers to fill seats in their existing big rigs.

(WSJ)

Time for a new 30 year trend?

Industrial Metals used to enjoy the rise in interest rates. But no longer…

@AndrewThrasher: The relationship b/w copper and gold is not buying the move higher in 10-year Yield. Prior divergences have been won out by the metals.

Many of us are watching credit spreads closely…

We don’t want rising credit costs or a decline in the appetite for corporate debt.

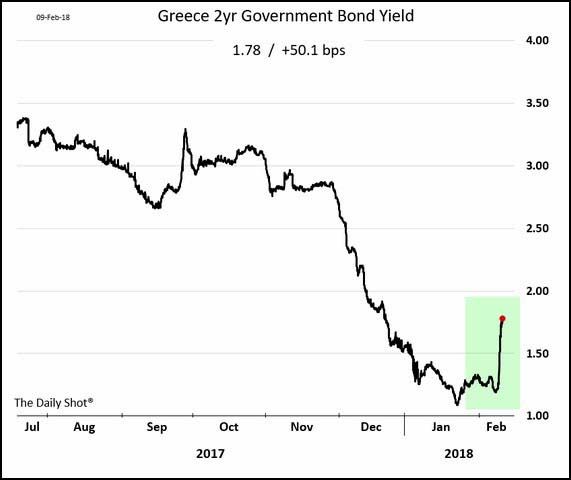

We also don’t want to see a spike in riskier Euro debt like Greece…

(WSJ/Daily Shot)

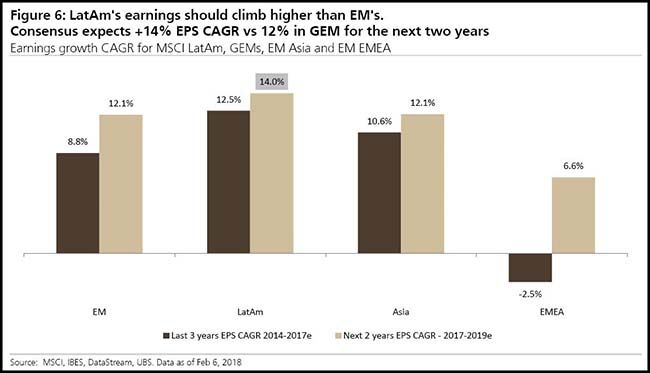

Emerging Markets did not hold up well in last week’s decline. Hopefully earnings growth will help them outperform in the future…

A good lesson learned from Mark Mobius’ exit interview in Barron’s…

What is a mistake you made that others can learn from?

I was too rigid at times. We would focus too much on metrics like price/earnings and price/book ratios, and didn’t pay enough attention to the total picture. We didn’t have the imagination of what could happen over five or 10 years and missed a lot of technology stocks during the boom. The spread of the internet—and knowledge—is another revolutionary change in the market. More than one billion smartphones will be sold this year, 70% of those in emerging countries like China and India. That’s an incredible development, not just from an economic standpoint, but also because people can learn what is going on and demonstrate against governments they don’t like.

(Barron’s)

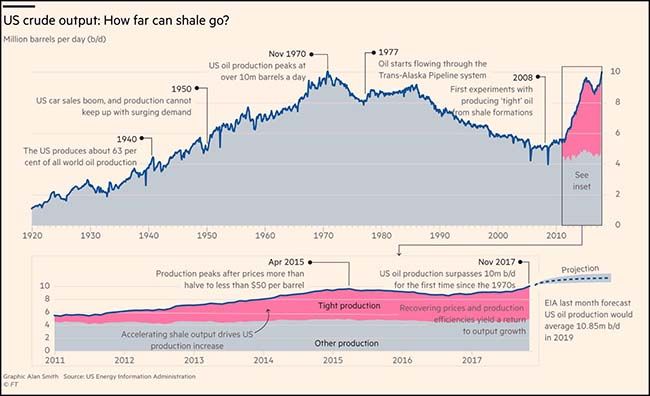

Just another great chart on the U.S. resurgence in the oil industry…

(@PlanMaestro)

This is item #1, #2 and #3 for the next Colorado Governor (as well as several other new Governors)…

If we don’t put a plan in place to solve our State’s largest liability, then any spending on Education, Health Care, Roads and the Outdoors will only be a dream.

A Denver Post review of thousands of pages of financial reports and hours of public meeting recordings found that state lawmakers and the pension board alike ignored numerous red flags after the landmark pension reform was passed in 2010, opting time and again for political expediency at the expense of the Public Employees’ Retirement Association’s long-term financial health.

Now, PERA is barreling toward its second watershed moment in a decade. PERA has only 58.1 percent of the money it owes in future retirement checks. Its funding gap has ballooned to $32.2 billion by one accounting measure — and $50.8 billion by another.

But unlike in 2010, when PERA’s looming insolvency was triggered in part by a global financial crisis, the latest fiscal crunch was arguably self-inflicted, brought on by wishful thinking and a consistent pattern of putting hard choices off to the future.

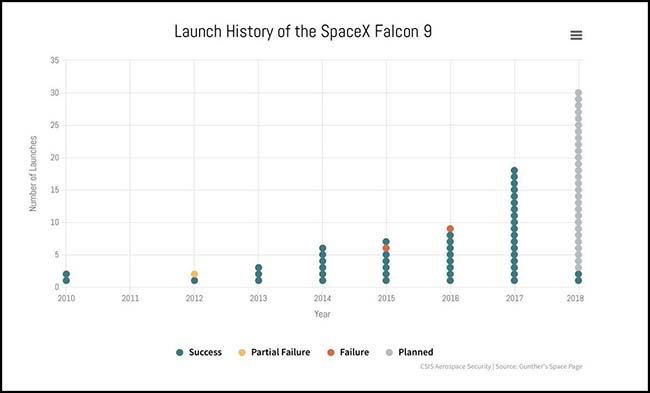

The Winter Olympics are cool, but nothing heats up an office full of quants like a SpaceX event…

And the good news is that there will be many launches this year…

(@PlanMaestro)

Which begs the question, has anyone seen Jim Chanos since Feb 2nd?

Finally, we had some questions from last week’s WRB:

Q1: When will it be “all clear” to be risk on? What will the bottom be characterized by?

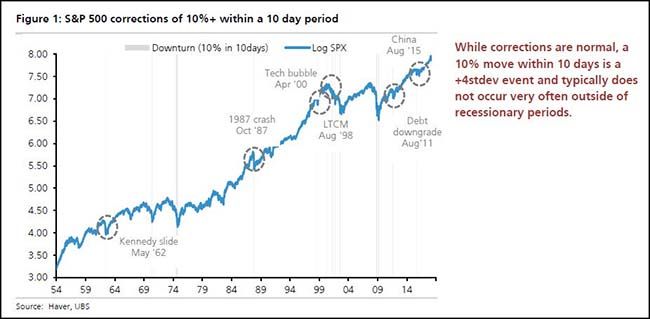

Markets will go both much higher and much lower than you will ever think. I have been run over in both directions during my investing career and it is no fun to sell too early (like Mark Mobius mentions above) or to dig in you heels and buy too soon. While evaluating the upside from a valuation perspective on any asset or security, I will also be very mindful of the trends and flows into and out of the same security. While the current 10% pullback that we hit last week was quite a slap, I didn’t see too many signs of panic or stress among investors or in the market. Maybe we will see flows quickly buy the dip and return to the market combined with a move to new highs. But I doubt it. I would rather see several tests of Friday’s lows before I felt comfortable enough to mark the bottom.

Q2: What are the probabilities that the Fed will overreach with four rate hikes and create disinflation and worse?

Given that there are four Fed Governor vacancies, this will only add to the uncertainty as to how the Board will react and vote in the future. The financial markets knew what they were getting with Yellen’s control of the FOMC. And we think that we are getting more of the same with Powell, but we really won’t know until they are faced with a difficult vote and who might be in the extra voting chairs. Anything can happen which is part of the market’s recent worry.

Copyright © 361 Capital