by Douglas J. Peebles, CIO, AB Fixed Income, AllianceBernstein

After a relatively quiet third quarter, bond markets are ripe for some volatility and bigger waves as major central banks begin to unwind quantitative easing. For global bond investors, that could lead to new opportunities. But for now, with valuations in many sectors stretched, it pays to be selective.

Fixed-income markets were remarkably tranquil in the last quarter. The global economic backdrop was bright, with major developed and emerging markets—including China—growing at a decent clip. At the same time, inflation was moderate. The combination provided a friendly atmosphere for most bond prices.

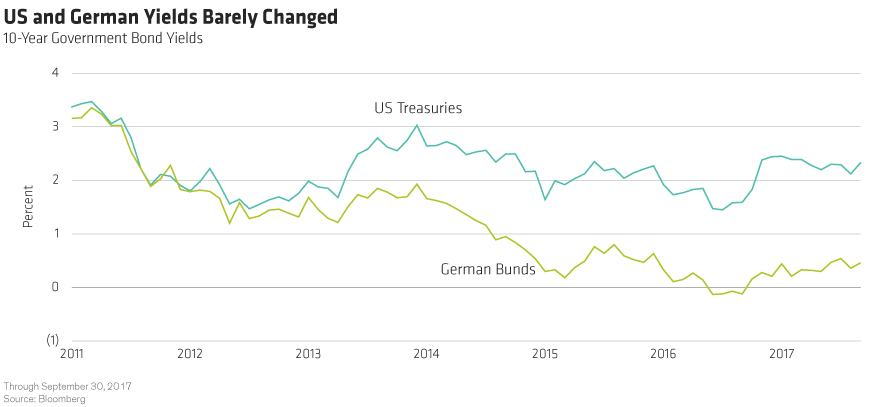

Benchmark government bond yields finished the quarter about where they started it. The 10-year US Treasury yield stood at 2.33%, compared to 2.30% at the end of June, while the 10-year German Bund yield was virtually unchanged at 0.46% (Display).

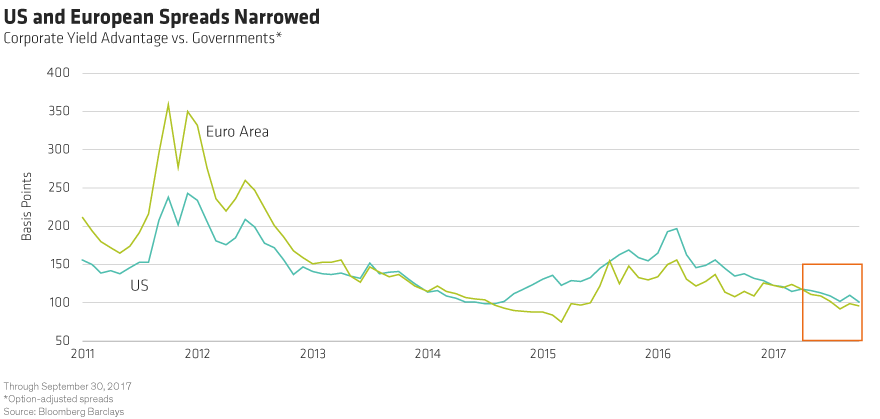

Credit spreads in the US and Europe tightened, keeping spreads near multiyear lows (Display), and most credit sectors outperformed developed-market (DM) government bonds.

Unwinding of QE Could Unleash Volatility

Investors should be prepared, however, for more volatility in the months ahead. Major central banks say they want to normalize monetary policy, which suggests higher interest rates and the eventual end of nearly a decade of quantitative easing.

As widely expected, the US Federal Reserve said in September that it would begin the multiyear process of reducing its $4.2 trillion portfolio of US Treasury and mortgage-backed bonds. But it also confirmed that another interest-rate hike is likely in December.

The Bank of Canada caught investors off guard in September when it raised rates for the second time during the quarter, and hawkish speeches by several Bank of England policymakers have traders pricing in nearly 50 basis points of tightening in the UK over the next year.

The European Central Bank and Bank of Japan are still fully engaged in quantitative easing. But with euro-area growth improving, we expect the ECB to further taper its monthly bond purchases and wrap them up for good by the end of 2018.

However, we expect the reduction of monetary accommodation to play out gradually, as central banks move at different speeds. That variance should create dispersion in rate markets, which in turn means more opportunity for global investors.

Riding the Waves in the Post-QE Market

With corporate bond valuations stretched, the US corporate credit cycle in its late stages, and central banks normalizing monetary policy, bond investors are understandably concerned about where to commit their assets today. But by diversifying across multiple sources of income and being very selective, it’s possible to ride out any waves of volatility without taking on undue risk. Here’s how:

High-income strategies can diversify their interest-rate and economic risk by taking a global, multi-sector approach that includes sectors ranging from US securitized assets to European banks to local-currency emerging-market (EM) debt.

Emerging markets in general remain attractive. Most EM countries stand to gain from improving economic fundamentals, stable or falling inflation, and high real yields relative to DM debt. We see outsized opportunities in some attractively valued local currency–denominated EM bonds from countries that are cleaning up their public finances and bringing inflation under control.

US high yield is in the later stages of the credit cycle. That means investors should be choosy about what they buy. But they shouldn’t avoid this market altogether. High-yield bonds are less sensitive to interest rates than other bonds are. And their steady income can enhance total portfolio returns even as rates rise. European financials and Latin American industrials, meanwhile, boast attractive valuations and are in the repair or recovery stages of the cycle.

What not to do? Don’t replace your high-income strategy with a portfolio of leveraged bank loans in the hopes that bank loans will protect you against rising rates. Bank loans have failed to meet those expectations.

A barbell strategy—for investors who want to maintain a lower risk profile—mixes interest-rate risk and credit risk as valuations and conditions change, continually adjusting the balance as needed.

Even as rates rise, this approach would involve US Treasuries and other government bonds, which provide important diversification to credit exposure in all environments.

Over the medium term, more than 90% of US Treasury returns come from the yield. That means that rising rates can dramatically boost income for investors who are not primarily focused on short-term price fluctuations.

Be Prepared for Any Kind of Surf

Investors welcome strategies that can extract alpha in markets that are volatile and markets that are calm. So even if big waves don’t hit the bond market anytime soon, dynamic, multi-sector approaches to bond investing generally benefit from maximizing opportunity.

No matter the surf forecast.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein