by Blaine Rollins, CFA, 361 Capital

The market will be in a food coma all week. Congress is gone until month-end, earnings releases will be few and volumes will grind to a crawl. Cooking plans and holiday shopping lists will get most of Wall Street’s attention this week. For those of us still looking at the market, we will be watching to see if Junk Bonds and Retail stocks put in a continued bounce. With all of the negative articles last week about riskier bonds, it was encouraging to see the indexes and ETFs finish higher. Also of interest to many is the upcoming plans to get rid of the Telecommunication sector and evolve it into a Media, Entertainment & T-com sector. It will be interesting to see how all of the passive ETFs and mutual funds will deal with the change given the large tax gain shifts that will impact Google, Facebook, Disney and Comcast.

Have a great Thanksgiving!

To receive this weekly briefing directly to your inbox, subscribe now.

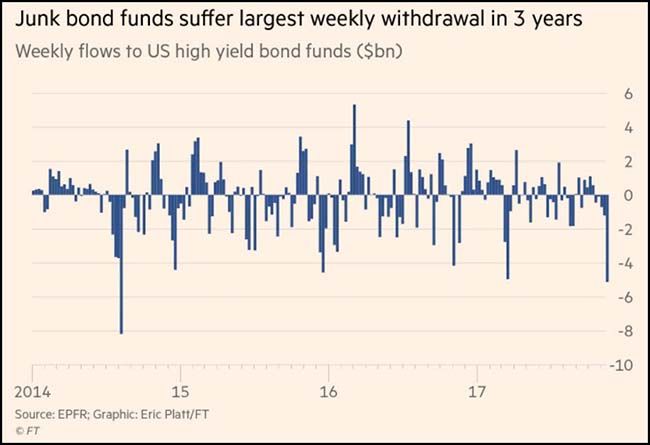

The Junk bond beat down in the press continued all week capped by a big outflow in the ETFs and Mutual Funds…

Of course maybe this was the bottom tick as the asset class did finish higher on the week.

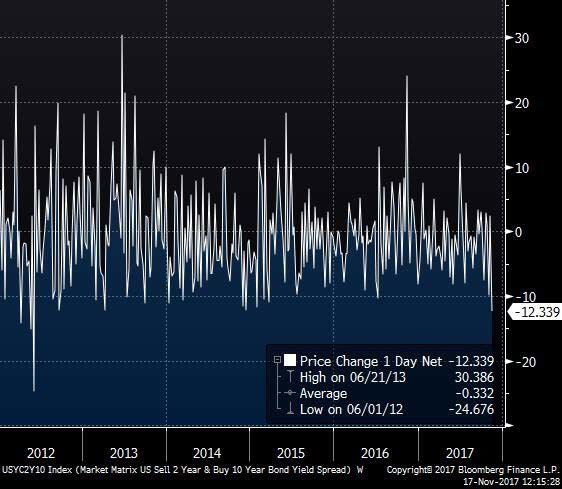

Maybe of more importance was the big week in yield curve flattening…

@LJKawa: Intense Flattening: This is biggest week of spread shrinkage for 10 vs. 2 year Treasury yields since 2012.

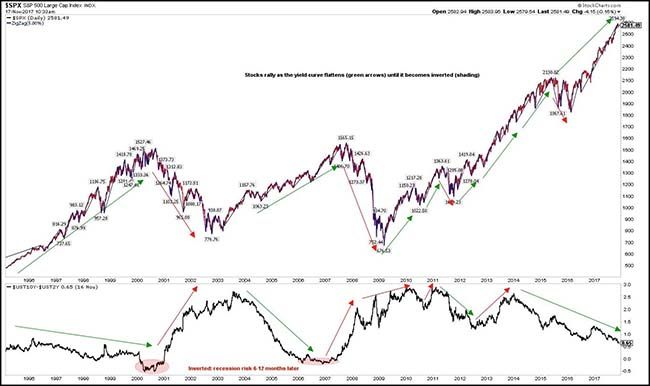

But while yield curve flattening might be bad for bank lending profitability, it is not always bad for equity gains…

@ukarlewitz: Yield curve flattening is not a notable risk to $SPX

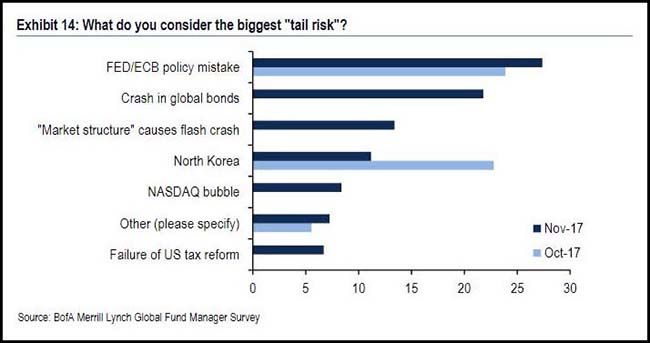

The big market participants are still more worried about Washington and global politics…

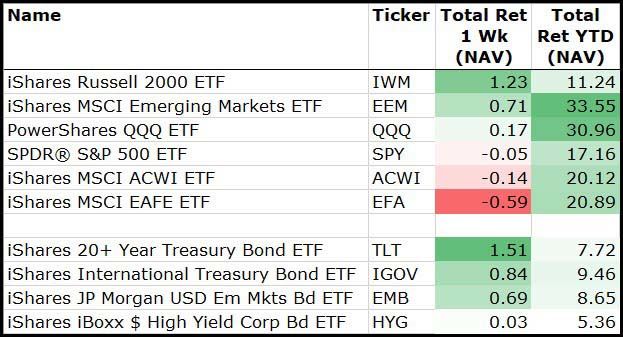

For the week, Small Caps and Treasuries found the most fans…

(11/17/2017)

Banking and Consumer stocks also did well, while Energy got liquified…

(11/17/2017)

The Consumer Discretionary sector looks to be breaking out on a relative basis after six months of underperformance…

And it is not just Amazon, but many names across the board.

One drag to Consumer Discretionary has been Retail…

But it sure woke up last week on better-than-expected earnings, as well as several M&A data points in the Retail and REIT space.

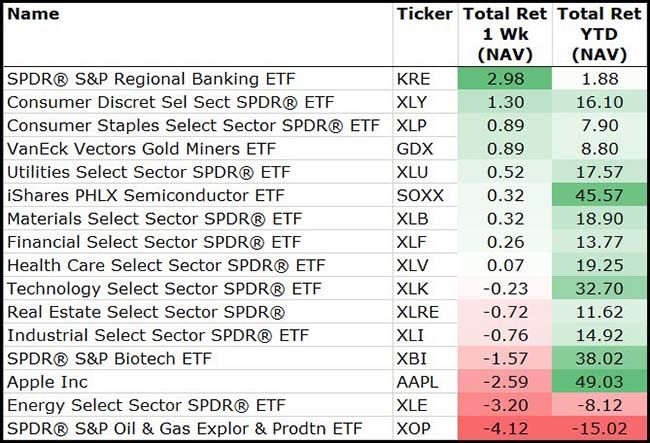

Just look at these moves on Friday from the Thursday and Friday earnings releases…

It looks like expectations may have hit the floor.

(@eWhipsers)

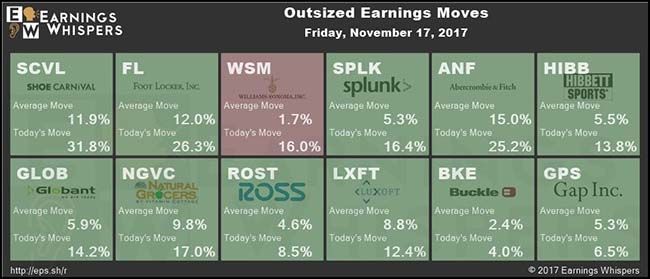

If it is year-end then it must be time to stock up on turkey, wrapping paper and small cap stocks…

You can thank the Pilgrims, Santa Claus and the Tax Calendar, plus Animal Spirits.

(@edclissold)

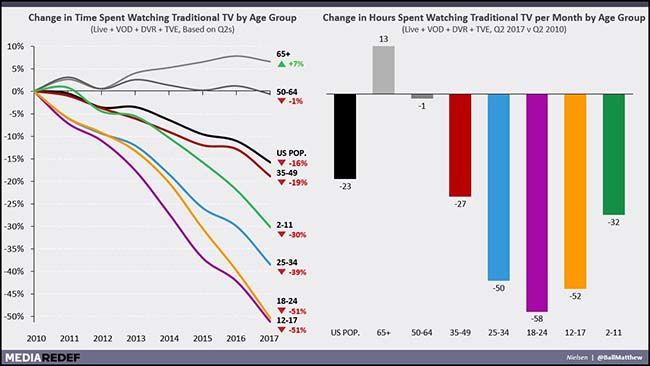

Time to stop humming your favorite commercial jingle or else anyone under 35 might call security on you…

@ballmatthew: Updated for Q2 2017: Decline in Pay TV usage by demo. 12-24 down 51% since 2010 (~55 hours a month), 25-34 down 39% (50 hours). Rate of decline still not slowing. If you’re under 50, you’re watching at least 20% less Pay TV. Only 65+ is up.

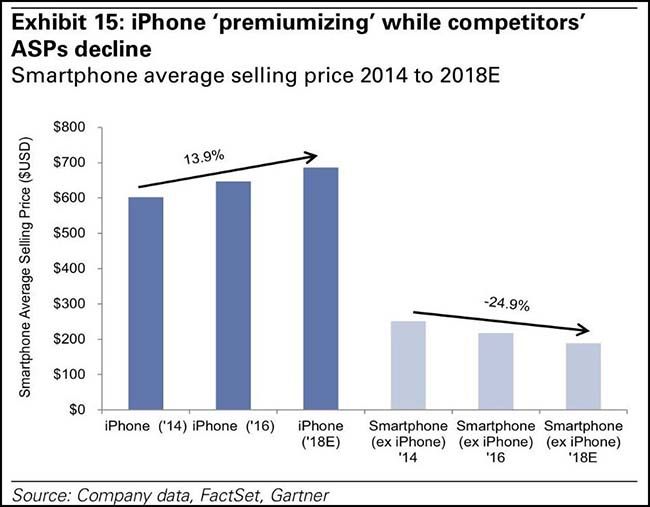

If you own Apple, then just keep watching this chart…

As long as the company can continue to figure out how to get you to pay for more on your next iPhone while its competitors can’t, then you should outperform.

(Goldman Sachs)

As for investing in Saudi Arabia? Many will be taking a pause…

As they mingled with Saudi Arabia’s business and political elite at the Ritz-Carlton in Riyadh last month, the world’s top financiers were effusive in their praise of Crown Prince Mohammed bin Salman’s vision to modernise the conservative kingdom.

But 10 days later, with the hotel turned into a deluxe jail for the hundreds of princes and businessmen rounded up in an extraordinary corruption crackdown, the mood of many of the foreigners considering investing in the world’s top oil exporter has turned from enthusiasm to alarm.

“Half my Rolodex is in the Ritz right now. And they want me to invest there now? No way,” said one senior investor. “The wall of money that was going to deploy into the kingdom is falling apart.”

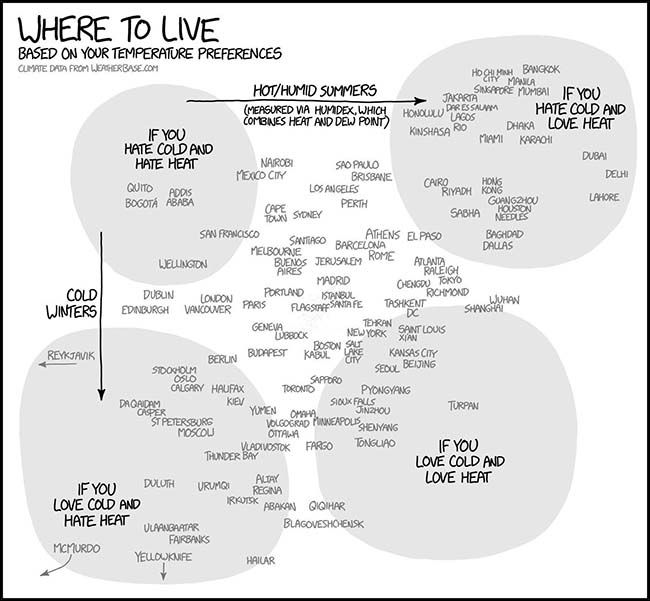

Graphic of the week…

(@PlanMaestro)

Finally, the best article of the week…

Max Deutsch went through a month of training before he traveled across the ocean, sat down in a regal hotel suite at the appointed hour and waited for the arrival of the world’s greatest chess player.

Max was not very good at chess himself. He’s a 24-year-old entrepreneur who lives in San Francisco and plays the sport occasionally to amuse himself. He was a prototypical amateur. Now he was preparing himself for a match against chess royalty. And he believed he could win.

The unlikely series of events that brought him to this stage began last year, when Max challenged himself to a series of monthly tasks that were ambitious bordering on absurd. He memorized the order of a shuffled deck of cards. He sketched an eerily accurate self-portrait. He solved a Rubik’s Cube in 17 seconds. He developed perfect musical pitch and landed a standing back-flip. He studied enough Hebrew to discuss the future of technology for a half-hour.

Max, a self-diagnosed obsessive learner, wanted his goals to be so lofty that he would fail to reach some. At that, he failed. Max was 11-for-11.

He knew from the beginning of his peculiar year that the hardest challenge would come in October: defeating Magnus Carlsen in a game of chess.

(WSJ)

And Lastly…

To get your daily dose of Blaine, follow @361Capital on Twitter for aftermarket tweets and more. Also, start following our 361 Capital Blog for timely insights from other members of our Investment team.

Copyright © 361 Capital