by Jeffrey Saut, Chief Investment Strategist, Raymond James

One hour after beginning a new job which involved moving a pile of bricks from the top of a two story house to the ground, a construction worker in Peterborough, Ontario suffered an accident which hospitalized him. He was instructed by his employer to fill out an accident report. It read:

“Thinking I could save time, I rigged a beam with a pulley at the top of the house and a rope leading to the ground. I tied an empty barrel on one end of the rope, pulled it to the top of the house, and then fastened the other end of the rope to a tree. Going up to the top of the house I filled the barrel with bricks. Then I went down and unfastened the rope to let the barrel down. Unfortunately the barrel of bricks was now heavier than I, and before I knew what was happening, the barrel jerked me up in the air.

I hung on the rope, and halfway up I met the barrel coming down, receiving a severe blow on the left shoulder. I then continued on up to the top, banging my head on the beam and jamming my fingers in the pulley. When the barrel hit the ground, the bottom burst, spilling the bricks. As I was now heavier than the barrel, I started down at high speed.

Halfway down, I met the empty barrel now coming up, receiving several cuts and contusions from the sharp edges of the barrel. At this point, I must have become confused because I let go of the rope. The barrel came down, striking me on the head. I woke up in the hospital. I respectfully request sick leave.”

. . . The Toronto Star

Speaking of “Painful Ups and Downs,” well not exactly very many “downs” over the past six months until last Thursday’s gotcha. That intraday plunge had many pundits shouting, “one-day downside reversal” – as the S&P 500 (SPX/2472.10) went from +6-points early in the session, to a minus ~17-point S&P 500 dive from 12:35 p.m. into the 1:30 p.m. pivot point – before recovering to close down by a mere ~2-points. The early strength was attributed to the better than expected June Durable Goods report, which jumped 6.5% (+3.9%E) due to a 131.2% surge in civilian aircraft orders. Interestingly, ex-transportation, orders were up 0.2% versus expectations of a +0.4% increase. Drilling down into those numbers caused some participants to cry “oops!” Despite the early morning stock strength, and the strong aircraft orders, Southwest Airlines telegraphed disappointing revenue growth causing the D-J Transports (TRAN/9227.07) to slide. The Transports trouncing accelerated as traders also sold Landstar (-8.47%), Fed Ex (-2.85%), UPS (-4.01%), and the rout was on. The result left the Transports off as much as ~336 points at the session’s lows (or -3.5%) before somewhat recovering into the closing bell (note: the TRAN intraweek low was at 9147.30 with its 200-day moving average residing at 9100.82). Of course, that action caused our email box to light up with oodles of question like, “What are the Transports telling us about the stock market and the economy?” Our response was, “’Absolutely nothing, say it again,’ a phrase from the song in an era gone by (War).” Also adding to the downside drama was this quip from J.P. Morgan’s quantitative analyst Marko Kolanovic, which hit the broad tape around the downside flip at 12:35 p.m. last Thursday:

It is safe to say that volatility has reached all-time lows and this should give pause to equity managers. Low volatility would not be a problem if not for strategies that increase leverage when volatility declines. Many of these strategies (option hedging, volatility targeting, CTAs, risk parity, etc.) share similar features with the dynamic “portfolio insurance” of 1987. While these strategies include concepts like “risk control,” “crisis alpha,” etc. in various degrees they rely on selling into market weakness to cut losses. This creates a “stop loss order” that gets larger in size and closer to the current market price as volatility gets lower.

Completing the day’s “news” trifecta were rumors that Amazon was going to notch a disappointing earnings report after the close. And sure enough, after the “bell,” Amazon reported a 77% decline in earnings ($0.40 vs. $1.42E) causing one Wall Street wag to scream, “Speaking of LEAKS, where is the SEC on this one?!”

Yet a funny thing happened Friday morning, for as I spoke to our financial advisors, and clients here in Vancouver, stocks did not crater, but actually stabilized and then attempted to rally. By the close the major indices were little changed for the trading session. To be sure, that type of action was forecasted by our models in the previous week, and early last week by our models, when we wrote:

Our short-term model continues to telegraph the potential for more downside attempts that don't gather much traction. Of major interest is that there is the lack of a leap in the Selling Pressure Index, which is declining. Meanwhile, Buying Power continues to rise and is about to cross above the Selling Pressure Index in the charts (read: bullish). Therefore, in the near-term, if more sellers "show up," we deem it a BUY, because the upside potential is for dramatically higher prices into 2018.

The call for this week: There have been five downside bursts like last Thursday’s over the past few weeks with only one of them closing near the lows of the session. The other four such bursts saw “buyers” show up leaving the averages little changed on the day. Andrew and I think there is a market message there in that those participants waiting for a large pullback are going to continue to be disappointed. Our work still suggests the equity markets should push higher this week. Moreover, there is a potential sea change at hand, for as the keen-sighted Jason Goepfert (SentimenTrader) writes:

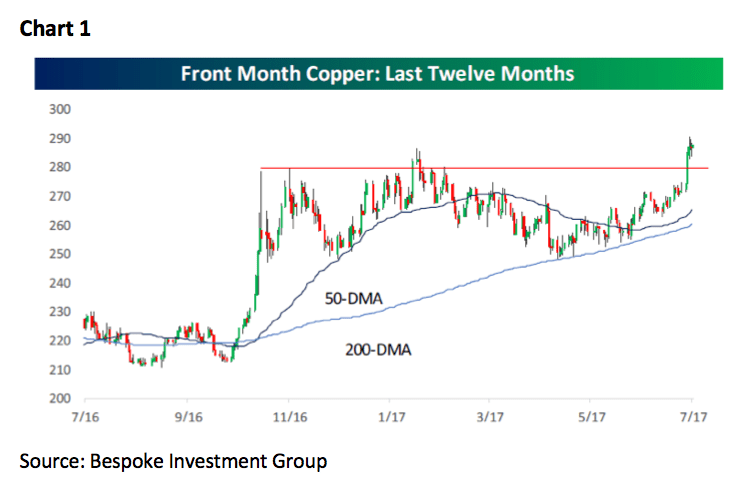

Both stocks and copper futures hit new highs this week [Chart 1], which is widely considered to be a sign of global economic growth, at least according to investors. By no means has it been a slam-dunk sign of future positive returns, but the S&P 500 did see further gains over the next 6-12 months almost without exception. Blame the dollar [because] a weak U.S. dollar is usually good for copper, so it's not a big surprise that copper is near a 52-week high [Chart 1] while the dollar has sunk to a 52-week low [Chart 2]. The correlation between the dollar and stocks is not nearly as strong. When stocks have been at a high and the dollar at a low, once again the S&P 500 showed a positive return over the next 6-12 months almost without exception.

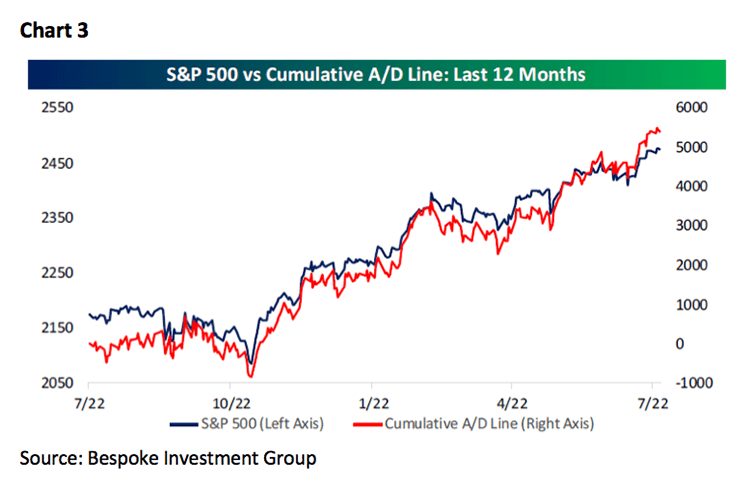

Meanwhile, the Advance/Decline Line continues to point the way higher [Chart 3] and reporting companies continue to beat earnings estimates at a +63.2% “beat rate” for the 2Q17, while revenue beats tag a +63% rate. Indeed, the secular bull market has transitioned to an earnings driven secular bull market from an interest rate driven secular bull market. And that is the way it is as we write at 3:00 a.m. from the West Coast. And the tweet of the weekend from DJT:

I am very disappointed in China. Our foolish past leaders have allowed them to make hundreds of billions of dollars a year in trade, yet . . . they do NOTHING for us with North Korea, just talk. We will no longer allow this to continue. China could easily solve this problem!

*****