by Sharon Fay, Head and CIO, Equities, AllianceBernstein

Equity markets are widely expected to do well this year after a stellar 2017. We share the optimism, but are monitoring multiple risks—from style patterns to inflationary pressures—that could deliver surprises as the year unfolds.

Global equities delivered powerful and consistent returns in 2017. The MSCI World Index surged by 18.5% in local-currency terms, adding $9 trillion to the market capitalization of global stocks. Both the MSCI World and S&P 500 indices posted positive gains in all 12 months of the year. US equity volatility sunk to the lowest level in a generation.

Will 2018 be as good? Possibly, as last year’s macroeconomic drivers of strong stock market returns remain in place. Yet it’s unlikely that the upward path will be as smooth, and the best areas to be invested in are likely to be different than in 2017.

Emerging-market stocks were the stars of 2017. They outperformed developed-market peers after several disappointing years (Display, left). Japanese stocks rebounded, while European equities trailed the developed world despite a revival of regional growth and receding political risk. US large-caps powered ahead, though smaller-caps lost steam after a strong 2016. Cyclicals and financials were the strongest performers (Display, right).

Currency moves made a big impact on equity returns. For example, European stocks (in euro terms) underperformed US large-cap stocks (in US-dollar terms). But the strengthening euro versus the US dollar in 2017 meant that in US-dollar terms, European stocks actually outperformed US equities.

Growth Stocks Surge in Style Shift

Perhaps the most notable trend in 2017 was the dramatic swing in style leadership (Display, right). For the third straight year, global markets were led by a completely different cohort of stocks than in the previous year. In 2015, low-volatility stocks did best. In 2016, value stocks were the strongest performers. And last year, it was all about growth.

Style trends were unusually extreme. Our research shows that the returns of global growth stocks have beaten value stocks by a wider margin in only three years since 1975.

The popularity of growth stocks is being driven partly by the explosive potential of new Internet and media dynamos. In the US, Facebook, Amazon and the three other so-called FAANG stocks were so popular that they accounted for almost a fifth of S&P 500 Index returns (Display, left). Similarly, in emerging markets, Chinese Internet powerhouses Alibaba.com and Tencent fueled much of the market’s gain.

Investors should always tread cautiously in crowded pockets of the market, in our view. This means that FAANG stocks should be subject to the same fundamental analysis as all other companies.

Should you worry about equity style patterns? No, but you should be aware of them. Since style returns can shift rapidly, consider whether you are sufficiently diversified across styles or positioned with core strategies that are better positioned to weather shifting style winds. Indeed, there were signs in December that this might already be happening.

Earnings Outlook Remains Firm

So, is it time to de-risk? We don’t think so.

While the FAANGs stole the spotlight in 2017, they weren’t the only companies doing well. Around the world, the earnings outlook is robust. Companies are expected to post double-digit earnings growth in the US, Japan, Europe and emerging markets this year, according to consensus estimates. These earnings are underpinned by solid and unusually consistent economic growth around the world.

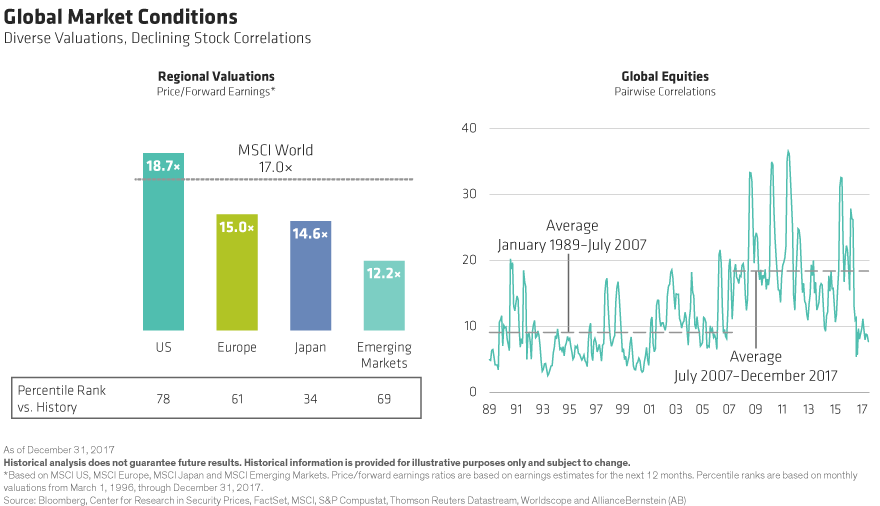

Equity market valuations are stretched after last year’s rally, but still far from extreme levels. Beneath the surface, there are also big differences between regions, sectors, industries and, of course, individual companies. US stocks are relatively expensive, while European and Japanese stocks remain more moderately priced, and emerging markets are still quite cheap, at least relative to the rest of the world. From another perspective, we believe that stocks are still very attractive versus bonds and that many investors cannot afford to give up the return potential of equities. What’s more, stock correlations have declined in recent months, which tends to create better conditions for stock pickers to generate alpha (Display).

Market Risks Warrant Attention

At the same time, investors can’t afford to ignore the risks. Perhaps most importantly, while growth trends are encouraging, inflation is a wild card. As the year begins, inflation forecasts are still benign for the developed world. But many variables could change the picture.

If labor market conditions in the US tighten or global economic growth accelerates, inflationary pressures could emerge. And if this prompts a sharper rise in interest rates than investors now anticipate, equities could suffer: multiples could take a hit as investors use a higher rate to discount future earnings and fears of recession rise.

Concerns of a slowdown could also emanate from China, where growth might decelerate more rapidly than expected. Political risk is real, from US tensions with North Korea to Brexit. And financial markets may generate their own surprises: we see some risks in the popularity with investors of potentially risky bank loans, for example, not to mention the explosion of interest in crypto-currencies. Currency is also a potential source of risk; if expectations of a rapid acceleration of US economic growth, driven by tax cuts, prompt a strengthening of the US dollar, emerging markets would be particularly vulnerable.

With so many variables that could prompt instability, we believe that it’s especially important to be selective with your equity exposure this year. The recent decline in stock correlations indicates that investors are paying closer attention to the differences between individual stocks. No matter whether you prefer more value, growth or core exposure to equities, we believe that understanding the fundamentals of the companies in your portfolio will be the best way of generating superior returns in 2018.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein