Is the Bond Market Signaling a Change in Course for the Federal Reserve?

by Steven Vanelli, CFA, Knowledge Leaders Capital

A recent run of weaker economic data, highlighted by the Citigroup Economic Surprise Index (CESI) plunging to -32 from 58 in mid-March has caught the attention of the US Treasury bond market. In the chart below, I plot the CESI against US 10 Year Treasuries. A falling CESI tends to be bullish for bonds.

Longer-term bonds are highly correlated with projections for federal funds in the future. Decomposing the 10 Year UST into its real and inflation components reveals an interesting insight. The recent drop in the implied break-even inflation rate is starting to pull on 2018 fed funds futures. At current levels, the implied fed funds rate at the end of 2018 is around 1.25%.

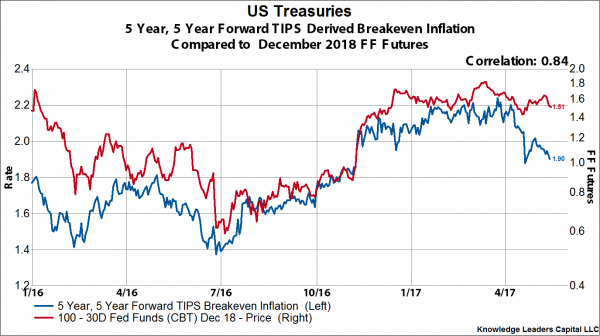

Same story if we use the 5 Year, 5 Year forward break-even inflation rate. While the correlation is slightly lower, it is still signaling the same outcome, that fed funds will be between 1-1.2% by the end of 2018.

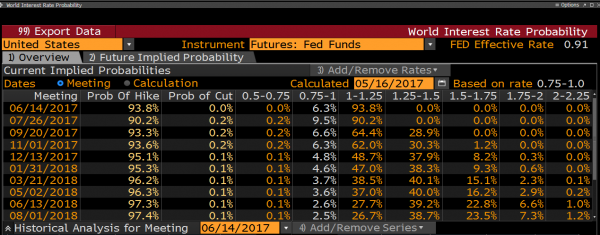

The current effective federal funds rate is 91bps, and the market is pricing in a 93.8% chance that the Federal Reserve raises rates in June to a 1-1.25% range. It is interesting to note, when looking at the 1.25-1.5% column, that there is only a 40% chance of a second rate hike this year.

The net of all this is that despite talk of 3 or 4 rate hikes planned for 2017, the market appears to be pricing in a scenario where the Federal Reserve hikes only once by the end of 2018, leaving the rate in the 1-1.25% range suggested by break-evens.

Copyright © Knowledge Leaders Capital