JUNE 2017 | A feature article from our U.S. partners

Business Cycle Update

European Growth on Upswing after Years of Struggle

Progress toward monetary policy normalization may occur sooner than markets anticipate.

Dirk Hofschire, CFA l Senior Vice President, Asset Allocation Research

Lisa Emsbo-Mattingly l Director of Asset Allocation Research

Josh Wilde, CFA l Research Analyst, Asset Allocation Research

Jacob Weinstein, CFA l Senior Analyst, Asset Allocation Research

Key Takeaways

• Europe’s economy is on firmer cyclical ground after a long, slow, and uneven path since the 2008 global financial crisis.

• Accelerating manufacturing activity, declining unemployment, abating deflationary pressures, and improving business conditions all point to a steadier mid-cycle expansion in the eurozone.

• With the risks to core inflation now on the upside, we believe the European Central Bank may shift toward policy normalization sooner than many investors expect.

• The global economy remains in a synchronized expansion, and European and other interna.tional currencies and equities are generally more attractively valued than those in the U.S.

• Smaller cyclical portfolio tilts are warranted at this point because the U.S. economy is in a more mature phase of the business cycle, asset valuations are generally elevated, and political risk remains high.

Download PDF

The eurozone has struggled to find stable economic footing since the global financial crisis in 2008. The region labored under a post-crisis mix of sluggish economic growth, rising sovereign debts in the periphery, an undercapitalized banking system, fiscal austerity, and disjointed political direction. After a pre-emptive monetary tightening in early 2011, the eurozone fell back into recession. By the end of 2011, the European Central Bank (ECB) shifted back toward easing and increasingly experimental monetary accommodation, but the path back to a sustainable expansion has been slow and uneven.

Today, the eurozone is on a cyclical upswing and deflationary pressures have abated. The region is enjoying a reasonably synchronized mid-cycle expansion across both its core and its periphery. Europe’s industrial sectors have benefited from the recovery in global trade and Asian growth, but the domestic underpinnings of the expansion have also become firmer. The maturing expansion is several years under way, but it remains in an earlier stage of the business cycle than the U.S. with respect to labor, credit, and monetary conditions.

The following conditions point to a steadier, more favorable mid-cycle environment:

• Recession probabilities are at their lowest levels since the sovereign debt crisis of 2011.

• Purchasing Managers Indexes of manufacturing activity have accelerated across the region since last summer, rising to the highest level for the region as a whole since 2011.

• Unemployment rates continue to gradually decline, falling from a peak of 12.1% in 2013 to 9.5%, with the greatest contributions coming from Germany and Spain.1

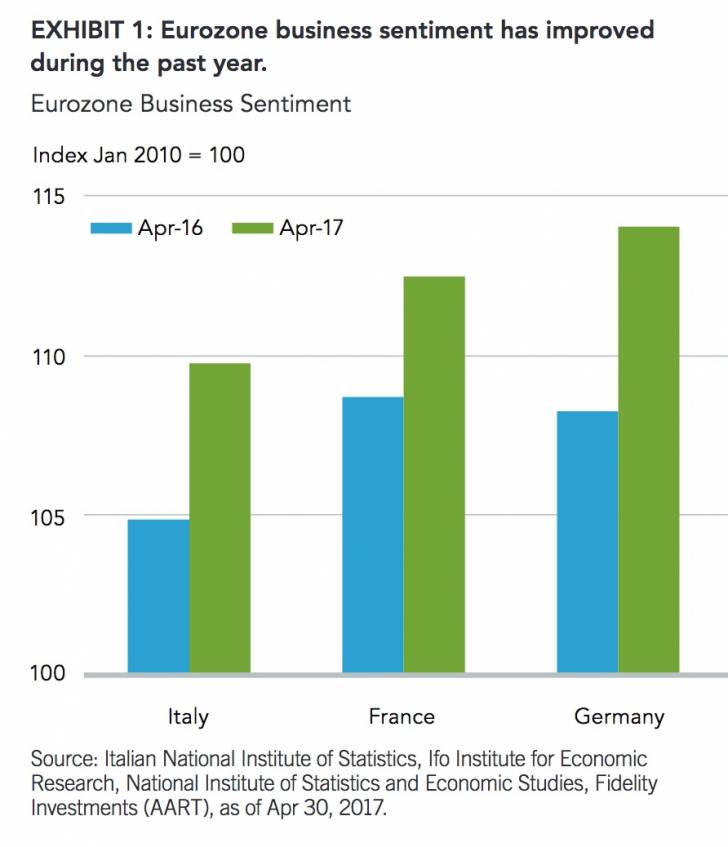

• Business sentiment is improving across the largest countries in Europe (Exhibit 1), registering an all-time high in Germany.2

• Private credit growth is moderately accelerating across corporate and household sectors.

• Consumer sentiment has risen to cycle peaks.3

• Consumer sentiment has risen to cycle peaks.3

• Deflationary pressures have abated, as headline consumer inflation is near a four-year high at just below 2% (year-over-year).

There are also fewer signs of late-cycle pressures (relative to the cyclical backdrop of the U.S.):

• Labor market slack remains, with high unemployment rates in some areas.

• No signs of rising inventory pressures or declining orders among industrial sectors.

• Banks have yet to begin tightening lending standards in large economies (Germany, France, and Italy).

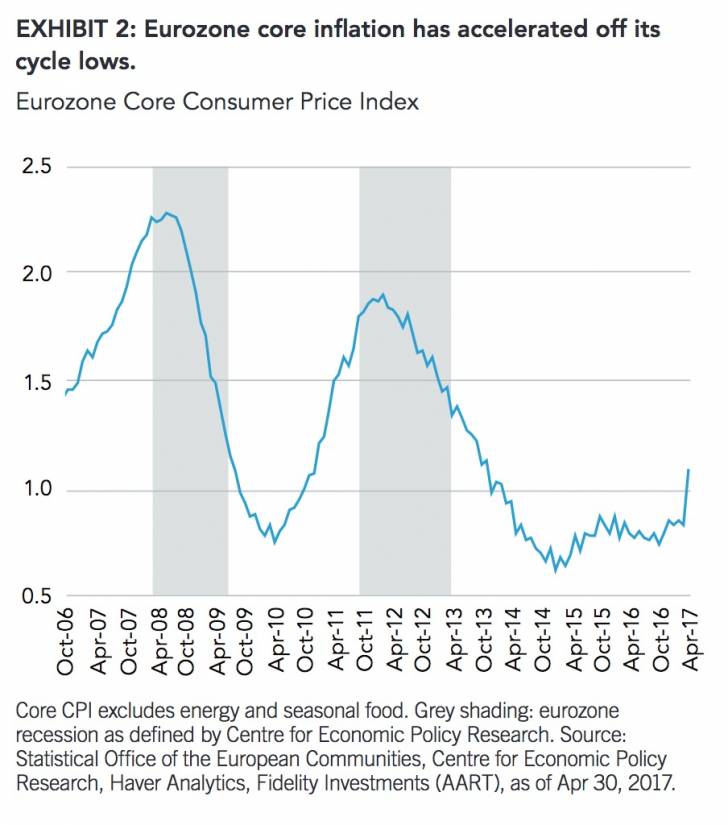

• Core inflation has firmed and become increasingly stable due to improving labor conditions, rising from 0.7% to 1.1% on a year-over-year basis during the past six months (Exhibit 2).4

Subdued market expectations lay groundwork for higher interest rates and euro currency

As the eurozone’s growth and inflationary backdrop has become more stable, the ECB has already moved incrementally toward a stance of less aggressive easing. Policy rates, while still at an extremely low level of -0.40%, have not changed since March 2016, and monthly asset purchases were reduced from €80 billion to a €60 billion during 2017. As long as the trajectory of European and global growth and inflation remain firm, the next step for the ECB will likely be a move toward greater normalization, which will most likely lead to higher interest rates.

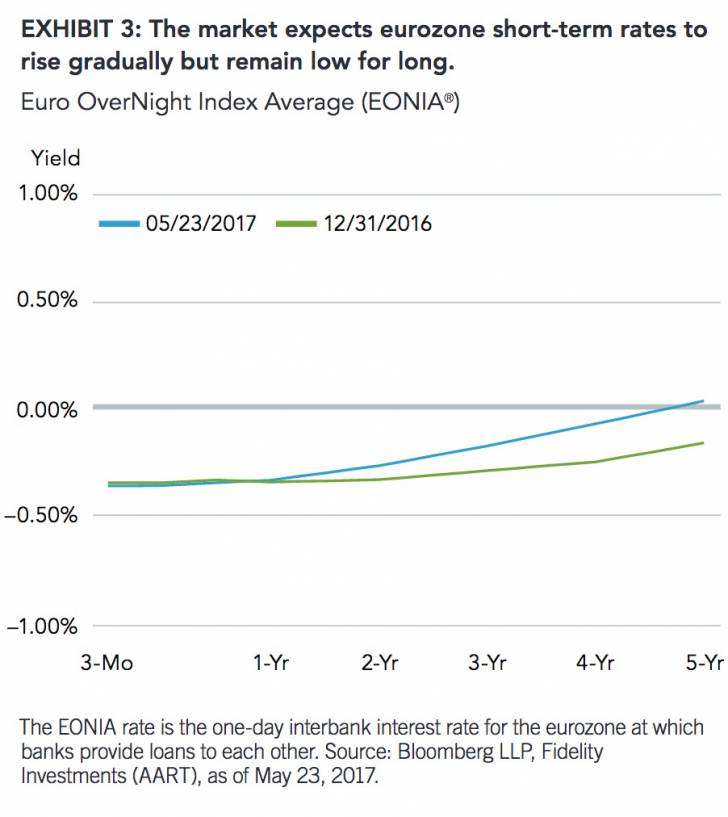

However, futures markets have not materially priced in the potential for higher ECB policy rates. Over the past year, markets have incrementally started to reflect an expectation that short-term rates may rise, but short rates are still expected to remain around today’s levels for the next 12 months and in negative territory for the next five years (Exhibit 3). We believe there is upside risk to core inflation in the eurozone, which implies progress toward monetary policy normalization may occur sooner than the markets anticipate.

The market’s outlook for European monetary policy is in contrast to the U.S., where futures markets suggest one to two additional hikes from the Federal Reserve (Fed) in 2017. Two-year U.S. Treasury yields, a good proxy for the market’s expected future path of policy rates, have continued to widen versus German two-year bond yields. Futures markets indicate the gap between two-year rates is expected to widen further over the foreseeable future, implying the faster U.S. pace of monetary normalization relative to Europe will continue (Exhibit 4). If the markets are wrong and the eurozone’s firming growth and inflation backdrop push the ECB toward an earlier move to normalization, such a shift may also impact currency markets. Generally, currencies tend to strengthen during periods of economic growth and monetary tightening, as capital flows to regions offering higher rates of return. With U.S. interest rate hikes priced in, an unexpected move toward monetary tightening from the ECB could bolster the euro vs. the U.S. dollar.

Political uncertainty is still high, but risks subside

The Brexit referendum in 2016 stoked widespread fears that core Europe could face a wave of populist, anti-euro discontent during several elections in major countries during 2017. However, so far, populist anti-establishment parties have performed worse than expected and failed to gain power in France, the Netherlands, and Austria.

Upcoming German elections appear to be an innocuous contest between the two centrist mainstream parties.

The Italian parliamentary elections (which aren’t yet scheduled) may represent the most significant near-term political risk, with the euro-skeptic Five Star Movement party currently one of the leading parties according to opinion polls. However, short-term political risk in Europe has clearly dissipated, and there may even be potential for an upside surprise if new French President Macron is successful in forging a revitalized coalition with Germany. While long-term political challenges within the eurozone remain considerable, the odds have subsided that a calamitous political event will knock the eurozone’s economy off its cyclically improving trajectory.

Eurozone summary:

• The European economy is in a more favorable part of business cycle relative to the U.S., with more potential for improvement.

• Inflation is likely to rise, which may warrant ECB tightening.

• Markets have yet to meaningfully account for higher rates, making the U.S. dollar more likely to weaken vs. the euro.

• Short-term political risk in the eurozone has dissipated, though long-term challenges remain considerable.

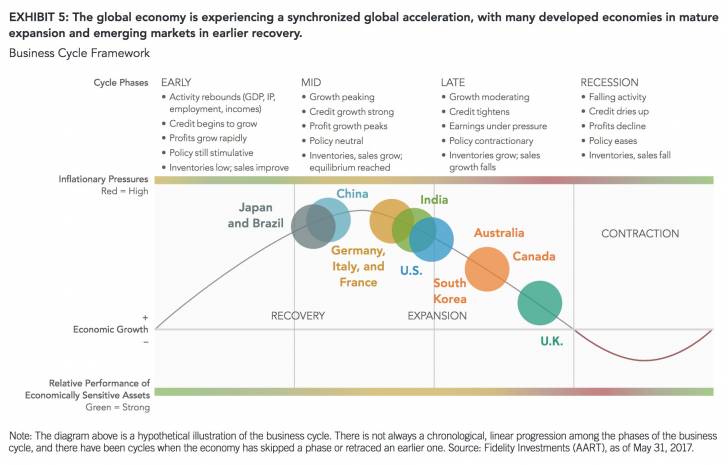

Global update: Economy is experiencing synchronized expansion

In general, the global economy continues to gain traction and show signs of a synchronized expansion (Exhibit 5). More than 75% of countries’ leading economic indicators are rising on a six-month basis, compared to just 50% a year ago.5 Emerging and developed countries are exhibiting improving corporate profitability, with emerging markets’ profit growth recovering off a low base to its fastest pace since 2011.

U.K. cycle maturing

It has been nearly one year since the Brexit referendum, and the U.K. remains in a late-cycle expansion. Business sentiment has improved and manufacturing activity has bounced back to cycle highs, aided by the improving external environment, accommodative monetary policy, and a weaker currency. Risks to the outlook include the uncertainty around Brexit negotiations, a softening housing market, and weak real wage growth. The U.K. is in a mature phase of the cycle, but the probability of recession remains low.

China growth solid but upside limited

China remains in cyclical expansion, but policymakers have begun to rein in stimulus measures. During the past year, industrial activity recovered to multiyear highs, the property markets reaccelerated (with prices and transactions growing year-over-year at double-digit rates), and recession risk sank to its lowest level in two years. However, in recent months, policymakers have pivoted from their easing stance. Restrictions on the real estate market have caused property activity in larger cities to moderate, and a less supportive posture toward lending has caused total credit growth to slow. The Chinese economy remains stable, but upside to growth is limited given the less accommodative policy stance.

Low recession risk in the U.S., but business cycle is maturing

The U.S. economy is in expansion, bolstered by solid labor markets, rising wages, and a healthy consumer.

However, the economy continues to exhibit elements of a more mature (mid to late) phase of the business cycle. Consider the following factors:

1. Tight labor markets are generating wage pressures and limiting corporate profit margins.

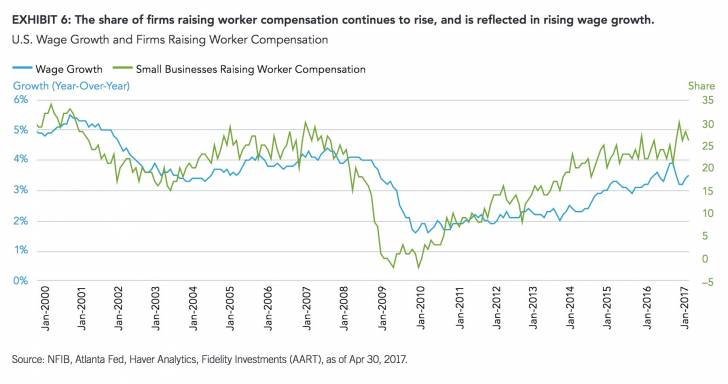

• The unemployment rate is back at pre-recession lows, and a lack of slack in the labor markets has begun to incite wage pressures, with measures such as the Atlanta Fed Wage Growth Tracker rising to 3.5% growth on a year-over-year basis. This supports a positive backdrop for consumer spending, but is also typical of a mid- to late-cycle transition.

• Wage pressures limit upside to corporate profit margins, as companies must pay out a larger proportion of their earnings in the form of labor costs (see Exhibit 6). While corporate earnings are experiencing a near-term rebound after the global trade recession, earnings growth is likely to be constrained during the next 12–18 months (see “Five Factors Driving Crosswinds for U.S. Earnings,” May 2017 Business Cycle Update).

2. A firming of inflation and Fed tightening monetary policy are indicative of a mature expansion.

• The Fed is expected to continue to hike its policy rate in 2017, as labor markets continue to strengthen and inflation is near the central bank’s target.

• The impact of tighter monetary policy has begun to show in select parts of the U.S. economy, including tighter credit conditions in auto loans, business loans, and commercial real estate. Overall credit conditions remain benign, but typically continue to tighten as the U.S. expansion matures.

Outlook and asset allocation implications

For the past several years, the U.S. has remained in a steady expansion while the rest of the world has experienced greater cyclical fluctuations. In particular, the eurozone’s landscape since 2011 has been punctuated by bouts of financial instability, unorthodox monetary experimentation, and fears of political meltdown. However, with the global economy now in a more synchronized expansion, the eurozone’s underlying trends point toward a more sustainable path of gradual improvement.

From an asset allocation standpoint, European and other international equities are benefiting from this improved cyclical outlook, as well as their more attractive valuations relative to U.S. stocks. In addition, the value of the euro currency does not reflect much change in the market’s monetary outlook, leaving room to surprise if economic and inflation conditions continue to improve. However, smaller cyclical tilts are warranted at this point because the U.S. economy is in a more mature phase of the business cycle, asset valuations are generally elevated, and political risk remains high.

Authors

Dirk Hofschire, CFA l Senior Vice President, Asset Allocation Research

Lisa Emsbo-Mattingly l Director of Asset Allocation Research

Josh Wilde, CFA l Research Analyst, Asset Allocation Research

Jacob Weinstein, CFA l Senior Analyst, Asset Allocation Research

The Asset Allocation Research Team (AART) conducts econom.ic, fundamental, and quantitative research to develop asset allocation recommendations for Fidelity’s portfolio managers and investment teams. AART is responsible for analyzing and synthesizing investment perspectives across Fidelity’s asset management unit to generate insights on macroeconomic and financial market trends and their implications for asset allocation.

Asset Allocation Research Team (AART) Research Analyst Ilan Kolet; Research Analyst Jordan Alexiev, CFA; and Analyst Cait Dourney also contributed to this article. Fidelity Thought Lead.ership Vice President Kevin Lavelle provided editorial direction.

For Canadian investors

For Canadian prospects and/or Canadian institutional investors only. Offered in each province of Canada by Fidelity Investments Canada ULC in accordance with applicable securities laws.

Endnotes

1 Source: Statistical Office of the European Communities, Haver Analytics, Fidelity Investments (AART), as of Mar. 31, 2017.

2 Source: IFO (Institut fur Wirtschaftsforschung), Haver Analytics, Fidelity Investments (AART), as of May 23, 2017.

3 European Commission, as of May 19, 2017.

4 European Central Bank, as of Apr. 30, 2017.

5 OECD, Foundation for International Business and Economic Research (FIBER), Haver Analytics, Fidelity Investments (AART), as of Mar. 31, 2017.

Unless otherwise disclosed to you, any investment or management recommendation in this document is not meant to be impartial investment advice or advice in a fiduciary capacity, is intended to be educational and is not tailored to the investment needs of any specific individual. Fidelity and its representatives have a financial interest in any investment alternatives or transactions described in this document. Fidelity receives compensation from Fidelity funds and products, certain third-party funds and products, and certain investment services. The compensation that is received, either directly or indirectly, by Fidelity may vary based on such funds, products, and services, which can create a conflict of interest for Fidelity and its representatives. Fiduciaries are solely responsible for exercising independent judgment in evaluating any transaction(s) and are assumed to be capable of evaluating investment risks independently, both in general and with regard to particular transactions and investment strategies.

Information presented herein is for discussion and illustrative purposes only and is not a recommendation or an offer or solicitation to buy or sell any securities. Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the authors and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Nothing in this content should be considered to be legal or tax advice, and you are encouraged to consult your own lawyer, accountant, or other advisor before making any financial decision.

Fixed-income securities carry inflation, credit, and default risks for both issuers and counterparties.

Although bonds generally present less short-term risk and volatility than stocks, bonds do contain interest rate risk (as interest rates rise, bond prices usually fall, and vice versa) and the risk of default, or the risk that an issuer will be unable to make income or principal payments. Additionally, bonds and short-term investments entail greater inflation risk—or the risk that the return of an investment will not keep up with increases in the prices of goods and services—than stocks. Increases in real interest rates can cause the price of inflation-protected debt securities to decrease.

Stock markets, especially non-U.S. markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets.

Investing involves risk, including risk of loss.

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

All indices are unmanaged. You cannot invest directly in an index.

The Business Cycle Framework depicts the general pattern of economic cycles throughout history, though each cycle is different; specific commentary on the current stage is provided in the main body of the text. In general, the typical business cycle demonstrates the following:

During the typical early-cycle phase, the economy bottoms out and picks up steam until it exits recession then begins the recovery as activity accelerates. Inflationary pressures are typically low, monetary policy is accommodative, and the yield curve is steep. Economically sensitive asset classes such as stocks tend to experience their best performance of the cycle. • During the typical mid-cycle phase, the economy exits recovery and enters into expansion, characterized by broader and more self-sustaining economic momentum but a more moderate pace of growth. Inflationary pressures typically begin to rise, monetary policy becomes tighter, and the yield curve experiences some flattening. Economically sensitive asset classes tend to continue benefiting from a growing economy, but their relative advantage narrows. • During the typical late-cycle phase, the economic expansion matures, inflationary pressures continue to rise, and the yield curve may eventually become flat or inverted. Eventually, the economy contracts and enters recession, with monetary policy shifting from tightening to easing. Less economically sensitive asset categories tend to hold up better, particularly right before and upon entering recession.

GDP: gross domestic product.

Eonia® is a registered trademark of EMMI a.i.s.b.l.

Third-party marks are the property of their respective owners; all other marks are the property of Fidelity Investments Canada ULC.

If receiving this piece through your relationship with Fidelity Institutional Asset Management® (FIAM), this publication may be provided by Fidelity Investments Institutional Services Company, Inc., Fidelity Institutional Asset Management Trust Company, or FIAM LLC, depending on your relationship.

If receiving this piece through your relationship with Fidelity Personal & Workplace Investing (PWI) or Fidelity Family Office Services (FFOS), this publication is provided through Fidelity Brokerage Services LLC, Member NYSE, SIPC.

If receiving this piece through your relationship with Fidelity Clearing & Custody SolutionsSM or Fidelity Capital Markets, this publication is for institutional investor or investment professional use only. Clearing, custody or other brokerage services are provided through National Financial Services LLC or Fidelity Brokerage Services LLC, Members NYSE, SIPC.

© 2017 Fidelity Investments Canada ULC. All rights reserved. US: 804157.1.0 CAN: 805047.1.0