by Blaine Rollins, CFA, 361 Capital

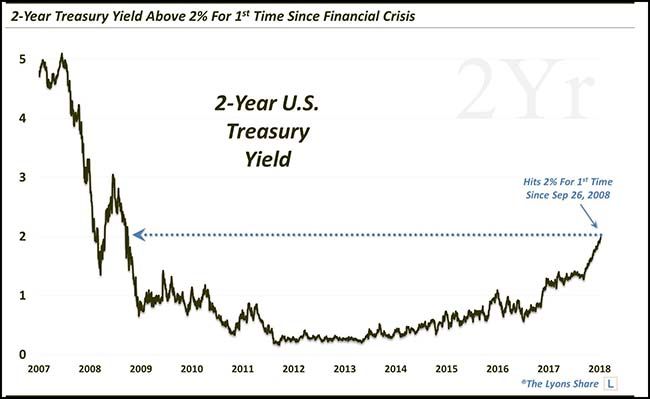

All of this economic activity is not only firing up welding rods, but it is increasing the values of our investment portfolios. Risk assets continue to be bought across the board while Treasuries remain for sale. Market breadth widens, while new all-time highs hit levels that I haven’t seen in 10 years. Credit spreads are tight and the appetite for Junk Bonds is lit. These are the good times if you are looking for a job, bidding on a contract, or making a loan. Money is being put to work and coming out of cash as evidenced by the 2% handle on the Two-Year Treasury yield. If capital remains disciplined and governments don’t interfere, this tailwind could last more than a couple of years. Investors will eventually get greedy, make mistakes and create losing opportunities; but for now, we should enjoy this time. Now, back to work.

To receive this weekly briefing directly to your inbox, subscribe now.

A very good piece by Mohamed El-Erian over the weekend…

With risk assets and commodities rising sharply along with bond yields, the markets are yelling at you that the global economy will take the correct fork in the road ahead.

The good news comes in the context of too many years in which the advanced world has been stuck in a “new normal” of growth that is too low and insufficiently inclusive. Already, it has led economists to improve their short-term forecasts and markets to build on an already impressive multi-year rally in risk assets.

But it is yet to translate into a materially improved medium-term growth path, nor has it significantly reduced worries about elevated financial asset prices and debt. Indeed, one of the most consequential questions facing the US and global economy is whether this could be more than just a short-term uptick in growth.

The protracted period of low and non-inclusive growth has fuelled the seeds of its own demise — economic, financial, institutional and political. Essentially, the global economy has been on a road to a “T-junction” whereby the current finance-reliant growth paradigm would give way to one of two very different outcomes depending on the extent to which the advanced economies’ policy responses include structural reforms, more balanced demand management and better cross-border co-ordination and architecture.

Goldman sees the near term risk of a recession across the major developed markets as low. For now…

If you are worried about their 34% forecasted risk for a U.S. recession in 12 quarters, then consider sliding your risk exposures toward some of the Euro Area assets.

There are now multiple bidders for workers…

Amy Glaser, a senior vice president for Adecco, a staffing firm, sa id that especially during the recent holiday season, there was a surge in demand for warehouse workers, creating opportunities for people who might have struggled to find work earlier in the economic recovery. Two years ago, Ms. Glaser said, companies required warehouse workers to have high school diplomas and experience with the scanners used to track merchandise. Now, increasingly, they require neither, she said.

“We’ve seen an extreme escalation in the past 12 months,” Ms. Glaser said. “If someone applies for a job and you don’t get to them within 24 hours, that person will already have taken another job.”

(NY Times)

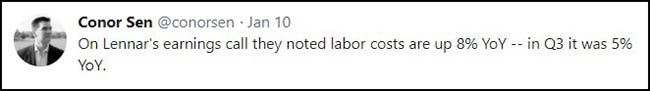

Labor cost pressures continue to move higher…

The Two-Year Treasury yield is seeing all of this economic activity and reacting…

@JLyonsFundMgmt: 2-Year Treasury Yield Above 2% For 1st Time Since Financial Crisis

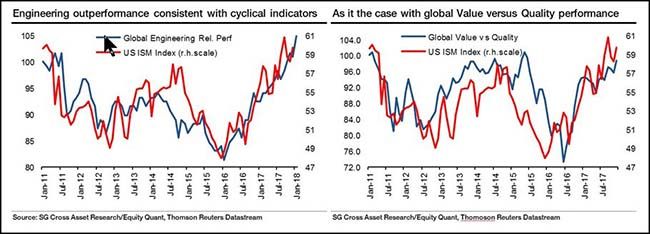

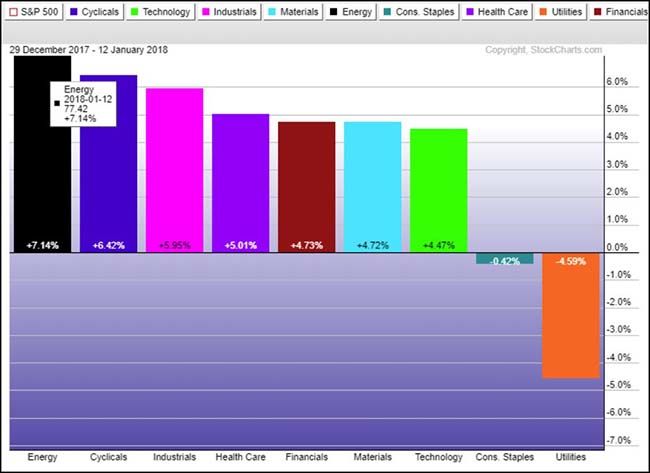

Global stock groups are also reflecting the higher economic activity…

With little chance of recession risk, economically sensitive equity groups remain on a global tear. Defensive stocks are for chumps right now.

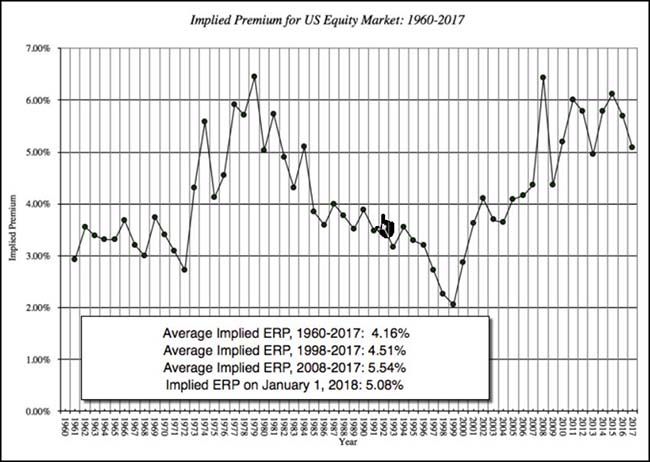

Dr. Damodaran updated his Equity Risk Premium calculation for 2018…

It is instructive to look at how the inputs have changed since the start of 2017, when my estimate of the implied ERP was 5.69%. The S&P 500 has risen 19.43%, while cash returned has remained stable; the drop in buybacks has been offset by an increase in dividends. Analysts have become more optimistic about future earnings growth, partly because US companies had a healthy earnings year and partly because of the expected drop in corporate tax rates. It is true that there are judgment calls that I had to make in estimating the implied premium, including using the analyst estimates of earnings growth for the S&P 500 (7.05%), but the resulting error pales in comparison to the standard error in the historical risk premium estimate.

While I take this implied equity risk premium as a market price for risk, and will use it in my individual company valuations in January 2018, there are some who like playing the market timing game. If you are so inclined, the question that you are asking is whether 5.08% is a high, low or reasonable number. If you believe that the current implied premium is too low (high), you also have to believe that stocks are over priced (under priced), and to help you make that judgment, I have graphed the implied equity risk premium for the S&P 500 from 1960 to 2017 in the graph below:

There is a reason why those who are intent on claiming that the market is in a bubble have a tough sell. Unlike the end of 1999, when implied equity risk premiums were at historical lows (close to 2%), the current implied ERP is well within the bounds of historic norms. It is only if you read this graph, in conjunction with the earlier one on risk free rates, that you should be concerned, since one reason that the premium is at 5.08% is because the US treasury bond rate is 2.41%. If the T.Bond rate moves towards 4.50%, and nothing else changes, the implied ERP will drop below comfort levels.

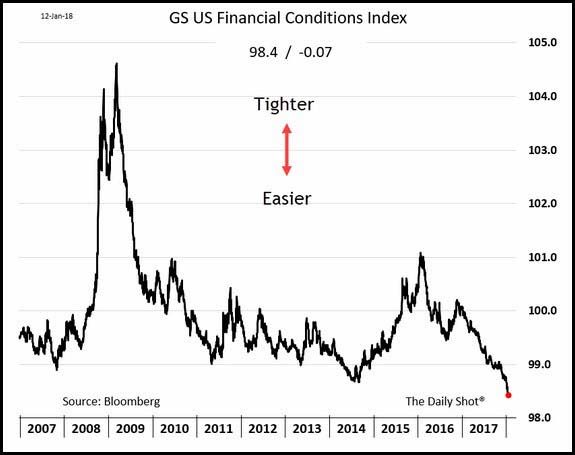

The many market inputs have pulled the GS US Financial Conditions Index to most healthy levels…

(WSJ/Daily Shot)

And with investors feeling safe about risk, they are now buying Junk Bonds at a ravenous rate…

Investors have hoovered up billions of dollars of riskier corporate debt since the start of the new year, fuelled by a rally in equities and high-yield bond prices that some portfolio managers warn borders on euphoria.

Sales of high-yield bonds in the US have more than tripled from year-ago levels, with one lowly-rated group drumming up strong demand for an exotic financial instrument popular before the financial crisis.

Speculative rated companies — those judged to be riskier than their investment grade counterparts by the major credit rating agencies — have borrowed $4.5bn through US debt markets so far this year, the strongest start to a year since 2014, according to Dealogic.

Portfolio managers and investors have latched on to improving economic data in the US, Europe and Japan, as well as rising commodity prices, for their sanguine outlook. Funds that buy high-yield bonds in the US have attracted $2.3bn over the past two weeks, the first consecutive weeks of inflows in three months, data from EPFR show.

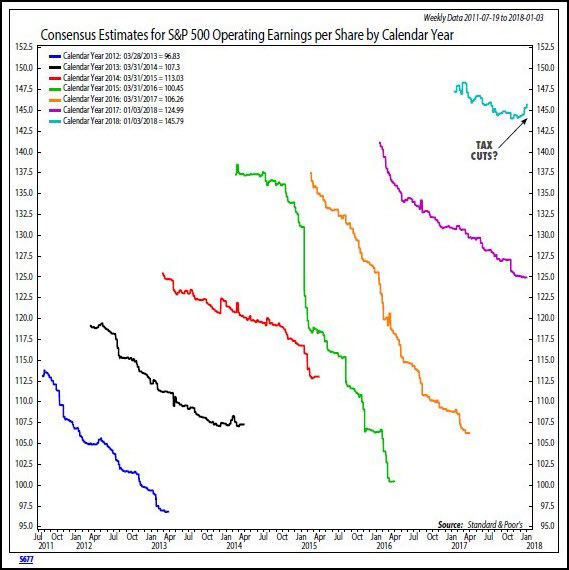

Analysts usually overestimate earnings. But not this year…

(@NDR_Research)

Speaking of earnings, it is going to be a full week of numbers with many S&P 500 companies reporting. Heavy on Financials…

(@eWhispers)

Now about that falling U.S. Dollar…

Sure it makes U.S. companies that sell overseas more competitive and it jacks up multi-national earnings which is why the Dow is outperforming the broader indexes this month. But at what point will the down double-digit move cause U.S. inflation to rise as iPhone, Nutella and drug prices rise?

More thoughts from the WSJ on the falling U.S. Dollar…

A modest further decline in the dollar would be welcomed by many large U.S. companies that report substantial earnings overseas. A falling dollar tends to boost exports by making U.S. goods more competitive abroad, a key policy objective of President Donald Trump, and a weaker currency potentially also gives the Federal Reserve more room to raise interest rates.

But some investors worry that an extended drop in the dollar could shake faith in the U.S. economy, elevating concerns about the lofty stock-market valuations and complicating the Fed’s efforts to raise rates. A rapid drop could also spur fears that inflation will rise beyond the moderate pace hoped for by policy makers and investors.

(WSJ)

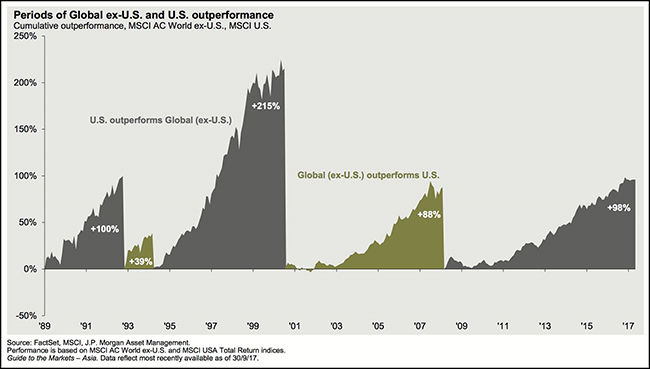

I have to agree that International equities should fare better in the future…

@TihoBrkan: US equities outperformance has been in progress since 2008, around the same time US Dollar entered a bull market against the majority of the global currencies. How much longer can the overvalued $SPY (PB @ 3.3, PS @ 2.2) outperform $EFA & $EEM?

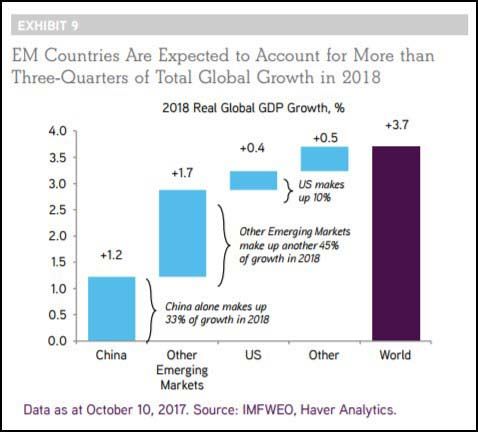

Emerging market equities fetch you 3/4 of the world’s growth and at a lower multiple than U.S. equities…

(KKR)

Crude oil has been on a tear and it is getting near to retracing half of the move from its pre-OPEC production change announcement…

@LMT978: Crude Oil $WTIC $USO 37 month high

Energy prices usually negatively impact Transportation stocks but not in this economy…

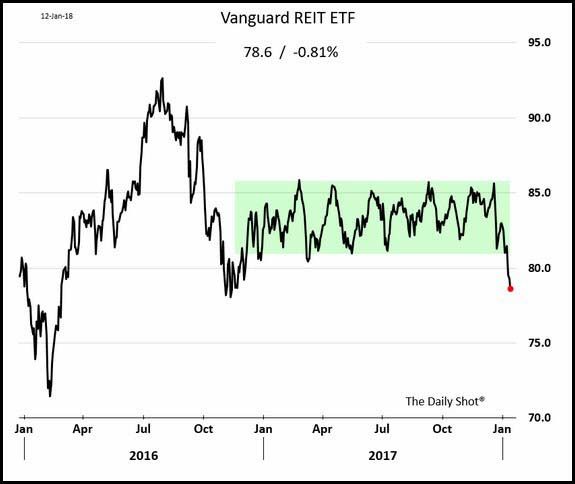

For the year to date, everything is working unless it is defensive (Staples, Utilities, REITs)…

Speaking of REITs, they are now -5% in 2018 and breaking some past resistance levels…

(WSJ/DailyShot)

So, if you are full owning risk assets, diversified in alternatives and afraid of duration risk in long bonds, where do you stash your residual cash?

In an interview with CNBC last week, Berkshire Hathaway CEO Warren Buffett said his firm stashed its cash in Treasury bills and estimated that Berkshire owns about $100 billion in T-bills. Emulating the Oracle of Omaha rarely has been a bad thing, and that goes for savers now.

One-month bills yielded 1.3% Friday, while three-month bills yielded 1.44% and six-month bills returned 1.6%. Hardly anything to send your heart aflutter, but a darned sight better than what most bank accounts, brokerages, or money funds yield.

It goes without saying that T-bills are the gold standard in terms of safety and liquidity for institutional investors such as Berkshire. And for individual investors in high-tax states, the elimination of the deduction for state and local taxes under the new tax law makes Treasuries’ exemption from state and local income levies all the more attractive.

(Barron’s)

Looking for declining asset values? Here is a new one to add to the list…

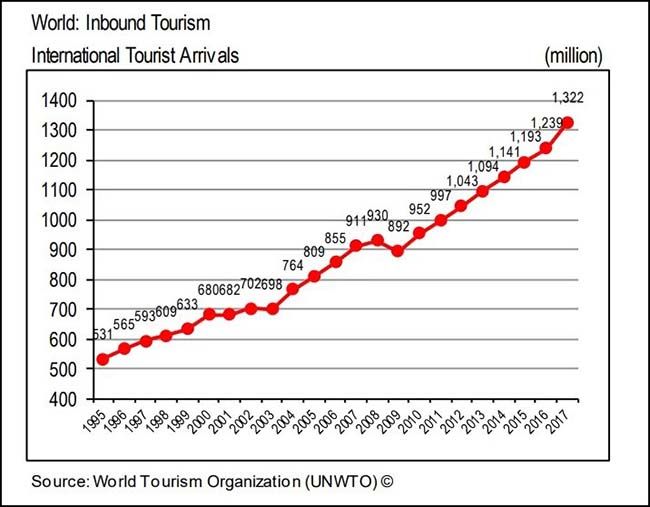

Need some investments with a giant wind at their back? Try global tourism…

International tourist arrivals grew by a remarkable 7% in 2017 to reach a total of 1322 million, according to the preliminary full-year results reported in this issue of the UNWTO World Tourism Barometer. This strong momentum is expected to continue in 2018 at a rate of 4%-5%.

(UNWTO)

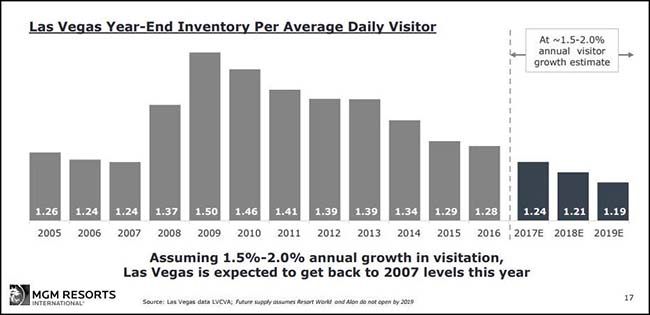

Combine the previous chart with this one and you can paint a picture of rising room rates in Las Vegas…

(@BluegrassCap)

If I were a recent college graduate, I would pack a bag and move to Dublin in a heartbeat…

For all the reasons that Barron’s would tell you to buy Dublin real estate, I would say that young people should go and start their life in Ireland. Nicest people in the world and the town is booming and in need of young brains. Thanks Brexit!

When looking for cities that haven’t yet performed to their full potential, Ms. Barnes noted that a few of them are in Europe, where for various reasons, international buying hasn’t been as strong as it’s been in other parts of the world. Dublin tops her list as a city worth considering in 2018 for a few reasons, she said.

“Dublin is a small market where there are a lot of nice fundamentals, such as economic growth and population growth,” Ms. Barnes said, adding that population growth, specifically, is important because it’s tied to capital growth and demand, and something many European cities lack.

Rental yields in Dublin, meaning the annual rental income over a property’s total value, are also high, at 5% to 6% in the luxury sector, which indicates that there’s room for capital growth.

Simon Barry, head of new development at Harrods Estates in London, agreed with Ms. Barnes, and included Dublin at the top of his list of places luxury buyers should look into in 2018.

“More than anywhere else in the E.U., Dublin has sorted itself out since the credit crunch,” Mr. Barry said, “but it still has a long way to go to reach its 2008 peak,” meaning that prices are likely to keep increasing.

(Barron’s)

The epic trolling of the Director of the NEC (Gary Cohn) and Treasury Secretary (Steven Mnuchin) by their former boss (CEO of Goldman Sachs) continues….

Dolphins probably do not eat Tide pods…

At the Institute for Marine Mammal Studies in Mississippi, Kelly the dolphin has built up quite a reputation. All the dolphins at the institute are trained to hold onto any litter that falls into their pools until they see a trainer, when they can trade the litter for fish. In this way, the dolphins help to keep their pools clean.

Kelly has taken this task one step further. When people drop paper into the water she hides it under a rock at the bottom of the pool. The next time a trainer passes, she goes down to the rock and tears off a piece of paper to give to the trainer. After a fish reward, she goes back down, tears off another piece of paper, gets another fish, and so on. This behaviour is interesting because it shows that Kelly has a sense of the future and delays gratification. She has realised that a big piece of paper gets the same reward as a small piece and so delivers only small pieces to keep the extra food coming. She has, in effect, trained the humans.

Space photo of the week…

@WIRED NASA’s Juno spacecraft was a little more than one Earth diameter from Jupiter when it captured this mind-bending, color-enhanced view of the planet’s tumultuous atmosphere. See more photos from Juno here: http://bit.ly/2DnxotP

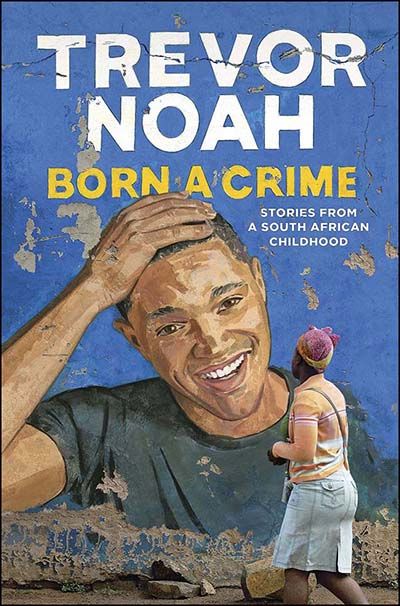

Finally, my high schooler and I both read this book over the break and would highly recommend it for anyone looking to add some perspective to their life…

Born a Crime: Stories from a South African Childhood is the compelling, inspiring, and comically sublime story of a young man’s coming-of-age, set during the twilight of apartheid and the tumultuous days of freedom that followed—from one of the comedy world’s brightest new voices and The Daily Show host Trevor Noah.

Copyright © 361 Capital

.png)