by Michael Batnick, The Irrelevant Investor

Every time I read something like this, it makes me want to trade again. It’s like how watching a Rocky training montage makes you want run straight to the nearest gym. But all it takes is one position in gold and a couple of pushups before I realize that I’m not Paul Tudor Jones or Sylvester Stallone. While there’s nothing wrong with a little inspiration, these things are of little use in the real world.

Paul Tudor Jones is one of the most successful traders of all-time, but I highly doubt he got to where he is by following this advice. He launched his hedge fund in 1980, and since then, the S&P 500 has experienced 737 new highs (171 in the recent bull market that started in 2013). Of those 737 new highs, only three of them were major tops. So the data emphatically suggests that new highs are often the best time to buy, not to sell. But even if you do buy stocks at a major market top, it doesn’t have to end in agony if you’ve got a long time horizon and a balanced portfolio that doesn’t leave you with more risk than you can stomach.

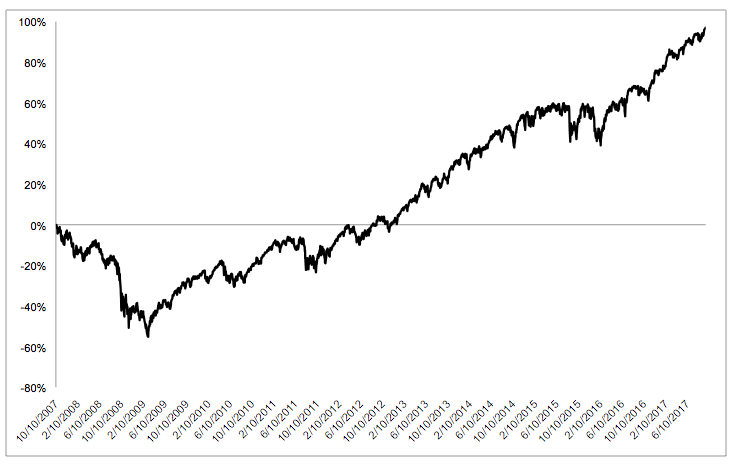

It’s been almost ten years since the market topped in 2007, prior to crashing nearly 58%. If you bought the S&P 500 on the exact day that the market topped and held on for dear life, ten years later, you would have doubled your money, earning just over 7% a year.

Warren Buffett has been investing for nearly eight decades and has seen thousands of new highs and several market tops. One of the biggest drivers of Buffett’s success, aside from his early stock picking prowess and later ability to allocate capital, is the fact that he never sold into the teeth of a bear market. He always expected the future to look better than the past, and this is a view that he still clings to.

This week Buffett said he expects the Dow will hit one million in 100 years. It would need to gain 4,374% to get there, which sounds ridiculous, until you realize that would require less than 4% a year to get there. In the 76 years since Buffett bought his first stock in 1941, the Dow has increased over 20,000%, or 6.4% year. The future doesn’t have to be as good as the past for the Dow to hit seven digits.

The Dow will eventually hit one million, whether it takes 50, 100 or 200 years to get there is anyone’s guess. How many bear markets and market crashes we’ll experience along the way is also impossible to foresee. The future path towards progress is always unchartered, but the important thing to remind yourself is this: beating the market over one’s lifetime is something that few accomplish, and I suspect that will hold true in the future, whether stocks compound at 3% or 7% for the rest of our lives. Sure it would be great if we could just sell at the top and buy back in at the bottom, but I’m not a billionaire and you’re not Rocky Balboa.

Copyright © The Irrelevant Investor