by Burt White, Chief Investment Officer, LPL Financial

KEY TAKEAWAYS

- Long-term technical indicators on equities continue to look strong.

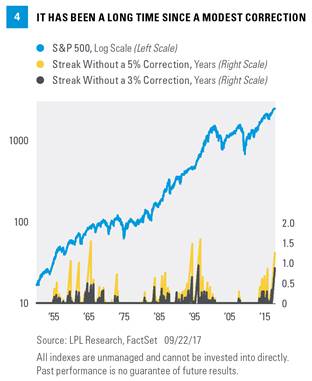

- This is currently the second longest streak without a 3% correction for the S&P 500, suggesting volatility could come at any time.

- Overall market sentiment continues to suggest that equity prices aren’t near a major peak.

The steady bull market—now the second largest—continues. The Dow just had its third nine-day win streak of 2017, which hasn’t happened within a single year since 1955. Can the rally continue? While longer-term technicals do look very healthy, a closer look suggests that it has been a historically long time since even a modest correction, thus increasing the chances of a rise in volatility soon.

THE SECOND LARGEST BULL MARKET HAS LEGS

On Monday, September 11, the bull market officially became the second largest since World War II (WWII), with a gain of nearly 270% for the S&P 500 Index, besting the 267% gain from June 1949 to August 1956 [Figure 1]. At this point, only the 417% gain during the 1990s is larger.

As explained in our recent Weekly Economic Commentary “Recession Watch Update” it is important to remember that economic expansions don’t die of old age, they die of excesses. From leverage, to confidence, to spending, we simply aren’t seeing the same type of excesses we’ve seen at other market peaks. Yes, this bull market might be old, but we continue to think that the odds of a recession starting in the next 12–18 months are low, and given that the worst sell-offs usually take place during recessions, there’s a good chance that this bull market has plenty of fuel left in the tank.

One other thing to remember is the S&P 500 has climbed for five consecutive months (ending August 2017). Going back to 1950,* the S&P 500 is higher a year after a five-month win streak 23 out of 24 times with an average gain of 13.2%, further supporting our belief that the bull market is still strong.

*Please note: The modern design of the S&P 500 stock index was first launched in 1957. Performance back to 1950 incorporates the performance of predecessor index, the S&P 90.

LONG-TERM TECHNICALS SUPPORT HIGHER PRICES

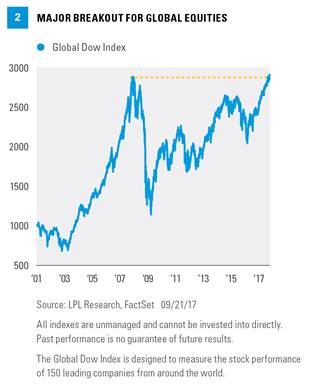

Our methodology at LPL Research focuses on three key tenants: fundamentals, valuations, and technicals. Out of the three, technicals have been the most bullish since the February 2016 lows and we see few signs of this changing as the global bull market continues to support higher prices. In fact, in October 2016, and February, April, and June of this year, we noted that technicals supported higher equity prices.

As Figure 2 shows, the Global Dow Index recently made a new all-time high, finally breaking above the peak from 2007. This index contains 150 components from around the globe, with 24 total countries included. For years the United States was one of the few places that outperformed, but now we are seeing various emerging and developed countries also making new all-time or 52-week highs. The Brazilian BOVESPA, for instance, which dropped 9% one day back in May on news of a presidential scandal, is already back to new highs. No matter what has been thrown at equities (and we all know the long list of worries), the global bull has remained healthy.

IS BREADTH REALLY THAT BAD?

One of the big arguments that we continue to hear from bears is that the market isn’t healthy, as only a few large names are holding things together. But when looking beneath the surface, this doesn’t appear to be the case. One of our favorite technical indicators is the New York Stock Exchange (NYSE) Advance/Decline (A/D) line, which is part of LPL Research’s Five Forecasters. Simply put, this indicator is showing more stocks advancing than declining, which is a sign of a healthy market.

Market breadth is a technical analysis technique that attempts to determine the direction of the overall market by analyzing the proportion of securities that are participating in the market move.

Figure 3 shows that the NYSE A/D line recently made a new all-time high. This indicator began to break down in the late 1990s, ahead of the tech bubble and ahead of the 2007 peak and financial crisis. The fact that this indicator is at new highs is another positive for bulls on a longer-term basis. Over the past week, we’ve seen new all-time highs from these A/D lines: Dow, S&P 500, S&P Small Caps, S&P Mid Caps, NYSE, NYSE common stock only, and the S&P 100. In other words, market participation is quite strong.

INVESTOR SENTIMENT

History has shown that the crowd can be right during trends, but it also tends to be wrong at extremes. This is why sentiment can be an important contrarian indicator and why we pay close attention to it.

Remember, bull markets peak with euphoria — which means everyone has bought and there is nothing left to do but sell. These sentiment indicators suggest that we aren’t anywhere close to seeing euphoria.

- Per Bloomberg, the ratio of bearish derivatives on the S&P 500 relative to bullish derivatives has climbed to its highest level in more than two years.

- A recent Gallup poll showed that the percentage of U.S. adults invested in the stock market is near a 20-year low.

- A survey of global fund managers by Bank of America/Merrill Lynch found that managers are underweight U.S. equities by the most in 10 years.

- The number of bulls in the American Association of Individual Investor (AAII) Investor Sentiment Survey has averaged only 33.3% this year. This would rank near one of the lowest levels of bulls ever.

- Investment Company Institute (ICI) data showed more than $31 billion in outflows from domestic equity mutual funds and exchange-traded funds in July and August, the largest two months of outflows since January and February 2016.

A PULLBACK COULD HAPPEN AT ANYTIME

Although technicals support higher prices, there is a catch. We could have a pullback at any time — mainly because we haven’t had one in so long. Although stocks have largely sailed right through a seasonally weak period the past few months, October is historically known as the most volatile month and we wouldn’t be surprised to see a bit of that volatility soon.

As seen in Figure 4, the most logical reason to expect a dip is that we’ve gone more than 10 months without a 3% correction, the second longest streak in the history of the S&P 500. Meanwhile, it has been 15 months since the last 5% dip, courtesy of the Brexit vote. Only three times in history was there a longer streak without a 5% correction. Historically, stocks don’t go up in a straight line, so we suggest that investors be prepared for the potential of some overdue volatility at any time.

CONCLUSION

Broad participation with so many global markets and indexes performing well is a clue that the bull market is alive and well. We are encouraged by these technical trends that demonstrate continued strength in the global bull market. At the same time, a pullback appears overdue and could happen at any given time. We continue to expect volatility to pick up in the fourth quarter, but based on our current assessment of the macroeconomic environment, we would consider using it as an opportunity to add to equity positions.

*****

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Global Dow Index is designed to measure the stock performance of 150 leading companies from around the world. In addition, stocks in The Global Dow™ are classified by country, enabling the generation of a variety of regional and country level sub-indexes.

Copyright © LPL Financial