NOVEMBER 2017

With growth drivers maturing, it’s time to view the investment landscape through a more critical lens.

by Jurrien Timmer, Director of Global Macro, @TimmerFidelity

Key Takeaways

• Global equities have enjoyed extremely favorable conditions for quite some time, with earnings growth and easing liquidity conditions benefiting stock valuations and prices.

• However, if earnings growth moderates to long-term trend levels and the Federal Reserve (Fed) maintains its relatively hawkish stance, these tailwinds could blow less strongly.

• Despite this potential moderation, it’s doubtful a correction is imminent and fears of a bubble are likely overblown.

• The big question in coming years remains how the end of the global easing cycle will affect the risk-free rate and, therefore, the valuation of all financial assets.

Rather than writing a deep-dive on a single topic as I usually do, this month I thought I would briefly address the various market-related questions that are on people’s minds these days.

On earnings

The earnings picture both in the U.S. and globally continues to look good. There is some deceleration evident in the growth numbers, however, as would be expected six quarters after a cycle bottom.

By definition, the rate of change typically progresses from steeply negative to steeply positive to less positive to trend growth as we approach, move through, and then move past a cyclical inflection point. The long-term trend growth rate for S&P 500 earnings is around 6% to 7%, so that’s where the numbers could settle in the coming quarters.1

For the current cycle, quarterly earnings bottomed at -14% (year over year) in the first quarter of 2016, accelerated to +14% in Q1 2017, and have moderated since then.2 Now, with Q3 earnings season upon us, the consensus expected growth rate has fallen from +9% six months ago to +3.6% as of last week. If the normal earnings-season bounce occurs, the final Q3 growth rate should rise to around 6% to 7%, right in line with the long-term trend growth rate.

At this point, the Q4 consensus estimate remains quite high at +11.9%. Chances are this will come down (on average by 800 bps), like it typically does as we approach Q4 earnings season in mid-January. The 2017 calendar-year consensus estimate remains pretty steady at +10.7%. Globally, earnings are up 11% from a year ago, with emerging markets in the lead at +17%, Europe at +15%, the U.S. at +9%, and developed international markets (ex-U.S.) at +14%. These numbers clearly exhibit a global earnings recovery.

On the (lack of) bears

An increasing topic of conversation has been whether or not investor sentiment has become one-sidedly bullish, and whether the stock market is in a bubble. Indeed, it’s not a stretch to call the 41% gain in the S&P 500 since the February 2016 low “one-sidedly bullish,” especially considering the historically low volatility that has accompanied it.

In fact, the rally since February 2016 has produced the second-highest Sharpe ratio3 (risk-adjusted return) since 1970 (the highest being the 1995 to 1996 period).

But has sentiment really reached bubble levels? I don’t think so. People still don’t seem to trust this market and wonder when the next shoe will drop. That’s pretty much been the story since the bull market started in March 2009 (when the S&P 500 was at 666).

The clearest case against calling investor sentiment “excessive” is to simply look at fund flows. After all, investors vote with their wallets. The fact is, since the February 2016 low, U.S. equity funds and ETFs have taken in a net total of only $11 billion,4 which is peanuts compared with the U.S. stock market’s $28 trillion market cap.

While it’s true that ETFs took in a sizable $299 billion, active funds had outflows of $287 billion. Globally, the picture shows more investor optimism, with flows into global equity funds and ETFs (including the U.S.) totaling $188 billion. But even that’s a drop in the bucket compared with a global equity market cap of $44 trillion.

One can also look at various surveys of investor sentiment. For the week ending October 11, the American Association of Individual Investors (AAII) Investor Sentiment Survey shows 39.8% bulls (its historical average is 38.3%) versus 26.9% bears.5 That’s hardly excessive. Elsewhere, the bullish sentiment for both MarketVane and Consensus, Inc., are at 71%, which show moderate optimism but nothing extreme.6 So does all this represent a frothy and overly optimistic sentiment? Is this a bubble? I highly doubt it.

What could derail this market?

Other than a sudden exogenous shock (geopolitical or otherwise), which are notoriously difficult to quantify, here are the main risks as I see them.

A hard landing in China resulting from tighter policy in response to the massive credit impulse in early 2016 could cause the global earnings picture to sour. This in turn could put pressure on equity valuations and, therefore, stock prices.

If the Fed (and other central banks) tighten interest rates more than the markets are currently pricing in, that could also put downward pressure on valuations. This would likely only happen if inflation forces the Fed’s hand, but so far core inflation remains well below the central bank’s 2% target.

But if it did happen, it could lead to a rise in the term premium,7 which since 2009 has remained well-below its normal range (currently, the term premium on the 10-year Treasury is negative). A more-normal term premium (100 to 150 bps) would mean a higher risk-free rate,8 and that would affect the valuation of all financial assets, including stocks. In my view, the below-normal term premium (suppressed by global QE) has been the transmission mechanism that’s driven the valuation of all markets higher.

What to watch/brace for

I am closely watching China as a proxy for the global earnings cycle and the Fed as the catalyst for the bond market. I think the Chinese economy is going to be okay over the intermediate term, so that really puts the Fed on my radar as an important factor for the coming months.

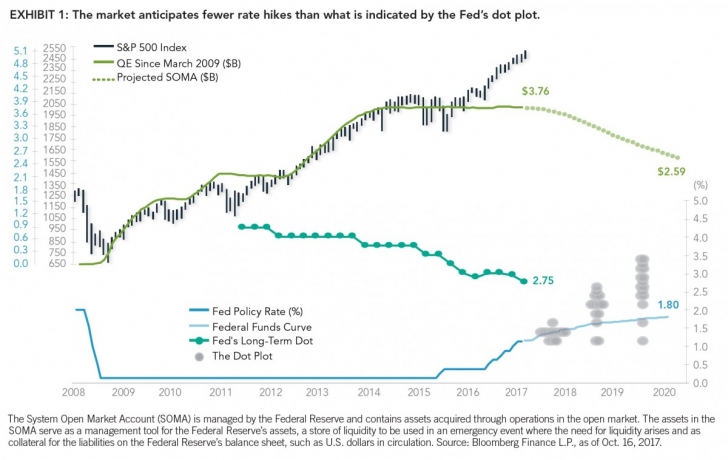

A December rate hike is now very much in the cards (markets are pricing in a 77% probability). Taken by itself, that’s no big deal. However, as I’ve highlighted in recent commentaries, there remains a disconnect between what the market is pricing in for the next two years (2.5 hikes) and what the Fed is implying via its dot plot (7 hikes).

This disconnect is illustrated in Exhibit 1. Currently, the Fed’s policy rate (the interest rate banks charge each other for overnight loans) is 1.25%. The fed funds curve, which reflects the markets’ expectation for the future direction and pace of Fed hikes, reveals a modestly higher trend. However, the Fed’s long-term dot—its longer-term federal funds forecast—is decidedly higher than what the market expects.

On top of this, the Fed is now going to be shrinking its balance sheet. While the numbers seem small at first, the expected reduction in the balance sheet over the next three years is $1.25 trillion. That would be a 25% decline in the balance sheet. For now, it’s unclear how this degree of balance sheet reduction will affect financial conditions, but chances are good that it will have some impact. For example, the elevated position of financial conditions and earnings growth is likely not sustainable as the Fed raises rates and shrinks its balance sheet.

Remember, the market has had the best of both worlds since early 2016, with earnings growth rising and financial conditions easing despite a Fed that is in tightening mode. This has been a rare gift for investors, but one that is unlikely to be repeated much longer. Fed tightening is called tightening for a reason, because usually it leads to a tightening—not an easing—of financial conditions. If financial conditions start to tighten from here, it doesn’t have to mean the end of the bull market by any means, but it would suggest a return of a more two-sided risk- return environment.

Who’ll buy stock if companies stop buying their own? The S&P 500 is up fourfold since March 2009, despite the fact that U.S. equity funds and ETFs have seen $265 billion worth of redemptions during that time frame. How is that possible? It could be because U.S. public companies have bought back $3.6 trillion worth of their own shares since the 2008 financial crisis. That’s more than 10 times the outflows from stock funds and ETFs.

This begs the question of what might happen to the stock market’s supply/demand dynamic if and when the global easing regime transitions to one of global tightening. If bond yields were to eventually reset higher as central banks stop buying government bonds, will that close the debt-for-equity arbitrage (an exchange of bonds for stock) that companies have been deploying since the global financial crisis? If this leads to fewer stock buybacks, what will happen to the supply/demand dynamics underpinning the stock market? That’s one of the big unknowns I’ll be watching closely in the months and year ahead.

As good as it’s going to get?

The trajectory of financial conditions has been and will likely continue to be of critical importance to the fate of the stock market. What’s unclear is to what extent rising interest rates and the Fed’s balance sheet reduction will cause financial conditions to tighten down the road. With both liquidity conditions and earnings growth well above their means, it seems reasonable to suspect that these two market drivers are running out of gas. If so, conditions could become less favorable than what we have seen since Q1 of 2016. In this type of environment, a diversified portfolio that’s appropriately allocated to both U.S. and international stock and bond markets could serve investors well.

Author

Jurrien Timmer l Director of Global Macro, Fidelity Global Asset Allocation Division Jurrien Timmer is the director of Global Macro for the Global Asset Allocation Division of Fidelity Investments, specializing in global macro strategy and tactical asset allocation. He joined Fidelity in 1995 as a technical research analyst. For Canadian investors

For Canadian prospects and/or Canadian institutional investors only. Offered in each province of Canada by Fidelity Investments Canada ULC in accordance with applicable securities laws. Endnotes

1 Source: FactSet, as of Oct. 16, 2017 2 Source for all earnings data in this report is Bloomberg Finance L.P., as of Oct. 16, 2017. 3 Risk-adjusted measure calculated using standard deviation and excess return to determine reward per unit of risk. The higher the Sharpe ratio, the better an investment’s historical risk-adjusted performance. 4 Source: EPFR Global weekly database, as of Oct. 13, 2017. 5 Source: AAII Investor Sentiment Survey, week ending Oct. 18, 2017. http://www.aaii.com/p/sentimentsurvey 6 Source: Barron’s, Investor Sentiment Readings, as of Oct. 16, 2017. http://www.barrons.com/public/page/9_0210-investorsentimentreadings.html 7 The amount by which the yield-to-maturity of a long-term bond exceeds that of a short-term bond. 8 The theoretical rate of return of an investment with no risk of financial loss.

Unless otherwise disclosed to you, any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity, is intended to be educational and is not tailored to the investment needs of any specific individual. Fidelity and its representatives have a financial interest in any investment alternatives or transactions described in this document. Fidelity receives compensation from Fidelity funds and products, certain third-party funds and products, and certain investment services. The compensation that is received, either directly or indirectly, by Fidelity may vary based on such funds, products and services, which can create a conflict of interest for Fidelity and its representatives. Fiduciaries are solely responsible for exercising independent judgment in evaluating any transaction(s) and are assumed to be capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies.

Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market and other conditions. Unless otherwise noted, the opinions provided are those of the author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk.

Nothing in this content should be considered to be legal or tax advice and you are encouraged to consult your own lawyer, accountant, or other advisor before making any financial decision.

Stock markets, especially non-U.S. markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets

Investing involves risk, including risk of loss. Past performance is no guarantee of future results. Diversification and asset allocation do not ensure a profit or guarantee against loss.

All indices are unmanaged. You cannot invest directly in an index.

Index definitions

Standard & Poor’s 500 (S&P 500®) Index is a market capitalization-weighted index of 500 common stocks chosen for market size, liquidity, and industry group representation to represent U.S. equity performance. S&P 500 is a registered service mark of The McGraw-Hill Companies, Inc., and has been licensed for use by Fidelity Distributors Corporation and its affiliates.

Third-party marks are the property of their respective owners; all other marks are the property of Fidelity Investments Canada ULC.

If receiving this piece through your relationship with Fidelity Institutional Asset Management® (FIAM), this publication may be provided by Fidelity Investments Institutional Services Company, Inc., Fidelity Institutional Asset Management Trust Company, or FIAM LLC, depending on your relationship.

If receiving this piece through your relationship with Fidelity Personal & Workplace Investing (PWI) or Fidelity Family Office Services (FFOS), this publication is provided through Fidelity Brokerage Services LLC, Members NYSE, SIPC.

If receiving this piece through your relationship with Fidelity Clearing and Custody SolutionsSM or Fidelity Capital Markets, this publication is for institutional investor or investment professional use only. Clearing, custody or other brokerage services are provided through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

© 2017 Fidelity Investments Canada ULC. All rights reserved. U.S.: 813965.1.0 CAN: 822134.1.0