by Frank Holmes, CIO, CEO, U.S. Global Investors

Share this page with your friends:

Please note: The Frank Talk articles listed below contain historical material. The data provided was current at the time of publication. For current information regarding any of the funds mentioned in these presentations, please visit the appropriate fund performance page.

May 1, 2017

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

Last week I had the pleasure of attending Evercore ISI’s Energy Policy & Geopolitics Conference in Washington, D.C., where I visited with senior staff responsible for infrastructure and energy decision-making. The meetings were encouraging and highly instructive, and they opened my eyes up to some of the lesser-known inner workings of the government. Among them is the reconciliation process, whereby Congress instructs a number of committees to report on any budgetary changes a new bill or spending package might trigger. For example, if President Donald Trump truly wishes to build a wall on the southern border, he’ll need to acquire the capital from other areas of the government’s budget. In other words, “the wall” must turn out to be revenue- and distribution-neutral. It’s a highly complex process—all matters of policy are entwined in and affect various departments, after all—which partly explains why Congress often seems to have such difficulty getting anything accomplished, including repealing Obamacare.

As President Donald Trump admitted to Reuters last week: “[Governing] is more work than in my previous life. I thought it would be easier.”

The Environmental Protection Agency (EPA), part of the reconciliation process, is one such entity that’s notorious for standing in the way of infrastructure and energy projects. The agency has traditionally held the attitude that the best development is no development. However, the Trump administration has an ace up its sleeve: the Fixing America’s Surface Transportation (FAST) Act, signed into law in December 2015. According to the official website, FAST-41, as it’s known, “was designed to improve the timeliness, predictability and transparency of the Federal environmental review and authorization process for covered infrastructure projects.” Project delays, therefore, can be combatted with transparency and accountability.

|

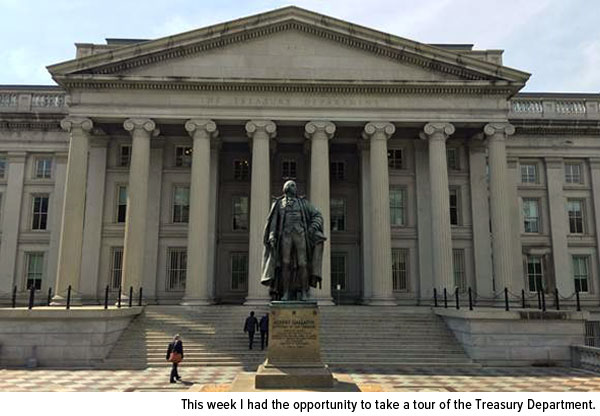

I also had the opportunity to visit the Treasury Department. I was pleased to hear that its senior analyst, who reports directly to Secretary Steven Mnuchin, closely monitors the purchasing manager’s index (PMI) and China, as we do, and keeps an eye on both oil and gold, which the department views as a currency. He seemed genuinely concerned about how federal rules and regulations might affect the work of professional brokers and traders. Specifically, he worries about impairing liquidity in capital markets, which makes price discovery exceedingly challenging. Having served in both the Obama and Trump administrations, the analyst was very insightful, articulate and balanced in his views. Not once did he have an explicitly negative thing to say about either president, and I got the sense that he cared deeply about the execution of his job, which was highly encouraging.

Can Trump Get His Way on Tax Reform?

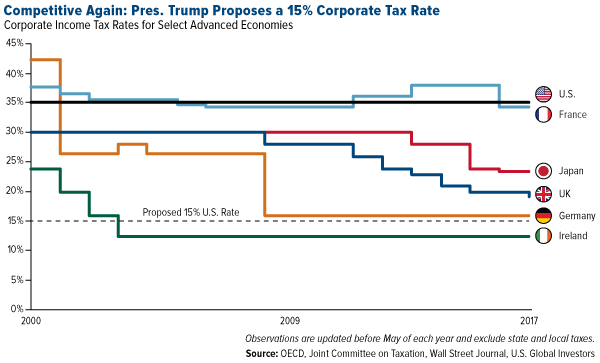

As promised, the president unveiled his long-awaited U.S. tax reform proposal last Wednesday, exciting many investors who might have begun to doubt his resolve following a number of significant setbacks. Most of the stock market gains actually occurred in anticipation of the announcement, with the Dow Jones Industrial Average and S&P 500 Index slightly losing ground on Wednesday, despite both indices logging positive monthly gains in five of the last six months. The small-cap Russell 2000 Index closed at an all-time high Wednesday, presumably because smaller domestic companies have the most to gain from Trump’s plan to lower the corporate tax rate from 35 percent, in effect since 1993, to a much more competitive 15 percent.

If Trump gets his way—and let’s be clear, it’s going to be an uphill fight—U.S. corporate taxes will decline from being the highest among fellow Organization for Economic Cooperation and Development (OECD) economies to just a few degrees north of Ireland’s highly favorable 12.5 percent.

Not only would this be the most meaningful overhaul of our tax code in more than 30 years, but it would also put the U.S. in very good company. If you recall from a September Frank Talk, I shared with you some of the accolades the Republic of Ireland has received partly as a result of its low tax rate, including being named “the most effective country in the EU in which to pay business taxes” by PricewaterhouseCoopers (PwC). It also ranks seventh in world competitiveness, according to Switzerland’s International Institute for Management Development (IMD), and is the fastest-growing European economy.

In the final quarter of 2016, Ireland expanded an impressive 7.2 percent year-over-year. Compare that to America’s sluggish start to 2017 with growth at 0.7 percent, the slowest quarterly rate in three years. Analysts had expected 1.2 percent. Gold, long considered a safe haven asset, closed up nearly 0.3 percent.

Obviously, there’s more to Ireland’s success than low corporate taxes, and we can’t expect the U.S. to enjoy the same momentum overnight after adopting a 15 percent tax rate. But it’s a start. As I said last week, there’s still much more work that needs to be done, including streamlining burdensome financial regulations.

Can’t Please All of the People All of the Time

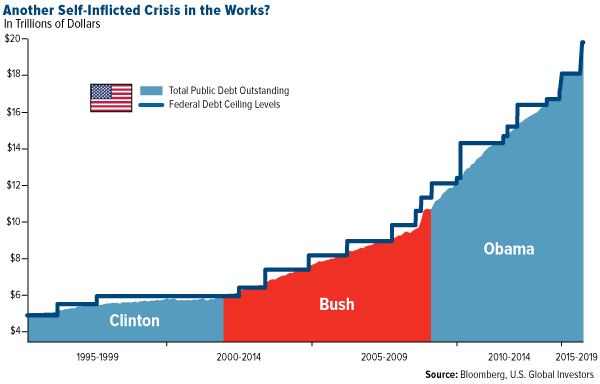

Not everyone is entirely on board with Trump’s idea, however. Many Democrats claim the plan—which includes both corporate and income tax reform—favors only the top earners, while fiscal conservatives worry the tax cuts could dig the U.S. deeper into deficit spending and add to the already-mountainous national debt, requiring another showdown over raising the debt ceiling.

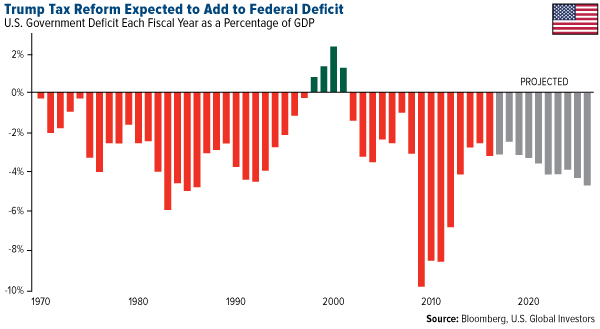

The bipartisan, Washington, D.C.-based Committee for a Responsible Federal Budget (CRFB) estimates that Trump’s plan could add between $3 trillion and $7 trillion to the federal debt over the next decade, stating emphatically that “America can’t afford” it. In addition, Bloomberg analysts see increased deficit spending over the next several years, provided everything else remains the same.

Others aren’t as negative. According to the highly-respected Tax Foundation, the oldest tax think tank in the country, an additional 1 percent growth in GDP would need to occur every year for the next 10 years to offset the cost of Trump’s plan. Although this doesn’t sound so out-of-reach, the report’s author, Alan Cole, makes it clear that this 1 percent growth must go “above and beyond” analysts’ top forecasts.

“Don’t Fear the Tax Haven—Be the Tax Haven”

As expected, among the most enthusiastic cheerleaders of the reform are members of Trump’s inner circle, including economic adviser Gary Cohn and Treasury Secretary Steven Mnuchin, who insists that the economic growth that results from the tax cuts will sufficiently self-finance the costs of the tax cut.

I’m inclined to agree, with reservations.

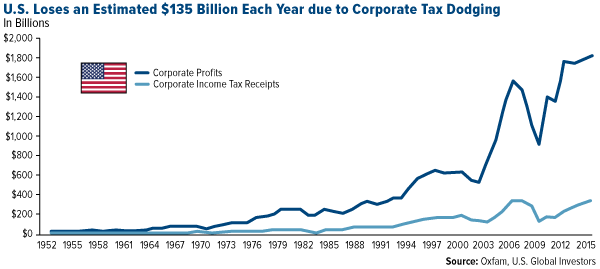

According to Oxfam, the U.S. loses out on approximately $135 billion each year as multinational companies continue to move operations overseas, presumably to avoid the astronomical tax and burdensome regulatory environment. In 1953, an estimated $1 out of every $3 of federal revenue was collected in corporate taxes. Today it’s closer to $1 out of $9, even as profits have surged dramatically since the 1950s. In 2015, the 50 largest U.S. corporations stashed as much as $1.6 trillion overseas, according to Oxfam.

Provided Trump can also deliver on his campaign promise to streamline corporate and financial regulations, I’m confident that a large percentage of this cash can be repatriated back into the U.S.

But what if there was another way? In a recent article in National Review, the conservative news magazine founded by William F. Buckley in 1955, columnist Kevin D. Williamson takes a hardline stance, arguing that Trump’s 15 percent tax is “about 15 points too high.” The corporate tax, Williamson says, leads to double taxation, as income is taxed once at the corporate rate and again as a salary or dividend.

Scrapping the corporate tax, Bahamas- or Cayman Islands-style, “would not represent a tax-free windfall to a bunch of pinstriped boardroom schmucks and Wall Street types and corporate shareholders.” Instead, he writes, it would unleash economic growth for the rich and poor alike, such as we’ve never seen. Imagine:

But if [businesses] pay [the saved 39 percent] out in salaries and bonuses, whether to fat-cat executives or ordinary line workers, those people pay the individual income tax on that money. If they pay it out to shareholders in the form of dividends, the shareholders pay the capital-gains tax on that money. If it is distributed through other capital gains, the same thing applies. If it is used to acquire facilities or equipment, then that money becomes income for another company, which has the same choices about how to dispose of it. The money still gets taxed, but not until it hits someone’s bank account.

Unrealistic? Probably. But Williamson’s idea is interesting food for thought regardless.

Frank Talk Turns 10 Years Old

I’m very excited to tell you that Frank Talk, my CEO blog, turned 10 years old in April. We were one of the very first financial and investment companies to attempt such a thing, and I’m so grateful and happy we took the chance. Not only has this labor of love won several awards, it’s also helped attract readers to the U.S. Global Investors site from more 200 countries and territories all across the globe. To help celebrate its 10th anniversary, our marketing mavens put together a brief video listing 10 facts about the blog you might not know. I invite you to watch it, share it with friends and family and sign up for email alerts if you haven’t already.

Then I hope you stick around for the next 10 years. Cheers!

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The Russell 2000 Index is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000. The Russell 3000 Index consists of the 3,000 largest U.S. companies as determined by total market capitalization.

This post was originally published at Frank Talk.

Copyright © U.S. Global Investors