by Ryan Detrick, LPL Research

As we noted in our newly released Outlook 2018: Return of the Business Cycle publication, we believe small caps are one area that could do quite well over the next year. Per Ryan Detrick, Senior Market Strategist, “Although it feels somewhat strange to be bullish on small caps this late in the economic cycle, the reality is that a potent cocktail of tax reform, a lower corporate tax rate, cyclical strength, a stronger U.S. dollar, and a return to a market environment in which business fundamentals drive stock prices are all major drivers for possible outperformance in 2018.”

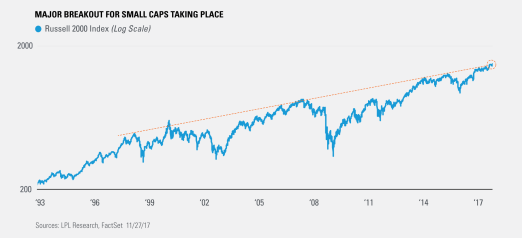

Besides potential positives on the fundamental front for small caps, technically speaking, we believe the group continues to look quite strong. For instance, the Russell 2000 Index is in the process of breaking above a trendline going back nearly 20 years. This may be yet another clue that the rally could only be heating up, and the next 12 months could be a good time to have some small cap exposure.

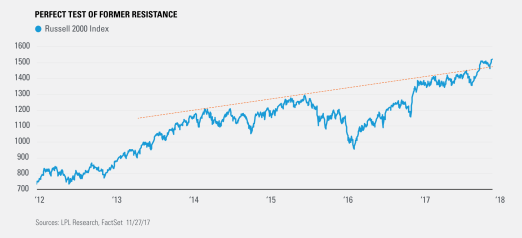

Even more recent trends suggest there is plenty to like. The Russell 2000 recently broke above a previous three-year bearish trendline, but then found support right at that trendline. From a purely technical standpoint, we like to see previous resistance hold as support, and that is exactly what just happened.

Overall, we feel the global equity bull market continues to look strong and will likely continue if earnings surge. However, one thing we’ve often seen historically during periods with huge gains is that different segments of the equity market take turns leading the charge higher, and we think there’s a good chance small caps will take back some of that leadership in 2018.

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The Russell 2000 Index measures the performance of the small cap segment of the U.S. equity universe.

The Russell 2000 Index is a subset of the Russell 3000 Index representing approximately 10% of the total market capitalization of that index.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results.

Small cap stocks may be subject to a higher degree of risk than more established companies’ securities. The illiquidity of the small cap market may adversely affect the value of these investments.

Because of its narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

Technical analysis is a method of evaluating securities by analyzing statistics generated by market activity, such as past prices and volume. Technical analysts do not attempt to measure a security’s intrinsic value, but instead use charts and other tools to identify patterns that can suggest future activity.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking #1-671818 (Exp. 11/18)

Copyright © LPL Research