The elephant in the room… see the big picture

By Doug Drabik, Fixed Income, Raymond James

We are always looking for answers. Answers provide us with the proof or the explanation to justify our actions. Having the answer is like having the solution to the puzzle that shapes the steps we take from the start to the finish. We usually know what we want in the end. The game is typically discovering the path to or the best way to get there. Understanding the process and the means may provide the best answers on how to get the end game.

Fully understanding what is going on in the economy certainly would give investors a better road map on how to get to the end game or for many investors, the accumulated wealth necessary to retire in a fitting life style; however, understanding the the economy is anything but an easy task. The variables that effect the markets are numerous and rarely pushing or pulling in the same direction. There may be no singular event or cause at any point in time that represents the finite answer on what action to take.

The point is, investors need to focus on the big picture and not get caught up daily headlines or singular events that create sudden or temporary movements in the market. It is human nature to react or attempt to outmaneuver the markets, but in the long run, staying the course will likely outdo knee-jerk reactions.

Eye-catching headlines may be concealing the elephant in the room. Central bank activity is the elephant, the big picture, the kingpin driving the market. Despite claims that earnings or lack of inflation or whatever choice data point is chosen to explain the market’s move, it cannot be ignored that the market is being cash-driven. Let’s put this in perspective.

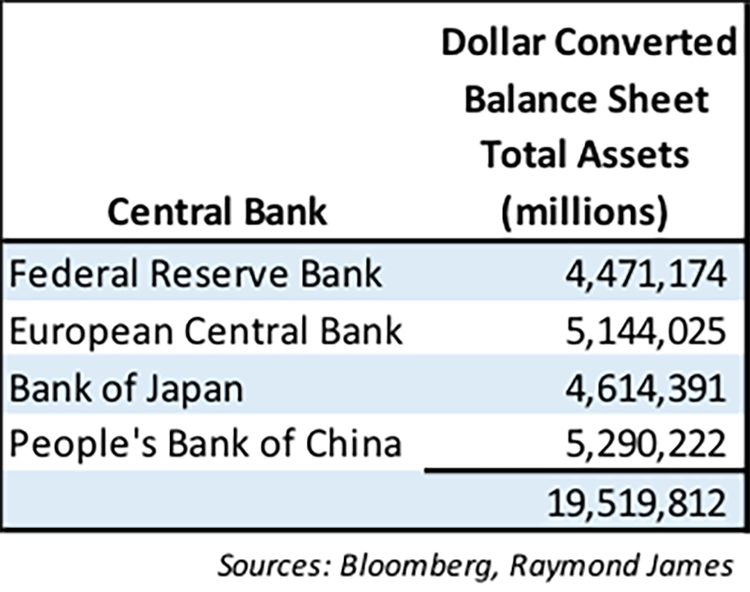

The Federal Reserve’s balance sheet was between $840 and $870 billion prior to the beginning of the financial crisis in 2007. According to Bloomberg data, it now is $4.47 trillion. Four of the major central banks have combined balance sheets now larger than the gross domestic product of the United States. The size and the impact cannot be ignored.

Central banks purchase bonds in the open market. This puts cash into the banking system. The purchase is made by crediting the member bank’s ledger (cash is created out of thin air). This lowers interest rates as more money is available to businesses and people to borrow. Despite a few Fed hikes, which by themselves haven’t pushed domestic policy to a state of tightening, the global policy remains one of easing. Big picture: rates will remain low as long as this continues or until it pushes consumption and investment to grow global economies with healthy employment and eventual price increases or inflation. Since this still is not happening, we can expect interest rates to remain low until something changes.

Big picture: many investors have pushed more of their money beyond their dedicated limits into growth assets such as equities in order to compensate for the low interest rate environment. Fixed income assets with some duration may offer the best protection and balance as they are negatively-correlated with equities. In other words, if a market correction were to wipe out some of the gains associated with a heavily growth weighted portfolio, bonds may provide the balance in holding up the overall value.

In addition, a simple yet effective laddered bond strategy may provide additional income and mitigate interest rate risk during this low rate environment by supplying constant reinvestment going forward.

Keep the big picture in focus and practice appropriate asset allocation. Keep your eye on the elephant in the room: central banks continue to pump money into the markets. Until this stops or consumption and investment increase, don’t expect interest rates to reverse course.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James