by Ryan Detrick, LPL Research

High-yield bonds have been in the news lately, as the Bloomberg Barclays U.S. Corporate High-Yield Index has lost 1.1% since the beginning of November; while high-yield spreads are 0.31% higher month to date. The moves remain small by historical standards and may be at least partially attributable to profit taking after a strong year of performance, but in today’s low volatility world markets are watching for any sign that cracks may be developing.

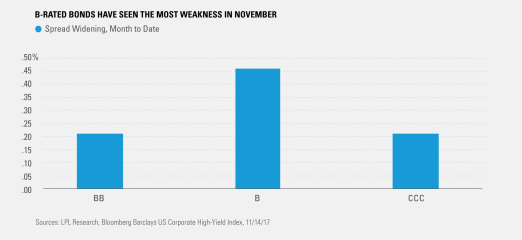

The good news is that so far, most of the weakness in high yield has been contained to a small portion of the market. When we break the move down into individual credit rating buckets, it is clear that B-rated bonds have seen the most weakness. Yet, if investors were expecting economic growth to falter, we would expect the lowest-rated CCC bucket to underperform as their weaker financial condition suggests that they would fare the worst in a broad economic downturn.

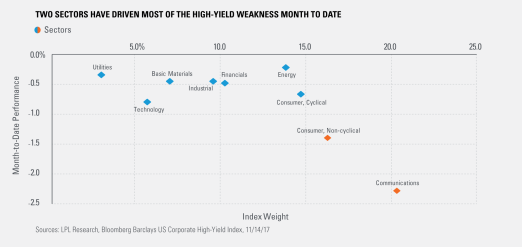

While all sectors of the high-yield market have seen at least some weakness, the majority of the selling pressure is concentrated in a few particular sectors. The communications sector, which makes up 22% of the high-yield index, has been dragged down by weakness in several large firms in the telecommunications industry. Similarly, the non-cyclical consumer sector has seen weakness driven by the cosmetics and healthcare industries.

Equity markets have seen weakness over the past couple days, which may be a sign that they are starting to agree with the message the high-yield bond market is sending. However, the overall breadth of the high-yield pullback remains narrow at this point, which may indicate that concerns are tied more directly to specific companies or industries rather than the economy as a whole.

****

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

High-Yield spread is the yield differential between the average yield of high-yield bonds and the average yield of comparable maturity Treasury bonds.

Because of their narrow focus, sector investing will be subject to greater volatility than investing more broadly across many sectors and companies.

The Barclays U.S. Corporate High-Yield Index measures the market of USD-denominated, noninvestment-grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below, excluding emerging markets debt.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking #1-668234 (11/18)

Copyright © LPL Research