by Cameron Webster, CFA, Mawer Investment Management, via The Art of Boring Blog

The ski season is officially open and the keeners have taken their first turns. I know our CIO, Jim Hall, is an avid skier so I sat down with him recently to discuss portfolio risk management and how it relates to skiing.

CW: Jim, welcome back to Risk Road. This time I want to go a bit more general with things. Why don’t you give us a sense of why risk management is important to your CIO role.

JH: One of the most important aspects of my role as CIO involves conducting portfolio risk management reviews twice a year. These reviews are designed to ensure our investment process is being followed and that our culture remains supportive of our investment philosophy. Are we doing the right things to ensure we are putting the odds in client’s favour by selecting high quality companies, run by excellent management teams, purchased at a discount to fair value?

CW: Within that framework, what would you say is the most important risk factor?

JH: To me, our investment discipline is the most important risk factor. Nothing else comes close, be it company results, sector exposure, geographic exposure, or any number of macro risks. Without the foundation of our investment process, the other risks may get amplified. With it, I have confidence that the portfolios we build will be diversified and resilient.

CW: What is the worry, Jim? It seems everything in the equity world is all good right now.

JH: With many markets continuing to hit new highs, I get even more focused on ensuring our process is being followed. That is because the longer the bull market runs, the more likely you are to get sucked in and drop the tenets of your investment philosophy—perhaps your time horizon shortens, or your risk appetite grows, or your risk management mentality slides, because you continue to be rewarded for taking risk.

That’s where we are right now. That’s the bigger risk—the longer and longer (and longer) into a bull market in all assets you get, the higher the risk that you start telling yourself they always go up. My most important job as CIO is to ensure that kind of thinking doesn’t happen in our process.

CW: Can you describe the risk management process you and your team follow?

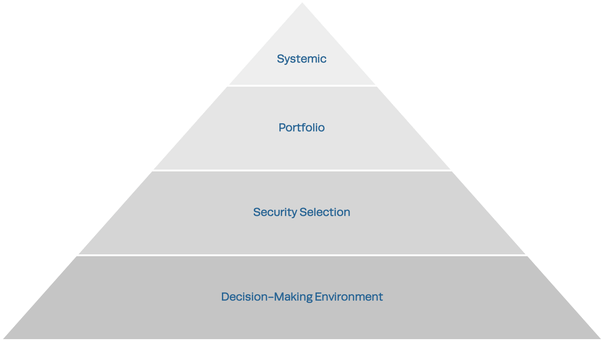

JH: Sure. I would compare it to an elevator ride. Each floor represents a different part of the process and I ride up and visit each floor on my twice-yearly tour (Figure 1). The first floor is the decision-making environment, i.e., our investment culture. This is a stop to ensure we are following our process and we are engaging with one another in important conversations of varying viewpoints with candour. If this is not running properly, I get very nervous. It is also a stop to evaluate process improvements to make sure we have systems in place to ensure our inventory of high quality companies continues to grow. My current evaluation is that we are in a good spot here.

Figure 1. Mawer Risk Management Framework

Figure 1. JH: This diagram summarizes our risk management approach and I view it more as a CIO elevator. I stop at each floor to take a look around and engage in conversations to understand our risk exposures.

CW: Great, first floor and investment culture ticks the box. What’s next?

JH: When the doors open on floor two, I am looking at security selection – how we arrive at buy/sell decisions. Specifically, I am looking at how the teams are using our investment matrix to make position size decisions. The matrix plots investments based on their overall quality versus their overall return potential. Ultimately, those with the highest combination of quality and return potential justify the highest position size in the portfolio, and vice versa. I stop here to ensure position size decisions make sense based on the team’s overall assessment and evaluate justifications for why there may be differences. I play a bit of devil’s advocate here to ensure our rationales are not reliant on any single scenario playing out.

CW: Is there anything that has changed recently to help you with floor two?

JH: We are using technology tools better. In the case of the matrix, we back-tested our sizing decisions and determined they are adding value over an equal-weighted portfolio. We’ve improved our ability to evaluate each stage of our investment process with this type of analysis.

CW: What about sector and geographic exposures?

JH: On the third floor, we are moving up to where the view is a bit wider: a portfolio level view. My stop here is to assess the diversification of portfolios at the sector, geographic, and currency levels. I’m essentially asking if there are any “sharp edges” in the portfolio. Are the risks sharp enough to warrant action to enhance the diversification of the portfolio? These are usually engaging discussions with the lead portfolio managers. It is rare for me to find action items given the foundation of our investment philosophy, but it is an important exercise in order for all of us to understand as best we can the active decisions we’re making.

CW: On to the last floor Jim. Is this where you give us your macro predictions?

JH: I’m not letting you suck me into that one, Cam. We avoid making predictions. On the final floor, I am looking at the macro environment to determine if portfolios are significantly at risk to events such as political change, war, economic crisis, technological displacement, regulatory change, or any number of external factors. These are usually highly unpredictable events but there may be times when position changes are warranted. A couple of actions from the past include: 1. the night of the Brexit vote where we saw prices decline enough to add to some high-quality businesses while at the same time we reduced exposure to domestically-oriented UK companies, and 2. increasing exposure to domestically focused U.S. businesses on the Trump election results—particularly due to the potential cash flow benefits of lower tax rates.

CW: Thanks for the elevator ride. One last question Jim. Given we just started ski season and your passion for skiing, can you relate Mawer’s risk management approach to how you pick out a ski line?

JH: That’s an interesting one Cam.

CW: Let me start you off. Your lift ticket comes with a nice long disclaimer that reminds you of the risks you’re taking. We don helmets and skis with brakes and goggles to help us ski safely, and…

JH: OK Cam, you got me going. I think there is a very high correlation between my approach to skiing versus the risk management approach we just discussed. As you know, I enjoy my off-piste trips so I’ll give you my version of that ticket disclaimer.

Imagine you are on a wide, open slope in the backcountry, it’s a beautiful blue-sky day. You want to ski that slope because you know the payoff will be huge. Hold on though…what risks will I have to take to get that payoff? Like investment decisions, any backcountry line is going to have unknowns, so I prepare myself with lots of information: avalanche reports, weather reports, snowpack reports etc. From this, like a company earnings report or a management interview, I have some indicators to make an informed decision.

Despite the potential payoff, if the conditions suggest the risk is extreme, the best strategy is likely to ski somewhere else, or not ski at all. The first question is: what exposure is appropriate? Not buying a stock can be a prudent choice—sometimes you win by not losing. In skiing, maybe there’s an alternative slope where I am willing to take some of the risk but for a lower payoff. In portfolio terms, maybe that means I manage the weight of that security to a smaller weight in the portfolio. In skiing, I can still have a great run without risking my life. In investing, I can still generate attractive returns without risking my whole portfolio.

Despite taking steps to minimize my exposure, I still need to think about the possibility of things going wrong and how I might get out of it. My mitigation strategy is to come prepared. I ski with an avalanche beacon, for example, and I ski with partners and guides familiar with how to deal with the situation. In the stock market, my mitigation strategy is designed to put me in the position of being able to survive downturns. That means I have done my homework on the companies, I understand the potential risks of each investment, and I am aware of scenarios that may unfold. And if those scenarios unfold, I am in a position to act; I can help myself and mitigate a potentially negative situation.

I suppose my role as CIO is like being a ski guide responsible for assessing risk conditions on any given day. If I decide to be on the slope, do I have both an exposure and a mitigation strategy? If I’ve done my guiding right, then in all likelihood, I’ve made it home safely and with a smile on my face. I didn’t put myself and my clients at risk of losing everything but was prepared if something did go wrong. It’s the same with investing. Do your homework, enjoy the day, enjoy the ride, get a return, but don’t put yourself at risk of losing all your money.

CW: Wow, just the mention of a lift ticket gets us a full “Jim’s take” episode. Thanks for sharing and have a good ski season.

This post was originally published at Mawer Investment Management