by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

August 7, 2017

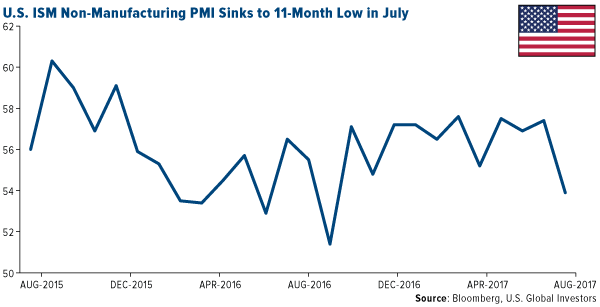

In July, the Institute for Supply Management’s (ISM) Non-Manufacturing Index fell to an 11-month low of 53.9, 3.5 points below its June reading of 57.4. The index measures the non-manufacturing, services industries such as food services, education, real estate, health care and more.

Economists had expected a reading closer to 56.9, so it’s safe to call this a disappointment. Although the index is still above the key 50 threshold, where it’s held for 91 straight months now, the slowdown suggests that “the economy may have lost some momentum going into the third quarter,” as Capital Economics’ Andrew Hunter said in a note last week.

Following this report, it’s possible we’ll see the U.S. dollar rally before pulling back even further. Having hit a 15-month low last week, the dollar looks oversold and ready for a “retracement,” as CLSA’s Christopher Wood put it.

“It remains remarkable how weak the dollar has been so far this year given the Fed’s surprisingly hawkish rhetoric and given that its latest statement last week still suggests that the American central bank intends to commence balance sheet contraction next quarter,” Wood wrote in the latest “GREED and fear.”

|

|

I’ll have more to add on the Fed’s balance sheet later.

July was the dollar’s fifth consecutive month of losses, the longest such stretch since December 2010 through April 2011. As I said in a Frank Talk last week, the major contributing factor to the greenback’s slide is political uncertainty surrounding President Donald Trump and Congress. Not only did the Obamacare repeal and replace bill fail (again), but Trump’s White House continues to look like a revolving-door workplace, with the foul-mouthed Anthony Scaramucci pushed out as communications director last week after only 10 days on the job. This reportedly came at the urging of brand new chief of staff John Kelly, who recently replaced Reince Priebus.

But it’s no secret that Trump favors a weaker currency. Since he declared that the dollar was “getting too strong” back in April, it’s lost close to 8 percent of its value against a basket of several other currencies. Add to this the disappointing ISM report, weakening automobile sales and slightly lower-than-hoped-for GDP growth in the second quarter, and it seems less and less likely we’ll see more than one additional rate hike in 2017.

Economic Growth Revised Down

On Friday, the Labor Department announced the U.S. economy added a robust 209,000 jobs in July, beating the consensus, while the unemployment rate dropped even further to a 16-year low of 4.3 percent.

Wage growth, however, remained pretty flat, which is a concern. Consumption is the number one driver of economic growth in the U.S., and if American workers aren’t getting raises, they’re not spending more.

All of this is spurring some economists to rethink their U.S. growth estimates. In its World Economic Outlook for July, the International Monetary Fund (IMF) revised down its domestic economic growth forecast, from 2.3 percent to 2.1 percent in 2017, and from 2.5 percent to 2.1 percent in 2018. The Washington-based fund attributes this revision to “the assumption that fiscal policy will be less expansionary than previously assumed, given the uncertainty about the timing and nature of U.S. fiscal policy changes.”

IMF economists, in other words, have doubts that tax reform, deregulation or an infrastructure package will be coming anytime soon.

We’ll see if they’re right. After the August recess, Congress plans to tackle tax reform, which the U.S. sorely needs. I hope lawmakers can come together and pass a comprehensive bill this fall that will deliver some relief to American workers, families and corporations.

Fed to Take Away the Punchbowl

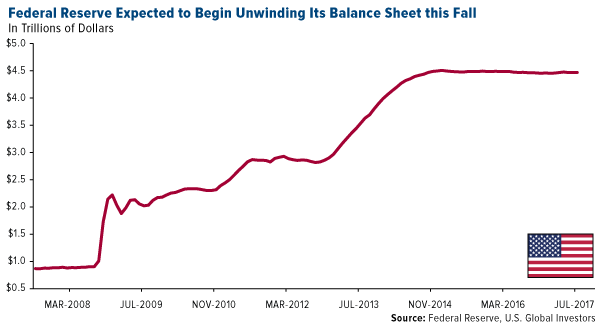

Big changes could be coming on the monetary side this fall as well. In an address to the Economic Club of Las Vegas last week, President and CEO of the Federal Reserve Bank of San Francisco John Williams said the Fed will likely begin the process of monetary normalization as soon as next quarter. This includes unwinding the Fed’s $4.5 trillion balance sheet, composed of long-term Treasuries and mortgage-backed securities (MBS). The process could take up to four years to complete.

Now that “we’ve finally recovered from the recession,” Williams said, it’s time for the private and public sectors to “step up and take the lead in making the investments and enacting policies needed to improve the longer-term prospects of our economy and society.”

I agree 100 percent. For nearly 10 years now we’ve seen an imbalance in monetary and fiscal policies, with the economy and stock market being propped up by cheap credit.

There’s a historical risk in the Fed reducing its balance sheet, though. The central bank has embarked on this reduction six times in the past—in 1921-1922, 1928-1930, 1937, 1941, 1948-1950 and 2000—and all but one episode ended in recession.

That’s according to research firm MKM Partners, whose chief economist, Mike Darda, urged attendees of a Fidelity event in May to hope for the best but prepare for the worst.

|

|

“My opinion is that business cycles don’t just end accidentally,” Darda said. “They are killed by the Fed. If the Fed tightens enough to induce a recession, that’s the end of the business cycle.”

So how can investors prepare?

“Obviously, diversification is important,” Darda said, highlighting municipal bonds and emerging markets. “But my focus there would be on the commodity-importing emerging markets.”

Fidelity’s Julian Potenza seconded Darda’s emphasis of muni bonds, saying “investors should consider keeping the portion of their fixed-income portfolio that is currently earmarked for liquidity relatively short, in terms of duration.”

Indeed, shorter-duration, tax-free munis have a history of delivering positive returns even during economic downturns and in environments of rising and lowering interest rates.

As for emerging markets, CLSA reported last week that international ETF inflows so far this year are outpacing domestic U.S. ETF inflows, $103 billion to $86 billion. The brokerage and investment firm recommended an overweight position in emerging markets, specifically Europe ex-U.K.

Tech Stocks a Third of Market Gains in 2017

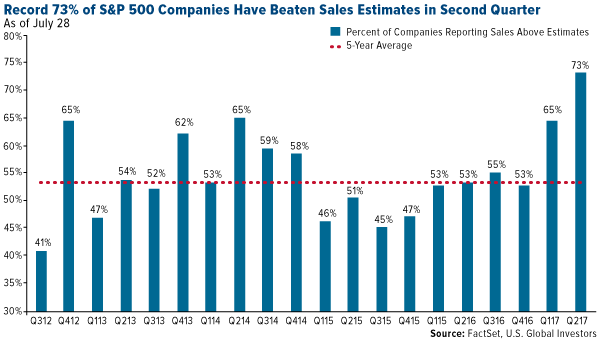

For the second quarter, close to a record 75 percent of S&P 500 Index companies are beating not just sales estimates but also earnings per share (EPS) estimates, according to FactSet data. What’s more, they’re beating these estimates by wider margins than historical second-quarter averages.

Granted, only around 60 percent of companies have reported as of this writing, but the news is impressive nonetheless.

How much of this is due to euphoria over Trump’s pro-growth fiscal agenda, and how much to a weakening U.S. dollar? That’s difficult to say, but no one can argue the fact that American multinationals are benefiting from a weaker dollar, which makes their exports more competitive globally. Apple, which generated 61 percent of its revenue from foreign markets in the second quarter, just reported an all-time quarterly services revenue record. “Services,” which includes Apple Music, iTunes, iCloud and Apple Pay, brought in an astounding $7.3 billion, up from $6 billion during the same quarter last year.

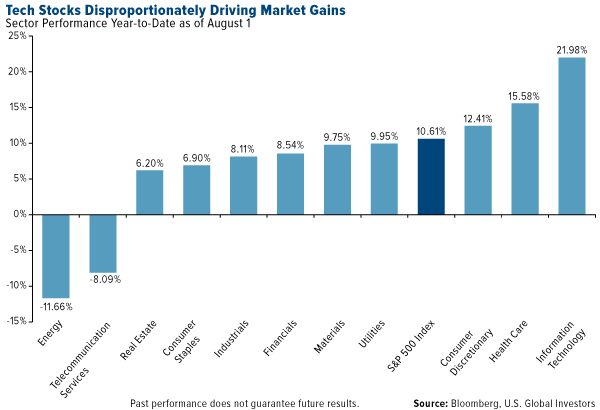

Speaking of Apple, it’s one of only five U.S. stocks that, together, are responsible for a third of the market’s gains in 2017, the other four being Amazon, Facebook, Microsoft and Alphabet (Google). As you can see below, information technology is up close to 22 percent year-to-date, followed by health care at 15.5 percent.

The reason I share this with you is because, while the market appears to be seeing solid growth right now, it’s being propelled disproportionately by only a handful of tech stocks. The S&P 500 is up 10.6 percent, but if we remove information technology, it’s up only around 7.5 percent. This makes the market vulnerable, should those stocks see a correction.

And that’s why I believe it’s particularly important to stay diversified, as Mike Darda said—diversified in emerging markets, which offer attractive valuations; muni bonds; and, as always, gold and gold stocks.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The ISM Nonmanufacturing index based on surveys of more than 400 non-manufacturing firms' purchasing and supply executives, within 60 sectors across the nation, by the Institute of Supply Management (ISM). The ISM Non-Manufacturing Index tracks economic data, like the ISM Non-Manufacturing Business Activity Index. A composite diffusion index is created based on the data from these surveys that monitors economic conditions of the nation.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

Earnings per share (EPS) is a figure describing a public company's profit per outstanding share of stock, calculated on a quarterly or annual basis. EPS is arrived at by taking a company's quarterly or annual net income and dividing by the number of its shares of stock outstanding.

Diversification does not protect an investor from market risks and does not assure a profit.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 6/30/2017: Apple Inc.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors