ETF trading: Watch the clock

by Hussein Rashid ETF Capital Markets Specialist, Invesco Canada

In my last blog post, I covered how to get the right price when trading ETFs. Now, we turn to the second part in this ETF trading series – timing.

Some of the most common questions we receive here at our ETF Capital Markets help desk are about the best time of day to buy or sell ETFs, so I’ve put together the two key points on this topic.

Avoid market open and close

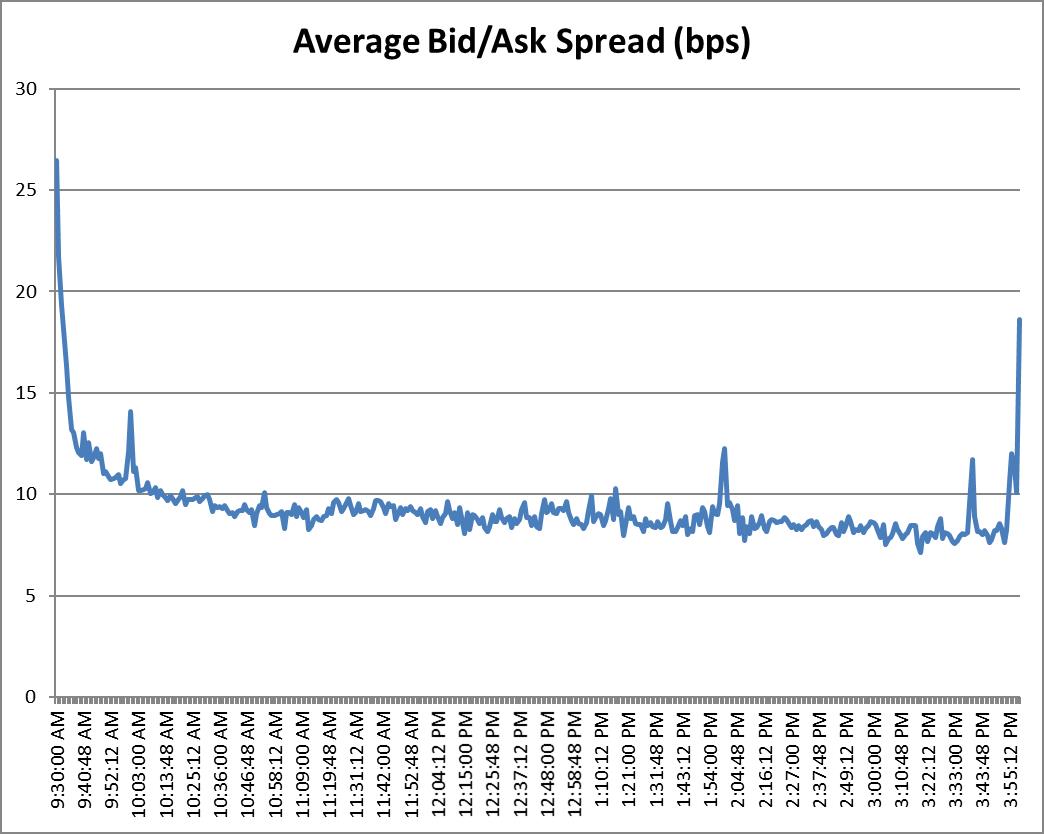

In general, it’s a good idea to avoid buying or selling during the first and last 15 minutes of the trading day.

At the start of the trading day, it’s possible, even likely, that some of the underlying stocks within an ETF haven’t started trading. If this is the case, market makers can’t accurately price the ETF and you may end up paying a less-than-ideal price (see “Volume does NOT equal liquidity. Here’s why” for more info on market makers and their role in ETF trading.) At the end of the trading day, some market makers may bow out to try to limit their risk. Fewer market makers in play could limit options and cause bid-ask spreads to widen.

The average bid-ask spread shown above was calculated based on an Invesco Canada ETF and is shown for illustrative purposes only.Source: Bloomberg L.P., from November 1, 2017 to December 31, 2017.

Check if overseas markets are open for international ETFs

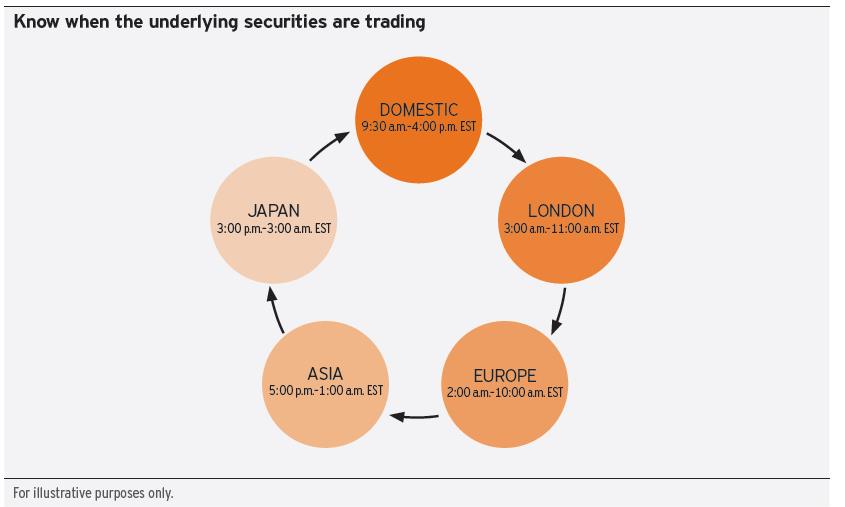

Whenever possible, it is preferable to trade international ETFs during the trading hours of the underlying securities. There are two reasons for this. First, trades tend to be executed more smoothly when the related international markets are open. The second, and important reason, is pricing. International ETFs tend to be priced closer to the value of the underlying securities – with a narrower bid-ask spread – when the appropriate markets are open.

Trading international ETFs when the underlying market is open is the preferred option, but in many cases, not feasible. For example, Asian and European markets are generally closed during North American trading hours. Market makers may use alternative methods to price an ETF when the underlying market is closed, such as futures contracts on international markets. This helps keep spreads from widening out significantly.

This is the second of three blog posts looking at ETF trading best practices. Read “Volume does NOT equal liquidity. Here’s why” to better understand the role of the market maker, and watch for my next post, where I’ll discuss what to watch for when trading ETFs in volatile markets.

The PowerShares ETF Capital Markets trading desk supports our clients with execution of their ETF trades and any pre-trade questions. We are available to advisors for trading and liquidity guidance.

To get in touch with our ETF Capital Markets team, please contact your PowerShares Sales rep at 1.800.261.8689 or e-mail us at capitalmarkets@powershares.ca.

This post was originally published at Invesco Canada Blog

Copyright © Invesco Canada Blog