by Lance Roberts, Clarity Financial

This past week, the lovely, and talented, Danielle DiMartino-Booth and I shared a discussion on the ongoing debate of why “Rates Must Rise.”

@DiMartinoBooth Interesting reads on the question of "Will Corporate Bonds Crossover." https://t.co/usBY0mVGnJ pic.twitter.com/1azjrtOAlb

— Lance Roberts (@LanceRoberts) July 14, 2017

I'm agreeing with you Lance. Just don't think low rates will be with us indefinitely. At some point Piper paid.

— Danielle DiMartino (@DiMartinoBooth) July 14, 2017

For the last several years, I have produced a litany of commentary (see this, this and this) on why rates WILL not rise anytime soon, they CAN’T rise because of the relationship between debt and economic activity.

Most of the arguments behind the “rates must rise” scenario are based solely on the premise that since “rates are so low,” they must now go up. This theory certainly applies to the stock market which is driven as much by human emotion, as fundamentals. However, rates are an entirely different animal.

Let me explain my position using housing as an example. Housing is something everyone can understand and relate to, but the same premise applies to everything bought on credit.

People Buy Payments – Not Houses

When the average American family sits down to discuss buying a home they do not discuss buying a $125,000 house. What they do discuss is what type of house they “need” such as a three bedroom house with two baths, a two car garage, and a yard.

That is the dream part.

The reality of it smacks them in the face, however, when they start reconciling their monthly budget.

Here is a statement I have not heard discussed by the media. People do not buy houses – they buy a payment. The payment is ultimately what drives how much house they buy. Why is this important? Because it is all about interest rates.

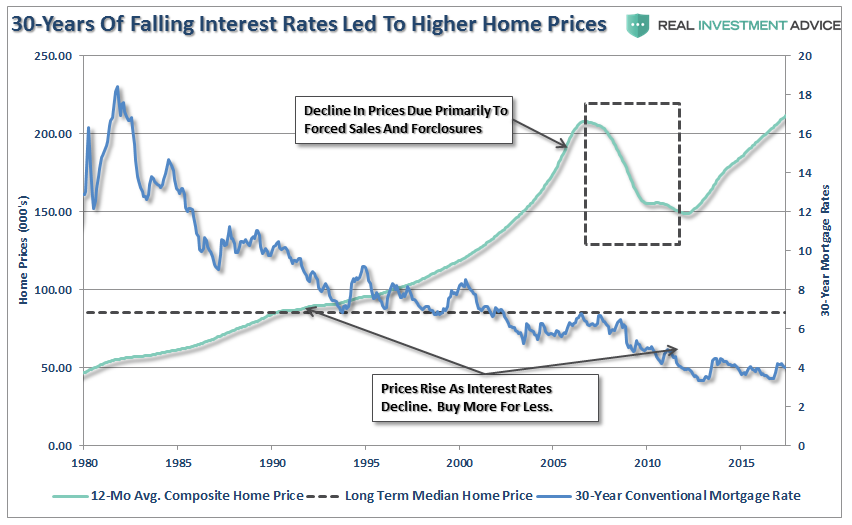

Over the last 30-years, a big driver of home prices has been the unabated decline of interest rates. When declining interest rates were combined with lax lending standards – home prices soared off the chart. No money down, ultra low interest rates and easy qualification gave individuals the ability to buy much more home for their money.

The problem, however, is shown below. There is a LIMIT to how much the monthly payment can consume of a families disposable personal income.

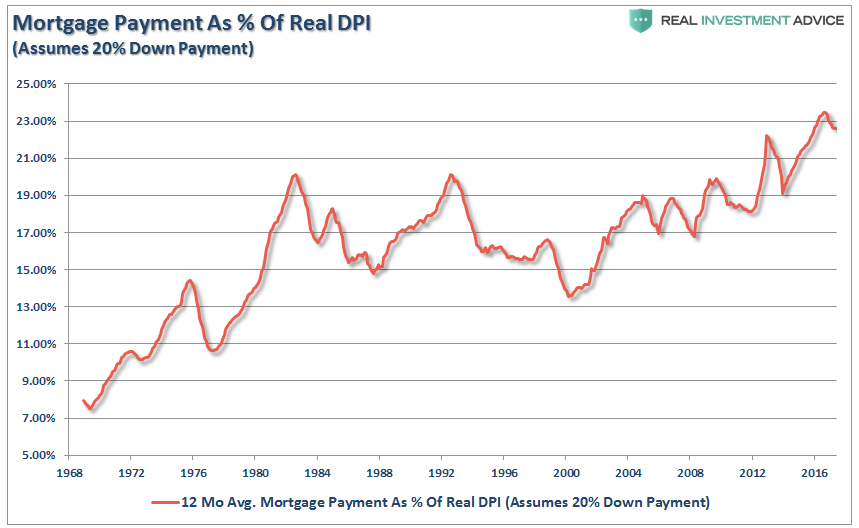

In 1968 the average American family maintained a mortgage payment, as a percent of real disposable personal income (DPI), of about 7%. Back then, in order to buy a home, you were required to have skin in the game with a 20% down payment. Today, assuming that an individual puts down 20% for a house, their mortgage payment would consume more than 23% of real DPI. In reality, since many of the mortgages done over the last decade required little or no money down, that number is actually substantially higher. You get the point. With real disposable incomes stagnant, a rise in interest rates and inflation makes that 23% of the budget much harder to sustain.

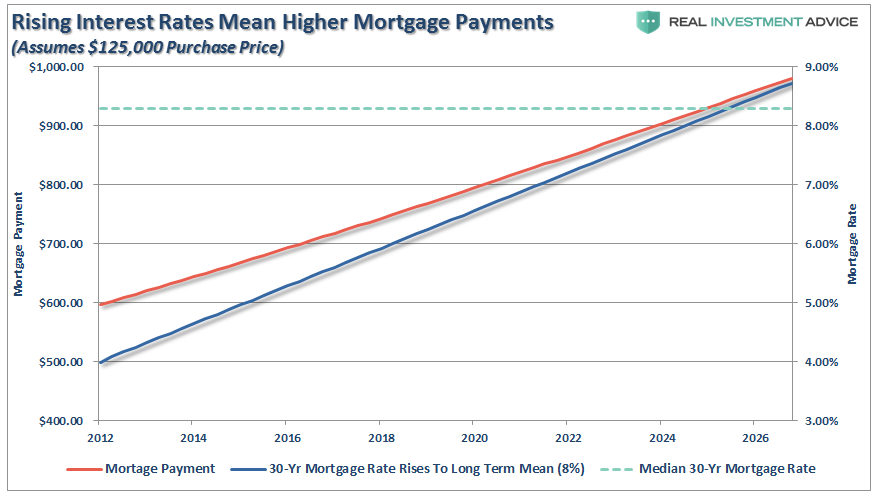

To illustrate this point, look at the chart below. Let’s assume we buy a $125,000 home. I have projected the monthly payment of that home assuming a rise in interest rates going forward back to the long-term median of roughly 8%. Pick a rate in the future and you can see what the payment would be.

With this in mind let’s review how home buyers are affected. If we assume a stagnant purchase price of $125,000, as interest rates rise from 4% to 8% by 2027 (no particular reason for the date – in 2034 the effect is the same), the cost of the monthly payment for that same priced house rises from $600 a month to more than $900 a month – more than a 50% increase. However, this is not just a solitary effect. ALL home prices are affected at the margin by those willing and able to buy and those that have “For Sale” signs in their front yard. Therefore, if the average American family living on $55,000 a year sees their monthly mortgage payment rise by 50% it is a VERY big issue.

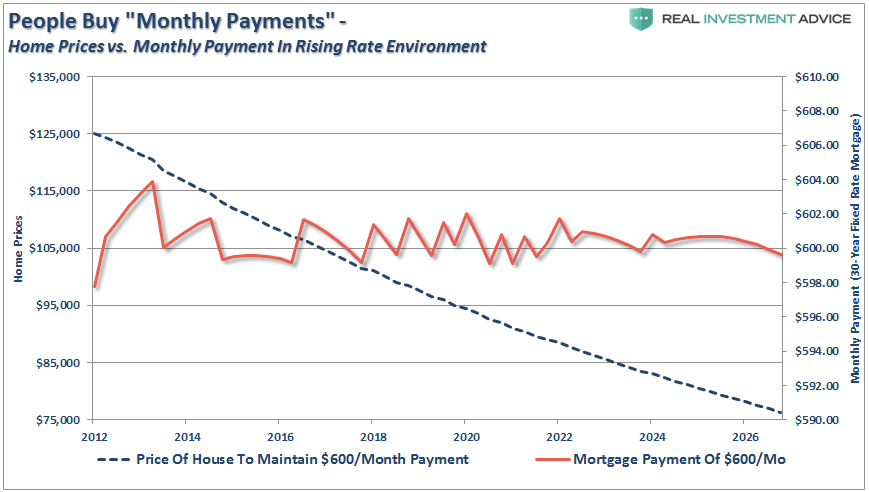

Assume an average American family of four (Ward, June, Wally and The Beaver) are looking for the traditional home with the white picket fence. Since they are the average American family their median family income is approximately $55,000. After taxes, expenses, etc. they realize they can afford roughly a $600 monthly mortgage payment. They contact their realtor and begin shopping for their slice of the “American Dream.”

At a 4% interest rate, they can afford to purchase a $125,000 home. However, as rates rise that purchasing power quickly diminishes. At 5% they are looking for $111,000 home. As rates rise to 6% it is a $100,000 property and at 7%, just back to 2006 levels mind you, their $600 monthly payment will only purchase a $90,000 shack. See what I mean about interest rates?

This also explains WHY America has become a nation of renters as affordability for many is no longer an option.

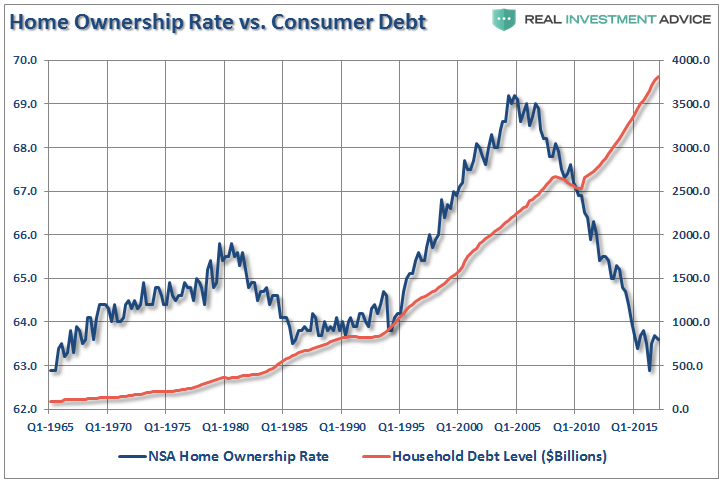

Since home prices, on the whole, are affected by those actively willing to sell – a rise of interest rates would lead to declines in home prices across the board as sellers reduce prices to find buyers. Since there are only a limited number of buyers in the pool at any given time, the supply / demand curve is critically affected by the variations in interest rates. This is particularly the problem when the average American is more heavily leveraged than at any point in history.

Not Just Houses, It’s Everything

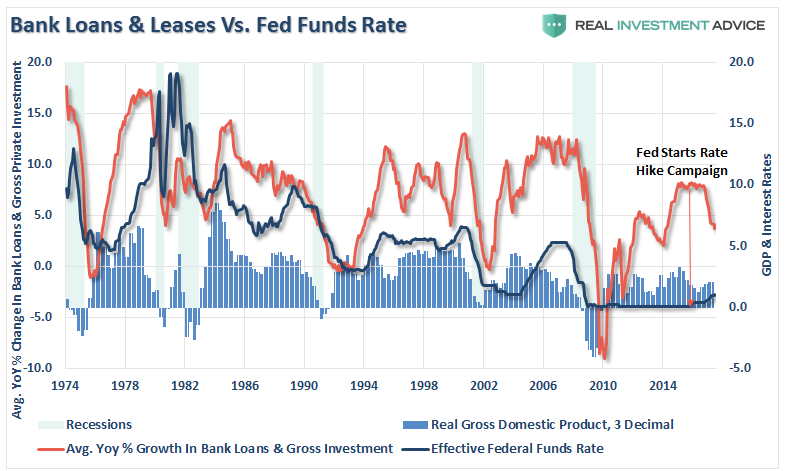

The ramifications of rising interest rates do not only apply to home prices, but also on virtually every aspect of the economy. As rates rise so do rates on credit card payments, auto loans, business loans, capital expenditure profitability, leases, etc. Credit is the life blood of the economy and, as we can already see, even small changes to rates can have a big impact on demand for credit as shown below.

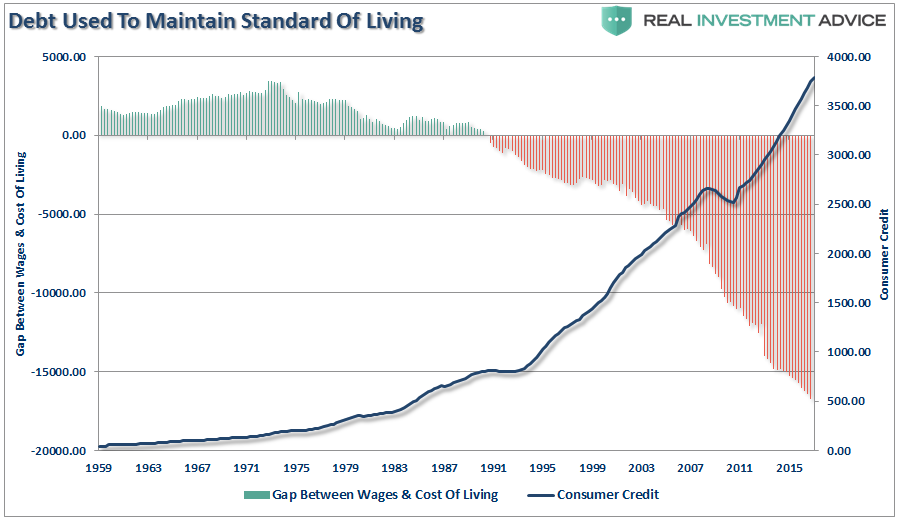

More importantly, despite economic reports of rising employment, low jobless claims, surging corporate profitability and continuing economic expansion, consumers have sunk themselves deeper into debt. With the gap between wages and the costs of supporting the required “standard of living” at record levels, there is little ability to absorb higher rates before it drastically curbs consumption.

There are basically only TWO possible outcomes from here, both of them not good.

First, Janet Yellen and gang continue to hike rates until an economic recession occurs which requires them to lower rates again. As an aging demographic strains the pension and social welfare systems, the economic malaise contains rates at the lower bound. This cycle continues, as it has over the last 30-years, which has created the “Japan Syndrome” in the U.S.

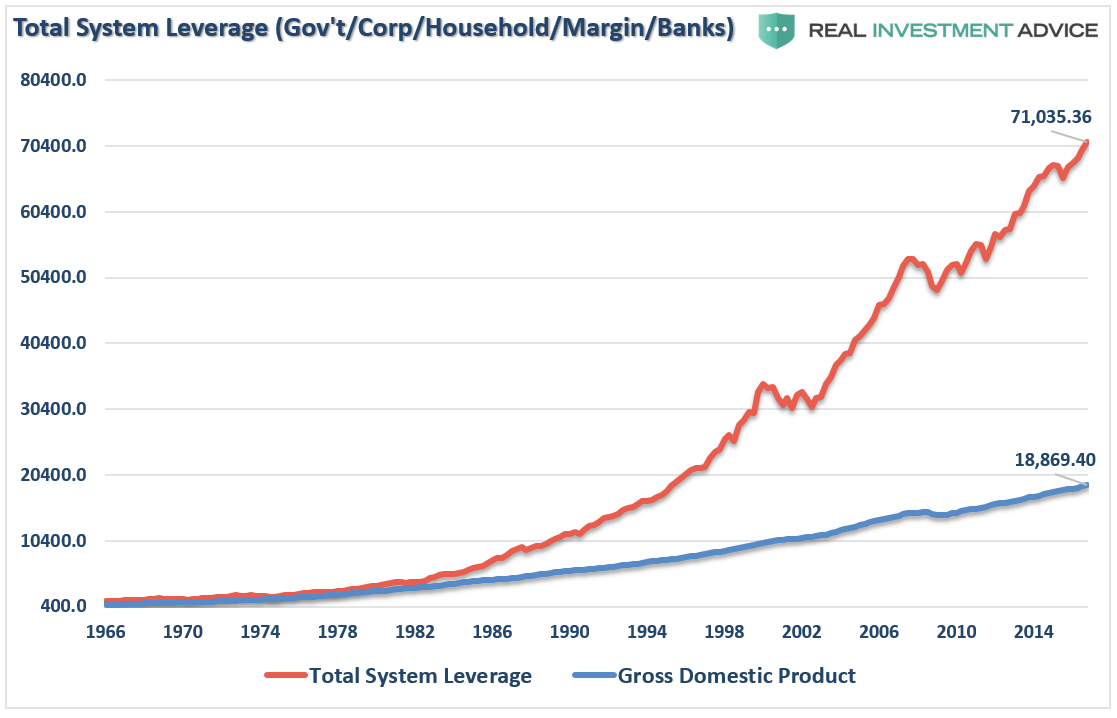

The second outcome is far worse which is an economic decoupling that leads to a massive deleveraging process. Such an event started in 2008 but was stopped by Central Bank interventions which has led to an even more debt laden system currently.

The problem with most of the forecasts for the end of “low interest rates” is the assumption that we are only talking about the isolated case of a shifting of asset classes between stocks and bonds.

However, the issue of rising borrowing costs spreads through the entire financial ecosystem like a virus. The rise and fall of stock prices have very little to do with the average American and their participation in the domestic economy. Interest rates are an entirely different matter.

Since interest rates affect “payments,” increases in rates quickly have negative impacts on consumption, housing, and investment which ultimately deters economic growth.

Again, given the current demographic, debt, pension and valuation headwinds, the future rates of growth are going to be low over the next couple of decades until a “clearing” process is completed. (This is what the “Great Depression” provided.)

While there is little room left for interest rates to fall in the current environment, there is also not a tremendous amount of room for increases.

This is what the bond market continues to tell you if you will only listen. With the 10-year bond close to 2%, and the yield curve flattening, future rate increases are limited due to limited GDP growth due to “secular stagnation.” Therefore, bond investors are going to have to adopt a “trading” strategy in portfolios as rates start to go flat-line over the next decade.

Copyright © Clarity Financial