by Drew O'Neil, Fixed Income, Raymond James

August 21, 2017

Staying with our theme of trying to keep the endless barrage of dramatized news headlines in perspective, today we try to shine some light on the municipal market. In the today’s world of seemingly constant “breaking news” being shot at us from every direction, it helps to take a step back and think about how the news system works. When things go as planned and nothing unexpected or out of the ordinary happens, it doesn’t make for a good news story, which means nobody talks about it and unless you seek out the information, you will probably go about your life unaware that these “non-news” items ever happened.

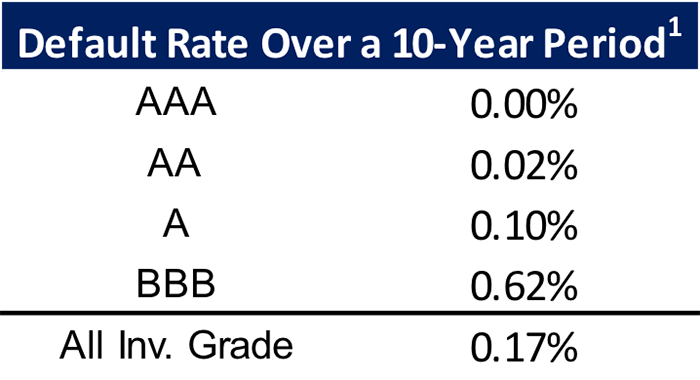

If I asked you what has been going on in the municipal market over the past 5-10 years, you would probably mention some stories that you remember seeing about Detroit, Puerto Rico, Illinois, and Chicago. Seeing that these are the first headlines that pop into your head when I mention the municipal bond market, it is natural to have some negative feelings and let your brain trick you into thinking that the municipal market is in bad shape and has been struggling in the recent past. But what about all of the “non-news” event that happened that you never heard about? There is no news story written when a bond is issued by a municipality and they make every coupon payment on time and in full, and then pay back the entire face value at the maturity date. Even though there is no “breaking news” story when this happens, it still happened and does happen a vast majority of the time. The table below highlights default statistics report by S&P over a rolling 10-year time frame.

The takeaway here is that historically, if you bought a AA rated municipal bond, 99.98% of the time that bond made all interest and principal payments on-time and in full as it was supposed to. Looking at that from the other side, if you purchased 10,000 separate municipal bonds, only 2 of them would have defaulted. A 99.98% success rate is going to be hard to beat in any other asset class, and is a good reminder as to why for anyone who has accumulated a significant amount of wealth, a high-quality municipal bond portfolio should be a cornerstone of their portfolio. As we like to say, municipal bonds are not necessarily intended to make you wealthy, they are intended to ensure you never lose the wealth you have worked for a lifetime to accumulate.

1Source: S&P Global Fixed Income Research, excludes housing, rolling 10-year periods tracked from 1986-2016

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James