Why to be wary of these bonds

by Richard Turnill, Global Chief Investment Strategist, Blackrock

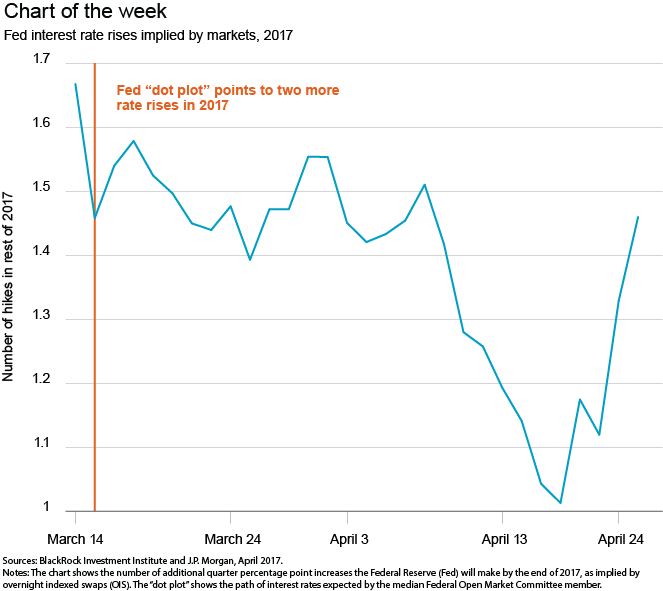

We see Federal Reserve rate increase expectations returning as a bond market driver, justifying our cautious stance on sovereign debt. Richard explains, with the help of this week’s chart.

Geopolitical forces suppressing global government bond yields have somewhat dissipated after the first round vote of the French presidential election. We see Federal Reserve (Fed) rate increase expectations returning as a bond market driver, justifying our cautious stance on sovereign debt.

The business-friendly Emmanuel Macron’s clear first-round election win in France reduced near-term European political risk. Markets are now pricing in nearly 1.5 additional 0.25% rate increases in the U.S. this year, but we think they still underestimate the Fed’s resolve to tighten policy.

Focus returns to the Fed

The Fed has made clear it views the U.S. economy as nearing the central bank’s employment and inflation goals and accordingly plans to stay on a gradual normalization path. We expect global government bond yields to rise—and prices to fall—as market expectations catch up to our base case of two more Fed rate increases this year.

Strong demand for income and still-accommodative central bank policies in much of the world should help keep rises in yields moderate, in our view. We do expect to see a steepening of the yield curve over time, where very long-term bond yields rise faster than those on shorter-term bonds. This is because we see reflation moving from a period of accelerating growth to a new phase of sustained economic expansion.

We see yields on bonds with durations of five years or less (i.e., the short end of the yield curve) as vulnerable in the near term to any jumps in Fed tightening expectations, and we are underweight U.S. Treasuries and European sovereign bonds overall. Bullish sentiment following the French vote sparked the selling of safe-haven assets. Rising European growth and inflation, along with the prospect of a less supportive European Central Bank, may help push European and global yields higher. We expect the Bank of Japan to stay on hold until we see meaningful Japanese growth and inflation. Read more market insights in my Weekly Commentary.

Richard Turnill is BlackRock’s global chief investment strategist. He is a regular contributor to The Blog.