by Doug Drabik, Fixed Income, Raymond James

What can be referred to as tabloid reporting disguised as journalism is at it again. Fresh off of last week’s “bond market bubble”, the new dramatization is about “fire and fury”, the president’s pledge that “things will happen to them like they never thought possible”. What better fodder for the tabloid sensationalism and drama aimed to capture readership and/or viewership? Realizing that it’s low-hanging fruit, one can almost excuse the story’s luridness except when it’s reported as Armageddon.

Previous chapters of fifty ways to scare your investors include: Meredeth Whitney’s municipal market credit collapse forecast, skyrocketing inflation, Brexit, negative interest rates, unwinding the Fed’s balance sheet, the bond market bubble, etc. Now the North Korea conflict is being described as creating an “unthinkable impact on the global economy”. Very dramatic but does it have any real bite?

North Korea has a population of about twenty-five million, roughly the population of the state of Texas. They produce an estimated $12.38 billion (US) in gross domestic product (GDP), roughly 39% of the GDP of the 50th ranked US state. That’s right, the entire country produces a fraction of the state of Vermont’s GDP. On the debt side, North Korea’s bonds that were sold internationally in the late 1970s were defaulted on in 1984 and most of their outstanding debt is held by non-economic power nations. The net economic effect of this situation to the US seems negligible at best. Beyond this, the doomsdayers, based on North Korea’s potential actions, can conjure up a thousand domino effects but none that seem highly plausible given the premise that no country outside of North Korea is desiring conflict.

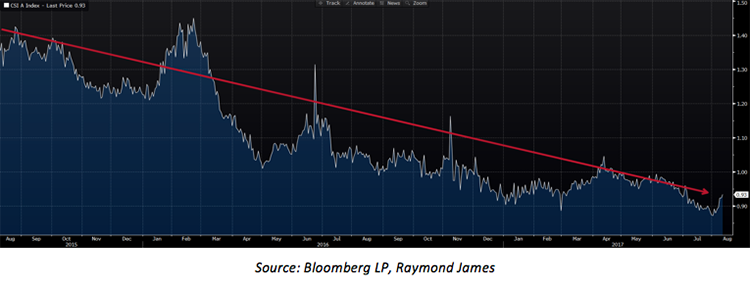

Let’s look at Fifty Ways to Scare Your Investor from another angle. What is the market telling us? One simple way to gauge the amount of fear in the market may be to look at spreads. A spread is essentially the additional market yield required above a “risk-free” asset (i.e. Treasuries) in order to make a riskier investment attractive to investors. With more risk, demand declines thus spread must widen to entice investors. A high yield bond offers a wider spread versus a triple A-rated bond. The chart above shows the trend of ‘A’ rated corporate bond spreads over the past two years. Clearly, spreads have been declining steadily and currently sit near their lows over that time frame. The lower the spread, the less risk the market is perceiving. This might help support the idea that investors are not currently scared of corporate credit identifying less current risk than observed in recent history. The trend, at the very least, does not support the sensationalized news. These spreads represent investor sentiments and market reality unlike the fear driven articles as they often erroneously highlight “the next tragedy”.

Don’t change long-term portfolio strategy for dramatized news. History suggests that after knee-jerk reactions to crisis are implemented, the market amends the negative reaction within months. Stay your course and don’t be thrown off by the latest invalidated headline or investor scare.

To learn more about the risks and rewards of investing in fixed income, please access the Securities Industry and Financial Markets Association’s “Learn More” section of investinginbonds.com, FINRA’s “Smart Bond Investing” section of finra.org, and the Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access System (EMMA) “Education Center” section of emma.msrb.org.

The author of this material is a Trader in the Fixed Income Department of Raymond James & Associates (RJA), and is not an Analyst. Any opinions expressed may differ from opinions expressed by other departments of RJA, including our Equity Research Department, and are subject to change without notice. The data and information contained herein was obtained from sources considered to be reliable, but RJA does not guarantee its accuracy and/or completeness. Neither the information nor any opinions expressed constitute a solicitation for the purchase or sale of any security referred to herein. This material may include analysis of sectors, securities and/or derivatives that RJA may have positions, long or short, held proprietarily. RJA or its affiliates may execute transactions which may not be consistent with the report’s conclusions. RJA may also have performed investment banking services for the issuers of such securities. Investors should discuss the risks inherent in bonds with their Raymond James Financial Advisor. Risks include, but are not limited to, changes in interest rates, liquidity, credit quality, volatility, and duration. Past performance is no assurance of future results.

Copyright © Raymond James