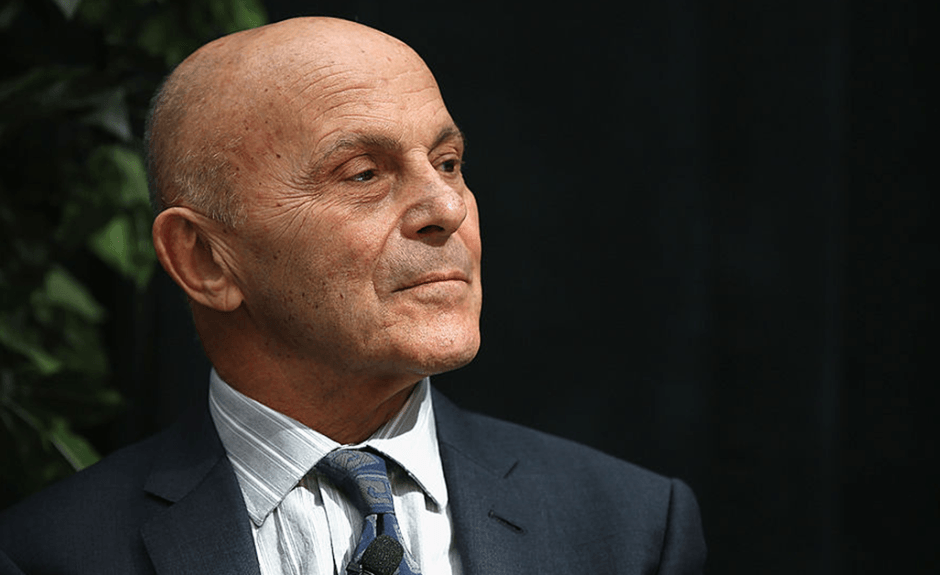

by Ron Rimkus, CFA, CFA Institute

Have the advances in technology, computing power, and data made the markets more efficient?

It’s “not clear,” according to Nobel laureate Eugene Fama.

The point Fama makes is a subtle one. The development and application of technology have clearly altered the competitive landscape for investment returns. Perhaps such sophistication simply enables the more savvy market participants to generate greater returns than their less-abled peers? Perhaps the triumph of technology is really the triumph of financial and human capital?

While technological sophistication will change over time, Fama asks: Will the precarious balance between the lions and the lambs persist?

Fama discussed this question and more with moderator Robert Litterman, founding partner of Kepos Capital, before a packed auditorium at Chicago’s Standard Club on 13 June 2017. Their wide-ranging conversation, hosted by CFA Society Chicago, touched on such topics as the efficient market hypothesis, active management, factor investing, passive investing, and more

When Fama began his career some 50 years ago, the academic landscape for finance was dramatically different than it is today. “At the time, only two universities were doing serious research in finance — the University of Chicago and Massachusetts Institute of Technology [MIT] (and to a lesser extent, Carnegie Mellon University),” he said. “Today, every university has a good finance group with really good people. And they’re all doing similar sorts of things. That’s what changed. It was like shooting fish in a barrel.”

Of course, not all of today’s finance scholarship is useful. Nor are all of the finance sector’s offerings useful, either.

“One of the problems with the financial industry today,” Fama lamented, “is that academic research produces about three to five good ideas every 20 years. However, the financial industry packages and sells about 10 new ideas per week.” The industry has clearly begun to embrace passively managed index funds and such factor-based products as smart beta.

The three stock market factors Fama and Kenneth R. French introduced in their seminal paper, “Common Risk Factors in the Returns on Stocks and Bonds,” are the overall market risk, firm size, and book-to-market equity. For the bond market, they introduced two factors related to maturity and default risk. Their work inspired other researchers to explore additional methods of fundamental index construction in hopes of identifying other drivers of returns. Subsequent work by Research Affiliates’ Robert Arnott weights corporate bonds by cash flow, sales, the book value of assets, and dividends paid. Weightings for sovereign bonds are determined by a nation’s GDP, as well as its population size, land area, and energy consumption as proxies for the labor force, resources, and technological development, respectively. Arnott and his associates believe these factors give a better indication of a country’s importance to the global economy. These portfolio-weighting strategies are based on fundamental metrics rather than market capitalization.

Whatever the approach, Fama returns to the same core components of underlying risk factors — market, size, and value, with market risk measured by the standard market beta, size by the relative market capitalization, and value by the book-to-market ratio.

Even though others, Campbell R. Harvey and Yan Liu among them, have documented more than 300 factor anomalies, Fama believes they are all incorporated into the three basic factors he uses. In many cases, smaller, more exotic factors diminish when comparing among markets and over time. He noted, “Many of these factors are not robust across countries and across time, or they are not actionable by real-world investors because they exist in micro-cap stocks that are highly illiquid.”

With respect to the rise of passive investing, Litterman asked Fama if he thought it might harm price discovery. Fama was unconcerned. “Passive is only 30% of the market,” he said. “Where’s the problem?” Indeed, passive vehicles do represent about 30% of the US market. However, their share of the overall market is increasing at a rapid pace. So, the marginal bid for financial securities is almost certainly coming from passive funds, which means it is now indifferent to valuation. For the time being, this could be a problem Fama may have undersold.

Fama conceded that good active managers will always be a part of the market. But he doesn’t think they can justify their costs. Whatever benefits asset owners receive by hiring them will be offset by the fees.

In the end, Fama stuck with his time-tested message: Stick with basic factors and don’t time the market.

Copyright © CFA Institute