Well, you know what they say about a strong January. The equity markets received a big boost last week from strong Corporate Earnings, a good Q4 GDP report, a weak U.S. Dollar, and surging commodity prices. Everything is good… Maybe too good. Read the news and commentaries and you can see that the dialog is beginning to shift toward more discussions about valuations and fewer discussions about credit risk and recessions. This is a difficult part of the investing cycle but it will be one ripe with opportunities to add value as sector and geography holdings change hands while investors attempt to outguess each other. Who will benefit from a directional move in currencies, interest rates, cost advantages, operating leverage, global growth, secular growth, etc.? These are fun times for analysts, portfolio managers and stock pickers. It will take work and brainpower to add alpha in this next phase. Just another reason to spend time looking at the earnings data points (which we will hit the peak of reporting season this week). Another big event this week is the FOMC meeting which will see a transition from Yellen to Powell. I would not expect a rate hike in her final meeting, but you can guess that the language from the Fed will get much more hawkish given strong global data points and the corporate earnings surge aided by the recent tax cuts.

To receive this weekly briefing directly to your inbox, subscribe now.

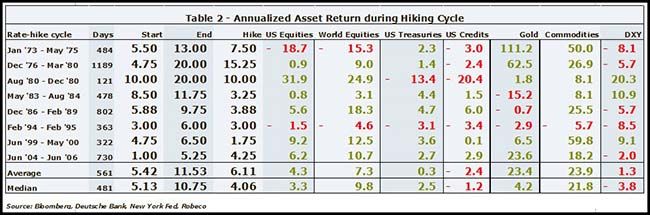

So far, the markets appear to be following the historical script…

As the world gets better and the Fed raises rates, Stocks and Commodities are rising, while Bonds and the U.S. Dollar flounder.

Diving into Friday’s GDP report… While the top line bored, the internals were impressive…

Fourth quarter GDP rose 2.6 percent on an annualized basis following the third quarter’s 3.2 percent rate of growth. Our preferred measure of core demand, real final sales to private domestic purchasers, climbed to 4.6 percent on an annualized basis. One of the most impressive aspects of the GDP report was consumer spending, which rose 3.8 percent for the quarter, led higher by stronger spending on durable goods. Business investment and government spending were both stronger in Q4 relative to Q3. Domestic demand led to growth in imports outstripping growth in exports, which subtracted from headline growth as did a downshift in the pace of inventory building. Net exports subtracted 1.1 percent from headline growth, while the slower pace of inventory building shaved off 0.7 percentage points.

As a result of the strong GDP report, the market continued to bid up the chance for four rate hikes in 2018…

Meanwhile over in Davos, Mnuchin started an avalanche with the U.S. Dollar…

Meanwhile over in Davos, Mnuchin started an avalanche with the U.S. Dollar…

“The dollar is one of the most liquid markets. Where it is in the short term is not a concern for us at all. A weaker dollar is good for us as it relates to trade and opportunities. Longer term, the strength of the dollar is a reflection of the strength of the US economy and that it is, and will continue to be, the primary reserve currency.”

(Treasury Secretary Steven Mnuchin)

But the U.S. Dollar really doesn’t need any help to fall…

It is losing its relative strength in the world already; and this is even before we start tearing up trade agreements.

At the end of 2015, the Federal Reserve thought America’s economy would grow about 2.0 per cent over the long term and that the appropriate policy rate would be about 3.5 per cent. This was downgraded significantly by the end of end of 2016, when the longer-run growth projection was revised to 1.8 per cent per year and the longer-run policy rate forecast was cut 3.0 per cent. The most recent projection, from December 2017, cut the longer-run interest rate forecast to 2.75 per cent despite keeping the growth forecast unchanged.

The European Central Bank does not quite publish an equivalent set of forecasts, but its Survey of Professional Forecasters also has longer-term GDP growth estimates. These have held steady at around 1.6-1.7 per cent over the past few years.

In other words, people think the longer-term growth outlook for America has gotten relatively worse compared to Europe. That could then affect investment decisions by Americans and Europeans, which in turn would move around the exchange rate.

Also in Davos, two of the biggest wealth managers in the world let it be known that they think cash is trash…

The heads of the world’s biggest asset manager and largest hedge fund are anti-cash.

Larry Fink, chief executive officer of BlackRock Inc., is urging investors around the world to stop keeping money in cash as stock markets reach new highs. There’s too much savings on the sidelines of financial markets in countries from the U.S. to China despite the stock market rally, Fink said Thursday at the World Economic Forum.

“We don’t talk about the pool of money that is still sitting here,” Fink said during a Bloomberg Television interview in Davos, Switzerland. “Our financial markets are up three times since the financial crisis.”

On Wednesday, money manager Ray Dalio also warned investors on holding high levels of cash. Dalio, who founded hedge fund Bridgewater Associates, said the current economic environment is good for stocks but bad for bond investors.

“It feels stupid to own cash in this kind of environment,” Dalio said in a Bloomberg News interview in Davos. “It’s going to be great for earnings and great for stimulation of growth.”

The State of Illinois was listening and is now thinking about a moonshot to save its pension finances…

Lawmakers in Illinois are so desperate to shore up the state’s massively underfunded retirement system that they’re willing to entertain an eye-popping wager: Borrowing $107 billion and letting it ride in the financial markets.

The legislature’s personnel and pensions committee plans to meet on Jan. 30 to hear more about a proposal advanced by the State Universities Annuitants Association, according to Representative Robert Martwick. The group wants Illinois to issue the bonds this year to get its retirement system nearly fully funded, assuming that the state can make more on its investments than it will pay in interest.

It would be by far the biggest debt sale in the history of the municipal market, and in one fell swoop would be more than Puerto Rico amassed in the run up to its record-setting bankruptcy.

“We’re in a situation in Illinois where our pension debt is just crushing,” Martwick, a Democrat who chairs the committee, said in a telephone interview. “When you have the largest pension debt in the world, you probably ought to be thinking big.”

Helpful thoughts in Dan Loeb’s recent letter…

The odds of a recession over the next one to two years are low due to a) the current strong level of growth supported by easy financial conditions, b) the growth support from tax cuts and fiscal spending, c) the low level of the real Funds rate, and d) the lack of major macroeconomic imbalances such as excess credit growth or overinvestment. Sometimes, however, recessions are caused by unanticipated events. A recession would come as a surprise to investors and would likely lead to a substantial market decline given the expansion in valuations in recent years and the concern that the Fed would not have enough ammunition to sufficiently stimulate the economy.

(Third Point Q4 Investor Letter)

Howard Marks’ latest pen writes about the markets and taxes…

On the Markets…

Thus the current environment is still mixed – better fundamentally and worse price-wise. The positive near-term economic outlook, lowness of interest rates, need of most investors for return and moderate psychology all seem to suggest it would be a mistake to get out. On the other hand, the extremely high asset prices, macro-fragility and risky behavior going on all around us argue for considerable caution.

On the Tax Cuts and Jobs Act…

All else equal, the tax law is likely to result over time in higher deficits, higher national debt, higher economic growth, higher inflation, higher interest rates, higher federal debt service requirements, and thus still-higher deficits and debt. These things tend to go together, and together they constitute the fiscal path Dudley describes as unsustainable. The outlook was troubling before; the tax cuts will make it worse.

The reward from the tax law is pretty clear: it’s likely that in the short run the economy will strengthen, corporate profits will increase and take-home pay will rise for most Americans. But the long-term benefits are less certain, and meaningful hidden risks exist.

Barron’s had a good interview with Marvin Schwartz who also talked about the power of the corporate tax changes…

Barron’s: What does the U.S. economy look like after the tax overhaul?

Schwartz: There will be very little incentive for U.S. companies to move operations abroad: They will have to pay a U.S. tax of up to 10% on foreign earnings if the tax they pay abroad is less than the new 21% U.S. rate. We’re going into a two-year period where gross domestic product will grow 3.5% to 4%, instead of 2%. That’s a big difference. At 2% growth, there’s no big pressure to expand capacity. A couple of quarters of 3.5%—we’re kind of there already—and you’ll see capital expenditures take off. Capex will grow 8% to 9% in 2018, and be stronger in 2019. Tax reform permits companies to depreciate 100% of new equipment in year one, versus 50% before.

As for individuals, remember that 47% of working Americans pay no federal income tax. Maybe yours will go up suddenly if you live in New York City. But I wouldn’t call it crumbs if somebody gets an extra $2,000 or $3,000 a year. If you have a job and feel secure about it, you have a propensity to spend almost all of your income. You shouldn’t, but you do, and that contributes to a stronger economy.

(Barron’s)

The tax changes are accelerating projects (just as they should in a healthy and competitive environment)…

The same provision, speeding up tax deductions for capital spending, has prompted Kimberly-Clark, the diaper- and tissue-maker, to accelerate at least one major project, CEO Tom Falk said. The company’s board votes next month on a U.S. factory retooling expected to cost hundreds of millions of dollars. There wasn’t a timeline for the project previously.

“It gives us more incentive to invest, particularly in the U.S.,” Mr. Falk said in an interview. “The project made sense before the tax benefit. It makes more sense after the tax benefit.”

Similar reconsiderations are under way elsewhere. At United Natural Foods Inc., a grocery distributor with about 10,000 employees and more than $9 billion in annual revenue, the tax law has prompted a wholesale re-evaluation.

Projects previously viewed as risky are being given new consideration, Mike Zechmeister, the company’s finance chief, said in an interview. The return on investment improved by 4 percentage points on a warehousing project in the Pacific region of the U.S. that the company had already decided to pursue, he said, primarily because of the new lower tax rate.

“It’s going to impact all the decisions we make,” Mr. Zechmeister said. “Almost all investments look better from an investment standpoint because we won’t have to pay as much tax.”

(WSJ)

As we discussed last year, be long robot manufacturers and automation…

Companies are using their Tax Plan benefits to expand and with workers hard to find, WALL-E and R2-D2 are getting the call.

New tax rules are hastening automation and modernizing in U.S. factories by giving manufacturers an incentive to buy machinery and boost productivity in a tight labor market.

For the next five years, the revised tax code allows companies to immediately deduct the entire cost of equipment purchases from their taxable income. Previously, companies generally were allowed to write off only a portion of the cost in a single year.

The change is encouraging manufacturers to install robots and replace aging machines sooner than planned.

“We probably would have put it off another year” without the tax incentives, said Ken Mathas, president of Cornell Forge Co., a Chicago maker of gears and other components for heavy machinery.

(WSJ)

Here, UBS charts the increase in take home pay that is about to hit all workers…

These are not small numbers and they help to explain the recent strength in Retail and the Consumer stocks.

As the snowball of strength rolls down the hill, U.S. Treasury yields reach new highs…

As the snowball of strength rolls down the hill, U.S. Treasury yields reach new highs…

And overseas, Government Bond yields are again going positive…

@jsblokland: Well guess who’s back in the green after two years of ‘subzero-ness’? German 5-year government bond #yield.

Regarding corporate earnings, investors are just beginning to find out how positive the recent tax cuts and changes can be to the bottom line…

Regarding corporate earnings, investors are just beginning to find out how positive the recent tax cuts and changes can be to the bottom line…

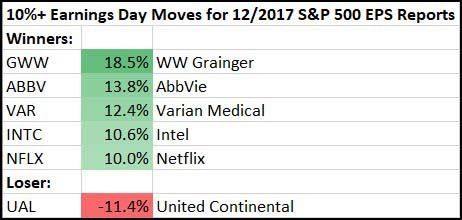

AbbVie, the maker of the world’s best-selling drug, issued what analysts described as a “jaw dropping” profit forecast after Donald Trump’s reforms helped the pharma company slash its tax rate to just 9 per cent. The new earnings guidance sent shares in the maker of Humira, a drug used for arthritis and many other inflammatory conditions, soaring 10 per cent to a record high on Friday, giving the group a market value of $190bn. “The company’s tax rate for 2018 is an astonishing 9 per cent compared to an expected 20 per cent, which is the most important contributor to their guidance increase,” said Geoffrey Porges, an analyst at Leerink. Mr. Porges said AbbVie would enjoy such low rates because it books almost all of its profits overseas, where they will be subject to a new 13 per cent tax on earnings from patents and other intellectual property. Chicago-based AbbVie said it expects to generate adjusted earnings of between $7.33 and $7.43 per share this year, versus the Wall Street consensus of $6.66. It said the 9 per cent tax rate would increase gradually to hit 13 per cent over the next five years — well below the 18.9 per cent it paid last year.

Companies are crushing their top and bottom line estimates so far…

@bespokeinvest: Companies have managed to beat EPS and revenue estimates at a very high rate so far this season, even as analysts have been upping estimates at the fastest rate in years.

And as you would expect, Companies are also increasing their estimates…

And as you would expect, Companies are also increasing their estimates…

A surge in earnings revisions has kept forward-looking valuation multiples flat even as the S&P 500 price has soared to new record levels. Since the passage of tax reform in late December, consensus estimates for 2018 EPS have risen by 5% to $154 from $147. With only 26% of S&P 500 companies having reported earnings so far this season, we expect estimates will continue to rise as the earnings season continues.

(Goldman Sachs)

Some very big earnings movers so far this season…

This is the major earnings hump week of the season for the S&P 500…

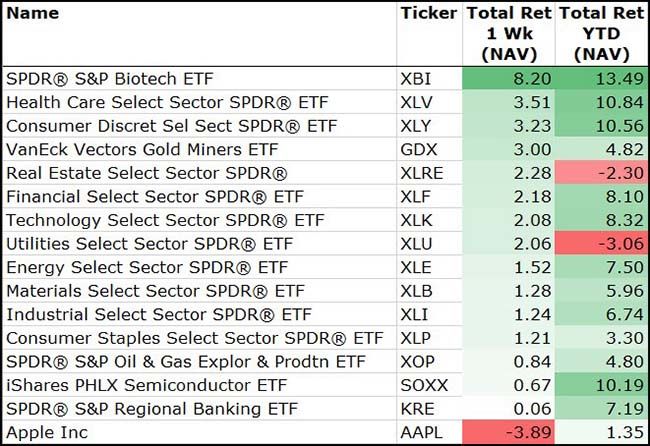

Last week was a positive one for all asset classes except for the U.S. Dollar…

The week also saw gains from every sector of the market…

Unfortunately, the largest company in the market could not ‘iPhone in’ a gain. Maybe this week… if they cure the ongoing iPhone production worries.

Breadth in the market for the week ended stellar…

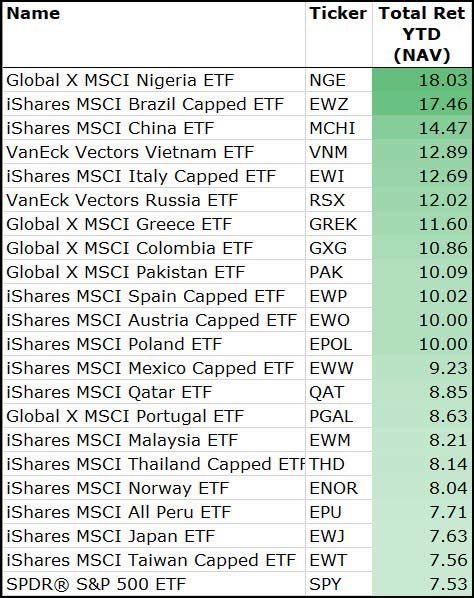

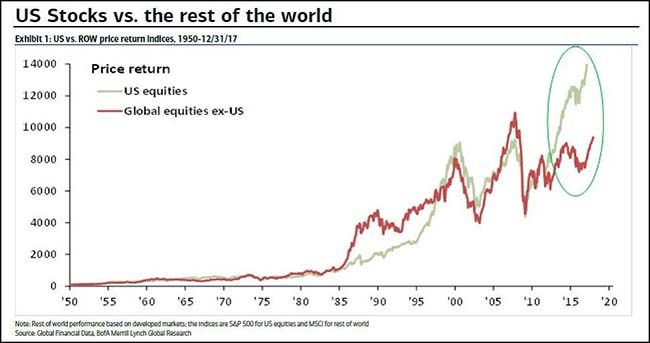

Looking at the ACWI, this is shaping up to be the best January performance in my investment career…

Looking at the ACWI, this is shaping up to be the best January performance in my investment career…

(WSJ)

(WSJ)

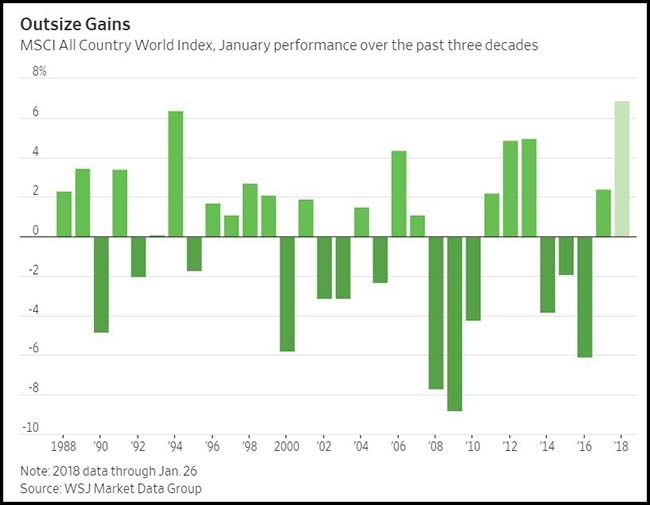

For U.S. investors happy with their +7.5% return in 2018, they could have done even better investing in any of these foreign markets…

And this trend could continue…

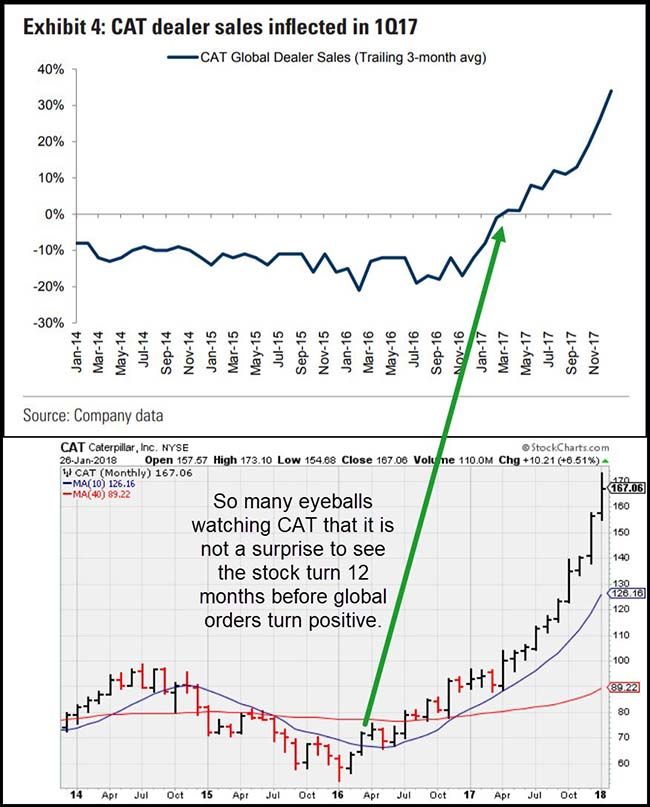

An example of market efficiency…

Caterpillar is a very over-researched and analyzed stock. Thus, it should not be a surprise that the stock price of CAT will tell you the direction of their business. As you can see below, the stock price turned almost exactly 12 months ahead of its order growth going positive.

Some companies will have difficulty managing costs as the economy continues to heat up. Here, Ford drops the ball…

“The changes in commodity prices and exchange rates that we’ve seen over the last several years have had a material effect on the business,” Chief Financial Officer Bob Shanks told analysts Jan. 16 at a Deutsche Bank conference in Detroit. “We see that continuing in 2018.”

The price of steel, Ford’s biggest commodity purchase, has spiked 18 percent since the start of last year. Aluminum, used for the bodies of F-Series trucks, is up by nearly a third.

The top crane city in the U.S. sees a slowdown…

Seattle was the only big U.S. city to see its crane count drop in the latest survey.

The city’s lead over others shrunk by half, with just nine cranes now separating it from three cities tied with the second-most cranes — Los Angeles, Denver and Chicago.

Seattle first topped the nation in cranes in July 2016 and has kept the top spot in every count since. Before now, its totals hadn’t changed much over the last few years — hovering consistently around 60 cranes at any given time — but the latest count is the lowest since the city dropped to 42 cranes in July 2015.

(Seattle Times)

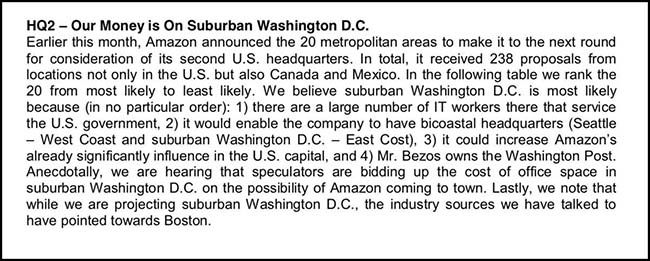

Sorry Denver, expect Amazon to drop several cranes in the D.C. area…

@carlquintanilla: DA Davidson hikes $AMZN target to $1800 (a street high), and says suburban DC will get #AmazonHQ2

Finally, House of Cards: Season Six started shooting last week…

Copyright © 361 Capital