by Lance Roberts, Clarity Financial

With the markets closed yesterday, there is little to update from this past weekend’s newsletter. However, in case you missed it, here was the crux of the analysis:

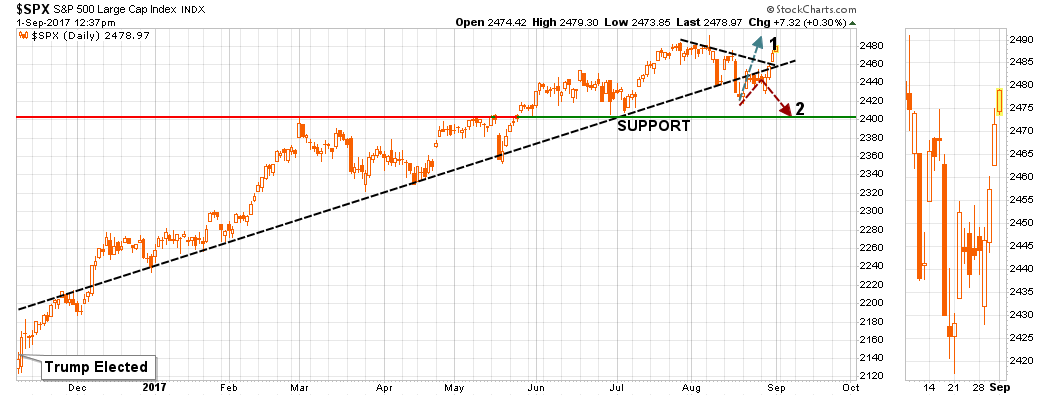

“While it looked like “scenario 2” was going to play out early last week, that was reversed as the markets started to bet on the optics of a stimulus fueled boost to the economy.“

“Regardless, the market broke back above its 50-dma and cleared the recent downtrend to re-confirm the bullish bias. Furthermore, the reversal of the short-term ‘sell signal’ also provides a tailwind for investors currently which suggests that markets should be able to reach all-time highs before the next corrective action begins.”

“Importantly, the bullish trend remains intact thereby keeping portfolios allocated toward equity risk. This “return to normalcy” is occurring within the context of a very short-term view. With valuations extended, economic data weak and exuberance elevated, this is not a time to ignore the rising longer-term risks to overly aggressive portfolio allocations.”

It is that last point I want to address today.

Seen This Before

I have been managing money in some shape, form or fashion for the last 30-years. During that time I have witnessed the rise and fall of one investing cycle after another with each being touted as “different” for one reason or another. However, they have all ultimately had three-things in common:

- A belief the market had become a “can’t lose” proposition;

- A rise in a speculative investment believed to be the next “new thing;”

- Valuations based on a trailing, reported earnings, at levels that have denoted dismal forward returns.

The rush into “robo-advisors,” stock trading apps and a surge in online trading accounts define point one. As Charles Schwab stated recently:

“Clients opened more than 100,000 new brokerage accounts per month during the quarter, putting total new accounts at 362,000, the highest quarterly total in 17 years excluding acquisitions. New retail brokerage accounts grew 44% to 235,000 during the March-ended quarter for a total of 7.2 million accounts.”

Hmmm…17-years ago was this statement from C.S. First Boston in 1999:

“Trading volumes surged as much as 50 percent in January, after a 34 percent rise to a record 340,000 trades a day in the fourth quarter.”

Point two is much easier to see in the following chart of the explosion in cryptocurrencies:

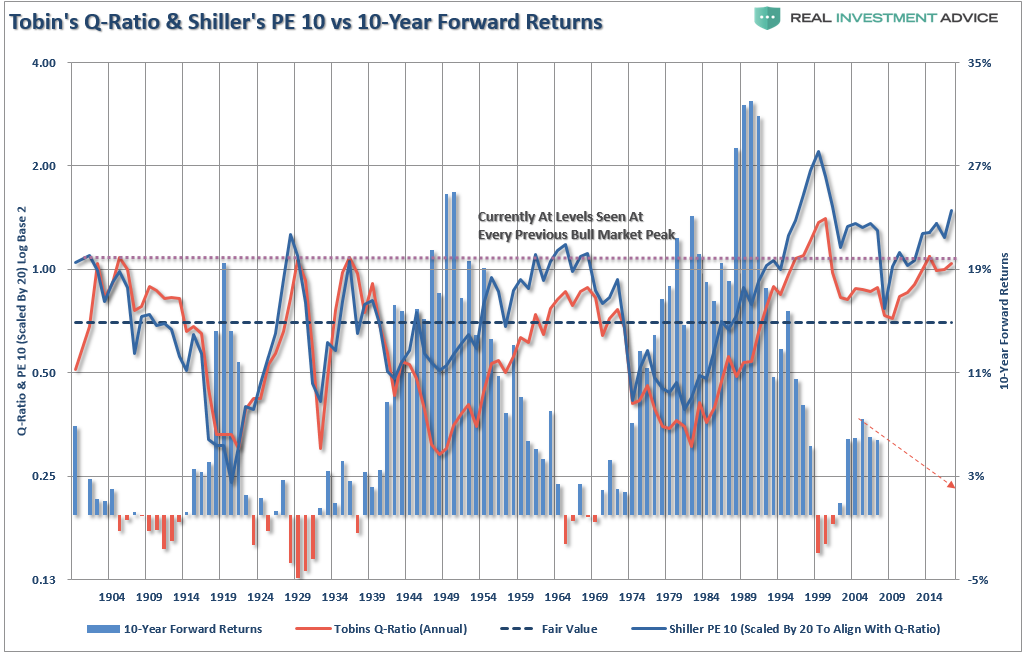

When it comes to valuations, I have written numerous discussions on the problems with forward returns from high valuations. (Read this) However, we can sum it up with the following chart:

So, with those three points fulfilled investors should probably heed Nassim Taleb’s recent warnings:

“‘We have more permanent threats: a stock market fueled by almost a decade of easy money.”

With Central banks around the world having pumped trillions of dollars of liquidity into the financial markets, which has found its way into creating the third asset bubble this century, he notes his concern.

“This is the tail risk — and is independent of the newspaper threat du jour. All investors now have and should hedge this exposure — much like a driver should own car insurance especially if they plan to drive on a road they know is particularly dangerous.”

But yet, with the markets are near all-time highs, the fear is of “missing out.” That emotion is certainly understandable given the markets complete dismal of threats over nuclear war, political intrigue, and civil unrest with every “dip” being an opportunity to buy.

The Difference Between “What” & “When”

As a portfolio manager, and as I have discussed in these missives previously, we are fundamental value investors.

Why is that important?

Fundamental value, based on trailing reported earnings, determines “WHAT” we buy. However, the key to successful long term investing, and particularly when navigating overvalued, momentum driven, bull market cycles, as the one we are in now, is having set of tools to determine not only the “WHEN” to buy, but also, the “WHEN” to sell or “WHEN” to just stay away.

For the sake of simplicity, we will focus today only the S&P 500, but this same analysis holds true for any position, asset class or market.

Individual investors do most of the damage to themselves by allowing emotions to override logical investing. There have been many articles written about the rules of investing in the financial markets and the basics of them all center around 5 important concepts:

- Sell losing positions quickly

- Let winners continue to win – until they don’t.

- Never take on more risk than you can afford to lose.

- Always protect your capital investment by minimizing losses.

- Buy low and sell high.

Yet it is exactly these basic rules that investors continue to ignore and violate which ultimately leads to more catastrophic outcomes.

There is one major tenant that must always be honored if you are going to survive and prosper in investing over the long term – always protect your principal investment.

This does NOT mean you will never lose money when you are investing – you will. If you are not willing to take losses in your portfolio – then you should probably not be investing to start with. The unwillingness to take losses has led to more money being transferred out of individuals portfolios than at the point of a gun. Losing money is part of the game…limiting how much you lose is what separates winners from losers over the long-term.

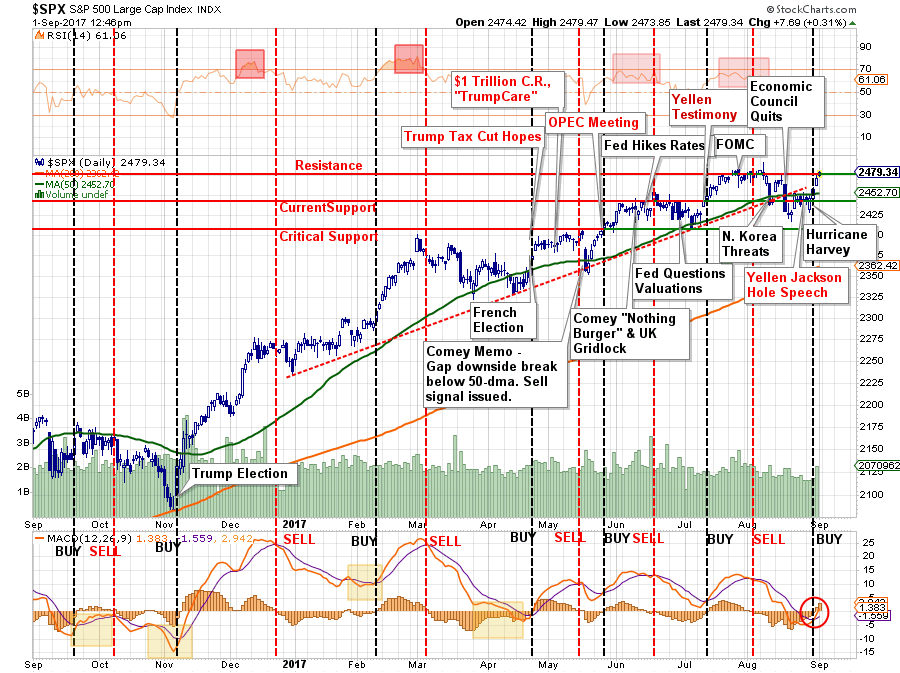

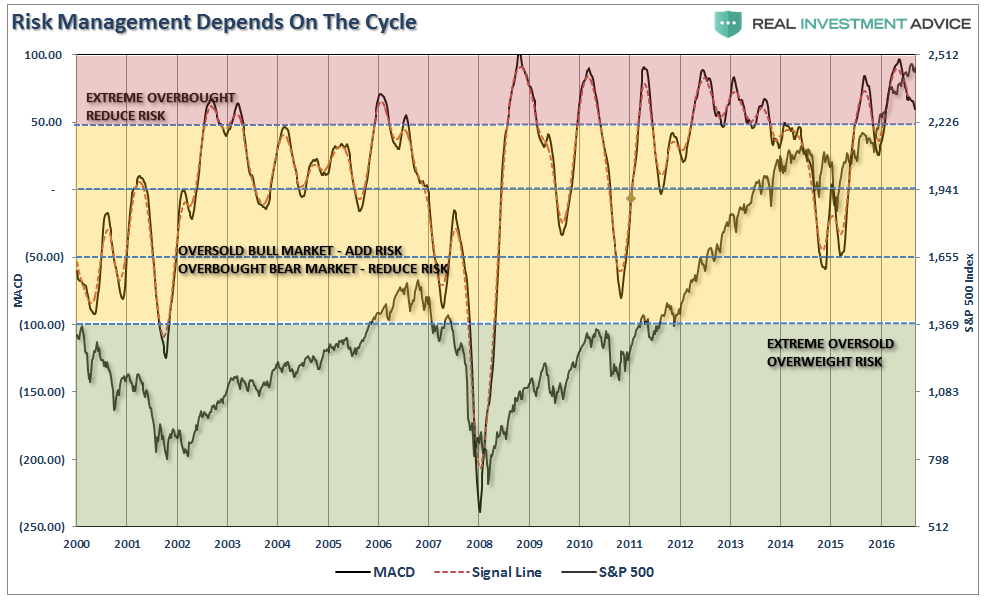

There are two important factors in determining the “WHEN” to invest.

- Is the market currently in a “bull” or “bear” cycle. (Are price trends generally rising or falling?)

- Are prices “overbought” or “oversold” relative to the cycle?

These definitions are important relative to overall positioning and fall back to one of the primary tenants of investing over the long-term.

- In a “bull cycle” – portfolios can either be “long” or “neutral.”

- In a “bear cycle” – portfolios can either be “neutral” or “short.”

When markets are extremely overbought, as they are now, it has generally been advantageous to reduce risk. such extremes have historically only occurred within the context of an advancing bull market cycle. Furthermore, such extreme overbought conditions have typically preceded short to intermediate-term corrections.

Conversely, extreme “oversold” conditions have been present during more defined “bear markets,” and have provided the opportunity to become aggressively overweight as it relates to equity risk within portfolios.

Here is the important point.

Value will NOT matter when the cycle changes from “bull” to “bear.”

During the intermediate to latter stages of a “bear market,” positions will be liquidated without discretion throughout the market. Those that cling to the idea they will be able to hold out during the decline will eventually succumb to the “pain of loss.”

Importantly, as the effect of “margin calls” forces liquidation, price declines accelerate expanding losses which forces more selling through additional margin calls. This cycle perpetuates itself until exhaustion.

Riding The Bull

At the current moment, the markets are clearly within the confines of a “bullish trend” and there is nothing currently warning of an immediate change either.

But there never has been.

Historically, market topping processes, and the change from a bullish trending market to a bearishly trending one, have occurred quietly. No one recognized the change initially. Excuses were made for why “this time would be different” from “it’s a soft landing scenario,” to “subprime is contained,” to “it’s a Goldilocks economy.”

The current market cycle is extremely overbought, exuberant and over valued, but that doesn’t mean it can’t get even more so in the near term. It does suggest that the “risk” of loss of investment capital at the current time is outweighed by the potential for return.

This is why we use several different indicators, both long term and short term, to try and better determine the “WHEN” to invest.

It doesn’t always work.

However, here is a little-known secret – nothing does.

This is also one of the biggest mistakes that individuals make when investing. They buy into one strategy that is working (usually last year’s big winners) and then jump from that strategy to the next previously winning strategy when their returns suffer. This is the epitome of what drives investors to “Buy High and Sell Low”.

A disciplined investing strategy is one that requires, you guessed it, discipline. Being disciplined means that sometimes, even when a strategy is currently out of favor, you have to stay with it (this is provided it is a sound investment strategy to begin with.)

At the current time, we are still maintaining our equity exposure because the markets are still confined to the long-term bullish trend. We do so with risk controls and hedges in place.

But this bullish trend will inevitably change.

They always do.

As I questioned yesterday,

“So, what’s your plan for the second-half of the full market cycle?”

Copyright © Clarity Financial