by Frank Holmes, CIO, CEO, U.S. Global Investors

Here’s a news flash for you: Donald Trump is controversial and caustic. He says exactly what’s on his mind, no matter how incendiary, and he’s not afraid to make enemies, even with members of his party. “Bully” is a word many people use to describe the 45th U.S. president.

The thing is, no one who voted for Trump—I think it’s safe to say—didn’t already know this about him. His being a bully is baked right into his DNA, and he expertly honed this persona during his stint as the tough-as-nails host of NBC’s The Apprentice.

Remember when Trump received flak a few weeks back for retweeting a gif of himself body-slamming “CNN”? The clip actually came from WrestleMania 23 in 2007, when the future president defeated World Wrestling Entertainment (WWE) CEO Vince McMahon—and consequently got to shave his head—in a fight billed as the “Battle of the Billionaires.” Trump’s bombastic style and rough edges were so aligned with the smack-talking world of professional wrestling that he was inducted into the WWE Hall of Fame in 2013.

That’s who Trump is. He’s a bully. But I’m convinced that’s why he was elected—to stand up to even bigger bullies.

Standing Up to the Beltway Party

Right now those bullies include members of the beltway party, sometimes referred to as “the deep state”—career bureaucrats, lobbyists, regulators and other officials who make it their mission to oppose any Washington outsider who threatens to shake up the status quo.

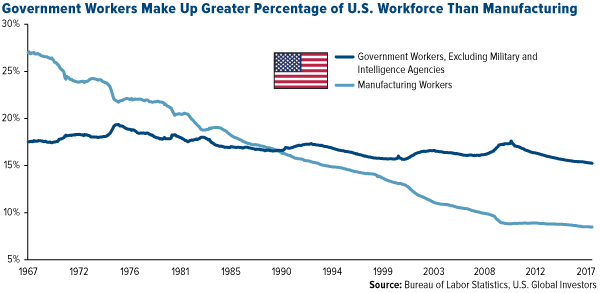

The beltway party isn’t a new phenomenon, of course. For the past 50 years, the number of government workers relative to the entire U.S. workforce has remained virtually the same. Meanwhile, the percentage of Americans employed in manufacturing has steadily plummeted.

Think about it: We have fewer people in this country who innovate and build things than people who enforce the laws that often prevent manufacturers from innovating and building at their fullest potential. What hope do they have?

When you have a bully problem, you don’t send in a Boy Scout. That’s what we learned with Jimmy Carter, whose presidency Trump’s administration so far resembles in an interesting way, according to former Federal Reserve chair Ben Bernanke. Carter and Trump, both outsiders, were sent to Washington to “drain the swamp” of the beltway party. We all know unsuccessful Carter was, but that’s likely because he was simply too nice and “decent” for the White House.

I don’t think anyone would ever accuse President Trump of being too nice and decent, but I also don’t think decency is what we need right now. Decency won’t motivate Congress to pass tax reform. Decency won’t roll back strangulating regulations.

Unlike Carter, Trump is a disruptor. He’s disrupting government just as Sam Walton, Jeff Bezos and Elon Musk disrupted the marketplace with Walmart, Amazon and Tesla. These entrepreneurs and businesses were initially criticized for shaking up the status quo and setting new precedents. Similarly, Trump gets harshly maligned, and for the very same reasons.

A Battle Brewing over Financial Regulations

Most everyone is aware of the fight that took place this past weekend between now-retired Floyd Mayweather and UFC Lightweight Champion Conor McGregor. Although official pay-per-view data hasn’t been released yet, the number of people who paid the $100 to tune in is expected to exceed the roughly 4.6 million who bought access to watch the Mayweather-Manny Pacquiao fight in 2015. This year, Mayweather’s purse was a guaranteed $100 million but will likely be northwards of $200 million. When all is said and done, McGregor’s payday is estimated to be about half that, according to ESPN.

It wasn’t called “the Money Fight” for nothing.

But over the weekend, a “money fight” of a different kind took place, with the first volley fired in Jackson Hole, Wyoming, where the annual economic symposium of central bankers was held. In what could be her last speech as chair of the Federal Reserve, Janet Yellen defended the efficacy of financial regulations that were enacted following the subprime mortgage crisis nearly 10 years ago.

Because of the reforms, Yellen said, “credit is available on goods terms, and lending has advanced broadly in line with economic activity in recent years, contributing to today’s strong economy.” Banks are “safer” today, she insisted.

Never mind that her conclusions here are questionable at best. Post-crisis reforms such as 2010’s Dodd-Frank Act have actually led to a large number of community banks drying up, giving borrowers, especially in rural areas, fewer options. Because of added compliance costs, many banks have done away with free checking, which disproportionately affects lower-income customers.

Leaving all that aside for now, Yellen’s intent was crystal clear. She made it known to President Trump that, should he re-nominate her to head the Fed when her term ends in February, she will do what she can to protect post-crisis regulations.

Trump, of course, has another point of view. He’s promised to do a “big number” on Dodd-Frank, which he claims has prevented “business friends” from getting loans.

So far he’s been true to his word. In April, he signed an executive order issuing a review of Dodd-Frank. Many of his top-level appointments to the Federal Deposit Insurance Corporation (FDIC), the U.S. Securities and Exchange Commission (SEC) and other such federal agencies have come from a pool of people the big banks feel comfortable with. And his Cabinet is well-stocked with former investment bankers, most notably Steven Mnuchin, who heads the Treasury Department.

In June, the Treasury Department released its recommendations for regulatory reform. Among them are a wholesale reduction in financial regulations, a decrease in their complexity and greater coordination among regulators.

But there’s only so much the executive branch can do alone. A bill designed to repeal key provisions in Dodd-Frank easily passed the House in June and is now in the Senate’s hands. Because it will need to clear a 60-vote threshold, a clean repeal bill looks unlikely, but relief of any kind is better than none.

Abrasive as his style may be, Trump is our greatest hope right now in bringing sensible reform to our complex tax code and regulatory infrastructure.

Looking Ahead to 2020

The Democrats might very well take a page out of the Republicans’ handbook and put up a similarly confrontational, in-your-face candidate in 2020. Right now I can think of no one more fitting of that description than Massachusetts senator Elizabeth Warren. A Democratic Socialist cut from the same cloth as Bernie Sanders, Sen. Warren can be every bit as much a bully as Trump. If you’ve seen her grill someone during a Congressional hearing, you’ll know what I’m talking about.

But whereas Trump supports free markets and business-friendly policies, I believe a President Warren would usher in a new age of punitive taxes and regulations on steroids.

As I’ve often said, it not the politics that matter so much as the policies. I support the candidate who makes it easier for Americans to conduct business and create capital. Sen. Warren has many admirable qualities, I’m sure, but her socialist, far-left ideology would be devastating to businesses and investors alike.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. None of the securities mentioned in the article were held by any accounts managed by U.S. Global Investors as of 6/30/2017.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors