by Blaine Rollins, CFA, 361 Capital

Do not be short Jingle Bells. In fact, you might even want to consider using the three-point harness on the Santa Rally this year because the market reindeer are very fired up. The Tax Bill is completed and will be signed this week. The Government will not shut down because Congress wants to leave the swamp for their winter holiday. There is little news or business to attend to in the last two weeks, so the month’s direction has been set barring any new geopolitical news or POTUS tweetstorms. While U.S. and global data points continued up and to the right last week, the FOMC got together for one last hike under Chair Yellen’s leadership. (The equity bulls and volatility sellers thank her also for her leadership!) Two other great leaders who left much too early over the weekend were Bob Wilmers of M&T Bank and Hunter Harrison of CSX. These two taught many of us how to better run a Bank and a Railroad. They will both be missed but their knowledge will be carried forward by current and future industry leaders.

Have a great Holiday. We won’t write a WRB next week but will be around if you need help with anything. Merry Christmas and Happy Holidays!

To receive this weekly briefing directly to your inbox, subscribe now.

One last time on how the Tax Bill will be good for U.S. Equity prices…

Using a bottom-up approach, UBS ests the impacts of major tax provisions, including foreign and sector specific items. They calculate a 21% corporate tax rate would boost S&P 500 EPS by 9.1%, with foreign (-1.7%) and sector -specific (-0.5%) tax provisions having a notable offset. Firms have a strong incentive to buy back stock to offset the 2018 headwinds. Similar to after the 2004 tax holiday, when more than $300bn was brought back, firm expects a surge in buybacks ($350bn+, 1.5%+ of mkt cap) and M&A, and a sizeable pickup in corporate spending and dividends. They believe full expensing of capex would boost FCF by 2% and further support a very positive corporate spending backdrop.

(Briefing)

If you want a good summary of the Tax Bill’s finer details for an individual taxpayer, this was a very good summary…

Republican lawmakers released the details of their tax code rewrite on Friday, which reconciles differences between the House and Senate bills.

Several of the most anticipated changes — such as a significant increase in the standard deduction and the curtailing of state and local income tax breaks — made the final cut. Some of the most controversial proposals, like eliminating the medical deduction, were wiped away.

Many of these provisions are temporary, however, and are set to expire after seven years. They all take effect in 2018, unless noted otherwise.

(NY Times)

While the Fed did raise rates as expected, there was increasing debate about inflation…

The Fed’s Charles Evans makes the case that the FOMC should hold back and let the economy run. Neel Kashkari would tell you the same and that hopes that inflation will rise in the future is not a prudent policy.

Real activity in the U.S. is on a solid footing, which by itself would support a further adjustment in policy. Inflation, however, is too low and has been so for quite some time. I am concerned that persistent factors are holding down inflation, rather than idiosyncratic transitory ones. Namely, the public’s inflation expectations appear to me to have drifted down below the FOMC’s 2 percent symmetric inflation target. And I am concerned that too many observers have the impression that our 2 percent objective is a ceiling that we do not wish inflation to breach, as opposed to the symmetric objective that it really is; that is, we would like to see the odds of inflation running modestly below 2 percent equal the odds of it running modestly above over the long run.

I believe that leaving the target range at 1 to 1-1/4 percent at the current time would have better supported a general pickup in inflation expectations and increased the likelihood that inflation will rise to 2 percent along a path that is consistent with a symmetric inflation objective.

Stan Druckenmiller is also in the ‘lower inflation for longer’ camp…

A great long interview with many great thoughts to chew on from last week.

I THINK THE 2% INFLATION TARGET NEEDS TO GO. IF I WAS RUNNING THE FED, THANK GOD FOR THE – TO THE WORLD – I’M NOT RUNNING THE FED IT WOULD PROBABLY NOT BE IN MY TOP TEN CRITERIA. THE 2% INFLATION TARGET HAS SORT OF BECOME A RELIGION INITIATED BY THE PROFESSORS. AND IT’S THIS TARGET. THERE’S AN INTERESTING STORY ON THE FRONT PAGE OF “THE WALL STREET JOURNAL” TODAY HOW AMAZON IS MAKING THE FED’S JOB MORE COMPLICATED. THIS BELIEF THAT 2% IS APPROPRIATE FOR ALL SEASONS AND ALL TIMES, TO ME IT’S PRETTY ABSURD. YOU TAKE THE LAST GREAT INNOVATION PERIOD WHICH IS THE LATE 1800s, WE HE DEFLATION FOR TEN OR 15 YEARS ACCOMPANIED BY VERY RAPID REAL GROWTH. IN THE ’50s, I THINK INFLATION WAS 1%, MAYBE A LITTLE LOWER, FOR A GOOD PART OF THE DECADE. FED FUNDS WERE 4%. WE HAD RAPID GROWTH. THERE WAS NO CRISIS.

(CNBC)

Online shopping and price comparison is helping to hold back inflation…

Economists attribute feeble inflation across developed economies to several causes, including aging populations, slow productivity growth and globalization, which have reined in the ability of companies to raise prices and wages. With consumer spending accounting for more than two-thirds of the U.S. economy, the explosion in e-commerce has been added to the list.

Stacy Peterson, 34 years old, of North Little Rock, Ark. said she started her holiday shopping in October, researching and comparing prices online. On Thanksgiving Day, she sprang for a trampoline she had been eyeing. It was marked down online at Academy Sports + Outdoors to $129.99 from $179.99.

The mother of two plans to check the holiday sales at her local stores, she said, but mostly will look online and buy from “whoever has it cheapest.”

In a nod to the growing practice, Ms. Yellen said in September that increased competition created by online retailers “may have reduced price margins and restrained the ability of firms to raise prices in response to rising demand.” She said in October that online shopping “could be helping to hold down inflation in a persistent way in many countries.” The Bank of Japan in has attributed part of the price declines at supermarkets to online shopping.

(WSJ)

As for the potential for wage inflation, there has never been a hotter labor market in my 30 years in Colorado…

@stlouisfed: .@KansasCityFed index of momentum in labor markets reaches new high of 1.65; see the trend since 1992

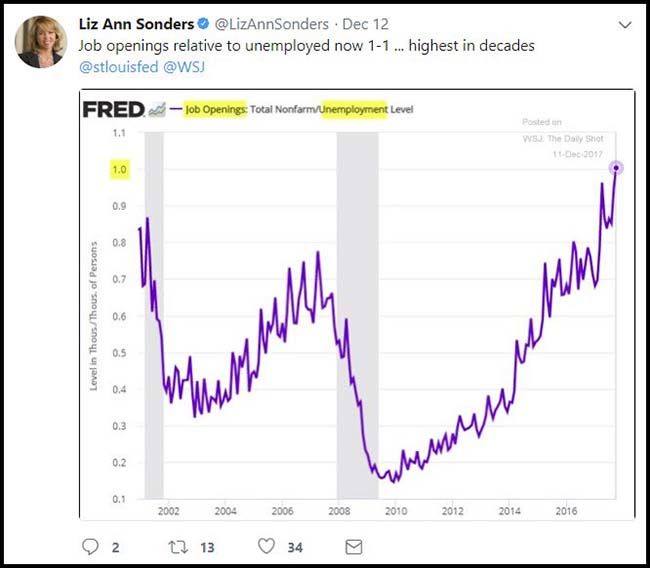

Nationwide, there is now one job opening for everyone who wants a job…

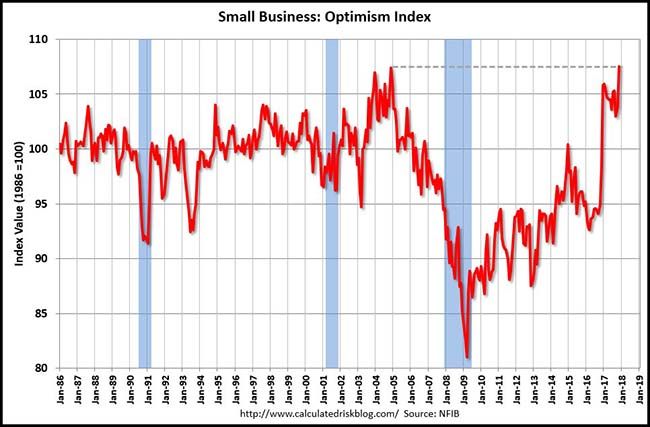

And small business optimism is completely lit…

The Index of Small Business Optimism gained 3.7 points to 107.5 in November, the second highest reading in the 44-year history of the NFIB surveys (108.0 in July 1983). Eight of the 10 Index components posted a gain and two declined, as Job Openings fell from its record high level and Capital Spending Plans declined 1 point. (NFIB)

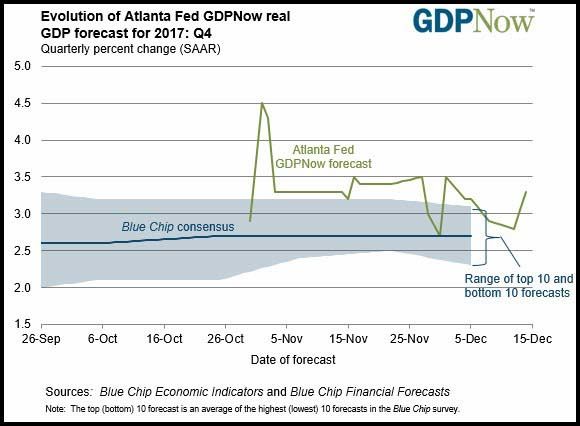

Positive December economic data points have caused the Atlanta Fed to lift their GDP growth rate…

@AtlantaFed: On December 14, the #GDPNow model forecast for real GDP growth in Q42017 is 3.3%.

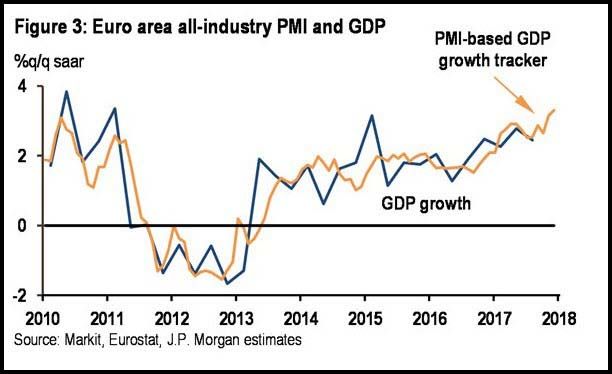

Overseas, a big cylinder in the global growth engine is going to start firing even faster…

Based on current PMI data, JPMorgan is expecting an acceleration in Euro GDP growth.

(@DriehausCapital)

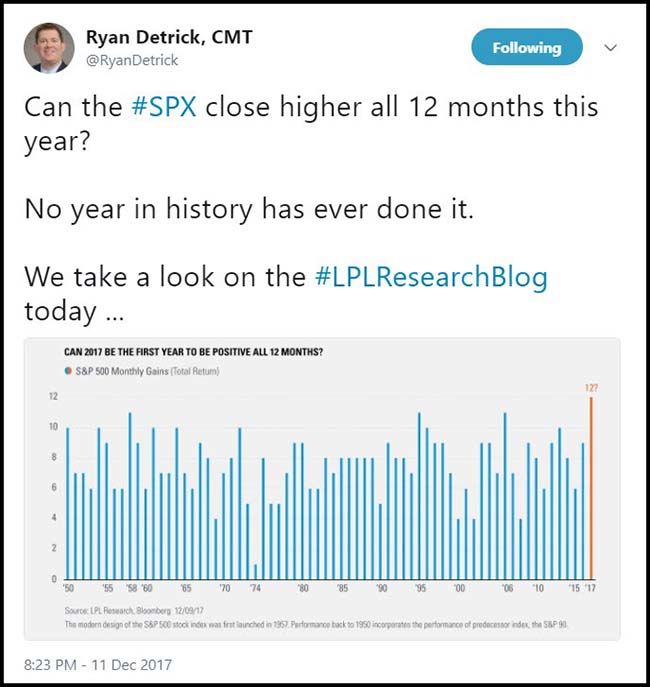

Ryan, my vote is ‘yes’…

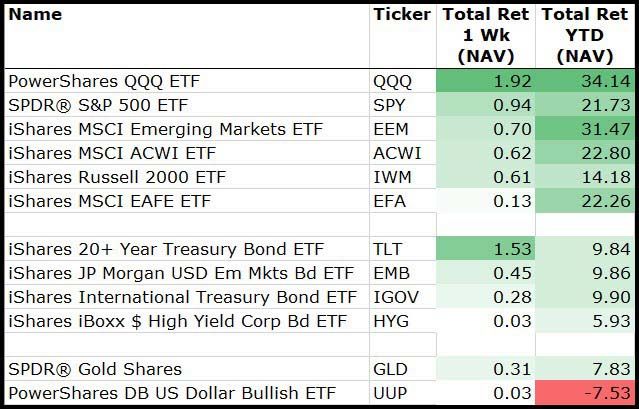

For the week, every major asset class was positive…

Tech and Bonds led. Go figure.

(12/15/2017)

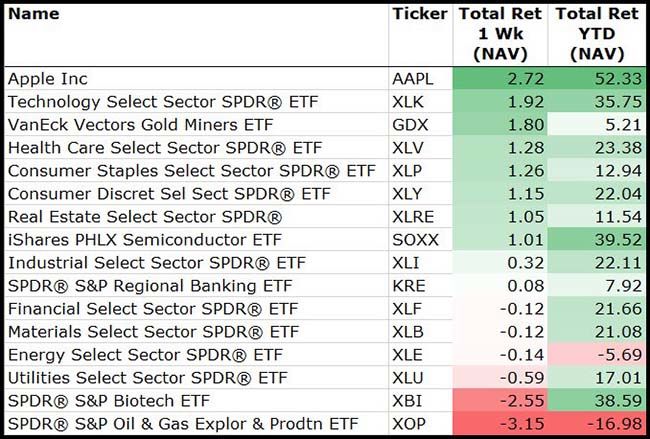

Among sectors, Tech and Gold Miners led. Again, go figure.

(12/15/2017)

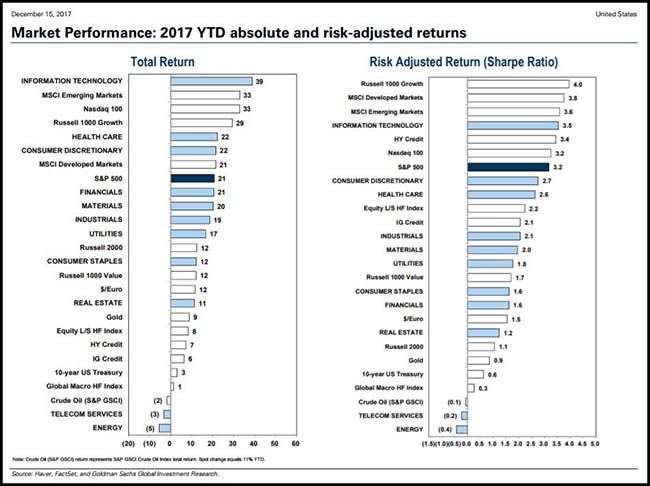

Interesting to look at the right chart on risk adjusted returns…

Your manager killed it for you this year if they were overweight Growth, International and Tech Stocks.

If you got’em, pump’em…

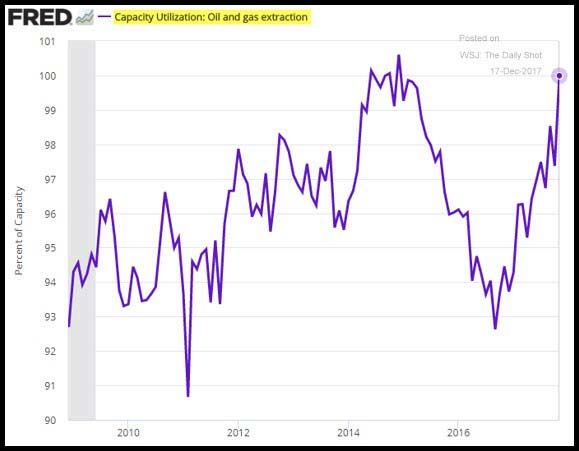

Putting pressure on energy prices and oil stocks has been this significant bounce in U.S. production.

(WSJ/Daily Shot)

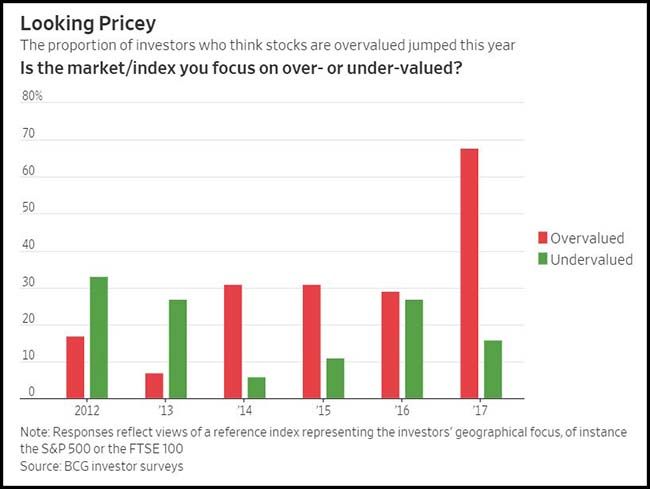

Big investors hate current market valuations. So maybe better to take the over?

Big investors are heading into 2018 with the most bearish perspective on stocks since the great financial crisis, according to Boston Consulting Group’s annual investor survey.

Fully 46% of investors were pessimistic about equity markets for the next year, up from 32% a year ago and 19% in 2015; more than one-third were bearish about stocks over three years, more than double last year.

As global equity benchmarks have rallied, more investors see the market as richly valued. Fully 68% of respondents said the equity market is “overvalued,” more than double the 29% of respondents who thought as much last year.

(WSJ)

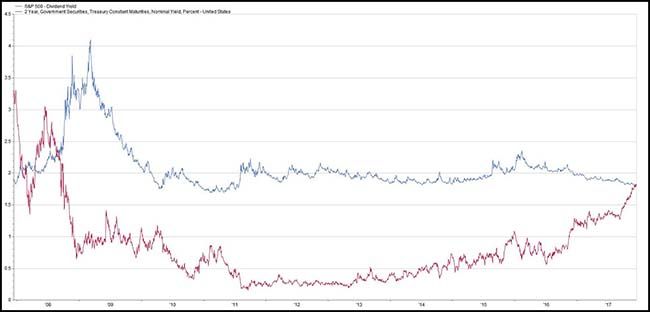

But to the bears’ credit, the risk-free interest rate is beginning to look much more attractive…

@LizAnnSonders: 2y Treasury yield now above S&P dividend yield for first time in decade

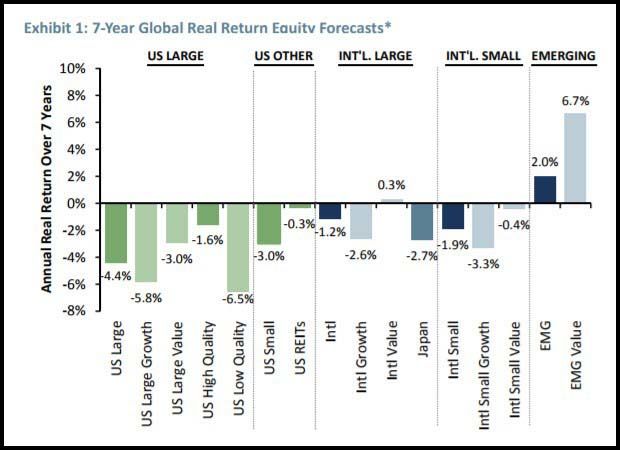

The GMO quarterly letters hit last week. Always a must read…

As you would expect, Jeremy and Ben are having an issue with market valuations. They still see the best opportunity for equity gains in the Emerging Markets…

There is a final, somewhat speculative piece of comfort I take in our equity portfolios. Significant inflation would certainly come as a nasty shock to equity investors in general. But if there is one group of equities that deals with inflation on a pretty much continuous basis, it is emerging equities. Emerging markets usually have a decently high beta in down markets. But it is not so far-fetched to imagine that if the catalyst for the fall were rising inflation, the stock markets where inflation was never absent in the first place might be better able to shrug it off. To be clear, our fondness for emerging equities today is driven overwhelmingly by their cheaper valuations, not a speculative belief in their resilience against an event that has not occurred since emerging became an institutionally buyable asset class. But if worse did come to worst and inflation flared up, owning a good chunk of the only equities that remember what inflation is like seems like a decent idea.

(GMO)

Company of the week…

Travelers in Atlanta were in trouble on Sunday. Chick-fil-A isn’t even open on Sunday’s but they showed up anyway to give out free food and water to thousands.

And then a large elephant appeared in the room..

In a report last week, the cryptocurrency website Digiconomics said that worldwide bitcoin mining was using more electricity than Serbia. The country. Writing for Grist, Eric Holthaus calculated that by July 2019, the Bitcoin peer-to-peer network—remember BitTorrent? Like that—would require more electricity than all of the United States. And by November of 2020, it’d use more electricity than the entire world does today.

That’s bad. It means Bitcoin emits the equivalent of 17.7 million tons of carbon dioxide every year, a big middle finger to Earth’s climate and anyone who enjoys things like coastlines, forests, and not dying of mosquito-borne diseases. Refracted through a different metaphor, the Bitcoin P2P network is essentially a distributed superintelligence utterly dedicated to generating bitcoins, so of course it wants to convert all the energy (and therefore matter) in the universe into bitcoin. That is literally its job. And if it has to recruit greedy nerds by paying them phantom value, well, OK.

(Wired)

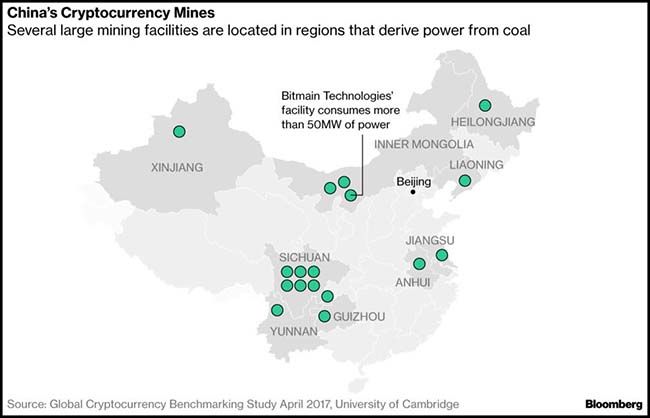

Even crazier is that the elephant is hungry for coal…

China, which gets about 60 percent of its electricity from coal, is the biggest operator of computer “mines” and probably accounts for about a quarter of all the power used to create cryptocurrencies, according to a study of the industry published in April by Garrick Hileman and Michel Rauchs at Cambridge University.

About 58 percent of the world’s large cryptocurrency mining pools were located in China, followed by the U.S. at 16 percent, the researchers said. China is the biggest producer and consumer of coal, and server farms in provinces such as Xinjiang, Inner Mongolia and Heilongjian are heavily reliant upon the fuel.

Copyright © 361 Capital