The US Economy Is Stronger—What Does It Mean for Interest Rates? - Context

by Fixed Income AllianceBernstein

US economic activity is picking up, and as a result, we’ve raised our growth forecasts for 2017 and 2018. What’s behind the good news—and how will it impact interest rates?

Hurricane Rebuilding and Easy Financial Conditions

Heading into the last quarter of 2017, two key factors seem poised to boost US economic growth in the quarters ahead.

First, the country will begin to recover and rebuild from this year’s devastating hurricanes in Texas, Florida and Puerto Rico. While the impact of the storms is likely to hold back third-quarter growth, the boost from rebuilding in the fourth quarter and early 2018 should more than make up the difference.

The second growth driver should last longer: financial conditions have been persistently easier than we’d expected. The US Federal Reserve has hiked short-term interest rates three times since last December, but markets and the economy have shrugged it off. Ten-year Treasury bond yields have dropped by 20 basis points, credit spreads are generally lower, the US dollar is about 8% weaker and the equity market has surged to record highs.

Our GDP Forecast Gets a Modest Boost

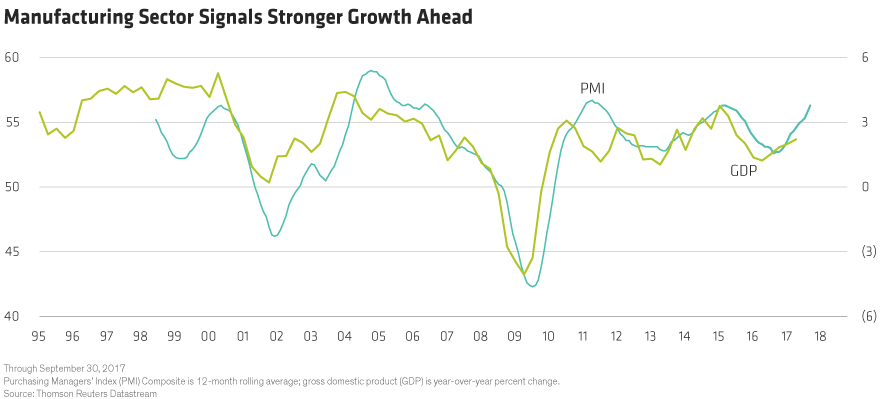

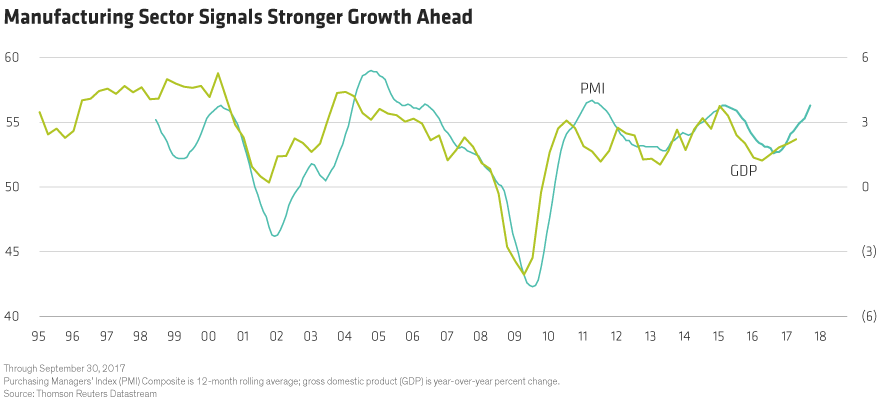

We can see the result of all those influences in the economy’s recent performance. And forward-looking indicators—such as the Purchasing Managers’ Index, a gauge of manufacturing strength (Display)—suggest that growth is above potential. We expect this to continue as long as financial conditions remain accommodative.

Our updated forecasts call for a few quarters of above-trend growth followed by a gradual slowing to trend-like growth in the second half of 2018 as less-accommodative monetary policy begins to catch up to the economy. This should keep things from overheating.

By the numbers, we’ve bumped up our full-year 2017 GDP forecast to 2.25% and our 2018 forecast to 2.0% (Display). At the same time, inflation seems subdued—we expect it to be slightly below 2.0% this year and slightly above that in 2018, in line with our last forecast.

Tighter Conditions…and Higher Rates…Ahead

Even though inflation is still tepid, our growth outlook is positive, so we still expect the Fed to hike rates in December and twice more in the first half of 2018. The market had been skeptical about a December rate hike, but has recently shifted to be more consistent with our view.

We don’t think these hikes depend on who’s at the helm of the Fed; any of the leading candidates for Fed Chair is likely to follow roughly the same path for the next few quarters in terms of both official interest rates and balance-sheet reduction.

We expect rate hikes to tighten financial conditions, mainly through higher US Treasury yields. Based on our revised GDP forecasts and the Fed’s balance-sheet reduction, we’ve bumped up our forecast for the 10-year Treasury yield by half a percent—to 3.25% by the end of 2018.

No Guessing on Fiscal Policy Changes

We aren’t incorporating significant changes to fiscal policy in our forecasts right now; there’s a lot of uncertainty about what tax changes, if any, will happen in the coming months. If a fiscal stimulus package does develop, we’ll reassess our forecasts; in the meantime, it seems more sensible to wait and see what takes place in Washington, DC, instead of guessing.

Forecasting is always an inexact science, so we view these updated estimates as just that…estimates. It’s the underlying story that’s more important than the numbers, and the story is positive. The economy is humming, and we expect this trend to continue even as policymakers lean against the wind to prevent overheating.

That combination is likely to lead to higher interest rates than we’d previously projected, but not in a way that’s any more broadly disruptive to financial markets or the overall economy.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein