by Taplin, Canida & Habacht, LLC, BMO Global Asset Management

Once a dominant sport, boxing has seen its popularity dwindle over time, punctuated by moments of heightened interest. One of those moments is now on the horizon. On August 26, Floyd Mayweather, who is 49-0 in his career and considered one of the greatest boxers of all time, will fight Conor McGregor, the current Ultimate Fighting Championship (UFC) Lightweight Champion.

UFC and mixed martial arts (MMA) have seen their popularity grow in recent years from relative obscurity, banned in many states, to the mainstream. Does the current fight represent a view of the future (e.g. the NFL and the upstart AFL) or a novelty (e.g. the XFL)? The fight highlights the topic of convergence and its current poignancy, from boxing to politics to investments.

Globalization, populist push back and the bonds that tie

A growing populist rebuke to globalization seemed to be gaining momentum in 2016 with the Brexit vote and President Trump’s election. In 2017, the presumed next steps in this global tide have stalled with Wilders in the Netherlands, Le Pen in France and even May in the U.K. (if viewed as a Brexit proxy) underperforming in elections. And while several of the political issues which have come to the fore (protectionism and immigration restrictions) center on national identity, financial markets are as global and interconnected as ever.

It would be easy to imagine this interconnectivity as unique in history, but it is the degree and the speed that are new, not the concept. From the Spanish Price Revolution, when Spanish explorers brought gold from the Americas back to Europe and triggered mass inflation, to the 1906 Bank of England decision to raise interest rates to reduce flows of gold reserves to the U.S., which (at least partially) caused the 1907 depression in the U.S., monetary impacts have crossed borders for centuries.

Those events occurred over the course of months and years in a largely unconnected world that was ever so slowly becoming more connected. Today, we find ourselves in a heavily intertwined world that is debating whether to proceed, pause, or turn around with regard to globalism, yet no such pause is plausible for communication or indeed financial markets.

In fact, convergence is the order of the day.

U.S. is global, global is American

U.S. is global, global is American

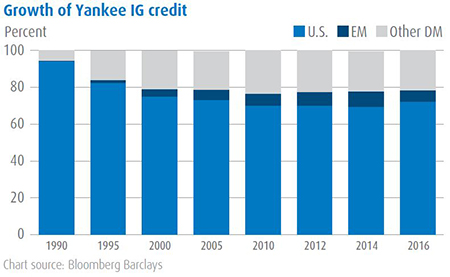

Whether choosing a restaurant or examining fixed income markets, the trend of globalization is pronounced. While U.S. financial markets have long been accessed by global players to capitalize on American capital, protection for investors, liquidity and even prestige, the non-U.S. participation has increased over time. Whereas 20 years ago Yankee bonds (bonds issued by non-U.S. entities into the U.S. market) were approximately 6% of the credit benchmark, now that number is nearly 30%. This increase is particularly noteworthy given the 11-fold growth of the Bloomberg Barclays U.S. Credit index from $540 billion in 1990 to above $6 trillion at the end of July. Using a broader investment grade credit universe, which includes 144a private placement securities, approximately 40% of the market value of the U.S. credit market is comprised of non-U.S. domiciled companies.

Where does a company live?

Even the question of what is a U.S. company, has itself become a gray area. Many classically American brands (Budweiser comes to mind) are now foreign owned despite massive U.S. operations, while classically foreign brands (think Toyota and Honda) are significant employers and producers within the U.S. 42% of S&P 500 company profits come from overseas, re-enforcing that American is global. The tax inversion acquisitions of the past few years involved American companies being purchased, sometimes by smaller rivals, to shift the corporate registration outside of the U.S. to lower the tax consequences for those companies, though they continue to operate and generate profits in the U.S. What defines the nationality of a company has become murky, or as Number 2 from Austin Powers said, “There is no world anymore! It’s only corporations.”

Tax reform, both personal and corporate, have been centerpieces of President Trump’s agenda. Much to the chagrin of Floyd “Money” Mayweather, who is estimated to owe $22 million to the U.S. government, this reform has yet to arrive. Marginal rates are one focus of the discussion and lowering tax rates would certainly be a boon to existing taxpayers, with the aim of inducing non-U.S. taxpayers to become U.S. taxpayers (or at least reduce the appeal of U.S. taxpayers leaving for tax benefits.) The structure of U.S. system is also fundamentally different. The U.S. government taxes U.S. entities globally, rather than territorially as most other countries do, effectively encouraging companies to leave cash in non-U.S. subsidiaries to reduce their tax burden. Changing this system to a territorial system (presumably with a one-time repatriation tax) would allow U.S. companies to move cash back to the U.S. Tax reform was previously discussed with a target of August, though aggressive goal now appears to be the end of this year. Sadly for Mr. “Money” Mayweather, the estimated $100+ million payout from his upcoming fight is likely be taxed at current personal rates.

Convergent

Convergence is not restricted to the increasingly amorphous definitions of nationalities. The once clear dividing lines between investments have themselves been blurred. The boundary between what was once called junk bonds and investment grade, has faded. Nomenclature for the asset class has evolved from “junk” to “speculative” to “high yield”, conveying increasing perception of worthiness for investment. This broader acceptance can be viewed in the 215 funds in the Morningstar universe providing direct access to the sector; a number which has more than doubled in the last two decades. More than just the number of funds themselves, high yield is a core component of multisector fixed income, a category which itself has become mainstream. Once a relatively obscure category, it now features nearly 100 distinct funds. In total, more funds focus on non-core categories (high yield, emerging market debt and multi-sector) than core categories (intermediate-term bond), though assets remain heavily weighted to the more traditional category.

Convergence is not restricted to the increasingly amorphous definitions of nationalities. The once clear dividing lines between investments have themselves been blurred. The boundary between what was once called junk bonds and investment grade, has faded. Nomenclature for the asset class has evolved from “junk” to “speculative” to “high yield”, conveying increasing perception of worthiness for investment. This broader acceptance can be viewed in the 215 funds in the Morningstar universe providing direct access to the sector; a number which has more than doubled in the last two decades. More than just the number of funds themselves, high yield is a core component of multisector fixed income, a category which itself has become mainstream. Once a relatively obscure category, it now features nearly 100 distinct funds. In total, more funds focus on non-core categories (high yield, emerging market debt and multi-sector) than core categories (intermediate-term bond), though assets remain heavily weighted to the more traditional category.

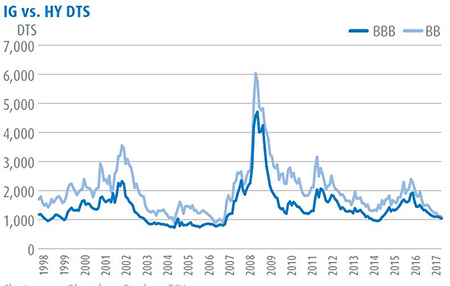

The phenomenon has been aided by the low yield environment post 2008-crisis, when investors have been encouraged to look at riskier assets by Central banks pushing yields lower globally. The low yield environment increased the risk tolerance for many investors to purchase lower rated bonds in exchange for higher yields. At the same time, the low yield environment has encouraged investment grade issuers (this includes the Treasury) to extend the maturities of the securities they issue. These parallel trends have resulted in a near complete convergence of the DTS (duration times spread) of higher quality high yield bonds (BB rated) bonds and lower quality investment grade (BBB rated). While no measure of bond risk is complete, DTS (simplistically) includes both credit risk and interest rate risk. Viewed through this lens, lower quality Investment Grade (IG) and higher quality high yield (HY) have nearly equivalent risk, though we would caution that the two risks are likely to manifest themselves very differently depending on market developments.

Emergent

The same phenomenon can be observed in the once large and now rather less significant difference between emerging markets and developed markets. Emerging markets represent major global economies, with several individual EM countries having GDP per capital and life expectancies in line with or ahead of developed market countries.

The same phenomenon can be observed in the once large and now rather less significant difference between emerging markets and developed markets. Emerging markets represent major global economies, with several individual EM countries having GDP per capital and life expectancies in line with or ahead of developed market countries.

As those fundamentals have converged, so too have markets. The most standard emerging market index, JPM EMBI, has an average quality of BB+ with nearly half (49%) of the index by market value being investment grade. And yet, none of these trends are linear or clean. While in the not too distant past countries such as Brazil, Turkey, and South Africa were upgraded to investment grade, they have since been downgraded back to below investment grade. Convergence while the long-term trend is not a forgone conclusion nor an easy achievement.

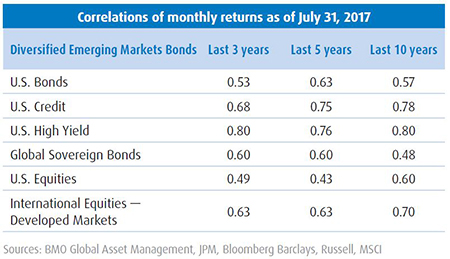

Even with ongoing mainstreaming of investments, the sectors continue to offer diversification benefits against each other. This benefit, along with continued yield advantages bode well for these sectors to remain appealing for investors.

The winner and still champion…

While commerce, technology and indeed investments have been consistently marching towards further integration and globalization, the 2016 political surprises should be a reminder that trends last until they no longer do. While certain aspects of globalization seem likely to proceed, cell phones and internet connectivity being the prime examples of increased connections, it should be unsurprising if political integration lags or reverses course. Europe is currently buoyed by improving economic data, but along with strongly accommodative European Central Bank policy, that masks some of the cracks revealed by the past several years of economic crisis and the Brexit vote.

Floyd Mayweather is the prohibitive favorite for the upcoming match as the match will be fought with boxing rather than MMA rules. Yet the acceptability of the match in the first place demonstrates how a once wide gulf between the sports has narrowed. So too with the investing world – while core fixed income assets dominate issuance, other assets are now sufficiently established to be considered broadly by investors as opposed to left on the fringe. This increased range of viable choices is healthy for investors. While remaining within broad fixed income, these wider choices increasingly offer investors additional opportunities for yield, diversification and the ability to calibrate return targets and risk trade-offs. As investors survey this new landscape, remember the words of the referee: protect yourselves at all times and let’s make it a clean fight.

Portfolio positioning

Interest rates/duration: Holding duration below benchmark but with an eye towards narrowing the gap opportunistically towards neutral; underweight Treasuries, favoring non-government sectors instead.

Credit: Overall, global demand for U.S. fixed income remains strong; broadly-speaking, U.S. corporate balance sheets have managed the credit cycle well; credit spread compression towards historical averages—offset by strong corporate earnings in 1Q’17— suggest risks largely in balance; the downward ratings migration within U.S. credit stabilized during the second quarter; pockets of relative value persist in cases where the OAS curves are too steep across sector and quality buckets.

Mortgages: Concerns for mounting pressure on U.S. agency MBS has largely abated as the Fed balance sheet normalization plans proved rather benign; following some OAS pressure, which was expected, risks appear fairly well-balanced.

High yield (HY) and emerging markets (EM): Highly selective approach to higher credit beta opportunities as lower quality credit stories appear fully-priced relative to the investment grade/higher quality buckets.

Taplin, Canida & Habacht, LLC is a registered investment adviser and a wholly owned subsidiary of BMO Asset Management Corp., which is a subsidiary of BMO Financial Corp. BMO Global Asset Management is the brand name for various affiliated entities of BMO Financial Group that provide investment management and trust and custody services. Certain of the products and services offered under the brand name BMO Global Asset Management are designed specifically for various categories of investors in a number of different countries and regions and may not be available to all investors. Products and services are only offered to such investors in those countries and regions in accordance with applicable laws and regulations. BMO Financial Group is a service mark of Bank of Montreal (BMO).