by Blaine Rollins, CFA, 361 Capital

Most investors get judged at frequent intervals, especially equity investors. While the end client, be it Institutional or Retail, wants you to be invested for the long term, they can still see a fund or account performance on a daily basis. This can cause friction when client desires for continued outperformance do not line up with manager strategies that fall out of favor. And sometimes a manager can be beating all of their performance benchmarks, and still all the client questions will rotate to those positions that are performing worst. Just look at all the heat that Warren Buffett takes when IBM underperforms.

We all want to own stocks that will outperform. We also want to own stocks that won’t make us reach for that bottle of Pepto Bismal a few times a year. Yes, stocks are riskier and more volatile than other investments, but that does not mean that you can’t own the best performing AND less risky of the equity subset. Why do some outperforming stocks have less volatility? Simple ‘Supply vs. Demand’ would suggest that it is solely a function of more buyers than sellers. The reason for increased accumulation of a company stock over time can be many things, but for the stock price it usually means higher prices. Some big institutional buyers wanting to own more equity in a company might buy on every trading day to build a position while other may only buy on down days. Either way, there is an ongoing bid for the stock that moves the price higher and takes away some of the volatility from those down days.

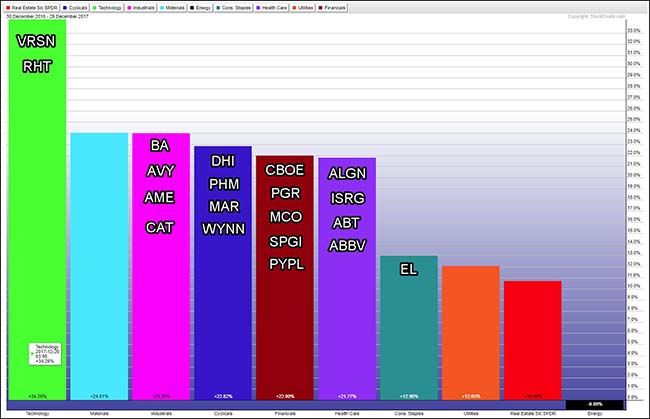

Listed below is my chart of the top 20 S&P 500 stocks that had both the performance to put a smile on your face and reduced volatility to let you sleep well. It is a list of the top 20 stocks in the index ranked by return divided by volatility. An equal weighted portfolio of the names would have gained over 70% in 2017. This was more than three times the return of the S&P 500. The list also has an average volatility of 18.2 which was 10% less than the average stock in the S&P 500. In other words, if you only owned this list of 20 stocks for 2017, few would have given you any criticism. And Warren Buffett might be calling to inquire about your availability for the next 50 years.

To receive this weekly briefing directly to your inbox, subscribe now.

The Sweet Dream Portfolio of 2017:

Before we roll up our sleeves on the list…

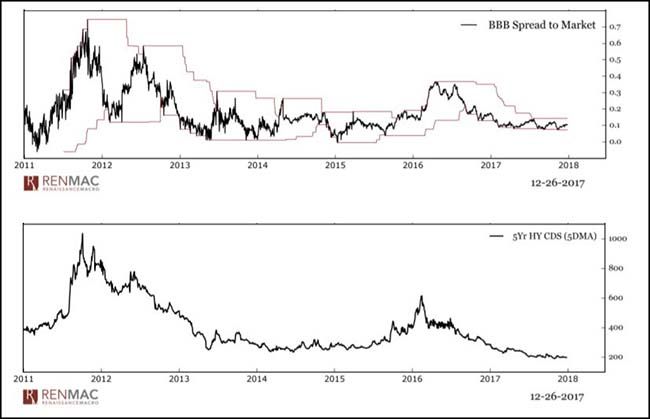

To increase the odds on getting a stock investment correct, it helps to have some wind at your back. First, we want to have the stock market headed in the right direction. While predicting the future direction of the market is difficult, it is easier to identify periods of significant market weakness that often occur during times of credit distress and/or economic recessions. Last year at this time, both the outlook for credit problems were low as the below two charts from RenMac illustrate. BBB bond spreads versus Treasuries were pushing back toward lows (as they are doing again now). This indicates that credit investors have an appetite for lower quality investment grade risks. Looking further down the credit quality food chain shows that the Junk Credit CDS market remains as tight as ever. And this is even with the many Retail and Mall REIT paper on the brink of hitting the final closeout bin. So, with a U.S. credit event not on the near-term horizon, the economy should have room to grow if it wants to borrow.

Next let’s take a look at the market breadth…

Another helpful tailwind is to have the market broadening so that more stocks are increasing in price than decreasing. You can make money in stocks in a narrowing market, but it is much more difficult as the numbers of factors and sectors to pick among are less. As we look back a year ago, the market was broadening in terms of the S&P 1500 Advance/Decline and the Up/Down Volumes. Even today, the market continues to broaden so last year’s tailwind is continuing into this year.

Now let’s look at the sector performance…

The final tailwind that you want for your stock is for it to be in the right industry group or sector. Again, just much easier to make money in a stock if it is in an industry that is high in demand. As you can see below, the 20 Sweet Dreams stocks are clustered in the sectors which had better-than-average performance. While tech and materials names may of had better individual returns, that outperformance also came with large volatility.

An important characteristic of the Sweet Dreams 20 list is its increase in earnings estimates during the year…

It should not be a surprise that the top performing stocks are the ones that are positively surprising at earnings time and where analysts are continually raising their earnings estimates. Our earnings estimate team here at 361 Capital helped me put together this table which showed the average analyst earnings estimate increase from a year ago until now is +15.8%. And how about Caterpillar whose earnings estimate for 2017 more than doubled during the year. So, given that the stock only rose +75% for the year, you can say that the stock is now cheaper on a 2017 P/E multiple basis. How about that?

Now on to the list of stocks that make up this list…

I also included some notes as to why these stocks were likely under constant accumulation. Through the study of these names, it could unlock that incremental idea that will work in another name (or maybe even the same one) in 2018.

1) BA – Boeing

– Significant improvement in commercial aero margins and earnings growth

– 2019 comm aero is 90% sold out

– Big push into services which is a higher multiple business than OEM

– Weak US$ doesn’t hurt with all the foreign sales

2) CBOE – CBOE Holdings

– Proprietary products (index options) growing faster than the market CBOE

– Great acquisition of BATS offers technology leverage

3) DHI – DR Horton

4) PHM – Pulte Group

– Solid unit order growth

– Continued pricing power

– Housing stocks a place to hide in consumer discretionary as retail stocks massively underperform

5) PGR – Progressive

– Ongoing market share gains in the direct business

– Auto insurance pricing increasing > loss cost inflation

6) MCO – Moody’s

7) SPGI – S&P Global

– Good credit ratings environment, low interest rates, healthy global economies

– MCO – Well received acquisition of Bureau van Dijk to grow their analytics business

– SPGI – Growing its custom indicies business

8) AVY – Avery Dennison

– Pressure sensitive label volume growth tied to economic growth

– Leveraging good acquisitions

– Free cash flow used to shrink share count 10% in 5 years (who says share repos can’t help stocks!)

9) PYPL – PayPal

– Organic revenue growth in the teens

– Expanding global footprint

– Trusted and favorite partner

10) ALGN – Align Tech

– U.S. and international volume growth surprise

– Pricing also better-than-expected

– New markets and products

11) MAR – Marriott International

– Big company executing on teens earnings growth

– Starwood acquisition cost synergies and asset sales

– Very high cash returns as only 2% of rooms are owned

12) EL – Estee Lauder

– Significant outperformance over its cosmetics category and retail peers

– China, Hong Kong and online markets growing fastest and have highest margins

– A big cap, safe place to hide in a difficult consumer product and retail environment

13) AME – Ametek

– Better-than-expected organic sales growth

– Several accretive acquisitions

– Exposure to big truck manufacturing which has exploded

– Also helped by international sales with the weak US$

14) ISRG – Intuitive Surgical

– Continues to grow into new procedure categories (lung biopsy and hernia repair markets)

– International growth opportunities

15) VRSN – Verisign

– Improving name renewal rates into the mid-70% range

– Ongoing return of capital to shareholders via 1%/qtr share repo rate

16) ABT – Abbott Labs

– Hopes for new product cycles across cardiology and diabetes to accelerate revenue growth > 6%

– Big, safe healthcare stock in a world of uncertain drug and device pricing

17) RHT – RedHat

– Open source Linux continues its strong growth into the enterprise

18) WYNN – Wynn Resorts

– Better-than-expected Vegas numbers

– Hopes for continued Macau acceleration in both VIP and general customer base

19) CAT – Caterpillar

– Global economic activity has accelerated and is being reflected in the ramp in CAT retail sales each month

– Global mining recovery

– Increasing construction in EMs from depressed levels

– Big leverage to significant restructuring of its cost structure

– U.S. infrastructure spending hopes

– Also the weak U.S. dollar

20) ABBV – Abbvie

– Humira re-acceleration

– Mavyret launch

– Blockbuster pipeline

– Accelerating free cash flow

To conclude…

So maybe you didn’t own all 20 of these Sweet Dream stocks in your portfolio. Even if you, your advisor or your portfolio manager had large weightings in a few of the names then you had some good support inside of your U.S. stock portfolio. If you did own the names in size, be sure to thank the person who got you into the names. If each of your analysts can put just one of these names in front of you each year and you can gather up a handful of these stocks, then looking at the day, week and month-end portfolio will be so much easier. Before I close, let’s go to the opposite end of the list and look at the company with the worst performance (but also with lower volatility). Think of a stock with a slow-controlled slide into the abyss. The stock is General Electric. Who knows if 2018 will be a turning point. Likely many value investors and bottom fishers looking at this closely. If activists take a run at it, maybe the low will be set during the year. But unfortunately, given that it is one of the oldest stocks in the market, there could be many stagnant owners who have become numb to sell and could pressure it on any upticks or bounces in the future. The General is going to take a lot of work. But we could have also said some of the same about Caterpillar at the end of 2015 and look at how that turned out.

Copyright © 361 Capital