by Craig Basinger, Chris Kerlow, Derek Benedet, Shane Obata, Connected Wealth, RichardsonGMP

Many investors agree, it is best to be a contrarian when it comes to making money. Betting against the herd is often a more profitable endeavour than simply following the crowd. The reasoning is pretty straight forward, if everyone likes or dislikes something that is probably already baked into the price of the asset. But being a contrarian is also often lonely. And when it comes to investing, in a world filled with uncertainty, many choose to stick with the crowd or consensus instead of taking that lonelier contrarian road.

Pretend you were considering an investment in one of two companies. For the sake of this exercise, they are pretty much identical: similar quality management teams, similar valuations, operate in the same industry, etc. The biggest difference is one company has eight buys while the other has two buys, five holds and a sell. Which would you choose?

If you were a contrarian, you may be equally or more interested in the 2nd company. But most would choose the one with all buy ratings. This reduces the risk of regret, a powerful behavioural bias. If the share price declines and you followed the herd into the company with all buy ratings, you can justify your decision with “well everyone said to buy”. However, if you purchased the 2nd company and the share price declined, well you own that since the analysts clearly didn’t like that one. Regret avoidance is a strong emotion.

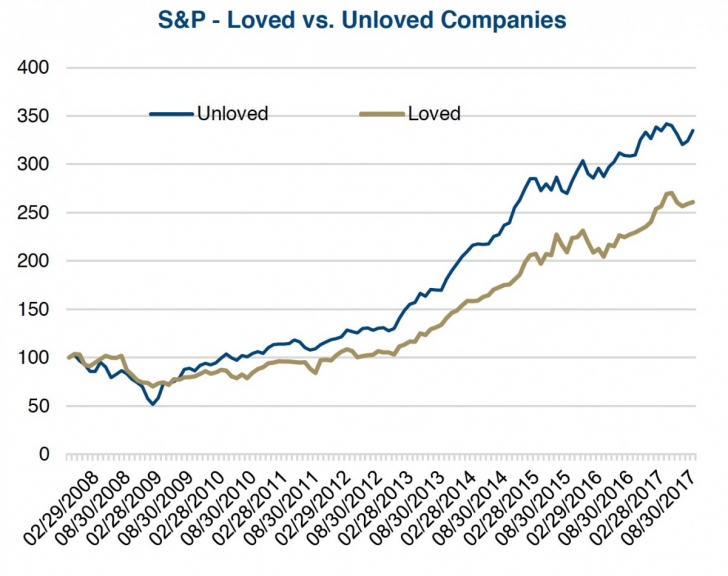

The tricky part is, it is more often the companies with fewer buy ratings that tend to perform better. We tracked the performance of all S&P 100 member companies over the past ten years, broken down by performance into quintiles. Quintiles represent the top 20%, next 20%, next 20%, etc. so the universe is ranked based on your criteria. In this case, percentage of buy recommendations. This captures a full market cycle back to 2007. The annualized return for the quintile of companies with the least number of buy recommendations (unloved) was +8.2% compared to the quintile with the most buy recommendations at +5.6%.

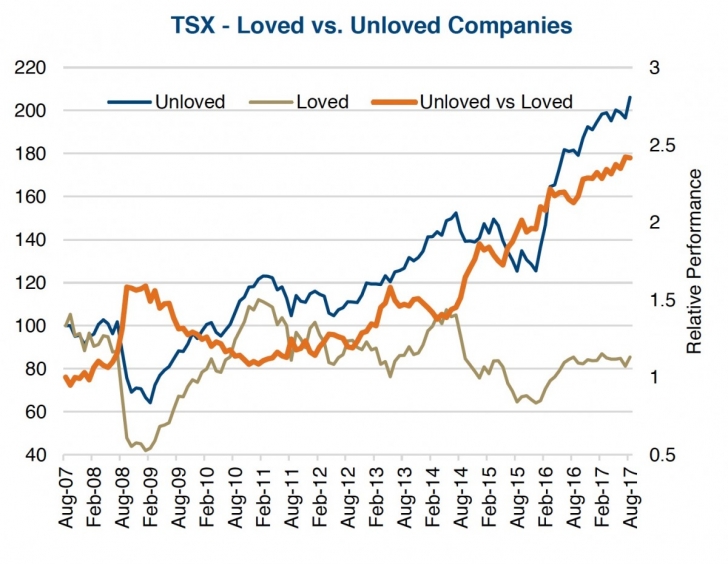

This trend was even more evident in Canada. Among TSX member companies, those in the top quintile with the most buy ratings actually declined over the past ten years. The least loved quintile enjoyed an annualized return of 3.4% compared to -3.8% for the most loved. Over ten years that really added up (chart 2).

While these are impressive variances in performance that would support not blindly piling into the companies with the most buy ratings, it is far from a hard and fast rule. Looking at each month’s performance the unloved only outperformed the loved quintile just under 60% of the time. Or in other words, 40% of months saw the companies with the most buy recommendations actually outperforming. As a result we have been researching tweaks to this research that would have a more reliable batting average or success rate.

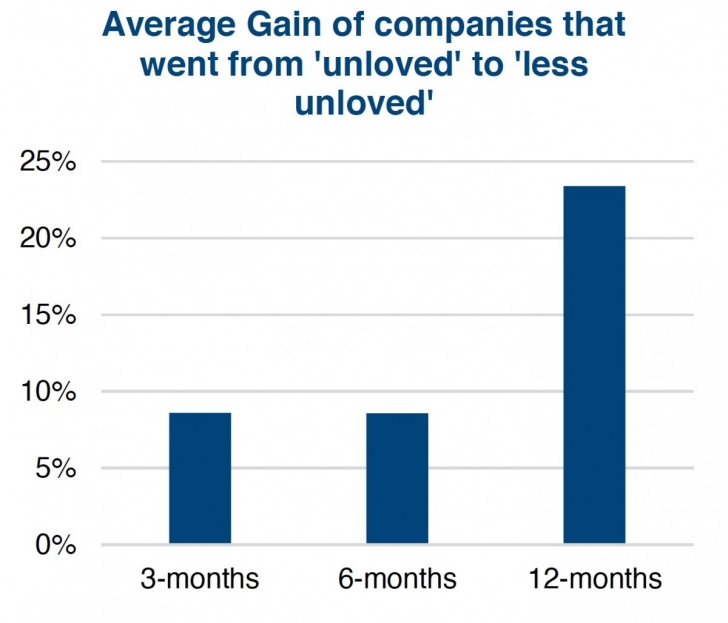

Instead of simply bucketing the companies into quintiles based on their percentage of buy recommendations, we looked for companies that were unloved but started to become less unloved. These are companies that had fewer than 30% of total analyst ratings giving them a buy for at least three months. We call this an unloved company and measured the subsequent performance once the percentage of buys rose over 30% as our signal.

The belief is being unloved for a period of time causes a company to be neglected or passed over by investors, thus depressing the share price. But when the buy recommendations begin to rise, the company is gradually becoming more popular in investor’s eyes, causing the share price to move higher.

This increased the batting average to almost 70% success and also showed very strong average returns. Chart 3 includes the average performance of companies that 1) spent at least three months with fewer than 30% buy ratings and 2) received an upgrade to move the percentage of buy ratings above 30%. The analysis period was over the past decade and the universe was the S&P 500.

Investment Implications

It may be useful to look for companies that have been unloved by analysts for an extended period of time that start to see upgrades. Perhaps these first upgrades are the more forward looking analysts that see a turnaround. Or perhaps a simple reversion to the mean bodes well for the share price after being hated for so long. Either way, it does seem profitable to look at unloved companies once in a while.

Note to Readers

Behavioural Finance combines behavioural and cognitive psychology theory with conventional economics and finance. Essentially it attempts to account or add the “human” element into understanding how the markets behave. While still a relative new area, it has garnered a rising amount of attention. The most common aspects of this discipline are behavioural biases, such as loss aversion, framing, overconfidence, anchoring, recency bias, overreaction, etc. Many publications are devoted to helping investors understanding these biases to avoid their negative impact on performance. We will be starting an investor speaker series later this fall devoted to helping investors better manage their inherent biases, with the goal to make our clients better investors. Stay tuned.

At Connected Wealth we are also taking this one step further. The team is currently researching not only the various biases in the real world but working on investment strategies that take advantage of these biases. In the coming months, we will be publishing on various aspects of this work, and we welcome any feedback.

*****

Charts are sourced to Bloomberg unless otherwise noted. This material is provided for general information and is not to be construed as an offer or solicitation for the sale or purchase of securities mentioned herein. Past performance may not be repeated. Every effort has been made to compile this material from reliable sources however no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please seek individual financial advice based on your personal circumstances. However, neither the author nor Richardson GMP Limited makes any representation or warranty, expressed or implied, in respect thereof, or takes any responsibility for any errors or omissions which may be contained herein or accepts any liability whatsoever for any loss arising from any use or reliance on this report or its contents. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P. Both used under license by Richardson GMP Limited.

Copyright © Connected Wealth, RichardsonGMP