by Ryan Detrick, LPL Research

Japan’s stock market is reaching new highs, marking another positive development in the overall global bull market. Japan is one the largest components of the MSCI ACWI (All Country World Index), which covers more than 14,000 securities in 23 developed markets and 24 emerging markets countries. As noted last week, improvement in Europe is also adding to this more positive market environment.

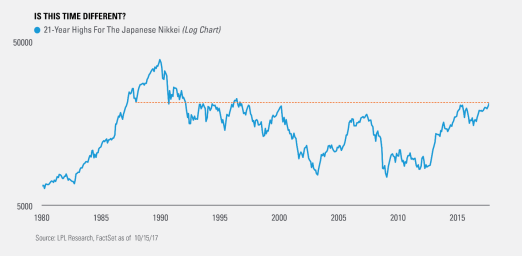

The Japanese Nikkei broke out to fresh 21-year highs recently, along the way closing higher 10 consecutive days. As the chart below shows, this is the highest the Nikkei has traded since late 1996. However, it has reached this range a couple of times within the past two decades, before turning back lower.

There are some major positives developing in Japan. Per Ryan Detrick, Senior Market Strategist, “Japan has been dead money for decades, but there are some silver linings indicating that things could be turning around. Six consecutive quarters of GDP [gross domestic product] growth for the first time since 2005, strong earnings, low unemployment, finally some wage growth, and PE [price-to-earnings] multiples cheaper than the U.S. are all pluses. And a 21-year high is still a 21-year high—that is always a positive sign.”

Prime Minister Shinzo Abe has been in office for 5 years now and it might be premature to say that his policies are finally working—as another economic slowdown could be around the corner. However, the fact that he’s expected to be re-elected on October 22 is reassuring to markets, as it could mean more of the same loose monetary policy for Japan. Remember, the U.S. is officially unwinding its balance sheet by $10 billion each month and Europe will likely announce tapering later this month; Japan has shown no signs of ending its loose monetary policy.

Of course, uncertainties about North Korea remain an obvious concern when it comes to Japan. But remember that worries and concerns tend to lower the overall expectations, which could mean that any good news produces strong results. For instance, the recent Barron’s Big Money poll of more than 140 money managers across the country showed that only 6% expect Japan to be the top performing market the next 12 months, the lowest out of the five choices (emerging markets, Europe, U.S., China, and Japan).

Japan is an interesting looking market for 2018. The bottom line is that seeing the third largest economy in the world hit 21-year equity highs is another sign that this global bull market is gaining traction—and we may see more worldwide gains in 2018.

*****

IMPORTANT DISCLOSURES

The economic forecasts set forth in the presentation may not develop as predicted.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Stock investing involves risk including loss of principal.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, political risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

The MSCI All Country World Index is an unmanaged, free-float-adjusted, market capitalization-weighted index composed of stocks of companies located in countries throughout the world. It is designed to measure equity market performance in global developed and emerging markets. The index includes reinvestment of dividends, net of foreign withholding taxes.

The Nikkei 225 Stock Average is a price-weighted index comprised of the top 225 blue-chip companies on the Tokyo Stock Exchange.

All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly.

This research material has been prepared by LPL Financial LLC.

To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial LLC is not an affiliate of and makes no representation with respect to such entity.

Not FDIC/NCUA Insured | Not Bank/Credit Union Guaranteed | May Lose Value | Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit

Securities and Advisory services offered through LPL Financial LLC, a Registered Investment Advisor

Member FINRA/SIPC

Tracking # 1-655985 (Exp. 10/18)

Copyright © LPL Research