by Frank Holmes, CIO, CEO, U.S. Global Investors

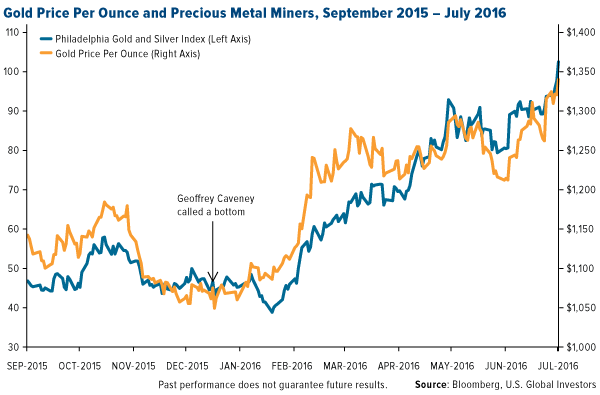

The best call financial writer Geoffrey Caveney ever made was in December 2015. Gold hit a multiyear low of $1,050 an ounce, and he was convinced that the metal had found a bottom. It was time to make a trade, he thought, not just in bullion but precious metal miners, specifically the juniors and some micro-cap names.

Readers who took Geoffrey’s recommendation were no doubt grateful they did. Responding to low to negative interest rates around the world, gold rose as much as 16.5 percent in the first quarter of 2016, its best three-month performance since 1986. By the end of June, it had surged 28 percent, its best first half of the year since 1974. Producers, as measured by the Philadelphia Gold and Silver Index, likewise took off.

Geoffrey’s track record is nothing to sneeze at. In July 2016 he advised readers to take profits on Alexco Resource, which was up an amazing 430 percent for the six-month period. A trade on Fortuna Silver Mines a month earlier netted him a 445 percent profit. He has a number of similar successes under his belt.

“I’m in the habit of thinking for myself,” he told me recently during a chat over the phone.

To make such a contrarian call on gold—or any other asset—you have to think for yourself. If you remember, gold in 2015 hadn’t logged a positive year in three years, and investor sentiment toward the precious metal was down. Every gold conference I spoke at, attendance was unusually light. When an asset gets this beat up, it’s often easy just to fall in with the herd.

But as Warren Buffett himself once said, “The time to get interested is when no one else is.”

Stay in Control of the Decision-Making Process

Thinking for himself has served Geoffrey well in a number of other ways—most notably when he got laid off during the financial crisis. Instead of wasting time looking for work that wasn’t available, he decided to try his luck at freelance tutoring. Combining his interests from when he attended Yale University in the 1990s, he began to teach young people chess, English, math and SAT prep.

His best advice to those about to take the SAT? Focus on the process rather than the goal, and keep your emotions in check. Take deep breaths, in through the nose and out through the mouth.

As Geoffrey himself pointed out, this is sound investing advice as well. Greed and fear can be powerful allies, but it’s important to learn to harness them and stay in control of the decision-making process. This isn’t New Age, hippie-dippie stuff. Ray Dalio, founder of Bridgewater, the world’s largest hedge fund, has often attributed his extraordinary success to meditating, which he says keeps him calm and centered.

“If you don’t reset yourself mentally on occasion, you run the risk of making the same mistakes over and over again,” Geoffrey said.

Life Changes, and So Should Your Strategy

Aside from tutoring, Geoffrey grew his interest in investing, where he put his background in math and chess to good use. In his youth he took chess lessons from the distinguished Uzbek grand master Gregory Serper, and he learned to apply this highly strategic mode of thinking to his trades. As his instincts improved, he started writing about investing and finance on sites such as Seeking Alpha, focusing on gold, precious metal miners, emerging markets, tech, cryptocurrencies and other themes. He watched his readership grow.

“Gold always gets lots of attention as well as bitcoin or any cryptocurrency,” he said. “I see tremendous value in China, but I find that those articles get much less attention.”

As someone who also writes about gold and China, I can attest to the accuracy of his observation.

As for gold, Geoffrey believes you “don’t have to be a gold bug to invest 5 or 10 percent,” which is in alignment with what I’ve been saying for years. Gold, I believe, is for all seasons and economic climates—5 percent in bullion, 5 percent in quality gold stocks, mutual funds and ETFs. Rebalance every year.

A New Market Newsletter

Right now Geoffrey is focused on the next trade and increasing his readership. In June he launched a newsletter, the Stock & Gold Market Report, which can be found on Seeking Alpha. In it he shares his latest buy and sell recommendations, and he also offers a handy service on how to build a well-balanced portfolio from the ground up.

After reading his valuable insights and speaking one-on-one with him, I feel confident recommending a subscription to the Stock & Gold Market Report. I wish Geoffrey all the best in this new endeavor and look forward to hearing from him again!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Philadelphia Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 6/30/2017.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors