by Richard Turnill, Global Chief Investment Strategist, Blackrock

The U.S. economy is poised to eliminate its post-crisis slack. We see a return of mild price pressures keeping the Fed on track to lift rates further. Richard explains.

The U.S. economy is shifting from reflation to inflation—and we have greater confidence in inflation returning to its medium-term trend and the Federal Reserve’s (Fed’s) target. Better wage growth and potential fiscal stimulus should cement this transition.

Investors are slowly waking up to an outlook of mildly higher U.S. inflation amid a backdrop of solid economic growth. This year’s surprise was better-than-expected growth coinciding with cooling inflation, partly due to one-off factors. We see that changing in 2018 as the U.S. economic slack created by the deep 2007–09 recession disappears.

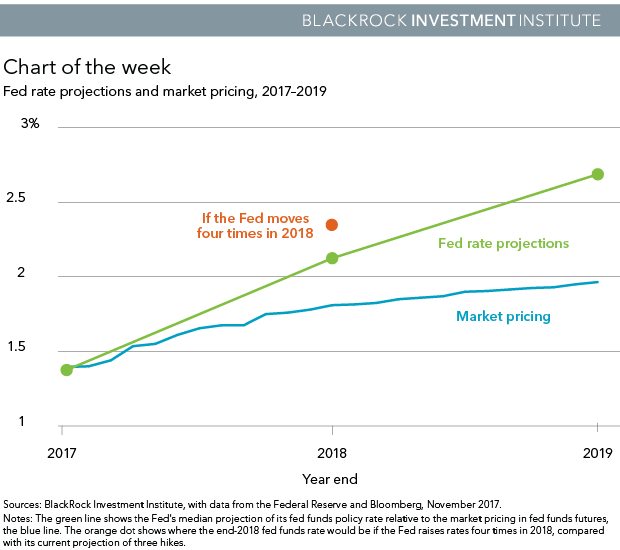

The market pricing of higher Fed rates has shifted up, yet the chart below shows it remains well below the Fed’s and our own outlook. We believe the Fed is on course to increase rates in December and match its projection of three increases next year. We see the potential for four rate rises in 2018 if growth gets a boost from fiscal stimulus.

2018 is likely to see an important transition in the U.S. economy. We see economic slack mostly disappearing as the labor market strengthens and the expansion motors on. Inflation expectations were dented this year due to the surprise slowdown, tied to major one-off drops and moderation in some categories such as housing. Yet we see inflation expectations firming up as prices climb at a gradual pace.

We launched the BlackRock Inflation GPS earlier this year to help cut the noise on prices. The Inflation GPS is consistent with core prices climbing back toward the Fed’s 2% target. The October Consumer Price Index supports the signal from the Inflation GPS. Still, we believe structural factors—including the role of technology—should keep price pressures in check.

We believe the Fed is likely to lift rates in December to 1.25%–1.5% and soldier on with steady but slow increases in 2018. The U.S. economy is experiencing solid growth. Further job gains could drive the unemployment rate below 4%—low levels rarely seen in the past 50 years. That should spur bigger wage growth. This comes as Congress looks poised to pass some form of tax reform in coming months, giving the economy an additional shot in the arm.

That might make it tricky for the Fed to justify pausing any rate increases, as its median forecasts now imply. Other factors are also playing a role. For the first time in a while, China is exporting much less deflation abroad. That has removed a key drag to global inflation—especially as China’s cuts to industrial capacity underpin commodity prices.

Our view on short-term U.S. rates rise fits with our expectation for a moderate rise in long-term rates—even with the greater uncertainty about the factors influencing bond yields, including high global savings. See our November 2017 Global macro outlook The safety premium driving low rates for details. Our outlook for inflation is one reason we like Treasury inflation-protected bonds in fixed income. Read more market insights in my Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.