by Jeffrey Saut, Chief Investment Strategist, Raymond James

The past eight weeks have been a blur. We have been in Vancouver, Victoria, Alaska, Boston, South Africa (Zulu Nyala, Cape Town, Umhlanga, Stellenbosch, Franschhoek, Jeffreys Bay, Durban, Wilderness, etc.), Boston (again), and New York City. Reflecting on the months of travel as we wing our way back to Tampa at 38,000 feet, one of the more interesting encounters in those travels was spending time with Steve Forbes (Forbes Magazine). Although Steve is a staunch Republican, he suggested that Republicans worship at the altar of the CBO (Congressional Budget Office). Scoffing, he stated it is ridiculous for ANY government agency to attempt to predict what is going to happen over the next 10 years. Continuing, Steve theorized the Republicans believed that repealing Obamacare would raise enough money to give them more room for tax cuts. However, they lost the public relations battle because the CBO wrongly predicted 22 million people would be thrown off of the health care rolls with such a repeal. He said the CBO starts with the false premise 15 million folks would not pay for healthcare if there was not a mandate and that 5 million would be shoved off of Medicaid. A few more of his random thoughts included: the White House had no clear message in the healthcare debate, there are no real free markets in healthcare, under the current system it does not create an environment to foster medical breakthroughs, and he proposed the following:

1) Have flexibility on Medicaid.

2) There should be a nationwide shopping system for healthcare.

3) Level the playing field on taxes for healthcare.

4) There should be transparency on pricing by hospitals.

5) Have flexibility on healthcare insurance.

To point number four Steve mentioned that in comparing pricing for the same test at various hospitals showed the price varied from $1,400 to $7,300!

Moving on to taxes, he noted the White House, having botched the healthcare debate, will now move on to taxes, but will they really get tax reform? His answer was YES, but first you have to ignore the CBO guidance. Yet the window for big tax reform has passed because too much time was wasted on the healthcare “thing.” What should be done is to cut corporate tax rates, accelerate depreciation, and immediately give taxpayers a “double exemption” (puts an extra $1,400 into their pockets), cut individual tax rates, and make all of that retroactive.

Finally the conversation turned toward “regulations.” Steve averred that unnecessary regulations cost the economy $2 trillion a year and there are 15 bills currently in the House of Representatives to reduce said regulations. Moreover, we should scale back the EPA, FDA, and FAA. In conclusion he opined that regulations would not have prevented the 2008 debacle and the subsequently imposed regulations have prevented the banks from lending somewhere between $1.5 trillion and $2 trillion dollars that typically would have been lent.

We enjoyed spending a few days with Steve Forbes and hope to so again in the not too distant future.

We had another interesting meeting while in Boston with Arvind Navaratnam, portfolio manager of the Fidelity Advisor Event Driven Opportunity Fund (FMRMX/$13.76). We began by asking Arvind why there was a picture of a Boeing B-17 Flying Fortress in his presentation. He replied, “Because that airplane prompted the first “check list” for an aircraft. I like this story as scribed in Wikipedia:

All of us know the famed B-17 used during WWII, which helped to win the war. You probably didn’t know, however, that the B-17 was the first aircraft to get a checklist! This came about when, on the first B-17 flight, three men were seriously injured, and a few days later died, when the aircraft stalled shortly after takeoff. After further investigation, it was found that the Captain had left the elevator lock on, and the aircraft was unresponsive to pitch control. . . . During a major think-tank session, it was determined that the pilots needed a checklist. It wasn’t a knock to the pilots, or that the aircraft was too hard to fly, rather the aircraft was just too complex for a one pilot’s memory.

According to Arvind, “In our business a ‘plane crash’ is a permanent loss of capital,” so Arvind uses a “check list” for each stock in his fund to make certain it meets all his requirements. The fund’s model is reflected in the name “event driven.” Event driven investing attempts to take advantage of corporate actions (index deletions, bankruptcy, corporate spinoffs, 13D filings, mergers, management changes, dividend reductions, etc.) that can result in a mispricing of a company’s stock or other underlying security. These situations can result in forced selling pressure, limited research coverage, and market inefficiencies that can lead to a greater probability of a security being mispriced. As always terms and details should be studied before purchase of the fund.

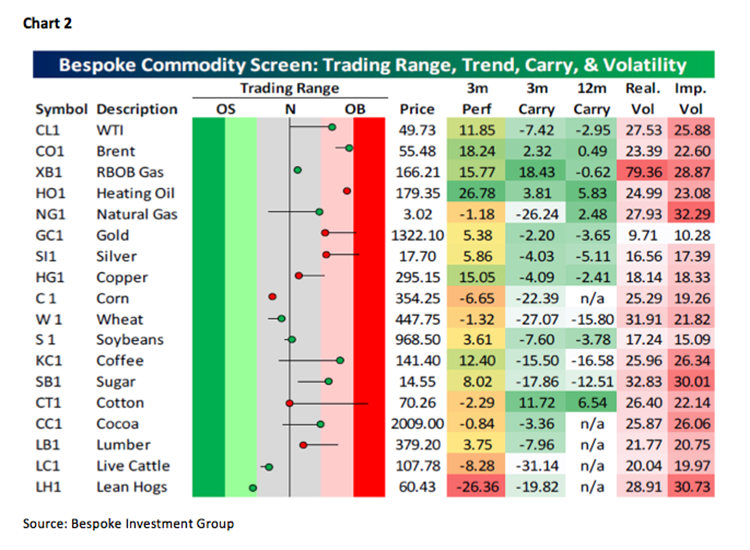

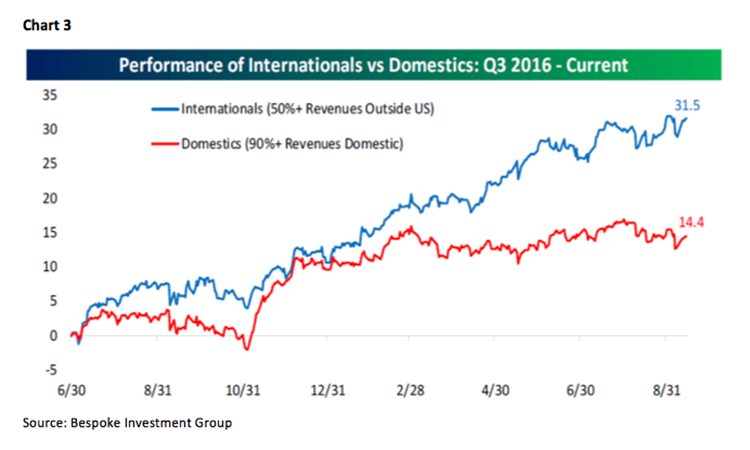

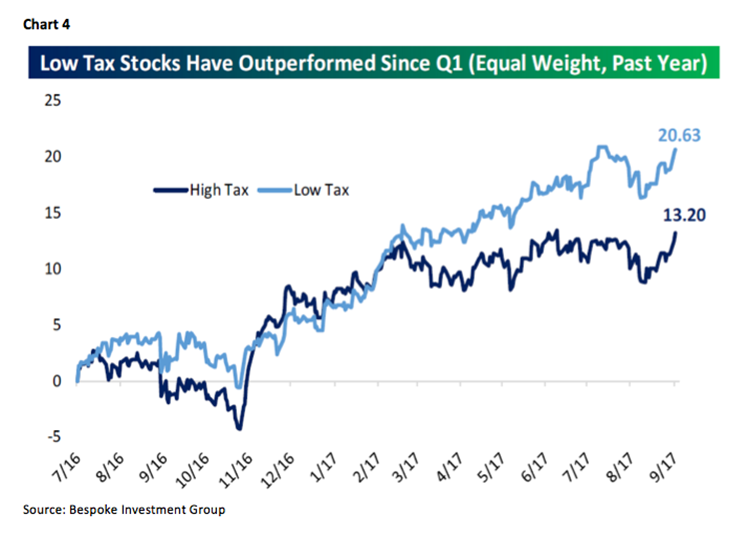

Moving on to the stock market, despite the S&P 500’s (SPX/2500.23) move to new all-time highs last week, our models continue to show that there just is not much “upside energy” right here, implying the “buy the North Korea dips” may not work this time. In fact, most of the indices we monitor have moved from neutral, or oversold, into an overbought condition on a short-term basis. That said, one of our overriding themes of the year has been a weaker U.S. dollar. We have been bearish of the “buck” for the last few years, rightly at times and wrongly at others. Still, after a post presidential election rally of 6.5% the Bloomberg U.S. Dollar Index has declined by some 10.5% (chart 1 on page 3). The dollar’s weakness has benefited many commodities (chart 2) and we have recommended tilting portfolios accordingly. If the dollar remains “soft” it should continue to benefit companies with international exposure/revenues (chart 3 on page 4). Another theme we have spoken of since DJT was elected is overweighting companies that have a high tax rate on the premise they will benefit from corporate tax reform (chart 4). Some names from the Raymond James research universe with such metrics (they all have an effective tax rate greater than 35%), are favorably rated by our fundamental analysts, and screen well on our models, for your potential “buy list” include: UnitedHealth (UNH/$198.18/Strong Buy); Dollar General (DG/$77.60/Strong Buy); CSRA (CSRA/$31.98/Outperform); Masco (MAS/$37.31/Outperform); Comcast (CMCSA/$36.93/Strong Buy); and CVS Health (CVS/$83.17/Outperform).

The call for this week: Back in June the three major indices traded out to new all-time highs, and we noted that every time those indices simultaneously trade to new all-time highs the SPX had an average 3.8% gain within the next three months nearly 100% of the time. Well, it is nearly three months later and the SPX is better by some 3.6%. Regrettably, we have underplayed that 3.6% rally because our models went into cautionary mode at the beginning of August. Most recently, our stock market internal energy model telegraphed there just is not a whole lot of upside energy available right here. Then too, the momentum indicator theorizes the odds of a trend reversal are high on a short-term basis, the breadth indicator is neutral (no trend reversal), and the sentiment indicator is flashing extreme complacency (high degree for a trend reversal). The catalyst for a potential near-term trend reversal could be the president’s address at the U.N. this week, where Ambassador Nikki Haley recently stated, “We’ve been kicking the can down the road, and we’re out of road!” All of this as Kim Jong-un bellows that North Korea is close to its goal of “equilibrium” in military force with the U.S.; and he might just try to demonstrate that coincident with the president’s U.N. address. This morning the preopening S&P 500 futures are up by about 4 points as investors believe the Federal Reserve will announce the trimming of its balance sheet and no North Korea provocations over the weekend.

Additional information is available on request. This document may not be reprinted without permission.

Raymond James & Associates may make a market in stocks mentioned in this report and may have managed/co-managed a public/follow-on offering of these shares or otherwise provided investment banking services to companies mentioned in this report in the past three years.

RJ&A or its officers, employees, or affiliates may 1) currently own shares, options, rights or warrants and/or 2) execute transactions in the securities mentioned in this report that may or may not be consistent with this report’s conclusions.

The opinions offered by Mr. Saut should be considered a part of your overall decision-making process. For more information about this report – to discuss how this outlook may affect your personal situation and/or to learn how this insight may be incorporated into your investment strategy – please contact your Raymond James Financial Advisor.

All expressions of opinion reflect the judgment of the Equity Research Department of Raymond James & Associates at this time and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. Other Raymond James departments may have information that is not available to the Equity Research Department about companies mentioned. We may, from time to time, have a position in the securities mentioned and may execute transactions that may not be consistent with this presentation’s conclusions. We may perform investment banking or other services for, or solicit investment banking business from, any company mentioned. Investments mentioned are subject to availability and market conditions. All yields represent past performance and may not be indicative of future results. Raymond James & Associates, Raymond James Financial Services and Raymond James Ltd. are wholly-owned subsidiaries of Raymond James Financial.

International securities involve additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets.

Investors should consider the investment objectives, risks, and charges and expenses of mutual funds carefully before investing. The prospectus contains this and other information about mutual funds. The prospectus is available from your financial advisor and should be read carefully before investing.

Copyright © Raymond James