by Lance Roberts, Clarity Financial

“The following is an excerpt from this past weekend’s newsletter. I have several follow up articles coming over the next few weeks that will reference Byron Wien’s comments.”

The Rule Of 20

Byron Wien recently asked the question of where we are in terms of the economy and the market to a group of high-end investors. To wit:

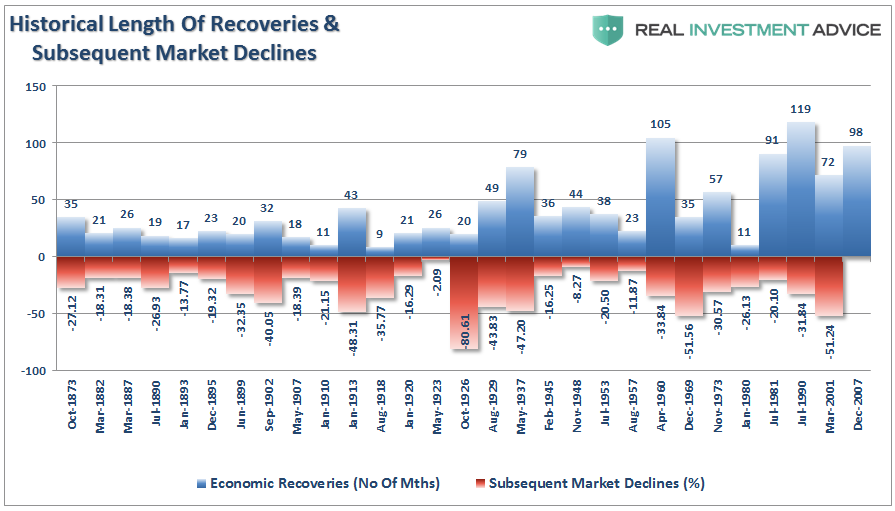

“The one issue that dominated the discussion at all four of the lunches was whether or not we were in the late stages of the business cycle as well as the bull market. This recovery began in June 2009 and the bull market began in March of that year. So we are more than 100 months into the period of equity appreciation and close to that in terms of economic expansion.“

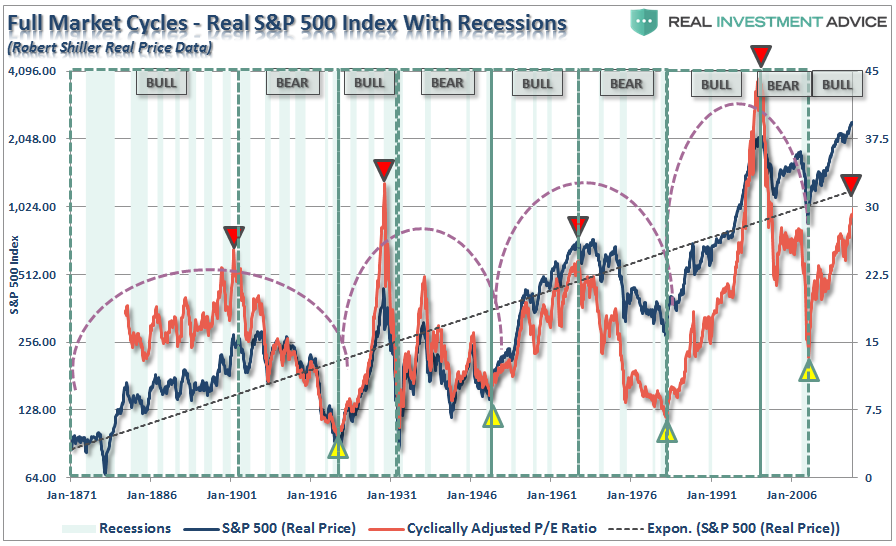

Importantly, it is not just the length of the market and economic expansion that is important to consider. As I explained just recently, the “full market cycle” will complete itself in due time to the detriment of those who fail to heed history, valuations, and psychology.

“There are two halves of every market cycle. “

“In the end, it does not matter IF you are ‘bullish’ or ‘bearish.’ The reality is that both ‘bulls’ and ‘bears’ are owned by the ‘broken clock’ syndrome during the full-market cycle. However, what is grossly important in achieving long-term investment success is not necessarily being ‘right’ during the first half of the cycle, but by not being ‘wrong’ during the second half.

Will valuations currently pushing the 3rd highest level in history, it is only a function of time before the second-half of the full-market cycle ensues.

That is not a prediction of a crash.

It is just a fact.”

As Wien states, Howard Marks, via Oaktree Capital Management, and arguably one of the most insightful thinkers on Wall Street recently penned a piece discussing the risk to investors. I suggest you read the whole piece, but here is the relevant passage:

“Today’s financial market conditions are easily summed up: There’s a global glut of liquidity, minimal interest in traditional investments, little apparent concern about risk, and skimpy prospective returns everywhere. Thus, as the price for accessing returns that are potentially adequate (but lower than those promised in the past), investors are readily accepting significant risk in the form of heightened leverage, untested derivatives and weak deal structures. The current cycle isn’t unusual in its form, only its extent. There’s little mystery about the ultimate outcome, in my opinion, but at this point in the cycle it’s the optimists who look best.”

Unfortunately, that was also a repeat of a passage he wrote in February 2007.

In other words, while things may seemingly be different this time around, they are most assuredly the same.

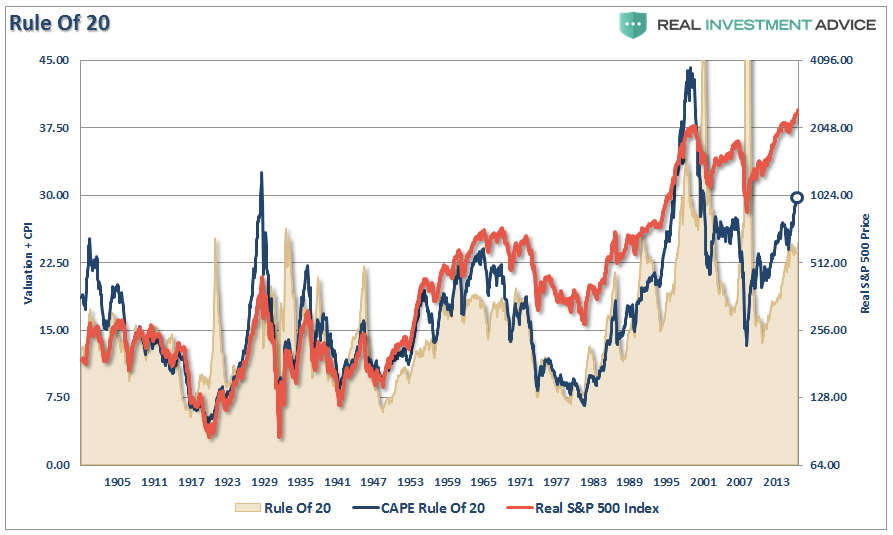

This brings us to the “Rule of 20.” The rule is simply inflation plus valuation and should be “no more than 20.” Interestingly, while the rule is pushing the 3rd highest level in history, only behind 1929 and 2000, Mr. Wien states that such levels only suggest the market is “fully priced” rather than “egregiously overvalued.” Regardless of what definition you choose to use, the math suggests forward 10-year returns will be substantially lower than the last.

In a market where momentum is driving an ever smaller group of participants, fundamentals are displaced by emotional biases. Such is the nature of market cycles and one of the primary ingredients necessary to create the proper environment for an eventual crash.

Notice, I said eventually.

I do agree the markets are indeed currently bullish and therefore, as stated above, portfolios remain tilted towards equities currently. However, just because fundamentals are currently ignored by “greed” and “momentum,” does not mean such will always be the case.

As David Einhorn once stated:

“The bulls explain that traditional valuation metrics no longer apply to certain stocks. The longs are confident that everyone else who holds these stocks understands the dynamic and won’t sell either. With holders reluctant to sell, the stocks can only go up – seemingly to infinity and beyond. We have seen this before.

There was no catalyst that we know of that burst the dot-com bubble in March 2000, and we don’t have a particular catalyst in mind here. That said, the top will be the top, and it’s hard to predict when it will happen.”

Is this time different?

Probably not.

The Risk To Passive

The other potential danger noted by Wien was ETF’s (Exchange Traded Funds). To wit:

“One other potential danger that investors seem too complacent about is Exchange Traded Funds. While most know these instruments as a great convenience in getting or reducing exposure to sectors or asset classes, they may prove to be less liquid than their participants believe and could destabilize the financial markets.”

But most importantly:

“Most owners of ETFs don’t know what’s in them. What happens when everyone wants to get out at the same time?”

As I noted in “Rise Of The Robots:”

“At some point, that reversion process will take hold. It is then investor “psychology” will collide with “margin debt” and ETF liquidity. As I noted in my podcast with Peak Prosperity:

‘It will be the equivalent of striking a match, lighting a stick of dynamite and throwing it into a tanker full of gasoline.’

When the ‘robot trading algorithms’ begin to reverse, it will not be a slow and methodical process but rather a stampede with little regard to price, valuation or fundamental measures as the exit will become very narrow.

Importantly, as prices decline it will trigger margin calls which will induce more indiscriminate selling. The forced redemption cycle will cause catastrophic spreads between the current bid and ask pricing for ETF’s. As investors are forced to dump positions to meet margin calls, the lack of buyers will form a vacuum causing rapid price declines which leave investors helpless on the sidelines watching years of capital appreciation vanish in moments.

If you don’t believe…just go look at what happened on September 15th, 2008.

It happened then.

It will happen again.”

While investors insist the markets are currently NOT in a bubble, it would be wise to remember the same belief was held in 1999 and 2007. Throughout history, financial bubbles have only been recognized in hindsight when their existence becomes “apparently obvious” to everyone. Of course, by that point, it was far too late to be of any use to investors and the subsequent destruction of invested capital.

This time will not be different. Only the catalyst, magnitude, and duration will be.

Investors would do well to remember the words of the then-chairman of the Securities and Exchange Commission Arthur Levitt in a 1998 speech entitled “The Numbers Game:”

“While the temptations are great, and the pressures strong, illusions in numbers are only that—ephemeral, and ultimately self-destructive.”

But it was Howard Marks which summed up our philosophy on “risk management” well when he stated:

“If you refuse to fall into line in carefree markets like today’s, it’s likely that, for a while, you’ll (a) lag in terms of return and (b) look like an old fogey. But neither of those is much of a price to pay if it means keeping your head (and capital) when others eventually lose theirs. In my experience, times of laxness have always been followed eventually by corrections in which penalties are imposed. It may not happen this time, but I’ll take that risk.”

I will receive a lot of emails from this article trying to pose counter-arguments, explain to me why this time is different, or that I am missing out.

I am okay with that.

Client’s don’t pay a fee to chase markets. They pay a fee to employ an investment discipline, trading rules, portfolio hedges and management practices that have been proven to reduce the probability a serious andirreparable impairment to their hard earned savings.

Unfortunately, the rules are REALLY hard to follow. If they were easy, then everyone would be wealthy from investing. They aren’t because investing without a discipline and strategy has horrid consequences.

So, what’s your plan for the second-half of the full market cycle?

Copyright © Clarity Financial