by Jeffrey Saut, Chief Investment Strategist, Raymond James

“You’ve Got Mail” is a 1998 romantic comedy-drama starring Meg Ryan and Tom Hanks. The film is about two people involved in an online romance who are unaware that they are also business rivals. In this morning missive, however, we are not referring to the movie, but rather some recent emails we have received. One of the cool things about my job and Andrew’s is the people we interface with, via both emails and phones as well as face-to-face conversations.

[Tweet "More than ALL [SPY's] performance came in after-hours trading, since 1993"]Said exchanges occur with financial advisors and their clients, portfolio managers, the media, the international crowd, and the list goes on. Consequently, we thought we would share a few of the more interesting ones with our readers this morning. This one came for a portfolio manager last week in response to our recent quip about the yield curve:

The flattening of the yield curve (YC) is getting tons of attention, as you know and have pointed out in missives. But, what is too often not mentioned by media is there's a big difference between a flattening YC and a flat or inverted YC. In fact, as you showed via Rich Bernstein research, some of the market's best gains occur when the YC is close to, but not yet flat (between 0-50 bps spread). The point being anticipating the YC becoming flat or inverted is a waste of time and even counter-productive for investing.

In this case, it's an all-or-nothing event that until the YC actually does become completely flat or inverted, no problem, continue as you were. It's not something where as the YC becomes flatter, you likewise should gradually become more bearish – wrong! It's more like a light switch, when on we have light, when off, darkness. There's no in between. And even when the YC does finally invert, you typically have 6-12 months of lead time for a recession, i.e. no need to panic.

Obviously Andrew and I agree. This one is from one of our financial advisors (FAs):

If this ends up being the “pause that refreshes” and we get a pullback in early/mid-February, would this be the end of the second leg, or only a pause? I know Leon Tuey and you maintain the second leg is the strongest and longest. If not, what typically ends a second leg? Some time ago you wrote about the three legs of a secular bull market. I thought you said the first leg started in 2008. Then again, I thought you had said that the secular bull market didn’t start until later (April 2013?). Can you help me out here?

Our answer read:

We think the first leg began on October 10, 2008 and ended in May 2015. The second leg began In February 2016 and is ongoing. Nobody knows when the second leg will end, but when it does, we will go through another upside consolidation (like the one from 5-2015 to 2-2016) and then breakout to the upside beginning the start of the third, or speculative, leg. In the 1982 to 2000 secular bull market, the third leg began in late-1994 or early-1995 and lasted into the spring of 2000.

Then there was this from an FA’s client:

I have been putting my 401k contributions to cash for now to avoid buying high but I have not trimmed any of my holdings to generate cash since September.

Jeff, I get nervous when I hear terms like Wednesday Wilt and February Flop suggesting a pull back. However, I also think about the extra money in paychecks that may spur earnings even more going forward. What do you think about the tax reform stimulus making any February Flop a flop and bounce?

Our answer was, “Some of the phrases we use in our missives are alliterations (February Flop, Wednesday Wilt, Dow Wow, etc.) Yet, we have been very clear that if our short/intermediate-models get it right about a pullback in February, it should only be a 5-10% drawdown in an ongoing secular bull market that has years left to run.”

And then there was this statistic from our friends at Bespoke Investment Group:

Remarkable: Since 1993, if you bought SPY on open and sold on the close each day, the return would be -5.2%. But, if you did the opposite and bought on the close and sold on the open next day, the return would be 568% (meaning more than ALL the performance came in after-hours trading).

Our comment: “Amazing!”

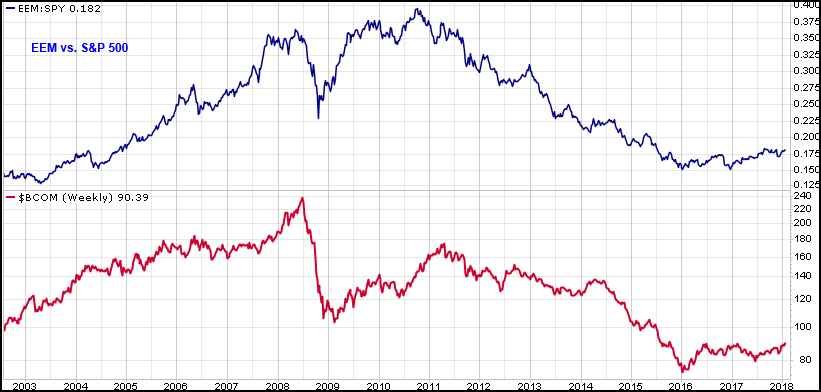

Speaking to embracing commodity-centric stocks (stuff stocks) over the past number of months, because they are the cheapest relative to equities as they have been in decades, another portfolio manager notes: “Needless to say, if you like commodities, you have to also like non-US equities, especially emerging (EM) markets because the relative performance of EM and commodities are highly correlated.”

We respond, “Yes we do like EM if your time horizon is long enough, and you can see the correlation in Chart 1 on page 3.”

We got this from one of the smartest guys in the room, namely Jason Goepfert of SentimenTrader fame:

The S&P 500 surged more than 1% and closed at a multi-year high on Friday, yet fewer than 55% of the issues on the NYSE advanced on the day. Even with all of the oddities from 2017, we never saw one this extreme. The only times since 1965 this has happened were 1987-03-23, 1999-03-18, 1999-11-18, and 1999-12-21. Each of them led to declines over the next two weeks, but it’s hard to put any weight on this when similar oddities failed so often in 2017.

Finally, there was this from our pal Doug Kass, captain of the sagacious Seabreeze Partners:

The supply of equities has been reduced because of a lower number of shares available due to a diminished supply of publicly traded stocks (halved in the last decade), the impact of buybacks (on the remaining companies), etc. The demand for equities is rising as expanding confidence has translated into record inflows into domestic equity funds in January. Aggregate trading volume has been recently trending markedly lower – exacerbating the aforementioned favorable supply and demand equation. During the last week investors added the most money on record into US equity funds – pouring over $33 billion into stocks for the week ending January 24, 2018. The virtuous cycle of demand and supply has continued; and, is actually strengthening.

The call for this week: So, at the end of last year, we were asked by numerous participants what we envisioned for 2018. What we answered was, “We think it will be a repeat of 2017.” “Impossible’” was their reply! Subsequently we received this email from Marshall Schield, Chief Strategist for STIR Research LLC, who writes:

There is a 70% probability that this bull market has at least one more year of gains. Looking at just secular bull markets (1949–1968, 1982–2000, 2011–2017), history shows that the market will have multiple back-to-back up years before being interrupted by a negative year. Rarely does the market advance just one or two years before hitting a down year. That sequence has only occurred three times, or 30% of the time. The market now has just finished its second up year with cumulative gains of more than 30%. History tells us that the market has a 70% probability of going three or more years with higher returns. The average gain if the market makes it to three consecutive up years is 58.7%. That would fit STIR’s 2018 outlook for another 20% gain this year, which would translate into a cumulative three-year gain of 57%.

Of course, we think this secular bull market has many more years left in it. This morning, as we write at 5:37 a.m. from Albany, NY, where we are speaking at a national engineering conference, the preopening S&P futures are off eight points as DJT considers retaliation against the EU for unfair trade policies, there is talk of nationalizing the G5 network, California considers a $1,000 fine for waiters offering unsolicited plastic straws, and participants await tomorrow’s SOU address. Oh well, it must be a Monday, so beware the month of February.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Copyright © Raymond James