by Russ Koesterich, Portfolio Manager, Blackrock

Value stocks are cheap, relative to growth, but have lacked a catalyst to rally. Russ discusses why tax cuts could be that spark.

If you squint really hard, you can almost see value stocks beginning to stir. Large cap U.S. value has nominally outperformed growth month-to-date. That said, value is still trailing its sexier cousin, growth, by roughly 1500 bps (basis points, or 15%) in 2017.

The question many are now asking is whether that will change if tax cuts are enacted? Given that an untested faith in fiscal stimulus led to value outperformance in late 2016, perhaps an actual tax cut might provide a more durable rally in value? My view is probably yes, assuming you believe that tax cuts will impact the real economy.

Big discount

To start, a bit of history. As I’ve described in previous blogs, years of underperformance have left large cap value stocks historically cheap relative to large cap growth stocks. Since 1995 the Russell 1000 Value Index has typically traded at around a 57% discount to growth. Today the discount is nearly 70%, close to the lowest relative valuation since 2000.

Many would argue that the discount is justified given a wide gap in earnings growth and profitability. Value stocks are, by definition, values for a reason, i.e. they tend to be less profitable. However, even after adjusting for current differentials in profitability, value looks cheap.

Historically, the differential in return-on-equity (ROE) explains approximately 35% of the variation in growth/value relative valuations. Currently, the ROE on the Russell 1000 Growth Index is over 25%, versus less than 10% for the Value index. This spread of 16 percentage points is historically wide, but even that does not fully explain the value discount. If the historical relationship held, value stocks would be trading at around a 62% discount to growth, not today’s historically wide levels.

All of which suggests that value does look too cheap relative to growth. Unfortunately, one could have reached the same conclusion for most of the past three years and still underperformed by betting on value. As discussed back in October, what value lacks is a catalyst.

A little bit of help from inflation

Tax cuts might provide the missing ingredient. The reason: Typically investors place a smaller discount on value when growth is faster, particularly nominal growth. In other words, a bit of inflation would help close the valuation gap between value and growth.

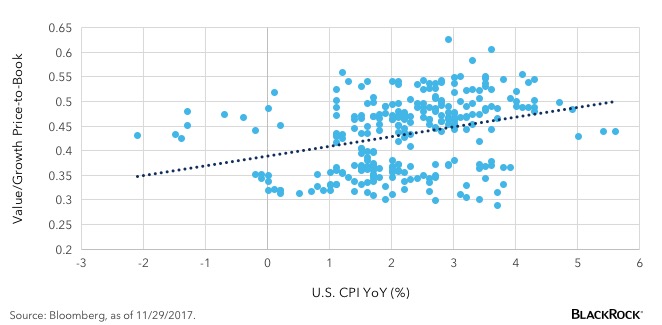

Looking back at the past 20 plus years, value has traded higher relative to growth when inflation, measured by the consumer price index (CPI), is higher (see the accompanying chart). Higher inflation would arguably be even more supportive if it were driven by higher oil prices, as energy companies appear particularly cheap today. In addition, to the extent higher realized inflation leads to higher inflation expectations—and in turn, higher interest rates—financial stocks, another big value sector, also benefit.

Value/Growth valuation vs. U.S. CPI (1995 to present)

Bottom Line

Tax cuts can provide the necessary catalyst for value stocks, assuming they do more than just boost corporate profitability. In order to really impact style performance, they will need to boost nominal growth as well.

Russ Koesterich, CFA, is Portfolio Manager for BlackRock’s Global Allocation team and is a regular contributor to The Blog.

Copyright © Blackrock