by Ryan Detrick, LPL Research

What can we say about 2017 that hasn’t been said already, as it continues to smash records? Per Ryan Detrick, Senior Market Strategist, “2017 will likely be remembered for two things: a persistent bullish trend and historically low volatility.”

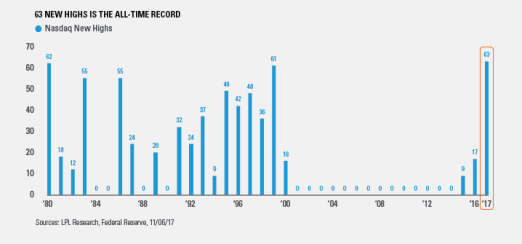

In fact, here are two more records that prove that point. The Nasdaq has never made more all-time highs than the 63 it has made (so far) this calendar year, topping the previous record of 62 set in 1980.

We’re also in the midst of another record streak showing just how rare big sell-offs have been recently. Incredibly, the S&P 500 Index has gone 43 consecutive days without closing down 0.5% or more; it’s been more than 20 years since the index last experienced such low downside volatility.

There are still nearly two full months left of 2017, so a lot can happen—but what we’ve seen so far is truly one of the most serene and strongest markets ever.

IMPORTANT DISCLOSURES

Past performance is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

The economic forecasts set forth in the presentation may not develop as predicted.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal and potential illiquidity of the investment in a falling market.

Stock investing involves risk including loss of principal.

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The NASDAQ Composite Index measures all NASDAQ domestic and non-U.S.-based common stocks listed on the NASDAQ stock market. The index is market-value weighted. This means that each company’s security affects the index in proportion to its market value. The market value, the last sale price multiplied by total shares outstanding, is calculated throughout the trading day, and is related to the total value of the Index. It is not possible to invest directly in an index.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor Member FINRA/SIPC

Tracking # 1-664211 (Exp. 11/18)

Copyright © LPL Research