Will Downbeat Labor Report Give the Fed Pause?

by Eric Winograd, Senior Economist – United States, AllianceBernstein

May’s labor-market report disappointed, with every meaningful indicator lower than expected and down from last month. But we don’t believe it’s weak enough to stop a June rate hike or knock the Fed off track.

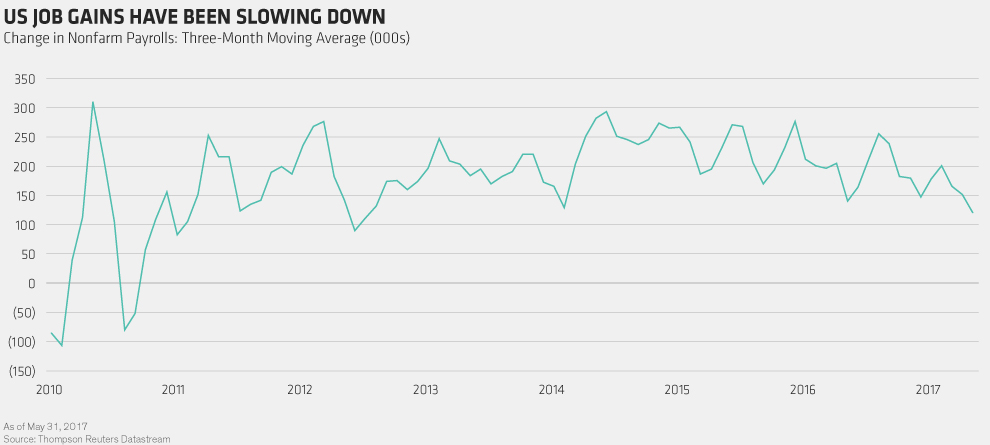

It seems clear from the labor numbers that hiring has slowed down. The headline gain in nonfarm payrolls was 138,000, lower than April’s 174,000, which was itself revised down from the original 211,000 number. That drops the three-month moving average of payroll gains to 121,000, the lowest in almost five years (Display).

This deceleration isn’t entirely surprising at this stage of the economic cycle, and the hiring pace is still enough to absorb new entrants to the labor force. So, the numbers are disappointing but not a disaster. And the report tends to be volatile, so investors shouldn’t put too much stock in numbers over shorter time horizons.

Unemployment Down—for the Wrong Reason

The unemployment rate declined based on the latest numbers, but obviously not from more robust hiring. Instead, the number of labor-force participants fell—the participation rate fell by 0.2% to 62.7%. That pulled the unemployment rate down to a cycle low of 4.3% despite weak hiring.

That 4.3% figure is below the Fed’s estimate of full employment, but wages aren’t picking up, so the Fed’s estimate may be incorrect. If the US economy were beyond full employment, we’d expect wages to pick up. Underemployment fell too, though it hasn’t yet reached precrisis lows—more evidence that there’s still some slack in the economy.

Wage Growth Also Disappointed

Average hourly earnings also fell short of forecasts, rising by 2.5% year over year. The slowdown in wage growth the last few months is inconsistent with the idea of an economy at full employment.

Of course, we shouldn’t expect wage growth to return to precrisis levels, because worker productivity has been much lower, but it’s still jarring to see wages decelerate this far into the business cycle. Other employment-cost indicators tell a somewhat different story, so it’s possible that the shortfall in compensation by this measure is exaggerating the extent of weakness in pay.

The net impact of the weak report is a modest downtick in household-income growth in May. Our proxy for the household paycheck grew by 4.0% year over year, down from the previous 4.23% growth. That’s enough to support consumption at current levels—but it doesn’t suggest any upside to household spending in the coming months.

Still on Track for Gradual Policy Normalization

The latest job numbers aren’t likely to forestall a June rate hike. The Fed prefers to look at the labor market on a longer-term time horizon, and there’s been enough cumulative progress toward full employment for it to go ahead with a June hike.

But the data over the last couple of months—the hiring slowdown and sluggish inflation—are enough to keep the Fed’s rhetoric focused on a gradual, patient approach to removing accommodative policies.

In addition to the June rate hike, we expect a September announcement that balance-sheet reduction will start in the fourth quarter, followed by a December rate hike—assuming that inflation data improve in line with our forecasts.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Copyright © AllianceBernstein