by Russ Koesterich, Chief Investment Strategist, Blackrock Investments

Value stocks have started to show signs of life. Russ discusses why energy and financial stocks are currently the best ways to play the theme.

Value stocks are not surging, but they have at least begun to stir. Since the August lows, U.S. large cap value stocks have gained around 5.50%, in line with the overall market and a bit ahead of growth stocks.

Back at the end of August, I suggested that value was unfairly being left for dead, despite the fact that the style was looking cheap, perhaps cheaper than at any time since 2000. What value lacked was a catalyst, something that has recently emerged in the form of firmer data and resurrected tax cut talk. To the extent this continues, the next question is how to play the theme. Within the U.S. market, energy and financial stocks stand out.

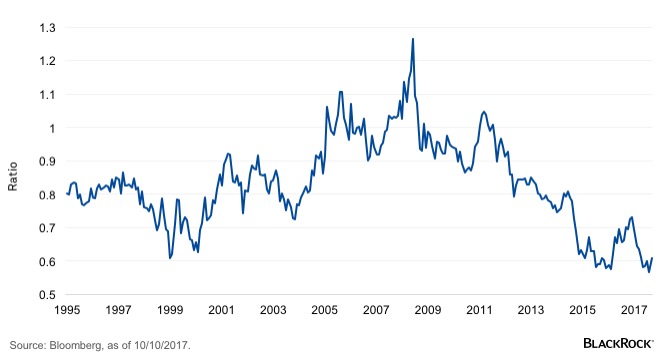

On an absolute basis, financials, energy and utility stocks appear the cheapest based on the price-to-book (P/B) ratio. However, utilities, thanks to a steady stream of bond market refugees searching for yield, are not particularly cheap compared to their history. This leaves energy and financials. Energy in particular appears inexpensive relative to the broader market. Since 1995 the S&P 500 energy sector has traded at approximately a 17% discount to the broader market. Today that discount is nearly 40%. See the chart below.

S&P Energy Sector P/B vs. S&P 500

The preponderance of value in these sectors is also evident in their respective weighting within value indexes. Banks and insurance companies make up around 26% of the S&P 500 Value Index, double their weighting in the S&P 500 Index. Similarly, the weighting of oil and gas in value indexes is approximately double the weight in the broader market.

What to watch: Crude oil and long-term rates

While both energy and financials are likely to continue to benefit from a rebound in value, each has its own idiosyncratic drivers. Not surprisingly, for financials, particularly banks, it is interest rates; and energy companies, the price of oil.

Starting with banks, as you might expect, banks benefit when long-term rates rise and the yield curve steepens. During the past two years, weekly changes in 10-year Treasury yields explained approximately 40% of the weekly moves in the Bank Index.

Energy has a similar story. Since late 2015, weekly changes in crude oil have accounted for more than 50% of the variation in weekly returns. This helps explain why these sectors have performed so well of late: Both interest rates and crude oil have risen sharply in recent weeks.

The takeaway is value still appears cheap. Should economic growth remain firm and investors stay enticed by the possibility of tax cuts, value is likely to continue to perform well. In the U.S., energy and financials appear the best way to play the theme, but with the caveat that each is as much driven by their respective fundamentals as style preferences. The good news is that for now, what is good for value—firmer growth—is also good for rates and oil prices.

Russ Koesterich, CFA, is Portfolio Manager forBlackRock’s Global Allocation team and is a regular contributor toThe Blog.

Copyright © Blackrock Investments