Has the stock market gotten too expensive? Overall, we would say it hasn’t. But we do feel some sectors are better positioned than others.

by Jim McDonald, Chief Investment Strategist, Northern Trust

SUMMARY

- Measures of corporate activity show the global economy has been gaining momentum all year

- U.S. tax reform remains an unknown, but does not seem to be priced into the markets yet

- Global monetary policy seems unlikely at the moment to cause any waves

OUTLOOK

One of the most frequent questions we receive is whether the stock market is too expensive to put new money to work, or even to maintain current positions. To help address this question, we recently published a research report entitled Not Worth Being Cute. The research showed that it doesn’t pay to sell out of the equity market just because it has become “expensive.” Investors haven’t improved their returns by switching to bonds in these cases, and switching to cash produced significantly worse results. Our conclusion is that broad asset allocation changes aren’t warranted. But we have been making selective moves over the last year to account for higher valuations. Not only have we recommended reallocating from the relatively expensive U.S. equity market to developed ex-U.S. and emerging market equities, we have reduced our recommended high yield bond allocation four times in response to higher valuations.

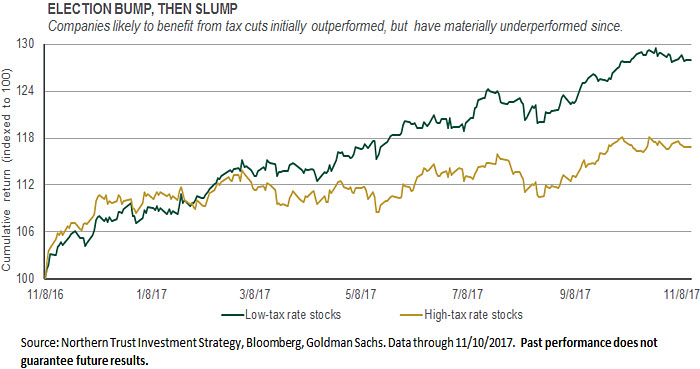

All of this is occurring in a constructive macro environment. Measures of corporate activity, such as purchasing managers’ surveys and corporate earnings, show that the global economy has been gaining momentum all year. Capital spending has also finally picked up, which indicates increased corporate confidence. While legislative progress has been virtually absent in the United States, deregulation has boosted corporate attitudes and could pay further dividends as it moves toward the banking industry. The status of U.S. tax reform is another question we hear a lot, and we see passage as more likely next year than this. While we think investors are hoping for lowered tax rates and reform, there isn’t much firm evidence that it is priced into the stock markets. This is highlighted in the graph below, which shows the recent underperformance of high tax rate companies that should be the beneficiaries of reform.

The Federal Reserve will be undergoing significant change, starting with the likely confirmation of Jerome Powell as the new Fed Chairperson in early 2018. We have felt that President Trump would favor a Chair with a dovish bias, and expect that to influence future appointments. So the expected path of monetary policy over the next year is likely to be similar to what a Yellen-led Fed would have delivered – but the communication of the policy is where some uncertainty resides. We don’t expect major issues, but the new Fed will need to gain experience in conditioning the markets about the likely path of monetary policy. We believe that the friendly policy environment anchored by easy policy from the European Central Bank (ECB) and the Bank of Japan will facilitate this.

INTEREST RATES

- Municipal bonds have gotten relatively expensive.

- We are awaiting new issuance for opportunities.

- Short-date European debt remains unattractive.

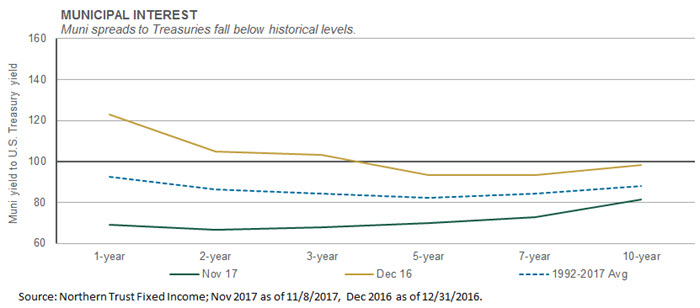

U.S. Treasury short rates have risen amid multiple hikes by the Fed, while municipals yields have fallen across the entire yield curve. This has driven shorter dated municipal/Treasury ratios well below where we started the year, and below their historical averages. The Fed wants to continue raising rates in 2018, but the municipal market does not see inflation or excessive economic expansion on the horizon. Additionally, the lack of supply in the municipal market and implications of the potential tax changes may prolong the technical factors driving muni yields. We have been shortening duration in portfolios, awaiting additional supply before year end.

As expected the ECB announced a reduction in monthly asset purchases from $60 billion to $30 billion, tempered by an extension in the length of quantitative stimulus. This cautious stance is in stark contrast with global central bank policy direction, including the Bank of England’s (BOE’s) fearless decision to raise the U.K. base rate despite Brexit uncertainties. This puts the ECB firmly behind trend. While its stance may be justified by the lag in euro-area inflation expectations, risks appear to be increasingly skewed to the upside. Euro-area bond yields remain deep in negative territory courtesy of the ECB’s dovish policy, but appear unattractive given the skew of risks, especially at the shorter end of the yield curve.

CREDIT MARKETS

- Positive earnings and good economic growth are supporting credit markets.

- The constructive growth environment is driving the default rate lower and recovery rates higher.

- Our high yield reduction was based on extended valuations and not an indictment of fundamentals.

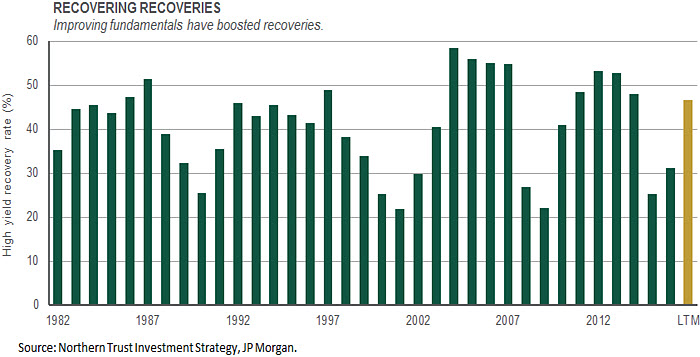

We reduced our allocation to high yield fixed income as a result of continued spread tightening that has led to an increasingly lower one-year return expectation. Importantly, we do not believe underlying high yield fundamentals have deteriorated. In fact, fundamentals remain strong as a result of continued company earnings strength and an improving economic environment. Putting numbers to it, the high yield default rate has declined from 5.6% at year-end 2016 to an expected 3.1% at year-end 2017 – and is expected to continue to decline to 2.3% by the third quarter of 2018. As default rates are going down, recovery rates (the percentage of the bond value recovered through the asset sales of those companies that do default) are going up. The high yield bond recovery rate over the last 12 months has improved to 47% – higher than the long-term average of 41% and up from 25% in 2015 and 31% in 2016 (driven lower by the commodity downturn).

As such, from a broader perspective, we do not believe the recent uptick in high yield credit spreads (from a low of 3.26% to a recent high of 3.63%) is the “canary in the coal mine” of impending economic and financial market troubles (as the media always likes to suggest whenever high yield spreads show any signs of weakness). However, over the past 18 months, we have been slowly reducing our once-large tactical overweight to high yield. With high yield credit spreads (even after recent weakness) sitting near decade-long lows, we took the next step in this unwind.

EQUITIES

- Emerging markets have had long cycles historically.

- We may be entering a new up cycle.

- Technology also leading emerging market stocks.

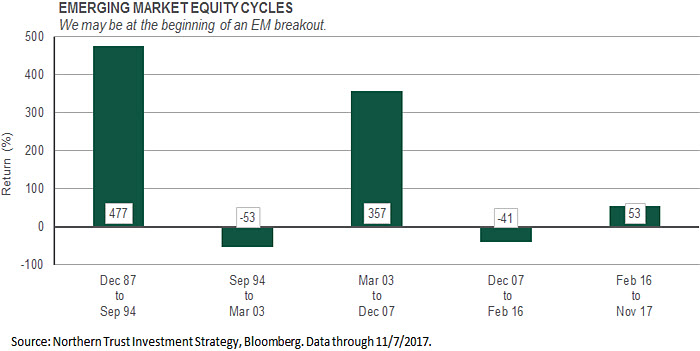

Emerging market equities may be in the early stages of the third multi-year up cycle in the past 30 years. As seen in the graph, emerging market equities have had two distinct down cycles over that time, each lasting roughly eight years. Both downturns cut the market nearly in half. Since early 2016, emerging market equities are up by more than 50%. While notable, the duration and magnitude of this cycle appears to be in the early innings compared to prior cycles. Prior upturns lasted more than five years on average and saw gains in excess of 350% from trough to peak. We are forecasting something far short of that level of appreciation, but we do see solid returns from emerging market equities going forward. Non-U.S. equities have materially lagged the U.S. markets since the financial crisis. From here, we forecast better earnings growth in non-U.S. markets, and that growth comes at more attractive valuations, even though segments of emerging markets have seen strong appreciation, including technology. With several world-class technology stocks (such as Alibaba, Samsung, Tencent and Taiwan Semiconductor) leading the indexes, the emerging markets rally has been more than just a macro rotation into the group. Finally, with synchronized global growth and accommodative central bank policy, we continue to like equities markets globally.

REAL ASSETS

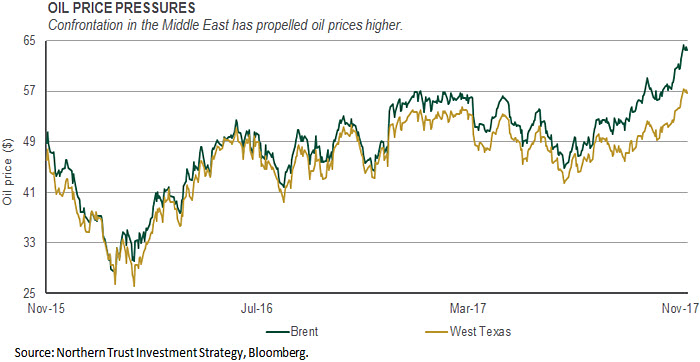

- Oil prices have moved higher on geopolitical concerns and ongoing inventory reduction.

- Oil demand should remain elevated as global growth continues; supply is harder to assess.

- We remain neutral natural resources – in addition to global real estate and listed infrastruct.

Oil prices have pushed through recent levels of resistance, with per barrel prices now sitting in the mid-$50s and low-$60s for West Texas and Brent Crude, respectively (see chart). The most recent push upward has been driven by renewed tensions in the Middle East, including Saudi Arabia’s crackdown on corruption and its growing tensions with other regional players. This includes the recent confrontations with smaller countries like Qatar and Lebanon as well as the ongoing Saudi-Iranian struggle for Middle East power.

Whether oil prices will remain at these elevated levels will depend not only on geopolitical developments, but underlying fundamentals as well. Indeed, one major oil price support pillar has been the steady increase in global demand. We believe this will persist amid the ongoing globally synchronized growth expansion. The other part of the equation is supply. OPEC members have kept mostly to their promised quotas, which has combined with some moderation of U.S. production growth to push inventory levels lower, albeit still above long-term historical levels. Key to the supply-demand equation will be the OPEC November 30 meeting. It is expected that current production quotas will be extended through 2018 at that meeting, but compliance with those quotas (currently 90%) may start to fall as oil prices move back to “breakeven” levels (the level at which oil revenues can support the broader economy). We remain equal weight natural resources, with more confidence in the demand side than the supply side of the oil market equation.

CONCLUSION

We have long felt that successful investing involves a combination of art and science. There is plenty of historical data about the economy and financial markets, and how the markets should perform under different scenarios, but history rarely repeats itself. Valuations are fairly discreet – however, what you do with that information is another question. This month, we’ve chosen to further reduce our recommended high yield position, a decision driven primarily by the relatively full valuation of the asset class. In contrast, we’ve determined that a similar move in the equities markets isn’t warranted. One way to explain this distinction is that there is a practical limit to the returns in high yield bonds, but not in equities. We’ve also sought to determine how much the market is “discounting” the passage of tax reform. While high tax rate companies haven’t outperformed like we would expect if investors were discounting tax reform, there is likely at least a small support to equity prices from the expectation of lower taxes.

Since we remain constructive on the economy and risk taking, we’ve chosen to reallocate our recommended 2% reduction in high yield bonds equally between emerging market equities and investment grade fixed income. Emerging market equities have benefitted from the global economic expansion and current technology cycle, while the overall asset class remains relatively inexpensive. We expect fixed income to generate low, but positive, returns in a generally benign interest rate environment. If these two destinations seem remarkably different, that is the intent. These changes allow us to maintain our desired risk exposure across the portfolio, while reducing exposure to high yield at a time of relatively high valuations yet good market liquidity.

We’ve updated our risk cases to reflect recent developments, but they remain fundamentally unchanged. The risk of a Monetary Misstep is critical, as low interest rates underpin high market valuations. This risk case has evolved to capture the increased risk coming from the high level of turnover within the Federal Reserve. To be clear, we think the outlook for monetary policy is unchanged – the new risk captures the inexperience of the new leadership in communicating monetary policy. The risk from Political Leadership Openings continues to be two-fold: the negative risks created by America’s new approach to foreign policy, and the positive risk created by new political leadership (e.g., France). A new wrinkle this month comes from the Middle East, where recent moves by Saudi leadership have increased risks in the region. For now, both of these risks seem manageable in financial markets supported by durable growth and easy monetary policy.

- Jim McDonald, Chief Investment Strategist

IN EMEA AND APAC, THIS PUBLICATION IS NOT INTENDED FOR RETAIL CLIENTS

© 2017 Northern Trust Corporation.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Forward-looking statements and assumptions are Northern Trust’s current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Investments can go down as well as up.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited.

Copyright © Northern Trust