by Lance Roberts, Clarity Financial

Throughout history, investors have repeatedly made the same investment mistakes. Whether it was selling at the bottom of major market corrections, or buying near the peaks of the next cyclical bull market, the results have, for the most part, been generally the same.

I have written many articles previously on investing, portfolio and risk management and the fallacy of long-term “average” rates of returns. Unfortunately, few heed these warnings until it is generally far too late.

One of the biggest problems with “buy and hold” investment advice is what I call a “duration mismatch.” The issue that arises is individuals do not necessarily have the “time” to achieve the long-term average returns of the market.

“Most have been led believe that investing in the financial markets is their only option for retiring. Unfortunately, they have fallen into the same trap as most pension funds which is hoping market performance will make up for a ‘savings’ shortfall.

However, the real world damage that market declines inflict on investors, and pension funds, hoping to garner annualized 8% returns to make up for that lack of savings is all too real and virtually impossible to recover from. When investors lose money, it is possible to regain the lost principal given enough time, however, what can never be recovered is the “time” lost between today and retirement. “Time” is extremely finite and the most precious commodity that investors have.

In the end – yes, emotional decision making is very bad for your portfolio in the long run.

Emotions and investment decisions are very poor bedfellows. Unfortunately, the majority of investors make emotional decisions because, in reality, very FEW actually have a well-thought-out investment plan including the advisors they work with. Retail investors generally buy an off-the-shelf portfolio allocation model that is heavily weighted in equities under the illusion that over a long enough period of time they will somehow make money. Unfortunately, history has been a brutal teacher about the value of risk management.”

Importantly, I am NOT ADVOCATING, and never have, “market timing” which is being “all in” or “all out” of the market. Such portfolio management can not be successfully replicated over time.

What I am suggesting is that individuals CAN MANAGE THE RISK in their portfolios to minimize the destruction of capital during market downturns.

It is important to remember that we are not investors. We do not control the direction of the company, their management decisions or their sales process. We are simply speculators placing bets on the direction of the price of an electronic share that is heavily influenced by the “herd” that makes up the markets.

More importantly, we are speculating, more commonly known as gambling, with our “savings.” We are told by Wall Street that we “must” invest into the financial markets to keep those hard-earned savings adjusted for inflation over time. Unfortunately, due to repeated investment mistakes, the average individual has failed in achieving this goal.

With this in mind, this is an excellent time to review 10 investment lessons from some of the investing legends of our time. These time-tested rules about “risk” are what have repeatedly separated successful investors from everyone else. (Quote source: 25IQ Blog)

1) Jeffrey Gundlach, DoubleLine

“The trick is to take risks and be paid for taking those risks, but to take a diversified basket of risks in a portfolio.”

This is a common theme that you will see throughout this post. Great investors focus on “risk management” because “risk” is not a function of how much money you will make, but how much you will lose when you are wrong. In investing, or gambling, you can only play as long as you have capital. If you lose too much capital but taking on excessive risk, you can no longer play the game.

Be greedy when others are fearful and fearful when others are greedy. One of the best times to invest is when uncertainty is the greatest and fear is the highest.

2) Ray Dalio, Bridgewater Associates

“The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.”

Nothing good or bad goes on forever. The mistake that investors repeatedly make is thinking “this time is different.” The reality is that despite Central Bank interventions, or other artificial inputs, business and economic cycles cannot be repealed. Ultimately, what goes up, must and will come down.

Wall Street wants you to be fully invested “all the time” because that is how they generate fees. However, as an investor, it is crucially important to remember that “price is what you pay and value is what you get.” Eventually, great companies will trade at an attractive price. Until then, wait.

3) Seth Klarman, Baupost

“Most investors are primarily oriented toward return, how much they can make and pay little attention to risk, how much they can lose.”

Investor behavior, driven by cognitive biases, is the biggest risk in investing. “Greed and fear” dominate the investment cycle of investors which leads ultimately to “buying high and selling low.”

4) Jeremy Grantham, GMO

“You don’t get rewarded for taking risk; you get rewarded for buying cheap assets. And if the assets you bought got pushed up in price simply because they were risky, then you are not going to be rewarded for taking a risk; you are going to be punished for it.”

Successful investors avoid “risk” at all costs, even it means underperforming in the short-term. The reason is that while the media and Wall Street have you focused on chasing market returns in the short-term, ultimately the excess “risk” built into your portfolio will lead to extremely poor long-term returns. Like Wyle E. Coyote, chasing financial markets higher will eventually lead you over the edge of the cliff.

5) Jesse Livermore, Speculator

“The speculator’s deadly enemies are: ignorance, greed, fear and hope. All the statute books in the world and all the rule books on all the Exchanges of the earth cannot eliminate these from the human animal….”

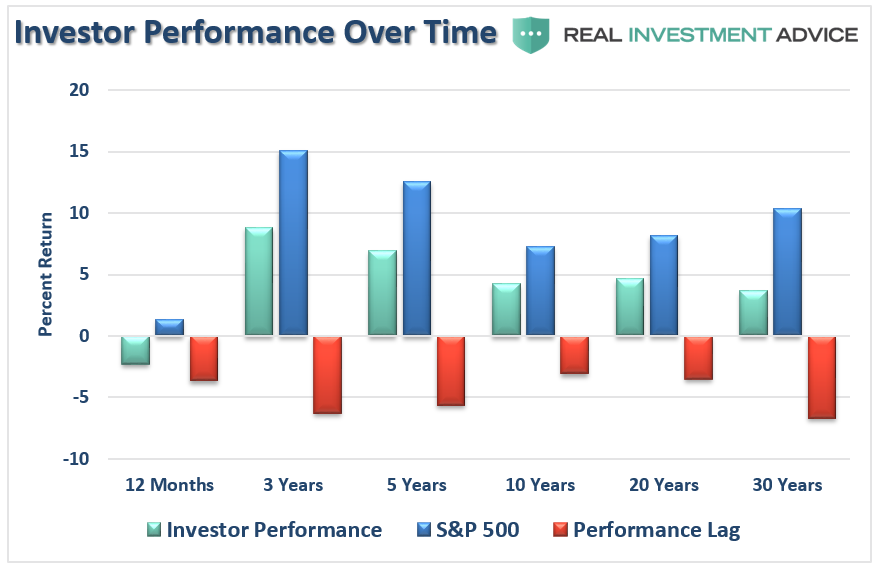

Allowing emotions to rule your investment strategy is, and always has been, a recipe for disaster. All great investors follow a strict diet of discipline, strategy, and risk management. The emotional mistakes show up in the returns of individuals portfolios over every time period. (Source: Dalbar)

6) Howard Marks, Oaktree Capital Management

“Rule No. 1: Most things will prove to be cyclical.

Rule No. 2: Some of the greatest opportunities for gain and loss come when other people forget Rule No. 1.”

As with Ray Dalio, the realization that nothing lasts forever is critically important to long-term investing. In order to “buy low,” one must have first “sold high.” Understanding that all things are cyclical suggests that after long price increases, investments become more prone to declines than further advances.

7) James Montier, GMO

“There is a simple, although not easy alternative [to forecasting]… Buy when an asset is cheap, and sell when an asset gets expensive…. Valuation is the primary determinant of long-term returns, and the closest thing we have to a law of gravity in finance.”

“Cheap” is when an asset is selling for less than its intrinsic value. “Cheap” is not a low price per share. Most of the time when a stock has a very low price, it is priced there for a reason. However, a very high priced stock CAN be cheap. Price per share is only part of the valuation determination, not the measure of value itself.

8) George Soros, Soros Capital Management

“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

Back to risk management, being right and making money is great when markets are rising. However, rising markets tend to mask investment risk that is quickly revealed during market declines. If you fail to manage the risk in your portfolio, and give up all of your previous gains and then some, then you lose the investment game.

9) Jason Zweig, Wall Street Journal

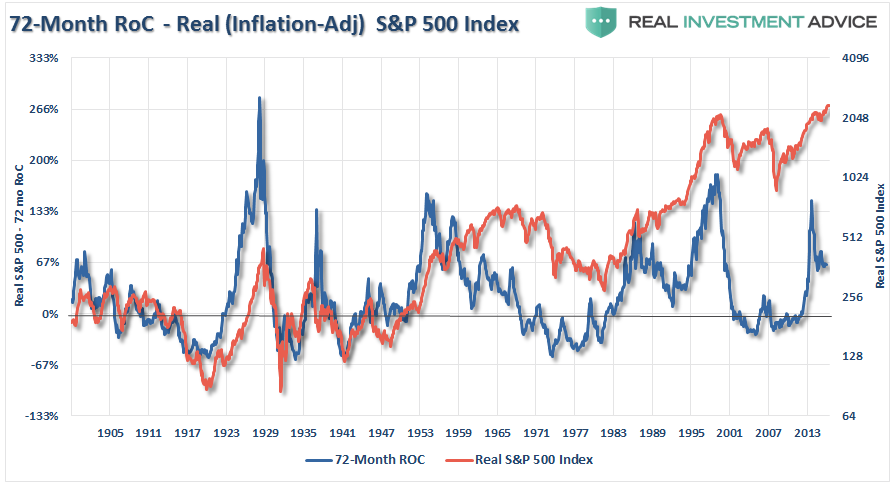

“Regression to the mean is the most powerful law in financial physics: Periods of above-average performance are inevitably followed by below-average returns, and bad times inevitably set the stage for surprisingly good performance.”

The chart below is the 6-year annualized inflation-adjusted rate of change of the S&P 500 index going back to 1900. The power of regression is clearly seen. Historically, when returns breached 133% it was not long before returns started falling and reverted below 0%.

10) Howard Marks, Oaktree Capital Management

“The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.”

The biggest driver of long-term investment returns is the minimization of psychological investment mistakes. As Baron Rothschild once stated: “Buy when there is blood in the streets.” This simply means that when investors are “panic selling,” you want to be the one that they are selling to at deeply discounted prices. The opposite is also true. As Howard Marks opined:

“The absolute best buying opportunities come when asset holders are forced to sell.”

As an investor, it is simply your job to step away from your “emotions” for a moment and look objectively at the market around you. Is it currently dominated by “greed” or “fear?”

Your long-term returns will depend greatly not only on how you answer that question, but to manage the inherent risk.

“The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham

As I stated at the beginning of this missive, “Market Timing” is not an effective method of managing your money. However, as you will note, every great investor throughout history has had one core philosophy in common; the management of the inherent risk of investing to conserve and preserve investment capital.

“If you run out of chips, you are out of the game.”

Lance Roberts

Lance Roberts is a Chief Portfolio Strategist/Economist for Clarity Financial. He is also the host of “The Lance Roberts Show” and Chief Editor of the “Real Investment Advice” website and author of “Real Investment Daily” blog and “Real Investment Report“. Follow Lance on Facebook, Twitter and Linked-In

Copyright © Clarity Financial