For this week’s edition of the Equity Leaders Weekly, we are going to look at the Technology sector and how the new proposed U.S. Tax reform could impact this and other sectors. Also, with the Bank of Canada leaving its key rate unchanged at 1%, we take a look at the USDCAD relationship again while keeping an eye on the Fed for next weeks announcement and a 2018 outlook.

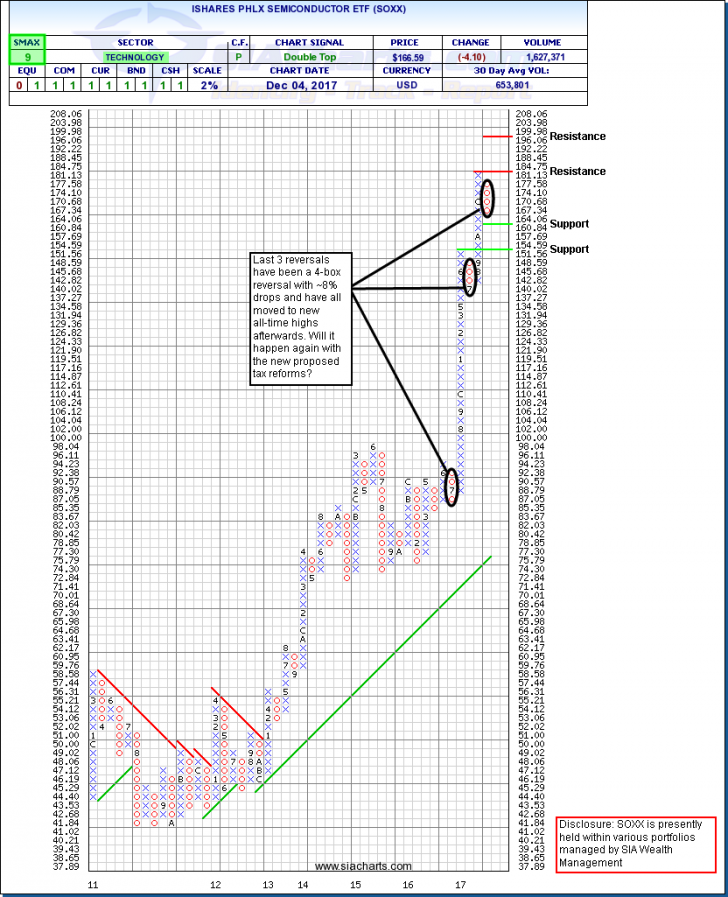

iShares PHLX Semiconductor ETF (SOXX)

The Technology sector has been the hottest and best performing sector in the U.S. so far this year and within this Sector, Electronics and Semiconductors have been one of the best performing areas comparatively. Even after a pull-back of over 7% in the last week, the iShares PHLX Semiconductor ETF (SOXX) is still up around 37% YTD which is about twice the return of the general market where the S&P 500 Composite Index is up around 18% YTD. The point and figure chart of SOXX still looks very positive right now as over the last 2 years, it has experienced this kind of pull-back before and bounced back both times to new all-time highs. So, keep an eye at the support level around $160.84 to see if that holds and also the resistance level at $181.13 to see if it can break through again to new highs.

According to Goldman Sachs Global Investment Research, the Technology sector pays an effective tax rate of 24% (5-yr median), which is the lowest among U.S. major sectors compared to 35% in Energy or 33% in Telecommunications. Part of the reasoning for this is that Tech has the lowest % of sales from the U.S. at 41% and has the largest overseas earnings at $828B (according to Compustat 2016 numbers). Companies like Apple have parked intellectual property overseas declaring profits in low-tax jurisdictions like Ireland, but the new Senate’s tax proposals could force tech companies to pay more on foreign earnings.

Still, the outperformance in technology may continue heading into the New Year, given expectations of strong earnings, improved overseas industry demand, and innovative technologies, but does have some of the highest risk from tax reform and government regulation. Looking at the relative strength rankings of the SIA U.S. Equity Specialty Report (which compares all the US Sector ETFs against each other), Information Technology, Semiconductors, Aerospace & Defense, and Internet sectors still dominate the top relative strength rankings on a long-term 6 to 18 month outlook, but it will be important to keep a close eye on this report moving forward with the new proposed tax reforms. One recommendation we have is to run this report at a lower % in your Portfolios area of SIACharts so you see the sector movement on a shorter time horizon to be more in tune with potential sector rotations.

Disclosure: SOXX is presently held in various portfolios managed by SIA Wealth Management Inc.

United States Dollar/Canadian Dollar (USDCAD)

The Bank of Canada (BOC) left its key rate unchanged at 1% as expected yesterday in its final rate decision of 2017. The BOC acknowledged recent improvements in the jobs market, but maintained its cautious approach to raising rates depending on incoming data. Positive news along the jobs front has Canada’s unemployment rate at its lowest level since November of 2008 according to Statistics Canada. However, uncertainty about the housing market and NAFTA negotiations are expected to keep the BOC rates on hold in the near future.

If the US does pull out of the NAFTA agreement, this could drastically impact the volatility of the Canadian Dollar and the Mexican Peso going forward adding more uncertainty to these currencies. If the US Fed does raise rates next week, and many project the U.S. to have more rates increases than Canada in 2018 as well, the impact of the Canadian dollar may be negative leading to more strength in the US Dollar.

Looking at the chart of the United States Dollar vs. Canadian Dollar (USDCAD), we see a column of 5 X’s have now formed since its low of the year. Resistance above is now found in the $1.3244 area with more resistance found at the June highs of $1.3781. Support is now found at $1.2352. Many economists expect the Bank of Canada to resume hiking interest rates in 2018, but as the BOC stated, "considerable uncertainty, notably about geopolitical developments and trade policies," continue to play a large role in the future direction and when comparing the USD vs. CAD outlook, keep a close eye on the USDCAD chart as this will continue to be very important heading into 2018 for Canadian investors.

SIACharts.com specifically represents that it does not give investment advice or advocate the purchase or sale of any security or investment. None of the information contained in this website or document constitutes an offer to sell or the solicitation of an offer to buy any security or other investment or an offer to provide investment services of any kind. Neither SIACharts.com (FundCharts Inc.) nor its third party content providers shall be liable for any errors, inaccuracies or delays in content, or for any actions taken in reliance thereon.

For a more in-depth analysis on the relative strength of the equity markets, bonds, commodities, currencies, etc. or for more information on SIACharts.com, you can contact our customer support at 1-877-668-1332 or at siateam@siacharts.com.