by LPL Research

As the Holiday season approaches and yet another year comes to a close; it is comforting to know as investors, that December tends to fare well for stocks. In fact, for those who follow the seasonal statistics for the equities markets; looking back over the past 20 years, it may appear likely that stocks move higher this month.

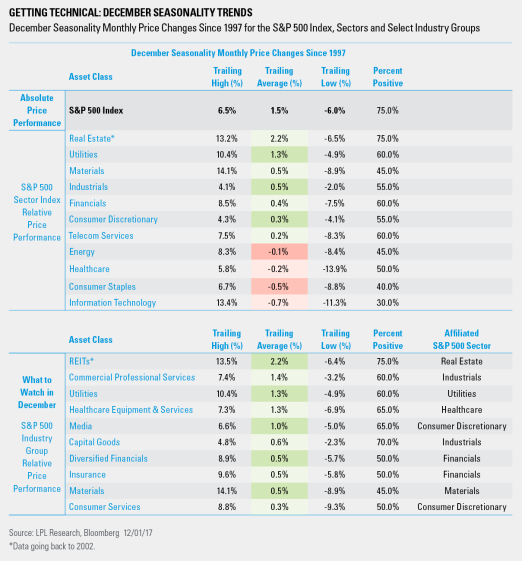

Our latest analysis identified a variety of sectors that showed a seasonal tendency to outperform the S&P 500 during December over the last 20 years—a month when the index has on average moved higher by 1.5%, generating positive returns 75% of the time. As we review the data, it’s important to note that nonseasonal factors still influence performance and should not be ignored.

The table below highlights sectors’ average over- and under-performance versus the S&P 500 during December since 1997, as well as the top-performing industry groups over the same time period:

Looking at the table above, the real estate and utilities sectors have on average tended to exhibit the highest relative strength versus the index in December over the past 20 years. However, if you are interested in looking under the hood for a more targeted strategy, out of the top ten industry groups, the industrials, financials and consumer discretionary sectors represent seasonally strong breadth for select industry categories in December.

Enjoying friends and family is the beauty of the holiday season; let us continue to be jolly and have a cup of cheer considering that the seasonal statistics suggest equities continue higher throughout this month – and possibly it could be a good time to consider implementing seasonal analysis as part of your portfolio management plan.

*****