by Peter Cook, via Clarity Financial

Main Ideas:

- A traditional portfolio of stocks and bonds (i.e., what almost all investors are invested in) is extremely overvalued compared to historical norms.

- A strategy of investing in ETFs for the stock portion of a portfolio reduces the long-run cost of investing, but does not reduce the risk of a major loss during a bear market for stocks. A cost reduction strategy is different than a risk management strategy.

- The benefit of diversification achieved by investing in bonds depends on the level of interest rates. If interest rates are low (high), diversification benefits will be reduced (increased). Today, interest rates are low, so the benefit of diversification is low.

Have you ever been asked to name your favorite song of all-time? Children have a way of asking impossible questions like that. Answering that question is impossible because a favorite song depends on the mood, the timing, and the events surrounding the time you heard it. Some are favorites for the melody or the performer and others because of the associated memories. The older you get and the more memories you have, the harder it is to identify only one favorite. The unsatisfying answer for my son when he asks about my favorite song is that many can be my favorite, for different reasons at different times.

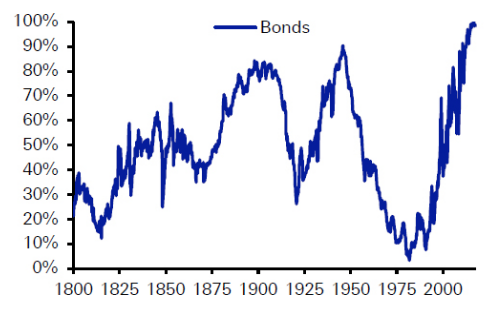

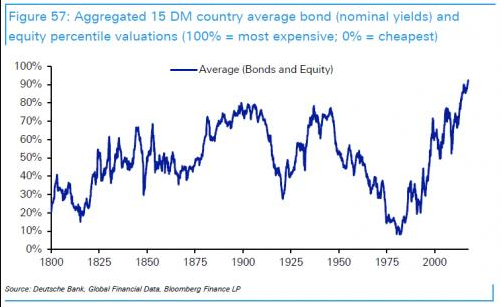

By analogy, in the investment world it should be impossible to find a single favorite chart of data that is clearly more important than others. But the analogy doesn’t hold, because the most important chart in the investment world is shown below. The following pages are devoted to explaining why.

Specifically, the chart shows the valuation of the largest 15 developed market stock and bond markets compared to all valuation levels in the past 200 years. When the blue line is low, a portfolio of stocks are bonds is cheap compared to history. When the blue line is high, a portfolio of stocks and bonds is expensive compared to history.

Most investment portfolios are composed of stocks and bonds because the outstanding amount of stocks and bonds dwarfs the amount of other available investment opportunities. That’s true whether you are an individual with a 401(k) plan or a pension fund which invests billions of dollars.

That reality translates, in a practical sense, to some basic potential portfolio strategies. The most common traditional portfolio contains a 60/40 split of stocks and bonds. Some investors will adjust the ratio based on their age and income requirements. More sophisticated investors will add private equity, commodities, or real estate to their portfolios to take advantage of specific investment opportunities. But in almost all cases, stocks and bonds comprise the overwhelming majority of a portfolio.

Why does that matter? Because the chart above shows that the valuation of a portfolio of stocks and bonds today is higher than it has ever been in the past 200+ years. That is, a portfolio of stocks and bonds is more expensive than at any time in the past 200+ years.

But instead of recognizing the risk the chart poses, investors are much more likely to be swayed into a sense of safety by the two hottest concepts in finance; index investing and diversification. While index investing and diversification are excellent investment concepts most of the time, they can offer a misleading sense of security some of the time. The chart’s message is that we are at a “some of the time” point in history today.

Index Investing to the Rescue?

Considering the benefits of index investing, John Bogle, who for decades has popularized index investing as the head of Vanguard Funds, was quoted in 2011 as saying….

“My rule — and it’s good only about 99% of the time, so I have to be careful here — when these crises come along, the best rule you can possible follow is not ‘Don’t stand there, do something,’ but ‘Don’t do something, stand there!’

In this case, Bogle was extolling the virtue of building a stock portfolio and staying invested for the long-term, regardless of short-term fluctuations. But what happens during the 1% of the time Bogle referred to? Can index investing save an investor from the peril of an extremely expensive portfolio? The short answer is no. Index investing can indeed reduce the cost of investing in stocks and bonds compared to investing in mutual funds or with a financial advisor, probably by ½-1% or so per annum. That insight has made Bogle a very wealthy man.

The good news is that if index investing can save an investor ½-1% per year, a portfolio would be worth 5-10% more over 5-10 years. Of course, during those 5-10 years, the investor must decipher the meaning of economic, political, and financial trends and how to adjust a stock and bond portfolio accordingly. In a world of accelerating technological change, that is no small task. Adding to the noise, there are almost as many opinions on markets as there are commentators, which can confuse any investor. Regardless of these nuances, people who rely on indexes to grow their portfolios are making a bet that financial advice is not worth its price.

But the bad news is that an investor can build a portfolio of stock and bond indices, which guarantees they receive a “market return,” while being completely unaware that the portfolio is being built at the highest valuation in history. Unfortunately, the “market return” includes stock market bear phases that occur every 5 years or so, in which the stock market loses 40-50% of its value. With stocks and bonds as expensive as they currently are, it is conceivable that a bear market could produce losses greater than 40-50%.

For example, in the case of extreme valuations for technology stocks in 2000, the Nasdaq lost 80% in the following three years. In the case of extreme real estate valuations in 2008, many bank and real-estate investments lost 100% of their value over two years. Are stocks perceived as “can’t miss” today, just like technology and real estate stocks were back then?

The main point is that saving ½-1% per year in cost for advice could become miniscule compared to the potential for catastrophic losses by achieving the “market return” after a period of extreme overvaluation. This point is not just theoretical. In fact, the broad S&P 500 index lost 50% or more twice in the past 20 years; first in 2000-2003 and again in 2007-2009. To demonstrate the danger of building a portfolio of stock indexes when valuations are extremely high, the chart below shows how a composite of global stock market index valuations have fluctuated over the past 200 years.

Focusing on the right side of the chart, the three peaks are the peaks in stock market index valuation that occurred in 2000 (internet bubble), 2007 (real estate bubble), and today (insert your own description). In all three cases, stock valuations were in the 90% zone, which are similar to the peak last reached in 1929. In other words, stocks in 2000, 2007, and today are more expensive than they have been for 90% of the time over the past 200 years. After the peaks in valuation in 2000 and 2007, broad stock market indices suffered multi-year declines, creating the possibility of a repeat in the current environment.

Locking in the market return by investing in a stock market index exposes an investor to the same severe losses any other stock market investor experiences. Many of today’s investors remember what it felt like when their stock portfolios were cut in half by 2003 and 2009, but seem oblivious to that risk today. In summary, building an indexed portfolio of stocks is an exercise in cost reduction but certainly not an exercise in risk management.

Diversification to the Rescue?

“Aha!” says the person familiar with the benefits of portfolio diversification, “that’s why I diversify my portfolio with stocks AND bonds. Bonds always go up when stocks decline. Plus, it is impossible to time the market. I invest in stocks because they always go up in the long run, and I diversify with bonds, just in case something bad happens to stocks in the short run.”

The good news is that bonds tended to rise in price in the past during bear markets in stocks, which provides some badly-needed upside when stocks are experiencing severe downside risk. In the most recent example, a portfolio of long-term government bonds rose 30% during the bear market in stocks from 2007-2009. Unfortunately, investors do not typically invest their bond portfolios solely in long-term government bonds, so only a small portion of investors achieved big gains in bonds to offset their stock market losses.

The bad news is that simple mathematics can demonstrate there is a limit to how much bonds can rise in price. One reason that long-term bonds could generate 30% gains in 2007-2009 is that interest rates began that period at 6% in the US and fell to 2-3%. In addition, that portfolio of long-term bonds paid interest of 6% per annum, further increasing the total return on a bond portfolio during a prolonged bear market in stocks.

Today US long-term interest rates are at 2-3%, leaving little room for bond prices to appreciate further. In Europe and Japan, interest rates are near zero or even negative, leaving no room for bond prices to appreciate further. How low are interest rates compared to historical norms? The chart below gives us the answer. Composite interest rates for 15 developed bond markets have never been lower in the past 200 years.

The chart above demonstrates the limited upside for bond prices in the future, based on actual 2017 prices and yields. An investor who buys bonds to diversify in case of a downturn in the stock market is really betting on bonds becoming even more overvalued relative to their historical norms. While there is no law stipulating that bonds can’t become even more expensive, future price gains during a bear market in stocks will be limited, and almost cannot come anywhere near the 30% achieved by long-term government bonds during 2007-2009. The main point is that the benefits of diversifying a stock portfolio with bonds are reduced when bond yields are already very low.

Investor Behavior to the Rescue?

Unfortunately, there is more potentially bad news when investing in stocks or bonds that are extremely expensive. Data shows most investors didn’t heed their own advice of investing for the long-term when confronted with losses during 2007-2009, or for that matter any other bear market of the past century. When a multi-year destruction of portfolio value occurs, at some point most investors discover their point of maximum financial pain/loss and sell the stock portfolios that have created the pain/loss. It is impossible to “buy low, sell high” when you are “selling low.”

One reason for this behavior is that other forms of pain are occurring simultaneous to stock market losses, which are associated with economic recessions. During recessions, a business might be in jeopardy, or a job might become much less secure. Investors, when considering those sources of financial risk, are in fact much less diversified from a stock market decline than they think. The main point is that any diversification program should not only consider the historical interaction between stock and bond prices; it should also consider the potential for a loss of employment income during a period in which stock prices decline.

Conclusions

At the risk of oversimplification, the most important chart in the investing world is the chart shown below, because it shows that investment portfolios of stocks and bonds are more highly valued today than at any time in history. That fact alone should force an investor to reduce expectations for returns on a portfolio of stocks and bonds, including the possibility of negative returns over a time-horizon of 5-10 years.

For investors who think they can avoid significant losses by using ETFs to reduce the cost of stock market investing and who diversify by buying bonds to cushion the risk of stock market losses, the following should be considered:

- Almost all portfolios are comprised primarily of stocks and bonds, so almost all investors in 2017 are holding portfolios at extremely high valuations. Your portfolio is probably just as risky as anyone else’s portfolio.

- Investing in portfolios at extremely high valuations increases the probability of future losses if/when valuations eventually revert to the normal levels. Valuations might continue to rise to even more extreme levels, but that is a low-probability bet.

- An index strategy is undertaken to reduce the costs of achieving the future’s “market return,” but achieving a “market return” at a reduced cost is not the same thing as a reducing the risk of a significant decline in stock market indices.

- Bonds are typically used to diversify a portfolio from the risk of a severe stock market decline. But the benefit of diversification is reduced when interest rates are extremely low, as they are today.

- The concept of diversification should be expanded to consider that a loss of employment or ownership income is likely to coincide with a period in which stocks are declining.

All of the graphs courtesy of Deutsche Bank

Copyright © Peter Cook