by Ryan Detrick, LPL Research

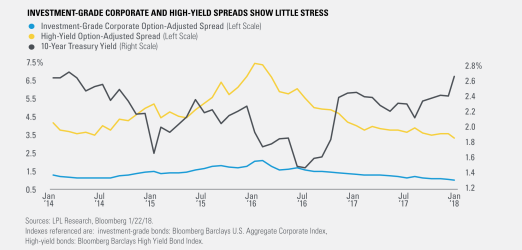

The 10-year Treasury yield recently surpassed its March 2017 post-election highs due to a combination of higher global rates (driven by more hawkish central bank expectations), rising growth expectations tied to tax reform, and an increase in inflation expectations. Yields on investment-grade and high-yield bonds have also risen, but not to the same degree as Treasury yields. This has caused spreads for both investment-grade and high-yield bonds to trade at their lowest levels since the current expansion began.

Rates remain low relative to history, but expectations of higher short-term rates (due to Federal Reserve policy) and higher longer-term rates (driven by economic growth and inflation outlooks) can cause investors to worry that higher borrowing costs for consumers and businesses could cause a slowdown in growth—though concerns seem to be muted thus far. In fact, markets are currently showing few signs of stress as seen in the chart below.

John Lynch, Chief Investment Strategist commented, “We continue to believe investment-grade corporate bonds, even at tight current spreads, offer value relative to Treasuries. High-yield bonds can also help provide additional income where appropriate, though their higher exposure to credit risk warrants a smaller allocation in most cases.” To learn more about what tight spreads could mean for investors, as well as our views on investment-grade corporate and high-yield bonds, please see the latest Bond Market Perspectives, “Bond Market Not Stressing About Higher Yields”.

Copyright © LPL Research