by Kate Moore, Chief Equity Strategist, Blackrock

Sentiment toward technology stocks is oscillating between optimism and skepticism. We dig into tech sector opportunities—and obstacles.

Technology has been the best-performing sector globally this year, accounting for roughly half of U.S. and emerging market (EM) Asia equity returns so far. Yet investors are torn between optimism on this fast-growing, high-earning sector and skepticism given its meteoric rise and memories of the dot-com bust. Our bias is to the former. We see opportunity in firms that are able to monetize their technology amid structural shifts, as we write in our Global equity outlook Tech for the long run.

Investors have tended to overestimate the near-term effects of technology and underestimate the long-term potential. But we see disruption and transformation across the technology universe creating attractive long-term investment opportunities for both growth and income seekers.

Technological disruption has only just begun: Digital has yet to permeate many industries; e-commerce represents under 10% of all retail sales; traditional devices are becoming connected via the Internet of Things (IoT); and artificial intelligence (AI) is starting to transform processes.

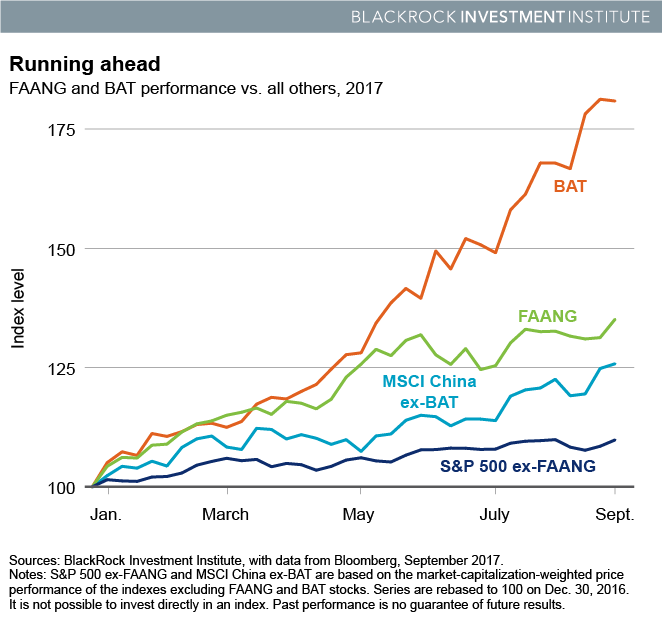

The many intricacies of tech may be outshone by high-flying headline makers: the U.S. FAANG stocks (Facebook, Apple, Amazon, Netflix and Google’s parent Alphabet) and their powerhouse equivalents in China —BAT (Baidu, Alibaba and Tencent). Both groups have propelled their regional stock markets higher year-to-date. FAANG returned 35% compared to 10% for the remainder of the S&P 500, while BAT returned 81% versus 26% for the remainder of the MSCI China Index. See the Running Ahead chart below.

But healthy corporate earnings and upbeat forecasts have been the drivers of technology performance, in our view, not “irrational exuberance.” The sector’s exceptional performance has coincided with outsized earnings growth. Earnings on EM Asia tech stocks have been revised up 45% year-to-date. BAT revisions have been particularly strong, while multiple expansion for Asian tech has been close to zero. The increase in global tech valuations has surpassed the broad market, but we see the move as largely warranted. Our base case: Technology broadly, including players outside the sector label, appear to have legs—even after a strong run.

Many companies beyond the popular acronyms hold appeal for diversified portfolios. Equities have become a critical income source in traditional 60% stock/40% bond portfolios, our analysis shows. Tech can play a lead role: The sector is home to many high-quality mega-cap stocks that offer healthy and growing dividends. Many more companies outside the tech sector label are leveraging data and analytics to evolve their business models. We believe the winners of the race to embrace new technology will be those companies that are least complacent today.

Semiconductors in particular are a story worth a read, we believe. We view them as both the backbone and the future of the tech industry. The once highly cyclical group is benefiting from a more diverse demand base, reduced supply after years of consolidation, and new applications in a data-driven world. But the industry may face real competition from China, which has named semis as a strategic priority.

We do see two would-be obstacles for technology stocks in general. We are worried about profit-taking in the short term, as nervous investors look to lock in gains and redeploy their capital in other opportunities. In the longer run, potential regulation is a concern, as the sector’s size and influence draw the attention of policymakers. Yet strong fundamentals make this sector a long-term buy, in our view. Read more in our full Global equity outlook Tech for the long run.

Kate Moore is BlackRock’s chief equity strategist, and a member of the BlackRock Investment Institute. She is a regular contributor to The Blog.

Investing involves risks, including possible loss of principal. There is no guarantee that stocks or stock funds will continue to pay dividends. Investments that concentrate in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of September 2017 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader.

©2017 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States or elsewhere. All other marks are the property of their respective owners.

Copyright © Blackrock