by Kara Lilly, Investment Strategist, Mawer Investment Management, via The Art of Boring Blog

In 1845, Scottish poet and author, William Aytoun, published his satire, How we got up the Glenmutchkin Railway, and how we got out of it. His story focused on the railway stock frenzy that gripped Great Britain, with the aim of bringing awareness to what he saw as madness, “if anyone ha[d] the sense to see it.”

By the mid-1840s, British Railway Mania was nearing its zenith. In 1845, total railway revenues were £6 million (already about 1% of GDP and 10% of government spending) yet British investors were expecting them to grow to £60 million by 1852!1 Even prominent intellectuals such as Charles Darwin, John Stuart Mill and the Brontë sisters were enveloped in this collective delusion—they had invested heavily into railway stocks even though none of them knew much about rail. The ending of this story should not be surprising: the mania created a bubble, the bubble eventually burst, and railway investors suffered extensive losses.

Readers may ask: why is this relevant today? The answer is that British Railway Mania is an excellent example of a pattern—the technology hype cycle—that has occurred repeatedly throughout history. This pattern is critical for investors to understand because, first, technology shapes so much of our economies and society, and, second, it is so timely: discussions of technology are seemingly everywhere these days. Indeed, it feels like a giant wave of change is rising beneath us! And it is this collective knowing that this time is different that makes this mood analogous to the 1840s and a review of the hype cycle so worthwhile.

When we look back at the history of technology hype cycles, there are two main lessons. First, the same patterns of emotions and beliefs seem to emerge at different parts of the hype cycle—even when technologies are new and transformative, the ways we react to them are surprisingly similar. Second, investors appear to consistently make the same mistakes in terms of expectations and predictions. Awareness of these biases and pitfalls may help us navigate our present circumstances.

Temperament and technological development

Human nature plays an influential role in our history. Our physiological makeup is a byproduct of millions of years of evolutionary programming and our genetic code has not changed significantly from when we roamed the plains of East Africa 70,000 years ago. It is not surprising, then, that the main driver of technology cycles is human temperament—specifically our tendency towards mania.

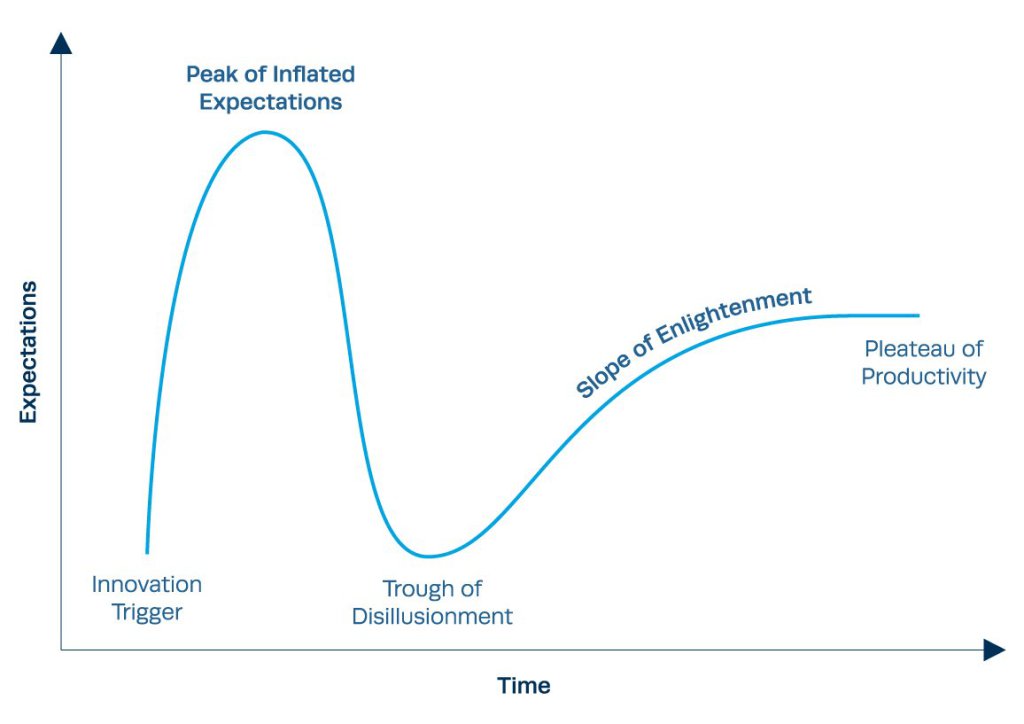

Gartner Inc., a U.S. research, advisory and IT firm, offers a compelling framework to help explain how temperament creates technology hype cycles. They describe how the adoption and maturation of technologies is driven largely by expectations and how these expectations impact capital investment. They call it the “Gartner Hype Cycle.”

The Gartner Hype Cycle

The cycle starts with a promising technology. Initially there are only a few believers, but eventually the technology establishes some wins (e.g., functioning prototypes, successful test phases etc.) and social proof begins to build. Capital starts to flow into the sector, which supports technological development and helps lead to more breakthroughs. This reinforces the apparent genius of investing in the sector in the first place, which prompts more capital inflows. A virtuous cycle forms.

Over time, hype for the technology really starts to build and it’s during this period that reason and skepticism may fall by the wayside. Ironically, the hype is only made possible because the technology shows real promise–like with rail and the world wide web—it’s just that investors take their assumptions too far. Eventually, a bubble forms. This psychological process is akin to boiling water: hype brews gradually, then quickly, then totally out of control.

At some point, the bubble collapses and reality sets in. “Only when the tide goes out do you discover who’s been swimming naked.”2 Valuations tumble, companies teeter or go bankrupt, and many investors lose their shirts. Gartner refers to this point as the “trough of disillusionment,” where much wealth is destroyed.

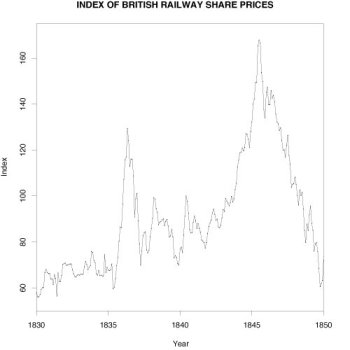

Railway share prices in Britain from 1830 to 18501

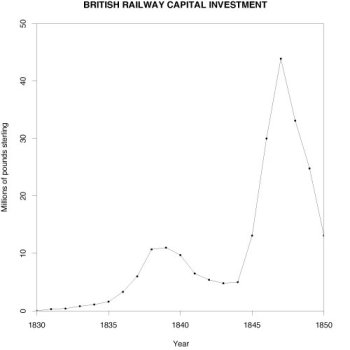

Railway investment in the United Kingdom from 1830 to 18501

While most investors are familiar with this part of the story, they may not realize what usually comes next. Most technologies take off after the hype dissipates. This happens because of the same force that brought the whole system down in the first place: mania. In boom times, mania compels investors to plow substantial amounts of capital into higher risk areas. It is this capital inflow that enables the sizeable buildout of infrastructure that later helps the technology to flourish. For example, one of the benefits of dot come mania was that it induced significant investment into fiber optic cable networks, which later enabled the rapid expansion of the Internet.

Paradoxically, the very mania that results in widespread destruction of wealth, ultimately allows for the creation of significant future wealth.

This pattern is apparent in the British Railway Mania example. After rail started to show substantive promise in the 1830s, investor interest grew until most of the upper and middle classes were invested to varying degrees. The fever pitch culminated by 1845, when the industry finally imploded. From 1845 to 1850, railway stocks followed a precipitous downwards path and much wealth was destroyed.

But a transformative technology emerged from the ashes. Most of the rail that was built during the mania was put into service, and since rail was a markedly superior way of transporting goods and services, this had a positive impact on Great Britain’s economy. Indeed, the British economy likely benefited for decades from improvements made possible by Railway Mania. But, as in most hype cycles, those who profited the most from railway technology were not the original investors.

There is always “railway speed”

History tells us that there are two major places where investors tend to make mistakes in hype cycles: either we get wholly wrapped up in mania OR we fail to acknowledge the technology’s potential.

In retrospect, the first error is easy to ridicule. Of course, those expectations were unreasonable! How were people that gullible? And yet throughout history, there are many examples where people were swept away by overly optimistic sentiment. It is often far harder to stand apart from the crowd in these moments than we’d think. One of the reasons for this is the tendency to believe that “this time is special.” In seemingly every period of technological transformation, there is a collectively held feeling that the speed of innovation is increasing. In 1840, “railway speed” was the catch-phrase of the day and in 2000, “internet time” was used to describe a similar sentiment. It is this “emotional certainty” that enables the leap from “rationally justified, optimistic expectations” to “wildly unjustified, optimistic expectations.”

Expressions like “railway speed” are red flags. When someone says, “but it’s different this time!”it is a reading on the mood thermometer that shouldn’t be ignored. Even when the technology has real promise (as it often does), it may indicate a collective irrationality is brewing.

When we fail to acknowledge technology’s potential, we are guilty of the second error: dismissal. While technology expectations in the short-term are often too optimistic, the eventual scope of change can be massive. In 1845, railway enthusiasts expected the 2,400-mile British railway system to grow to about 20,000 – 30,000 miles by 1851—a highly unlikely growth trajectory—but by 1924, the industry did have 24,000 miles in service. Often, technology will have an impact as much, or larger, than initial expectations…just much later than originally expected.

Dismissal of potential is also a major mistake. We might not be able to predict exactly how much a new technology will impact us in the future, but the most realistic assumption is that they will in some way. For example, investors might not all agree on the extent of e-commerce’s impact, but that doesn’t mean we ignore the threat that traditional retailers face. Usually, it is easier for an investor to successfully avoid the losers than to predict the winners.

But what about the horses?

With every new technology, predictions are made about its potential to grow and disrupt. Making and debating these predictions is, to some extent, completely reasonable; it is judicious to consider new innovations’ potential first and second order consequences. However, a problem arises when we believe too strongly in singular predictions because most end up spectacularly wrong.

For example, when British Railway Mania began, nearly everyone “knew” the demand for horses would go down. This sparked a fierce debate over whether there should be rail technology at all because…what of the horses?!! Proponents for railway technology argued that societal gains from rail outweighed the loss of horses. Moreover, they argued fewer horses would mean more food for people (the land required to feed one horse could feed approximately eight people). Conversely, opponents fretted about the societal impacts of fewer horses, including “the death of the noble art of horse breeding, with detrimental effects on such important parts of upper-class life as fox hunting, as well as deadly threats to national defense through lack of good horses for cavalry.”1

Both sides were wrong. As it turned out, horses were still necessary to solve the “last mile” problem of rail. While trains were a fantastic transportation improvement overall, tracks could not be laid everywhere, and there was a still a need after the rail line ended to get goods and people to their final destinations. Rail facilitated a growth in the overall number of goods transported throughout Great Britain, which in turn stimulated an increase in horse demand. Indeed, the demand for horses didn’t really crater until after the advent of another technology: the combustion engine. In short, what “everyone knew” and was “obvious” at the time turned out to be dead wrong.

This is a common pattern. During times of technological change, many predictions are made and debated but only a few turn out to be correct. In 1999, few predicted that “search” would become such an integral component of the Internet, or that an “online bookseller” would totally disrupt traditional brick and mortar businesses. Yet Google and Amazon are now behemoths in the corporate landscape.

Societies and economies are complex adaptive systems. While we may have our theories on the cascading effects to come, intellectual humility forces us to admit that we really don’t know how things will play out. Take artificial intelligence as an example. We can’t possibly predict how AI will impact society moving forward. It could turn out to be the greatest thing since sliced bread—allowing amazing advances in our understanding of the world and changing the way that we live our lives. Or it could totally upend labour markets, aggravate wealth inequality, and become a huge catalyst for political disruption. The spectrum of potential outcomes is vast.

Worth the wait

At Mawer, when new technologies emerge, we evaluate potential opportunities/risks and seek to map potential first and second order consequences. While we know we won’t’ be able to perfectly predict the future, we nevertheless consider what ripple effects could occur. We are particularly careful about our downside exposure—we don’t need to step unnecessarily into any oncoming trains. As an example, we are not rushing to buy publicly traded cab companies or traditional retailers any time soon.

When it comes to the upside, we often find it worthwhile to wait. For example, two decades ago the world went through the dot com bubble. Back then, like most investors, our team was intrigued by the promise of the new technology companies; clearly, there was a great deal of potential with the Internet. Yet we largely avoided big investments in the kinds of technology companies that soared and subsequently crashed. Why? Because our investment philosophy requires that we buy companies that are wealth-creating, run by good management teams, at prices that are discounts to their intrinsic values, and in 2000, it was very difficult to find technology stocks that met all those criteria. Moreover, our team was uncertain who the long-term winners would be. Without a convincing edge, we focused on managing our downside exposure and staying clear of the hype.

In retrospect, this was prudent, but it would be deceiving to say it was easily done. Like others, we felt the hype of the environment we were in. Moreover, many very smart people were espousing the virtues of the Internet and some very reasonable arguments were put forward (indeed, many of those grandiose early promises about the Internet eventually became true in the fullness of time!). Often, we found ourselves asking, “are we missing something?” Nevertheless, we stuck to our investment philosophy despite the pull from the market.

Today, we own many technology companies. Some of these were even around during the dot com bubble. Google was only a few years old at the height of the tech bubble; in fact, founders Sergey Brin and Larry Page tried to sell the company for $1 million in 1999 to Excite (back then one of the most recognized brands on the Internet). Thankfully, they were rejected, twice, and now Google is one of the most dominant companies in the world. But whether it’s Google or any one of our other technology companies, there is always one commonality: these are wealth-creating businesses with established competitive moats.

And how long are we willing to wait? Until it makes sense.

As it happens, two of our largest weights in our Canadian Equity Fund today are Canadian National Rail and Canadian Pacific Rail. Combined, these businesses make up the Canadian duopoly for rail. In both cases, the businesses are wealth-creating (i.e., they generate returns on capital in excess of their cost of capital) and have strong competitive moats. We own them because we believe they offer attractive risk-adjusted returns for our clients. But of course, we know that the rail business has not always been good to shareholders. Not only were the first investors in rail mostly wiped out, subsequent decades in the rail business have not always been good to shareholders (e.g., the rail industry was punitively regulated for years). The industry hasn’t really been very attractive from an investment standpoint until more recently. But it came around…it only took about 190 years.

Final thoughts

Without a doubt, the world is experiencing rapid change because of technology. Many technological innovations are unfolding in tandem that appear to be genuinely transformative. It is therefore completely reasonable to remark how this feels and to reflect on potential outcomes. But we should also recognize that this is not new. Technologies come with hype cycles. Hype cycles feel a certain way. This is all par for the course.

Ultimately, when it comes to technological change, investors do not want to fall victim to the hype, but they do not want to discount it either. We can be far too exuberant about technologies in the near-term, without realizing that it often takes time for transformative social change to take place. At the same time, we do not want to be dismissive, either, because technologies often fully realize their potential over time. On top of all this, we must be careful about the certainty we place in our predictions.

In 1845, investors could have read the clever Glenmutchkin Railway and awoken to the hype (potentially preserving their savings). Indeed, in most periods of hype, there seem to be clues that hint at our collective bearings, or at least opportunities to test the underlying assumptions. Unfortunately, it can be difficult to see these signals when the prevailing wisdom of society is going against us. That is why awareness of the hype cycle can be so valuable to investors. When you know how the magician does his trick, it can change your entire perspective of the magic show.

1 Odlyzko, Andrew. Collective hallucinations and inefficient markets: The British Railway Mania of the 1840s. School of Mathematics and Digital Technology Center, University of Minnesota. January 15, 2010.

2 Warren Buffet

This post was originally published at Mawer Investment Management